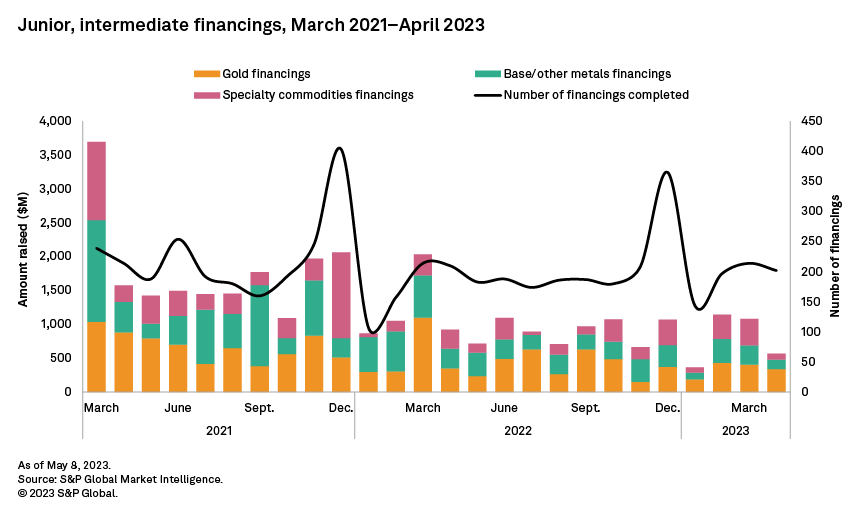

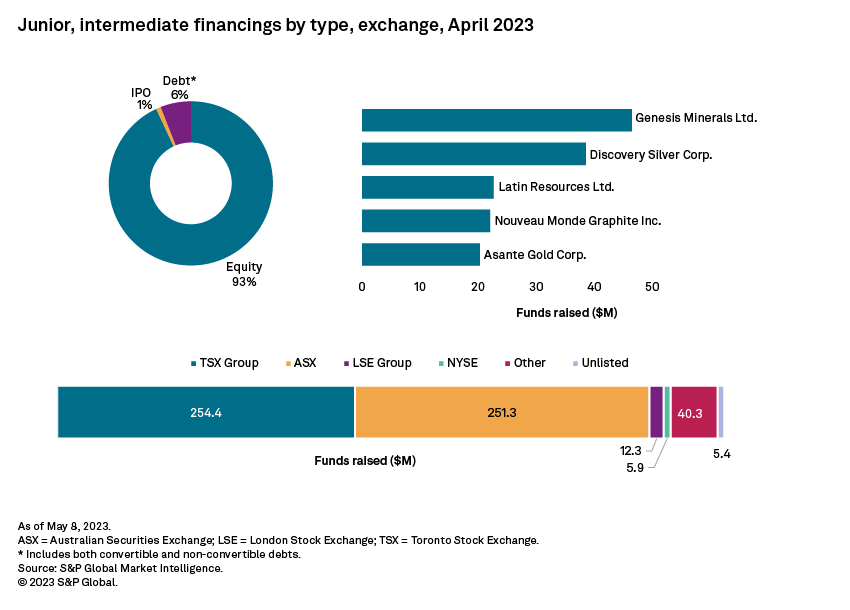

Funds raised by junior and intermediate mining companies fell 47% month over month to $570 million in April, following the slight decline recorded in March. The number of transactions fell to 202 — down 6% month over month. Significant financings, valued at $2 million or more, also fell, to 65 from 82 in the previous month, and accounted for 84% of the funds raised. No transactions were valued at more than $50 million, compared with three in March.

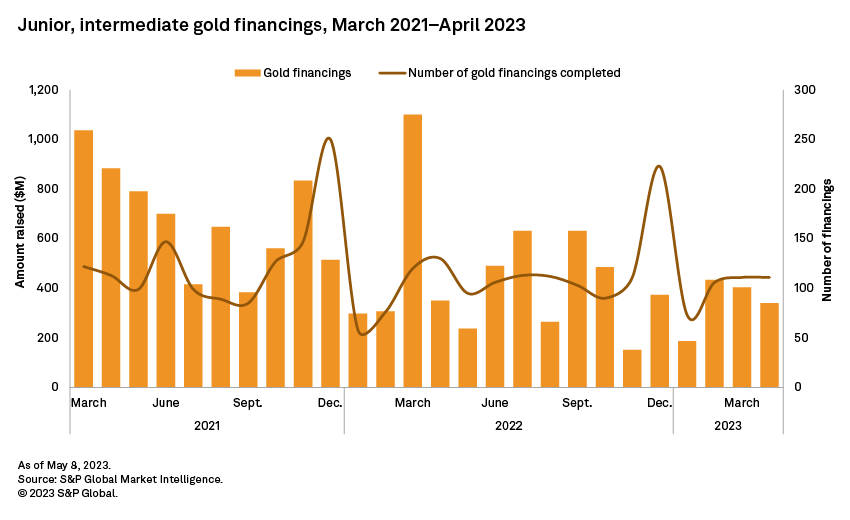

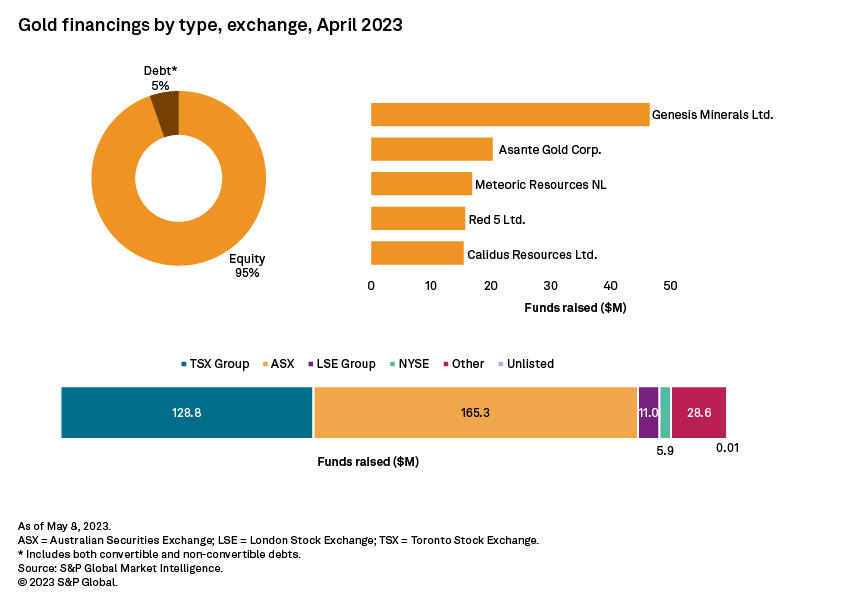

Gold financings fall again

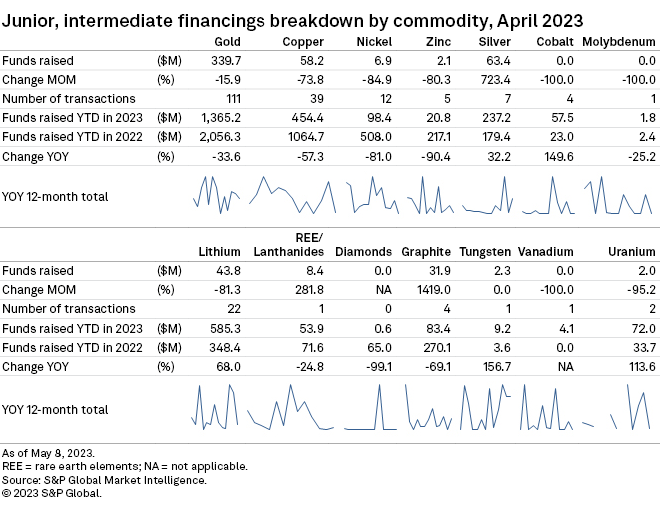

Gold financings fell for the second consecutive month, by 16% to US$340 million. The number of gold financings was flat at 111, and the number of significant financings was up by one to 37.

The largest gold financing and the largest overall was a A$70 million private placement follow-on offering by Australian Securities Exchange-listed Genesis Minerals Ltd. The company is currently conducting feasibility studies for its Ulysses gold project in Western Australia, and plans to conduct another feasibility study for its Kookynie asset, also in Western Australia, in June. Genesis recently agreed to acquire the Leonora asset in Western Australia from St Barbara Ltd., in exchange for at least A$370 million in cash and issued shares.

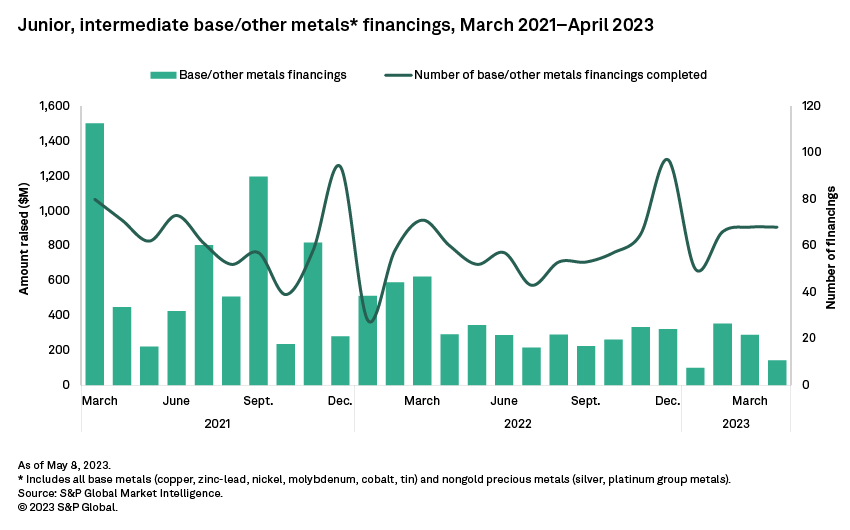

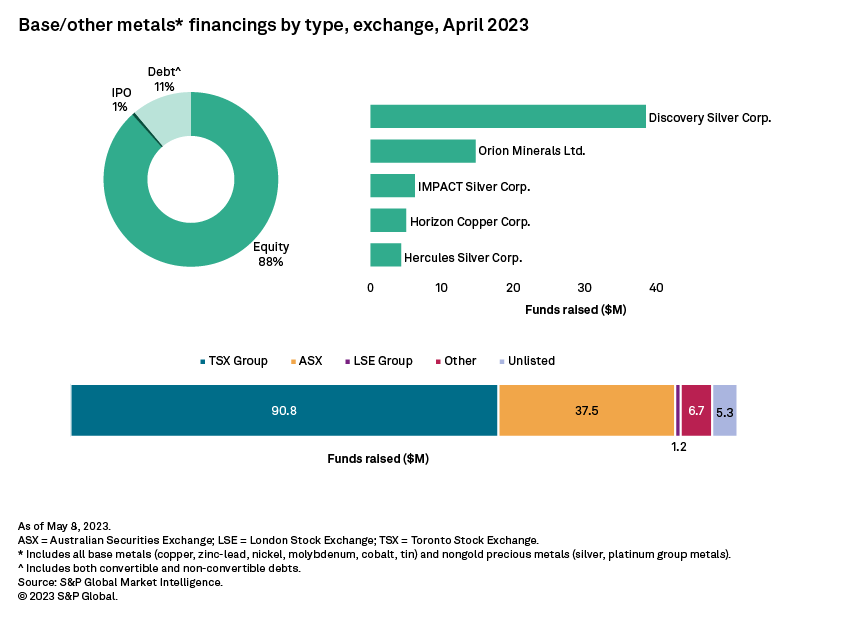

Base/other metals down on lower copper, nickel financings

Funds raised for the base/other metals group fell to nearly a three-month low, down 51% month over month to US$142 million. The number of financings was flat at 68, while significant financings fell to 18 from 26 in the previous month.

The largest base/other metals financing, and the second largest overall, was a C$45 million private placement by Toronto Stock Exchange Venture-listed Discovery Silver Corp., which owns various precious and base metals projects in Mexico. The company is currently focused on its reserves development-stage Cordero polymetallic project in Chihuahua and plans about 9,000 meters of drilling to expand resources.

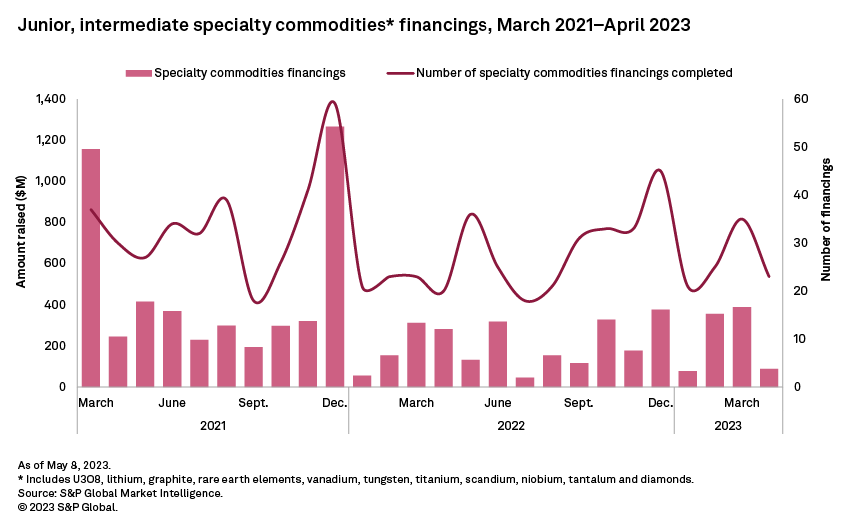

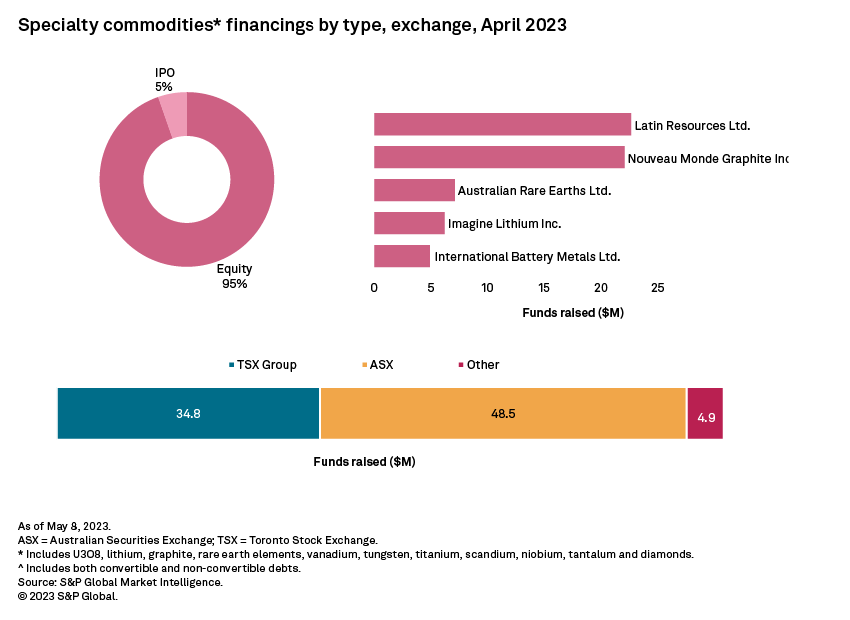

Specialty commodities fall to 3-month low

Fundraising for specialty commodities fell 77% month over month in April to $88 million, weighed down by declines in funding for lithium and uranium. The number of financings dropped to a three-month low of 23 from 35 in March, while the number of significant financings halved to 10.

The largest specialty commodities fundraising, and the fourth-largest overall, was the first of two A$34 million tranches in a follow-on offering by ASX-listed Latin Resources Ltd. The company owns lithium assets in various stages of development in Argentina, Peru and Brazil. In May, Latin Resources reported that it had completed 126 holes of a diamond drilling program at its Salinas lithium-spodumene project in Minas Gerais, Brazil, with 36,130 meters drilled to date.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.