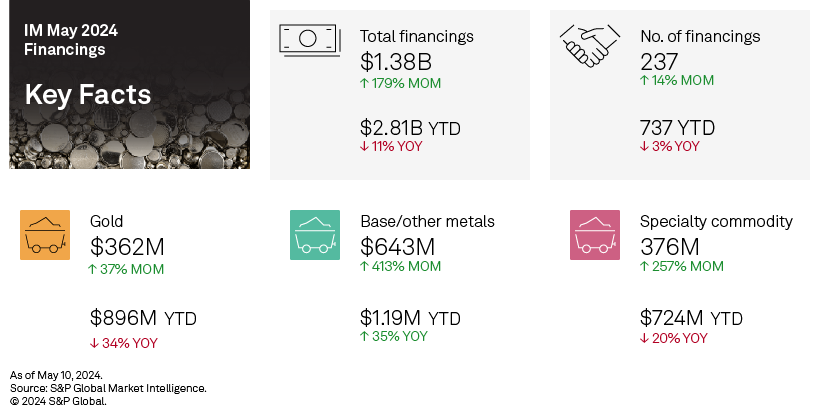

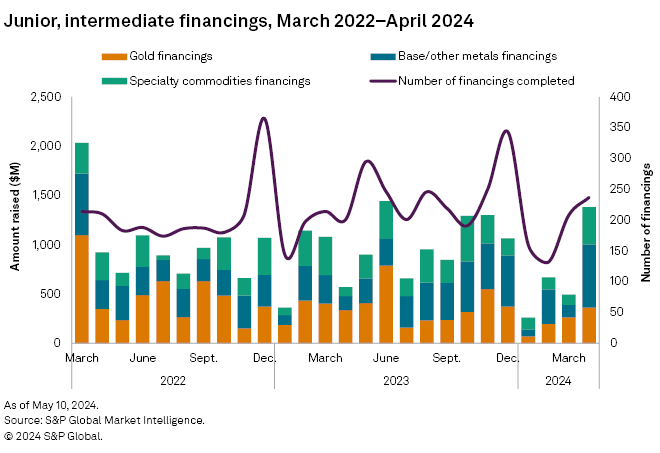

Funds raised by junior and intermediate mining companies jumped 179% to $1.38 billion after a lackluster performance in the first three months of 2024. Funds raised in April were the highest in 10 months, backed by an increase in the number of financings, up 14%, and a number of high-value transactions. All commodity groups increased, with copper and lithium contributing most to the jump. Six transactions were valued at more than $30 million, compared with two in March.

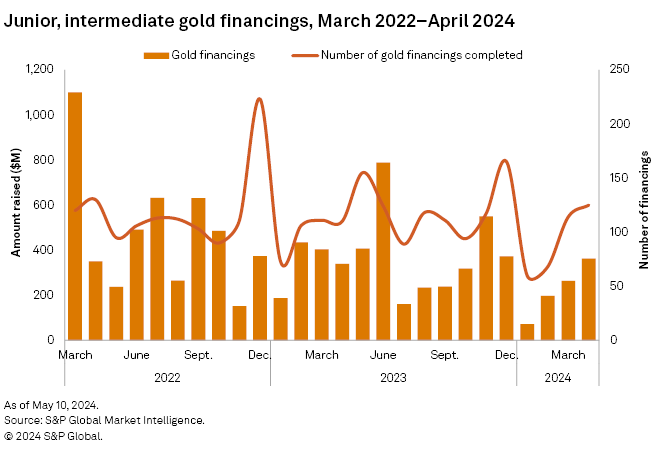

Gold financings jump to 4-month high

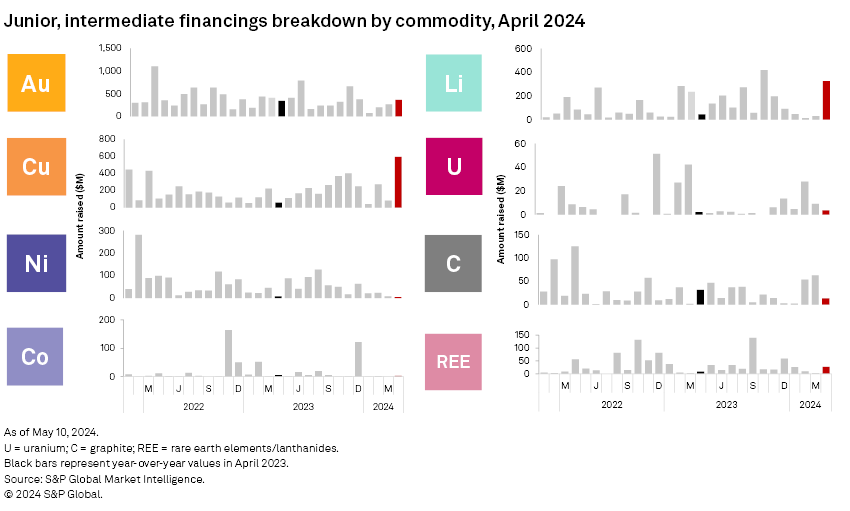

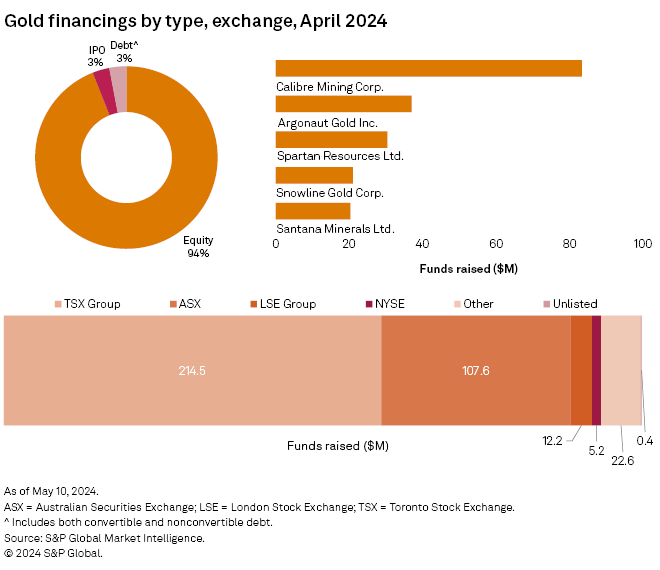

Gold financings jumped for the third consecutive month in April, up 37% to $362 million, after a five-year low of $72 million in January 2024. The number of gold transactions jumped to 125 — the highest in 11 months — up from 114 in March. There were three transactions valued at over $30 million, up from zero in March.

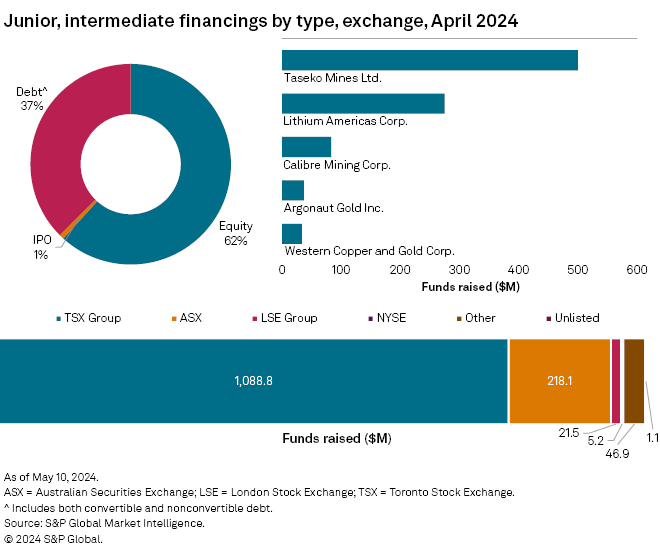

The largest gold financing, and the third largest overall, was the C$115 million private placement of 68.5 million common shares of Vancouver-based Calibre Mining Corp. The company owns active projects in Canada, the US and Nicaragua. The Valentine Lake gold project in Newfoundland and Labrador is currently being constructed and expected to start producing in mid-2025.

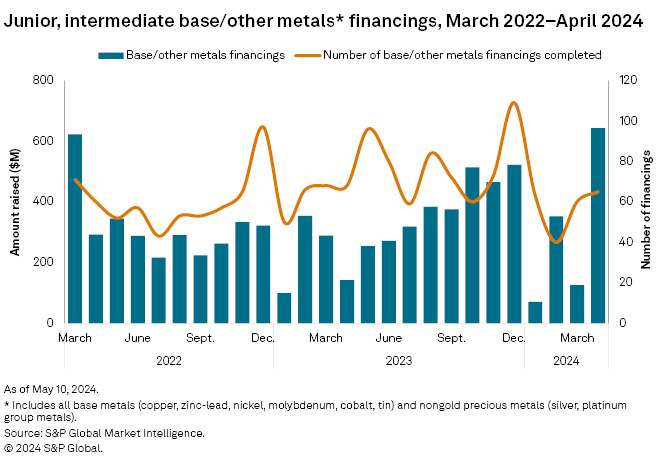

Copper financings lift base/other metals group to multiyear high

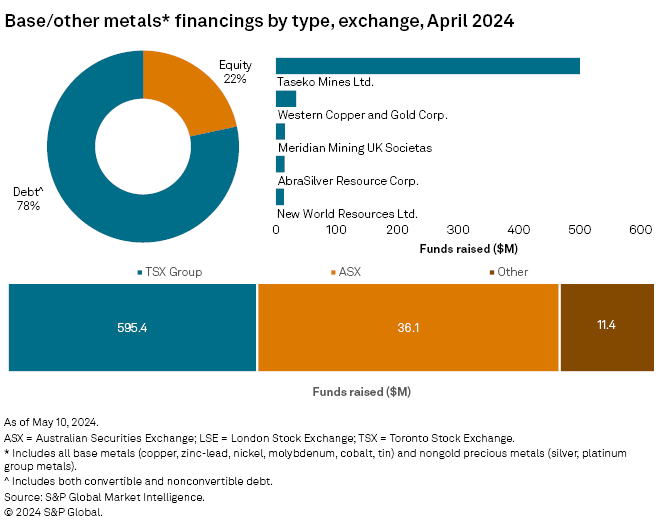

Fueled by a single transaction, the base/other metals group jumped fivefold to $643 million — the highest since November 2021. Copper led the increase, as funds raised for the red metal jumped to a multiyear high of $596 million. Slight increases were recorded for silver and cobalt, while molybdenum and nickel fell slightly. The number of transactions was up by five to 65. There were two transactions valued at over $30 million in April, up from one in March.

The largest base/other metals financing, and the largest overall, was Taseko Mines Ltd.'s $500 million offering of senior secured notes, with an annual rate of 8.25% payable semiannually and due in 2030. Proceeds are intended for the redemption of the company's existing notes due 2026, as well as for capital expenditures for its Florence copper project in Arizona and the Gibraltar copper mine in British Columbia.

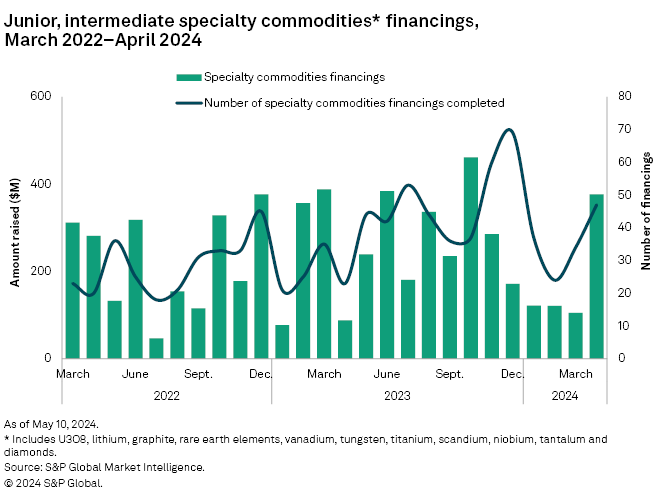

Specialty financing rises after 4-month decline

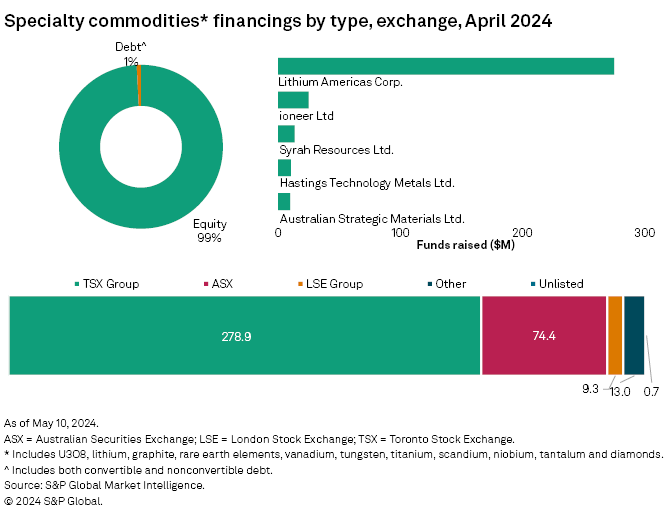

Funds raised for the specialty commodity group jumped to $376 million from $105 million in March, the highest since November 2023. The number of transactions jumped to 47, up from 34. Higher funds raised for lithium and rare earth elements pushed the group's total up, despite the decline in funds raised for uranium and graphite. There was one transaction valued at over $30 million, the same as in March.

The largest specialty metals financing, and the second largest overall, was the $275 million follow-on offering of common shares by Vancouver-based Lithium Americas Corp.. The company fully owns the Lithium Nevada mine that is currently being constructed. In 2023, Lithium Americas signed a lithium carbonate purchase agreement with General Motors Co. after the latter's $650 million equity investment with the former.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.