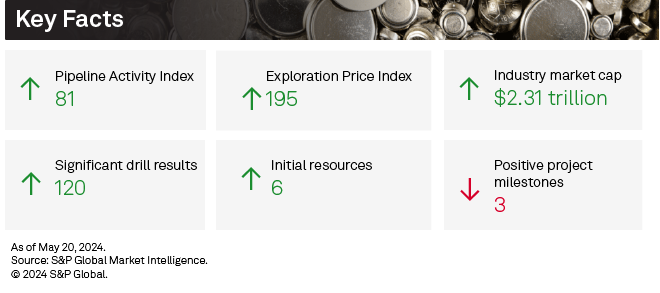

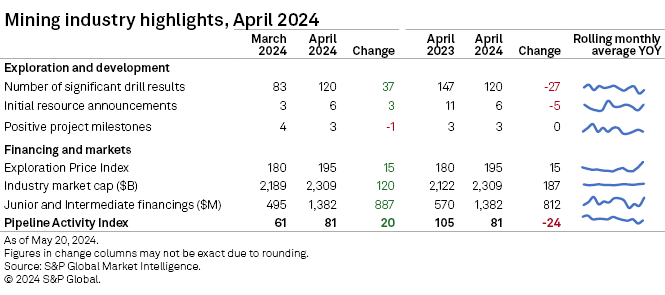

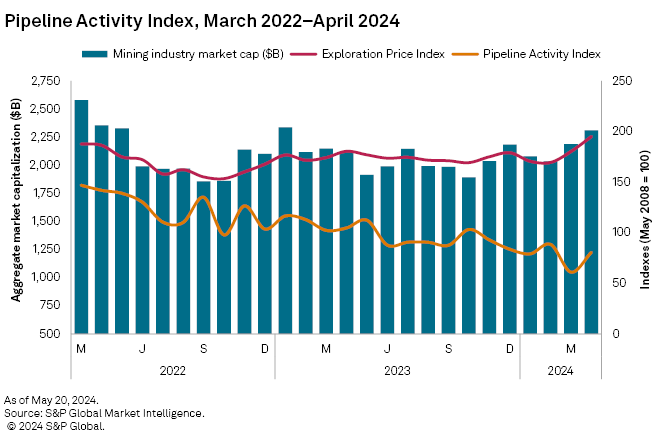

The S&P Global Market Intelligence Pipeline Activity Index rebounded from multiyear lows, increasing 32% in April to 81 from 61 in March. Both the gold and base metals subindexes contributed to the monthly rebound. The gold Pipeline Activity Index (PAI) increased 24% month over month to 114.5 from 92, while the base/other PAI increased even more — up 41% to 53 from 37.5.

The metrics we used to calculate PAI were mostly positive. Significant drill results, financings and initial resources all increased, while positive milestones dropped by one. Meanwhile, most metals tracked in our Exploration Price Index (EPI) posted significant price increases, continuing the trend. Enjoying the windfall, the mining equity rally accelerated in April.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel spreadsheet.

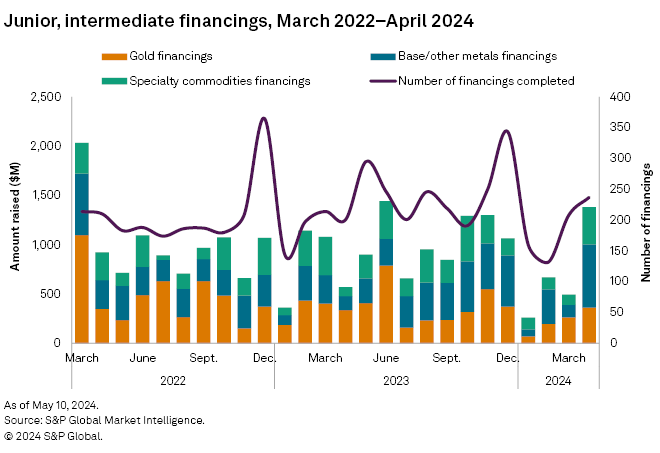

Higher gold, copper, lithium push financings to 10-month high

Funds raised by junior and intermediate mining companies jumped 179% month over month to $1.38 billion after a lackluster performance in the first three months of 2024. Funds raised in April were the highest in 10 months, backed by a 14% month-over-month increase in the number of financings and several high-value transactions. All commodity groups increased, with copper and lithium contributing most to the increase. Six transactions were valued at more than $30 million, compared with two in March.

Gold financings increased for the third consecutive month in April, up 37% to $362 million, after a five-year low of $72 million in January 2024. The number of gold transactions rose to 125 — the highest in 11 months — up from 114 in March. There were three transactions valued at over $30 million, up from zero in March.

Fueled by a single transaction, the base/other metals group jumped fivefold month over month to $643 million — the highest since November 2021. Copper led the increase, as funds raised for the red metal jumped to a multiyear high of $596 million. Slight increases were recorded for silver and cobalt, while molybdenum and nickel fell slightly. The number of transactions was up by five to 65. There were two transactions valued at over $30 million in April, up from one in March.

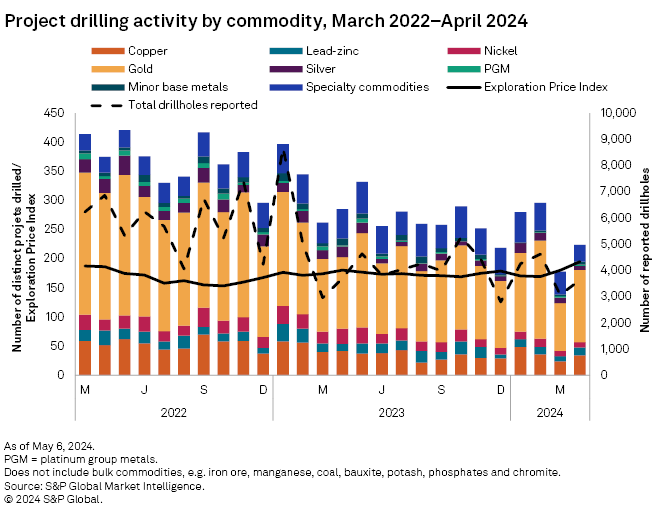

Drilling in Canada boosts global metrics

Drilling activity in Canada led to an upswing in overall drilling metrics for April. Projects drilled increased by 46 to 224, while the number of drillholes was up 562 to 3,634. Nearly half of the increase in drilled projects and 90% of the additional drillholes are attributable to projects in Canada. All drilling stages were also up month over month in April, with minesite projects jumping 65%, late-stage projects up 25% and early-stage projects up 7%.

April's top result came from Toronto Stock Exchange-listed Pan American Silver Corp.'s La Colorada silver mine in Mexico, which reported an intersect of 372.1 meters grading 5.79% zinc, 3.91% lead, 77.0 grams of silver per metric ton and 0.11% copper. Of late, the company has reported some of the highest-grade intersects since the discovery of skarn in 2018, with the highest silver grade to date reported in April. Pan American expects to present an updated mineral resource estimate in August 2024.

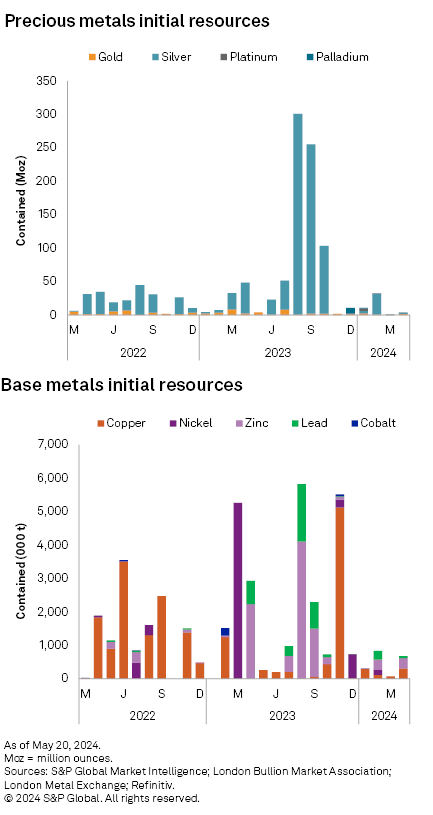

Initial resource announcements double

There were six initial resource announcements in April, twice as many as in March. Half were gold primary projects, two were copper and one was palladium. Unfortunately, announced contained volumes continued to be minimal, like in March.

The most noticeable gold announcement came from Dakota Gold Corp., which announced maiden resources for its Richmond Hill gold project in South Dakota. The company reports an indicated resource of 51.8 million metric tons at 0.80 g/t Au for 1.33 million ounces and an inferred resource of 58.1 MMt at 0.61 g/t Au for 1.13 Moz.

The most noticeable copper announcement came from East Star Resources PLC, which reported maiden inferred resources for its Verkhuba copper deposit in Kazakhstan. The inferred resources of 20.3 MMt with a copper grade of 1.16% and a zinc grade of 1.54% contain an estimated 236,000 metric tons of copper and 313,000 metric tons of zinc.

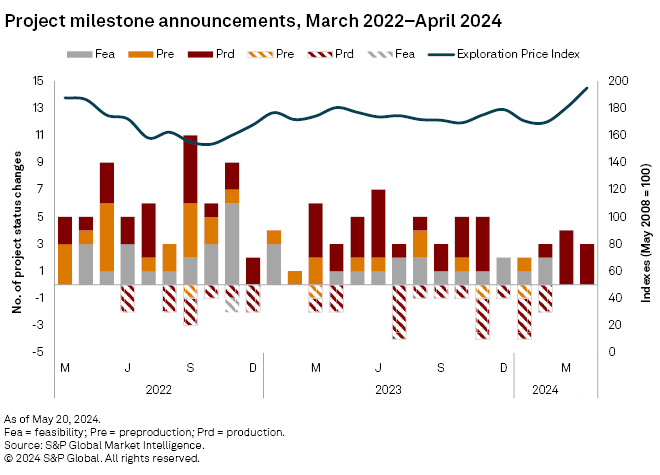

Positive milestones drop by one

Milestones dropped in April, with one less positive announcement being recorded month over month. All three were at gold-focused projects and, as in March, all were production-related. Also, there were no new negative announcements.

Interestingly, the three gold-related positive milestones in April were all first gold pours at new or existing operations. Most notably, South Africa-based Gold Fields Ltd. announced the first gold pour at its Salares Norte Mine in Chile. Approximately 350,000 ounces of gold are expected to be mined annually through the 12-year mine life. Endeavour Mining PLC announced the first pour from the Sabodala-Massawa mine expansion in Senegal, just two years after construction began. Ascot Resources Ltd. announced the first pour at the Premier gold project in British Columbia's golden triangle.

Exploration Price Index rises to record level

The Market Intelligence's EPI rose even higher in April, to 195 versus 180 in March. Nearly all metals in the index built on March's gains; these rises brought the index to the highest level since we began compiling it in 2008. Gold prices continued their climb and broke March's all-time highs. While gold prices increased 7.9% month over month, silver registered a 12.2% month-over-month gain. The core base metals — copper, nickel and zinc — notched impressive sequential gains: 8.7%, 4.2% and 10.9%, respectively, while molybdenum was up just 0.4%. Similar to March, cobalt was the only metal to decline month over month, slipping 1.2%.

The EPI measures the relative change in precious and base metals prices, weighted by the overall exploration spending percentage for each metal as a proxy of its relative importance to the industry at a given time.

Strong metal prices continue to boost equities

The strength in commodity prices boosted mining equities, many to 52-week highs. Market Intelligence's aggregate market capitalization of the 2,677 listed mining companies increased 5.5% to $2.31 trillion from $2.19 trillion in March. While metals prices are at multiyear highs, this is only the highest market cap recorded since January 2023, which suggests mining equities have yet to fully participate in the rally.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.