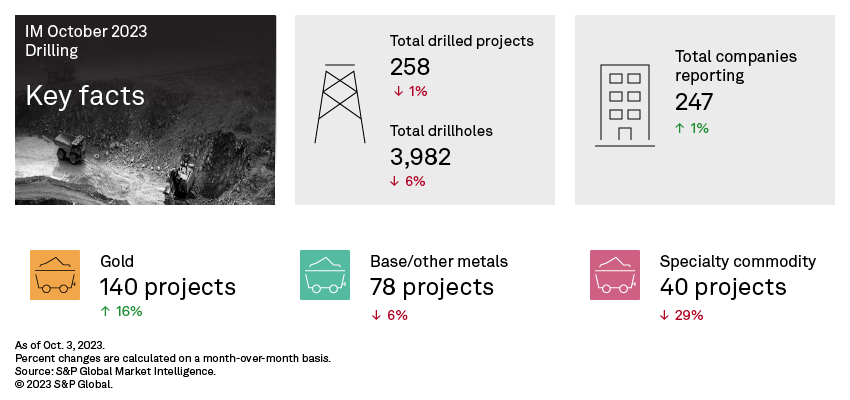

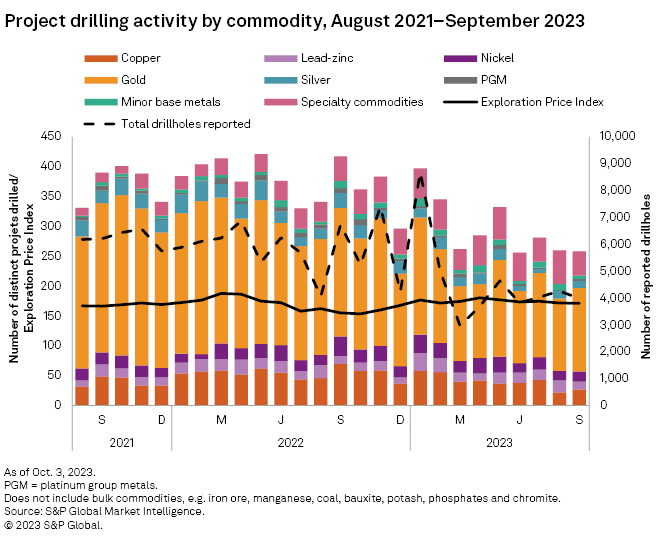

Most drilling metrics were down for September, with drilled projects decreasing to 258, inching closer to the year's low of 256 recorded in June. Distinct drillholes fell 6% from 4,258 to 3,982 — a September low not seen since 2020. A year-to-date comparison shows the total reported drilled projects and drillholes were both 23% lower than in 2022. The total early-stage projects remained constant at 96, while late-stage projects decreased 7% to 115 and minesite projects drilled rose 18% to 47.

After falling to its lowest total of the year in August, gold projects rebounded in September, up 16% to 140 projects. Of the 19 gold project additions, 11 came from Canada, with most reporting from early-stage projects. As a group, base metals projects decreased 9% to 63 projects, with lead-zinc down 35% to 13 and minor base metals down 45% to six. Alternatively, nickel projects increased to 17, and copper projects rose 23% to 27 after August's 33-month low of 22 projects. Drilled projects for silver decreased to 12, platinum group metals projects increased slightly to three, while specialty metals dropped to 40 projects after going down by 16.

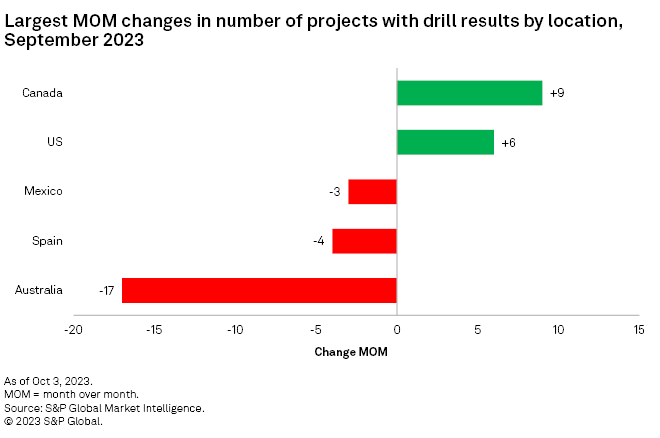

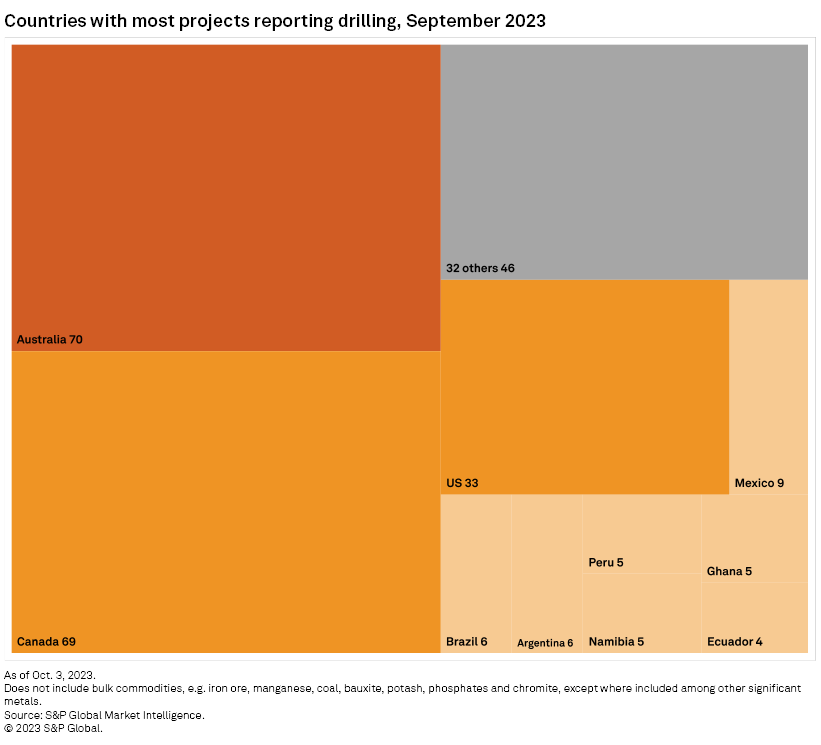

Australia barely made it as the top country reporting, down to 70 projects with a significant decrease of 17 projects month over month. Canada came close to tying for the top spot, but kept second place, increasing 15% to 69 projects, with a boost in gold projects reporting. Australia saw decreases in gold, lead-zinc and specialty metals projects, while Canada saw a large increase in gold projects reporting. US remained a distant third but increased 22% to 33 projects buoyed by gold projects.

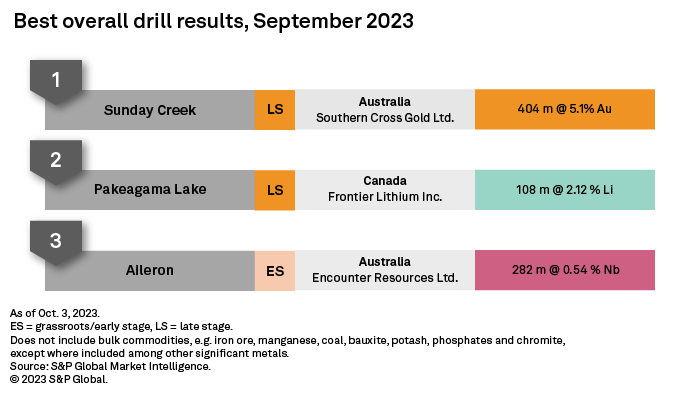

August's top result came from Australian Securities Exchange-listed Southern Cross Gold Ltd.'s late-stage Sunday Creek gold project in Victoria, Australia. Southern Cross reported its best drillhole to date, with an intersect of 404.4 meters grading 5.1 grams of gold per metric ton. This drillhole exceeds the previous best hole by almost three times and is the first hole to expand the mineralized footprint at the Rising Sun prospect area. The project continues to develop with four drill rigs currently operating, with ongoing laboratory work.

The second-best result came from TSX Venture Exchange-listed Frontier Lithium Inc.'s Pakeagama Lake lithium project in Ontario. The company reported a 108.4 meter intersect grading 2.12% lithium from the Spark pegmatite. The recent findings indicate the possibility of expanding the project's Spark resource. The Pakeagama Lake lithium project contains North America's highest-grade lithium resource and is the second-largest in the region by size.

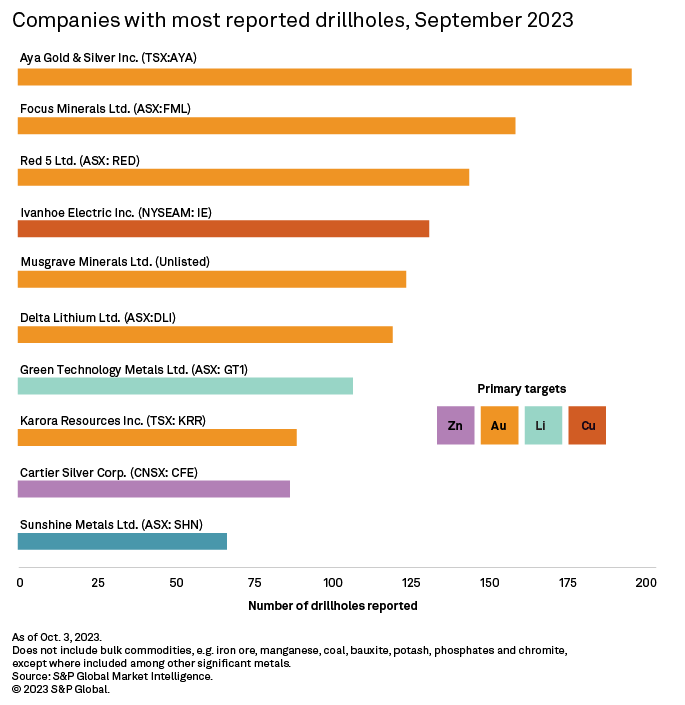

Toronto Stock Exchange-listed Aya Gold & Silver Inc. reported the most drillholes in September, with 185 holes drilled between its Zgounder silver mine and Boumadine project, both in Morocco. Following a devasting earthquake in early September, the company temporarily suspended operations at Zgounder to carry out inspections of the mine and mining infrastructure; it was able to resume operations after 24 hours.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.