Introduction

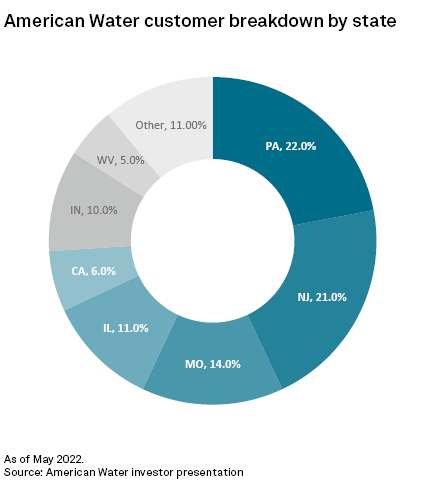

With the addition of two meaningful rate case filings in California and Missouri in July, American Water Works Co. Inc. has requests for base rate increases pending in five states comprising approximately 74% of the company's regulated customer base.

* Pending rate cases across American Water's footprint address over $10 billion of water and wastewater utility rate base. While investors have recently focused on inflation and escalating costs, the company's accelerated infrastructure investment program is driving these pending rate cases.

* Across the five jurisdictions, the company has requested returns on equity ranging from 10.25% to 10.8%. The requested ROEs are above the 9.73% prevailing nationwide average water industry ROE authorization for the first six months of 2022, which is up from an average authorized return on equity of 9.46% observed during 2021.

Given American Water's typical rate case cycle, it is not uncommon for the company to have multiple large rate cases pending at once. In particular, the company has previously navigated rate cases in New Jersey and Pennsylvania concurrently. In addition to the pending rate cases discussed below, American Water also has small wastewater proceedings pending in Hawaii and Kentucky and a $15 million water rate increase request pending in Virginia.

American Water's 7%-9% compound annual earnings growth rate is driven by 5%-7% annual growth in regulated capital spending. Between 2022 and 2026, the company plans to expend between $11.5 billion and $12 billion on regulated capital projects, with approximately 70% of that investment earmarked for replacement capex. According to Regulatory Research Associates, this spending program will require the company to continue filing for base rate increases on a two- to three-year cycle in most of its regulated jurisdictions.

American Water utilizes infrastructure surcharges to minimize the regulatory lag between rate cases for replacement investments, which represent a large portion of the company's capex spending program. In March, the company filed infrastructure surcharges to be incorporated in base rates in Kentucky and Missouri, totaling $22 million of additional revenue. On July 1, the company filed its annual 2023 Infrastructure Replacement Plan in West Virginia.

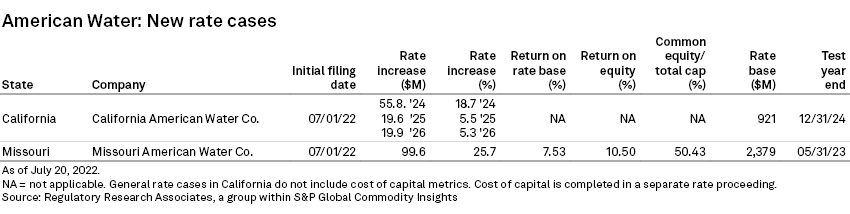

Recent rate filings

California – On July 1, California-American Water Co. filed a general rate case, or GRC, with the California Public Utilities Commission. The company, or Cal-Am, requested a $55.8 million, or 18.7%, rate increase for 2024, a $19.6 million, or 5.5% increase in 2025, and a $19.9 million, or 5.3%, increase in 2026. The request incorporates a $921 million rate base for a calendar 2024 test year. Rate of return is not an issue in this case, as it is determined in a separate cost of capital proceeding. The proceeding reflects the current return on equity of 9.2% and rate of return of 7.61% authorized in 2018.

Cal-Am said on "a company aggregate basis, the main drivers of the rate increase are necessary support for new capital investment ($40.2M), increased labor expense ($7.5M), inflationary pressure ($6.1M), reduction in demand ($1.7M), and small system consolidation support ($3.3M). These cost drivers are offset in part by decreasing costs in other areas and/or by increased revenues from acquisitions, improved efficiencies stemming from acquisitions, increased sales, and organic customer growth."

Of particular interest to investors, the GRC includes a proposal for a new rate design, which could expose Cal-Am to increased financial risk. In an August 2020 order associated with low-income affordability (A-17-06-024), the PUC ruled that the full decoupling mechanism utilized by the three largest water utilities should be transitioned into one known as a "Monterey-WRAM," — utilized by SJW Group subsidiary San Jose Water Co. — which would only recognize changes in water prices from wholesaler water providers. The full decoupling mechanism the companies currently operate under also accounts for differences in volumetric fluctuations. The Monterey-WRAM proposed by Cal-Am will continue to pass through certain expenses, including purchased water, purchased power and pump tasks, but is not considered a conventional decoupling tool. California Water Service Group subsidiary California Water Service Co. has similarly proposed a Monterey-WRAM in its pending GRC.

While a procedural schedule has not been established, the earliest a PUC final decision is expected is in December 2023. Recent water utility general rate cases have taken longer than the 12- to 18-month statutory period. In these cases, existing rates were designated as interim at some point during the proceeding, and new rates were implemented retroactively to that date.

Missouri – Also on July 1, Missouri American Water Corp., or MAWC, filed water and wastewater base rate cases with the Missouri Public Service Commission. The combined $99.6 million, or 25.7% rate increase, is based on a 10.5% return on equity (50.43% of capital) and a 7.5% overall return on rate base of $2.379 billion for a May 31, 2023, test year.

Since MAWC's last base rate, completed in 2020, the company has or will have invested approximately $769 million by the end of the test period. Over 70% of the total rate request is related to additional investments and associated depreciation and property taxes. In its rate filing, the company stated, "These investments enhance the safety, reliability and resiliency of Missouri-American's water and wastewater system, support customer service, and maintain the health, welfare, and economic wellbeing of the communities we serve."

Additional pending rate cases

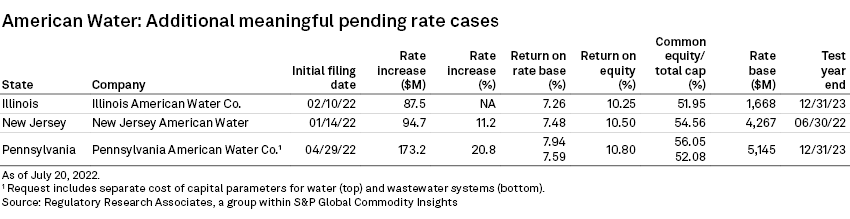

Illinois – On June 23, the Illinois Commerce Commission further suspended Illinois American Water Co.'s, or IAWC's, rate proceeding for an additional six months, extending the expected date for the commission to issue a final ruling until Jan. 9, 2023.

Most recently, the commission staff filed testimony supporting a $43.7 million revenue increase, based on a 9.78% return on equity (49.0% of capital) and a return of 6.85% on a rate base of $1.661 billion for a Dec. 23, 2023, test year.

IAWC's Feb. 8 filing seeks an $87.5 million base rate increase incorporating a 10.25% return on equity (51.95% of capital) and a total return of 7.26% on a rate base of $1.668 billion for a Dec. 23, 2023, test year.

IAWC's request includes $18.3 million of qualifying infrastructure plant surcharge and variable income tax surcharge revenue. The net increase to customers proposed by IAWC is $69.1 million, or 25%. Infrastructure investment accounts for over $72 million of the total, or three-quarters of the requested base rate increase.

Additionally, the company is requesting recovery of "moderately increasing O&M expenses ... driven by an increased demand on Company resources associated with the acquisition of 15 water and 14 wastewater systems since the Company's last rate case, totaling over sixty thousand additional customer connections. While the acquisition of smaller systems will result in increased economies of scale, the Company is currently incurring increased capital investment and operating costs."

New Jersey – At its June 8 meeting, the New Jersey Board of Public Utilities further suspended New Jersey American Water Co. Inc.'s, or NJAW's, rate proceeding until Oct. 13.

In a brief filed May 16, the Division of Rate Counsel sought to compel NJAW to provide 20 years of data related to the annual taxable income or losses for each affiliated regulated utility, NJAW's annual taxable income or loss, the annual taxable income or loss for each unregulated affiliate as Rate Counsel had requested in discovery. The data request is related to consolidated tax adjustments, which are designed to capture the tax benefits associated with losses on unregulated operations realized by holding companies for regulated customers. Refer to the New Jersey Commission Profile for additional background on the use of consolidated tax adjustments in the state.

The Division of Rate Counsel has not yet filed testimony in the proceeding, which is common in cases settled in the state. If testimony were to be filed in the coming month, RRA anticipates that the proceeding would head down a litigated path.

On Jan. 14, NJAW requested a $94.7 million, or 11.22%, base rate increase based on a 10.5% return on equity (54.56% of capital) and a 7.48% return on a year-end rate base valued at $4.267 billion for a test period ended June 30, 2022.

The company's filing states that it "has invested, or will invest, approximately $985 million in capital expenditures through the end of 2022." Infrastructure investment is driving nearly 68% of the proposed revenue increase.

Pennsylvania – On April 29, Pennsylvania American Water Co., or PAWC, filed a base rate case with the Pennsylvania Public Utility Commission reflecting over $1.1 billion in water and wastewater system investments to be made through 2023. The $154.4 million, or 21.6% water rate increase, is based on a 10.8% return on equity (56.05% of capital) and a 7.94% return on a rate base valued at $4.034 billion. The $18.7 million wastewater rate increase similarly includes a 10.8% return on equity and a total return of 7.59% and 52.08% capitalization for a rate base of $1.111 billion.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.