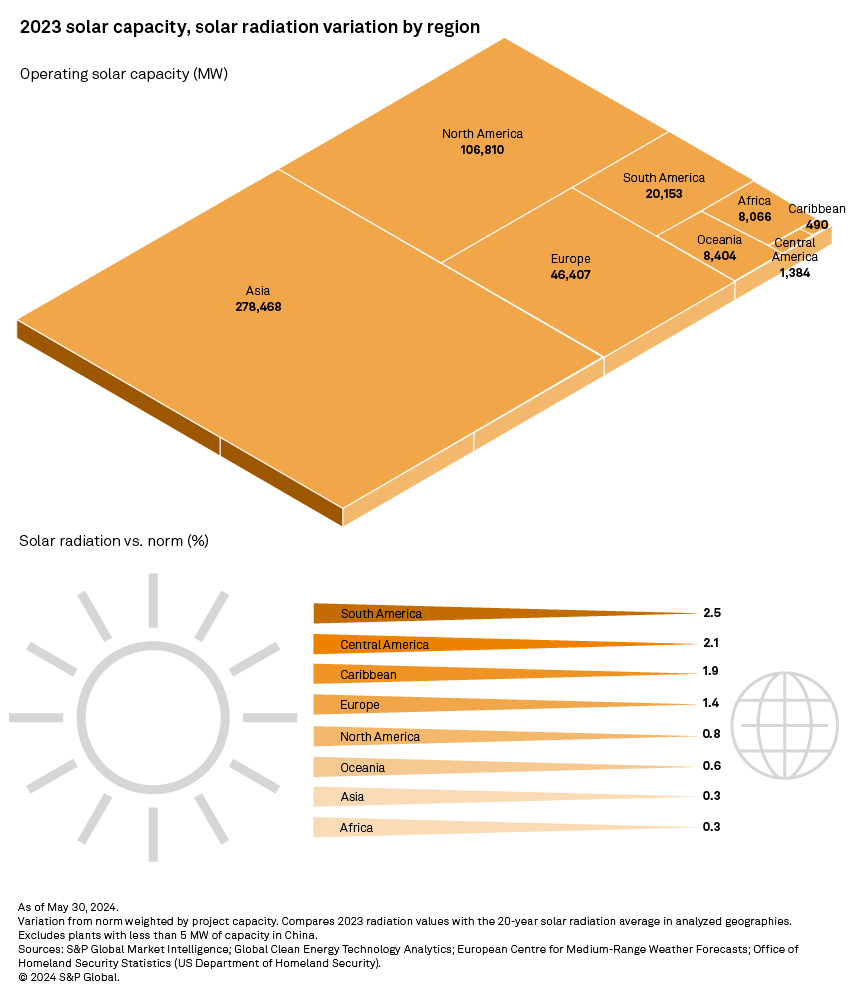

All world regions — as delineated by the US Office of Homeland Security Statistics — experienced solar radiation above the norm in 2023. This differential presumably boosted capacity factors and productivity across the globe's rapidly growing large-scale solar portfolio — positive developments in the pursuit of power decarbonization objectives amid record-high temperatures.

Zooming in on the world's 470.2-GW solar generation fleet shows deviations from the 20-year norm ranged between a weighted average 0.3% for solar projects in Africa and 2.5% across South America's photovoltaic solar assets. Asia's utility-scale solar park — the largest on the planet at 278.5 GW, 59.2% of the world's total — logged a 0.3% sunlight surplus, while North America had a 0.8% uptick. As analysis of solar fleets in North America is performed quarterly, it is excluded from this article.

Although solar radiation and air temperature do not necessarily move in tandem, the world soaked in extra sunlight as it experienced the highest temperatures on record in 2023 — theoretically, a production boost for the rapidly growing solar generation portfolios around the globe.

Regional averages show the largest positive deviations were recorded in South America, with the region's solar projects benefiting from sunlight on average 2.5% higher than the norm in 2023. Central America is not too far behind, with a sunshine surplus averaging 2.1%.

In Asia, home to the world's largest solar generation fleet, radiation levels were essentially in line with the 20-year trend.

Grab and spin the visual below to circumnavigate the globe. Mouse scroll to adjust the zoom.

Grab and spin the visual below to circumnavigate the globe. Mouse scroll to adjust the zoom.Asia

Asia is home to some of the largest solar generation fleets in the world. The cumulative installed capacity across mainland China inventoried for this analysis comes in at 211.2 GW, making up 44.9% of the global photovoltaic fleet. For India — the second-largest market by land mass — our analysis of 2023 solar radiation variations shows 26.5 GW of cumulative solar capacity, meaning it ranks second. Of note, Asia also has the largest floating offshore capacity in the world, reaching approximately 1.9 GW.

Bangladesh's solar portfolio experienced the largest jump in annual solar insolation among Asian markets with at least 100 MW of operating capacity in 2023, up 4.8% across its 865-MW fleet. The markets of Azerbaijan, Bangladesh, mainland China, Indonesia, Japan, Kazakhstan, Taiwan, Thailand, Uzbekistan and Vietnam all reported above-normal radiation, with the deviations ranging from 0.3% to 4.8%, presupposing favorable solar output and earning potential for solar energy generation facilities across these geographies.

Suboptimal insolation was more prevalent in the West and Southeast regions close to the equatorial zone. Of the markets with at least 100 MW of capacity, Bahrain, Cambodia, India, Iran, Israel, Jordan, Malaysia, Mongolia, Oman, Pakistan, Philippines, Qatar, Saudi Arabia, South Korea, Sri Lanka, Turkey and the United Arab Emirates experienced insolation deficits ranging from negative 0.1% to negative 3.6%, weighing on the region's weighted average amount of sunlight in 2023.

The provinces or states with solar insolation 3% or more above the norm are predominantly in Thailand and Japan. Thailand boasts a non-negligible solar generation fleet, at 1.9 GW as of this analysis, making it the second-largest solar fleet in Southeast Asia and seventh in all of Asia. Thailand experienced 3.3% higher-than-normal insolation in 2023 — the third-largest surplus in Southeast Asia and fifth overall in Asia last year. In Vietnam, which boasts the largest solar fleet in Southeast Asia at 5.1 GW, sunshine tracked closely to the 20-year average during the period under consideration. At the other end of the spectrum in Southeast Asia, Malaysia's 1.1-GW photovoltaic generation fleet experienced overall radiation dipping 3.6% below the 20-year average.

Japan is home to the second-largest solar fleet in East Asia, following China, at 10.1 GW, meaning it is the third-largest in all of Asia. Japan took in excess sunshine in 2023 at 2.7% above normal, ranking first in East Asia and sixth in the whole of Asia.

Caribbean, Central America and South America

The aggregate 22.0 GW of operating solar capacity across these three regions took in solar radiation more than 2.4% higher than the 20-year average in 2023. South America's 2.5% deviation makes it the top-ranking of the eight designated regions. Of the 15 countries across the geography with operating grid-scale solar capacity covered in this analysis, only two experienced below-normal annual insolation: Uruguay and Barbados. With only 195 MW of combined operating capacity, these two markets account for less than 1% of the region's total. Over 86% of the photovoltaic capacity in these three regions is located in three countries in South America: Argentina, Brazil and Chile.

Brazil leads this group, with 10.9 GW of operating solar capacity covered in this analysis. This sizable fleet took in sunshine 3.9% above average in 2023, the largest positive deviation in South America. Brazil is expected to remain one of the more popular growth markets for solar globally. Almost the entire fleet of solar capacity in Brazil has been added in just the last eight years, with solar recently becoming the second-largest source of electricity in the country after hydroelectric generation. The 765-MW Sol do Cerrado Solar Farm and the 1,200-MW Janauba Solar Complex — owned by Vale SA and Brookfield Corp., respectively — both took in annual insolation more than 6% higher than normal.

Chile's 7.0-GW solar portfolio experienced near-normal solar conditions throughout 2023, deviating just 0.7% above the 20-year average. Excess sunshine in the northern third of the country helped counter below-average radiation in the central states, including the Santiago and Valparaíso metropolitan areas. Argentina ranks third in the region in installed solar capacity at 1.1 GW, and its fleet experienced insolation 2.4% above normal.

Europe

Radiation 1.4% above the 20-year average hit European solar projects in the 12 months to Dec. 31, 2023, making the region the fourth-largest recipient of higher-than-normal insolation levels last year behind South America, Central America and the Caribbean. Sixteen of the 27 European markets tracked in this study benefited from excess irradiation. Most of the markets with negative deviations are in southeastern Europe, with Bulgaria bringing up the rear, down 1.6%.

The sunny Iberian Peninsula, perhaps unsurprisingly, logged the largest positive deviations among European markets with at least 500 MW of operating solar capacity in 2023. Portugal's utility-scale solar projects benefited from radiation 2.7% above the 20-year average. In Spain — home to the largest solar generation fleet in Europe, with more than a third of the region's overall grid-scale photovoltaic capacity — the sunlight surplus came in at 2.5%. Of note, Europe's largest solar plant, the 626-MW Cifuentes-Trillo Solar Project in Spain's Guadalajara Province, registered a 2.3% average radiation uptick.

Across Europe's second- and third-largest markets by grid-scale solar capacity, Germany and the UK, radiation levels eked out 0.9% and 0.2% departures from the 20-year norm, respectively. For perspective, combined UK and Germany capacity is slightly below that of Spain. Utility-scale solar capacity accounted for 18.6% of Europe's overall renewable generation capacity as of this report, based on S&P Global Market Intelligence data, with wind having a 68.3% share.

REPowerEU, an ambitious European Union decarbonization plan precipitated by Russia's invasion of Ukraine in February of 2022, calls for renewables to account for 45% of the EU generation fleet by 2030. In Europe, renewables currently account for 25.2% of the generation fleet and 62.7% of the additional capacity in the pipeline, according to Market Intelligence data. Of note, our regional aggregates are based on geographic grouping by the US Department of Homeland Security's Office of Homeland Security Statistics, not specific economic and/or political alliances such as the EU, the Association of Southeast Asian Nations (ASEAN) or other legal entities.

Solar radiation is the mean surface downward shortwave radiation flux measured from the fifth-generation European Centre for Medium-Range Weather Forecasts reanalysis. This variable includes direct and diffuse solar radiation and is the model equivalent of global horizontal irradiance, the value measured by a pyranometer, a solar radiation measuring instrument. The data is available at quarter-degree latitudes and longitudes, with a spacing of slightly over 27.5 km. This analysis compares 2023 radiation values with the 20-year solar radiation average for the analyzed geographies.

Data visualization by Cat VanVliet and Shirley Gil.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Kristin Larson contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.