A growing number of investors are upping their spend on women's sports teams as viewership and media deals grow.

Source: Lighthouse Films/DigitalVision via Getty Images.

Rising interest in women's sports among fans is leading to better media deals and record-setting spending by investors.

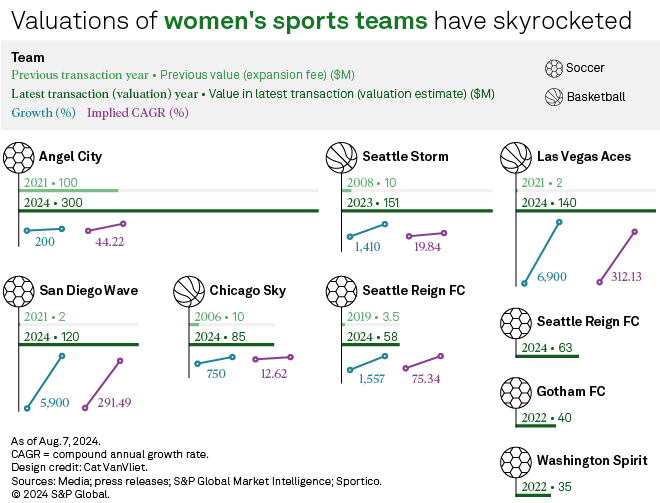

Recently, WFC LA Inc., known as Angel City, was acquired by Walt Disney CEO Bob Iger and Willow Bay, dean of the USC Annenberg School for Communication and Journalism, for a record sum of $250 million. The previous record for a National Women's Soccer League team was set just a few months before when the San Diego Wave was sold for $120 million. In the WNBA, Seattle Storm Foundation sold a stake in 2023 at a $151 million valuation. The growth in valuations of teams has been extraordinary, with teams seeing double- and triple-digit compound annual growth rates.

This growth is set to continue as the business of sports overall is increasingly attracting a widening pool of professional investors such as private equity firms, pension funds and investment firms.

"Traditional stock market returns aren't for everybody, and sports is a rising and underinvested alternative asset class, especially women's sports," said Ryan Harnetiaux, managing partner for Aequus Sports LLC, which owns the USL Super League's Spokane Zephyr FC.

Looking ahead

In terms of how long the runway for growth could be, many investors see a growth opportunity for the next 10 years or more, said Leron Rogers, a partner at law firm Fox Rothschild LLP focused on entertainment and sports law.

"I have clients that are looking to acquire a controlling interest in teams so they can operate, and then others that are just looking to invest in the space as a passive investment," Rogers told S&P Global Market Intelligence.

Investors are merely following the trend of growing viewership and media rights. The WNBA this year negotiated a media deal at $200 million per year for 11 years, four times higher than its previous deal. Acknowledging the potential explosive growth of the league in the years to come, there is a renegotiation clause after three years.

New leagues are being formed in soccer and basketball, with the addition of the USL Super League and the Unrivaled three-on-three in basketball. Most of the teams involved are newly founded, with the new leagues created to capitalize on growing demand and offer opportunities to US players to play at home.

"Many of our veteran players have been playing overseas, and we are especially excited to give these top-level female players an opportunity to be back in the US," Harnetiaux said.

Increasing viewership

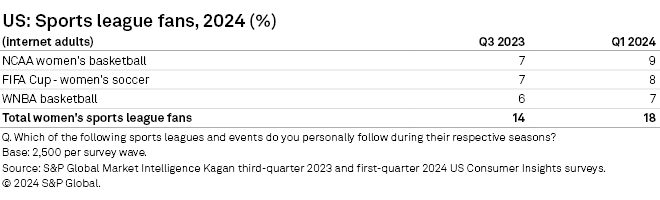

Viewership of women's sports has also continued to rise. According to S&P Global Market Intelligence Kagan's US Consumer Insights survey, women's sports viewership rose four percentage points between the third quarter of 2023 and the first quarter of 2024. The majority of those watching are avid live sports fans, though the emergence of basketball stars such as Caitlyn Clark and Angel Reese has helped fuel interest more broadly.

With viewership rising, sponsors are taking women's sports more seriously.

"For the first time, you have brands saying, 'What's my women's sports strategy?' which never used to happen," Dan Mannix, co-founder of underdog venture team, said in an interview with S&P Global Market Intelligence. "Brands are realizing they need to get on the bandwagon, or they're going to be left behind."

Walt Disney Co. reported that women's sports ad sales jumped seven times over the past two years, without disclosing the actual numbers.

Patient capital needed

While the growth has attracted many investors, Harnetiaux said women's sports offer the best opportunities for patient investors with an operator mindset.

"You need investors that are committed," he said. "Launching a professional sports organization takes a lot of capital and patience to take off the ground."

For the Zephyr club, Harnetiaux received much interest early on in the project from investors outside the Spokane area but passed, opting to find the right partners with ties to the community.

Mercury/13 Group, a fund set up by Victoire Reynal and Mario Malavé to acquire women's sports teams, aims to mimic an approach by City Football Group Ltd. in men's sports. Owned by a consortium, including private equity firms Silver Lake Technology Management LLC and Abu Dhabi United Group for Development and Investment, City Football has spent more than 10 years building a portfolio of majority-owned clubs ranging from its English Premier League crown jewel, Manchester City Football Club Ltd., to clubs in Spain, Belgium, the US and India, among other countries.

Similarly, Mercury/13 Group aims to deploy $100 million to build a portfolio of women's football clubs across Europe. Mercury/13 has already bought the Italian Serie A club FC Como Women.

Mercury/13's Malavé believes that women's football has tremendous potential for growth, but it "will not become a big thing if you don't invest in it." The main challenge in investing in women's sports is finding the right partner, Malavé said.

"Everyone wants capital, but you need to find someone who can understand what you want to do with the club," Malavé said.

STEFAN MODRICH contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.