S&P Global Commodity Insights discusses the iron ore market within the broader macroeconomic environment and provides supply, demand and price forecasts for a rolling five-year period.

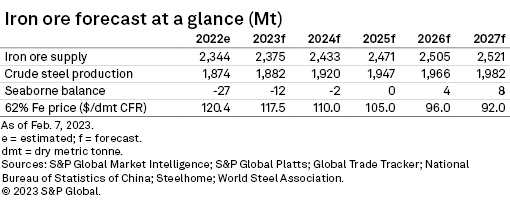

Key findings

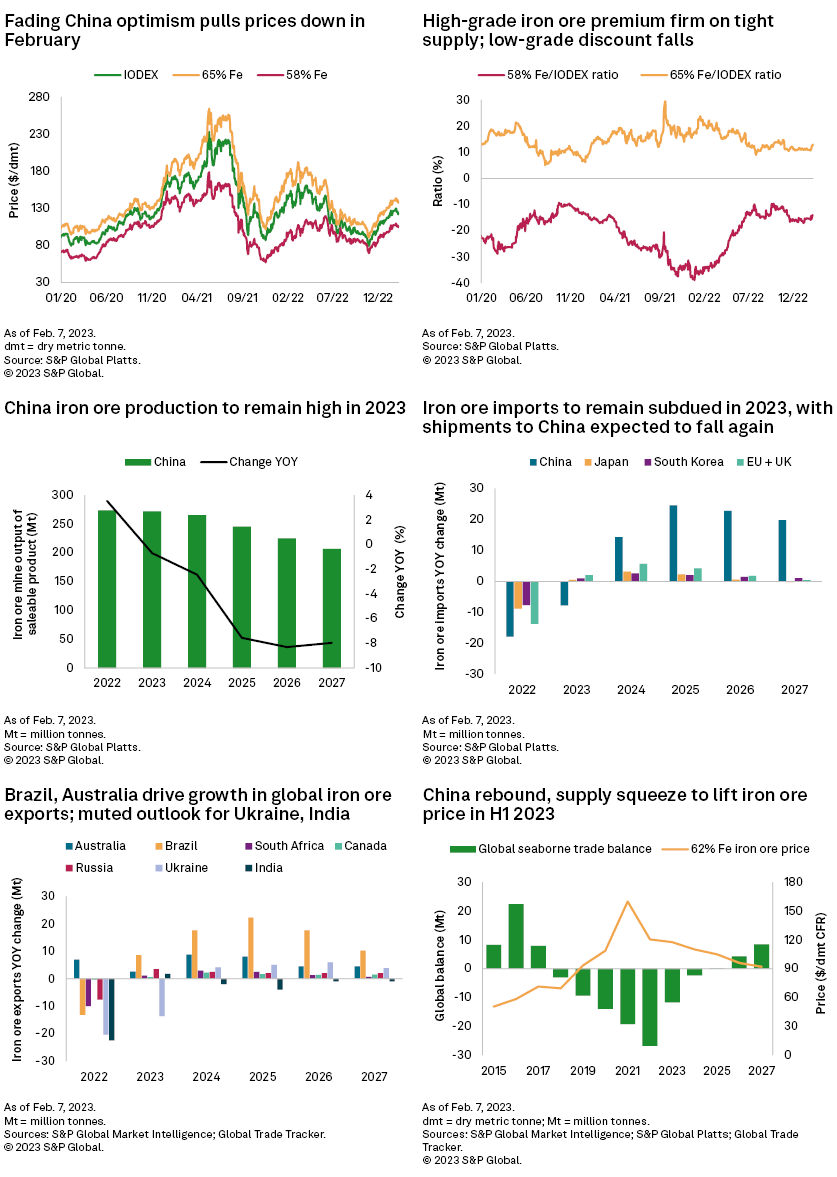

* The S&P Global Platts IODEX 62% Fe iron ore price rose to a seven-month high of $129.80 per dry metric ton at the end of January before pulling back as optimism fades on a buildup of steel stocks in China.

* China's property sector remains in the doldrums, with new residential floor space under construction and real estate investment down 39.8% and 10.0% year over year, respectively, in December.

* We expect China's full-year steel production to fall 0.7% in 2023 due to the slumping property market.

* Iron ore supply constraints, namely from weather-impacted Brazil and China's seasonal winter curb on production, are helping to support prices in the March quarter.

* Further buoyed by the broader benefits of China reopening, we have moderately upgraded our average iron ore price forecast to $123.11/t for the March quarter and $117.53/t for 2023.

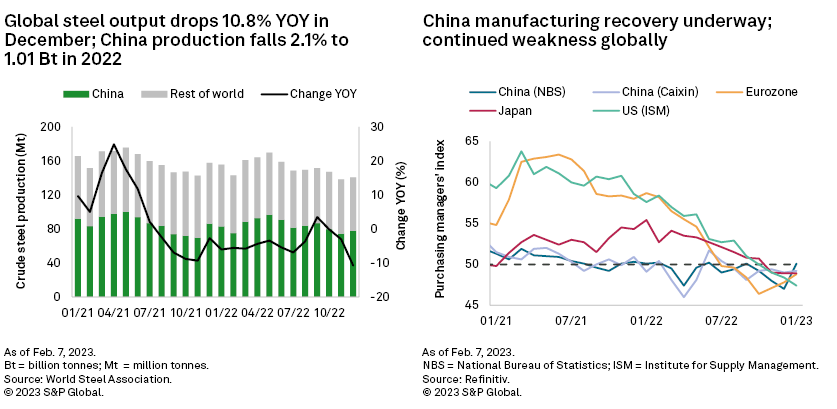

Bullish sentiment around China's reopening helped lift iron ore prices to a seven-month peak in January before fading optimism led to a pullback in early February. Expectations for a boost to China's economy through 2023 remain, although the market is reevaluating the foundations on which this will be built. The main downside risk for iron ore demand is weakness in China's steel sector, which the slumping property market exacerbates. We expect China's steel output to rise steadily over the near term, although we forecast lower full-year production and iron ore imports. A seasonal supply squeeze supports upgrades to our iron ore price forecasts for the first half of 2023 despite our expectation that ex-China demand remains subdued.

Analyst comment

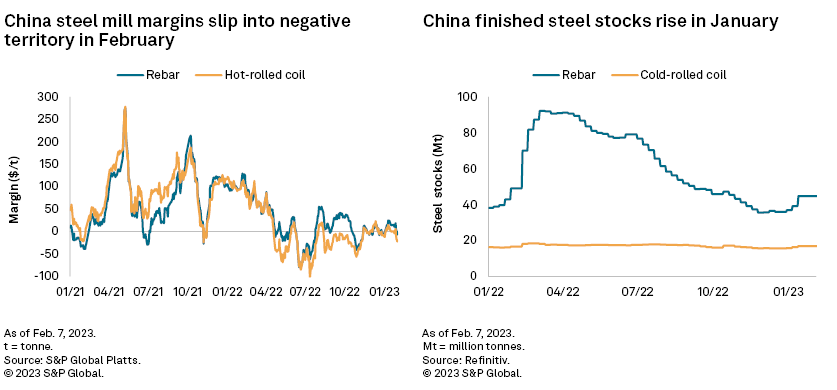

The IODEX 62% Fe iron ore price reached a seven-month high of $129.80/t on Jan. 30 as China lifting its zero-COVID restrictions spurred hopes for a boost to demand over the coming months. Restocking activity before the Lunar New Year holiday buoyed China's iron ore imports in the first half of January, but the expected post-holiday boost for iron ore demand has yet to materialize. The iron ore price slipped to $121.70/t on Feb. 7 as optimism faded on a buildup of steel stocks in China.

China's return from the Lunar New Year holiday without pandemic restrictions for the first time in three years is expected to trigger a recovery in economic activity and a rise in iron ore demand through 2023. The outlook for China's property sector — a key steel consumer — is less clear, however, as home sales fell over the Lunar New Year holiday. While the authorities have loosened restrictions on financing over recent months, their focus appears to have been on property developers already in good financial health and not those facing severe difficulties, according to the International Monetary Fund. To make matters worse, a large overhang of unfinished presold housing stock adds to developers' challenges. December data indicates new residential floor space under construction dropped 39.8% year over year, and real estate investment was down 10.0%.

China's property market woes are weighing on profitability at domestic steel mills, with margins moving back into negative territory in February. Weak margins support China's demand for low-grade iron ore imports, slightly eroding the price discount for 58% Fe iron ore fines. Steel mills will be encouraged by signs of a recovery in China's manufacturing sector, with the January National Bureau of Statistics purchasing managers' index above 50 for the first time in four months on stronger domestic demand. We expect China's steel output to rise in the coming months, helped by a seasonal upturn in construction activity, although excess steel stocks will limit the ramp-up in production. Based on our expectation for a muted recovery in the domestic property sector, we are forecasting another decline in China's full-year steel production of 0.7% and of 8.0 million tonnes for iron ore imports in 2023.

There is more pessimism toward the near-term outlook for iron ore demand in Europe and Japan, where further interest rate hikes to tackle inflation is expected to weigh on economic growth in the first half. Manufacturing purchasing managers' indexes for the two economies remained in negative territory in January, despite signs of improvement in Europe on rising auto sales. December saw monthly steel production in Europe and Japan drop to their lowest levels since the pandemic-hit months of 2020. We expect a 1.2% year-over-year rise in total iron ore imports into Europe and Japan in 2023 based on a muted recovery in steel output.

Iron ore supply constraints are helping to support prices, however. January saw weather-related disruptions to Brazil's exports, bolstering the high-grade iron ore premium. December-quarter production at Vale SA's mines in Brazil were 1.0% lower year over year at 80.9 Mt, despite a healthy 24.2% rise in quarter-over-quarter sales. The company's full-year production was 2% lower at 308 Mt, coming in below expectations due to licensing delays at Serra Norte and operational issues at Serra Sul. Vale's production guidance for 2023 is unchanged at 310-320 Mt, although supply remains at risk of further slippage. Meanwhile, Australia's iron ore shipments through its key Pilbara terminals ended 2022 on a high. However, major producers' low capital expenditure budgets for iron ore projects in the country are expected to constrain export growth from 2023 to 2027.

Ukraine's iron ore exports dropped 45.9% in 2022 to 24.0 Mt because of the conflict with Russia, while India's shipments — mostly to China — plunged an estimated 63.0% on lower demand and hiked export tariffs. The structural change in exports from these countries deepened the global seaborne trade deficit in 2022 despite weakened demand. We expect Ukraine's exports to fall further to 10.4 Mt in 2023, with a partial recovery to 29.4 Mt in 2027 on the assumption of a resolution to the ongoing conflict with Russia. In contrast, we expect India's shipments to remain subdued through the forecast period.

Outlook

Supply tightness is expected to support iron ore prices through the March quarter, helped by the winter freeze curbing domestic iron ore production in China. Excess steel inventories and weak margins limiting the ramp-up in domestic steel production, however, will temper China's near-term iron ore demand recovery. Buoyed by the broader benefits of China's reopening, we have moderately upgraded our average iron ore price forecast to $123.11/t for the March quarter and $117.53/t for 2023.

Key indicators

S&P Global Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Access metals market analysis and price forecasts.

Request Follow UpGain access to our full news & research coverage and the industry-specific data that informs our insights.

Request Follow Up