Looking ahead to next month's scheduled 17th Forward Capacity Auction, or FCA 17, for the reliability year 2026/2027, expected high levels of renewable growth combined with low load growth and few retirements drive a low ISO New England capacity price outlook in the S&P Global Market Intelligence Power Forecast.

The ISO-NE states of Massachusetts, Rhode Island, Connecticut, Vermont and Maine have renewable portfolio standards with specific requirements for offshore wind in Rhode Island, Connecticut and Massachusetts. Fulfilling those renewable mandates will substantially increase wind and solar capacity in ISO-NE, supporting the build-out of renewables as the grid operator focuses on the energy transition . The fourth-quarter 2022 S&P Global Market Intelligence Power Forecast projects the addition of 13.0 GW of installed renewable capacity (wind, solar, and storage) by 2028, contributing 5.3 GW of capacity to peak demand. The recent surge in regional natural gas prices due to the conflict in Ukraine and relatively low prices to build onshore wind and solar drive more renewables even after the RPS are satisfied, primarily in Massachusetts and Connecticut. The Inflation Reduction Act tax credits make renewables even more appealing , resulting in 50% of 2028 total peak summer generation coming from renewables — an increase of 1.8 TWh from the second-quarter 2022 power forecast. All these factors result in a forecast indicating that new renewables are more economical than fossil plants. While wind and solar power provide far less reserve margin benefit than conventional generation, this amount of capacity is projected to boost reserve margins and impact the amount of additional capacity procured by ISO-NE.

The S&P Global Market Intelligence Power Forecast reflects the 1,700-MW Mystic River 8 and 9 combined-cycle plant retirement, currently scheduled for July 31, 2024. Over 4.3 GW of fossil-fuel plants, mostly oil-fired peaking generation, are forecast to retire in 2025-2028 due to poor economics.

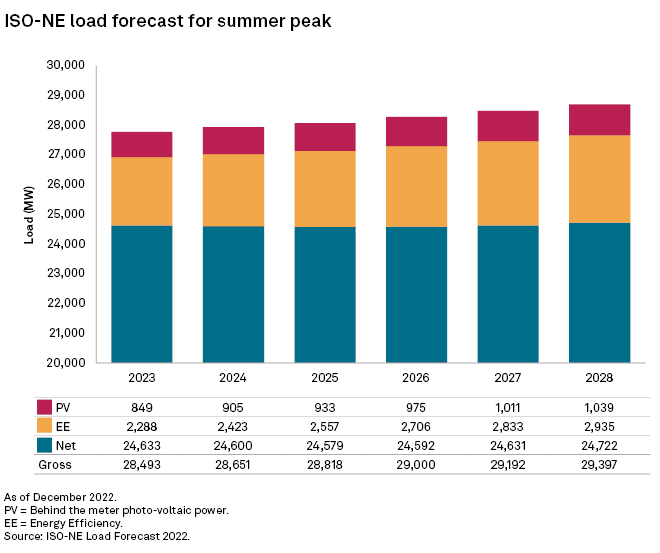

The ISO-NE 2022 load forecast projects growth in gross load through 2028, but with an increase in behind-the-meter solar and energy efficiency, net load growth is essentially flat. Behind-the-meter solar generation is forecast to increase by an average of 4.1% annually, while savings from energy efficiency are forecast to increase by an annual average of 5.1%. By 2028, ISO-NE forecasts behind-the-meter solar and energy efficiency combined to serve 3.9 GW of summer peak load, with a net load of about 24.7 GW to be served by wholesale generation, 89 MW (0.4%) higher than the forecast peak in 2023.

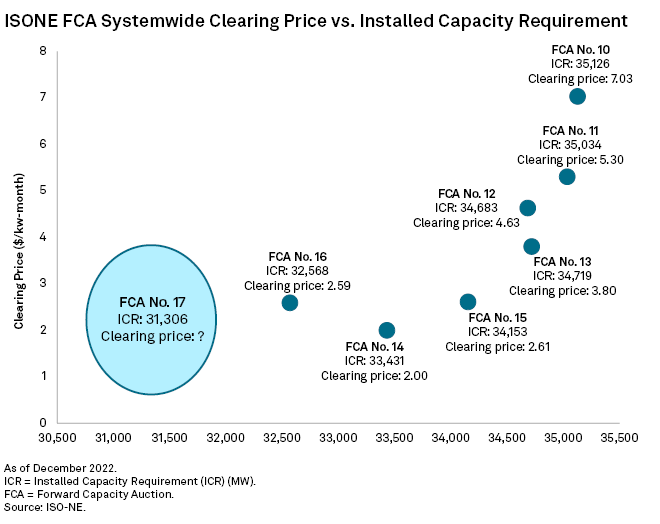

The combination of low load growth, increasing renewable capacity and few retirements create downward pressure on capacity prices in ISO-NE. These conditions prolong the recent trend, where the last four FCAs have cleared at less than $4 per kW-month.

For the upcoming FCA 17, the installed capacity requirement is set to 31,306 MW, more than 1,200 MW less than the installed capacity requirement for FCA 16, which cleared at $2.591/kW-month systemwide, and more than 2,800 MW less than the installed capacity requirement for FCA 15, which cleared at $2.611/kW-month systemwide.

In both FCA 16 and 15, Northern New England cleared at lower prices of $2.531 and $2.477/kW-month, respectively, while Southeast New England cleared higher at $2.639/kW-month and $3.980/kW-month, respectively. FCA 14 had the lowest clearing price of $2.001/kW-month across all ISO zones, with an installed capacity requirement of 33,431 MW.

While many additional factors impact supply bids, recent clearing prices plotted with the installed capacity requirements for each FCA show a decrease in clearing price as the installed capacity requirement decreases. FCA 17 has a lower installed capacity requirement than the previous six auctions by a wide margin, further increasing the risk of a historically low clearing price in the auction. Due to this, Market Intelligence Power Forecast predicts a clearing price comparable to the FCA 14 $2.001/kW-month clearing price.

FCA 17 bids are due to start March 6, 2023, one month later than last year.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Kristin Larson contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.