As US life insurers faced mounting questions during the first quarter about the commercial mortgage loans they already hold, new loan acquisitions slowed to a trickle relative to past periods, an S&P Global Market Intelligence analysis finds.

➤ The life industry's mortgage loan acquisitions across categories and property types plunged by 59.9% to just $14.86 billion in the first quarter, the lowest tally in any period since COVID-19-related fallout stalled origination volumes in mid-2020. It was the lowest dollar amount of acquisitions in a first quarter since 2014.

➤ Uninsured commercial mortgages traditionally account for a substantial majority of life insurers' mortgage acquisitions, but the industry accelerated its diversification into uninsured residential mortgages in the first quarter. The former category included 64.8% of the dollar amount of first-quarter mortgage acquisitions while the latter accounted for 29.1%. As recently as 2020, those percentages were 77.2% and 11.0%, respectively. The changing landscape of general account asset managers may be as responsible for that trend as a desire to diversify.

➤ Credit quality as measured by commercial mortgages in good standing remained stellar, with only 0.3% of loans held by life insurers classified as 90+ days past due, in the process of foreclosure. But among loans in good standing, there had been a downward creep in risk categories in 2022. And in the first quarter, life insurers experienced the largest negative impact on mortgage loan book value from the combination of declines in unrealized valuation and the recognition of other-than-temporary impairments since the second quarter of 2010. These data points may represent only the initial cracks in the industry's commercial real estate armor.

Office lending tumbles

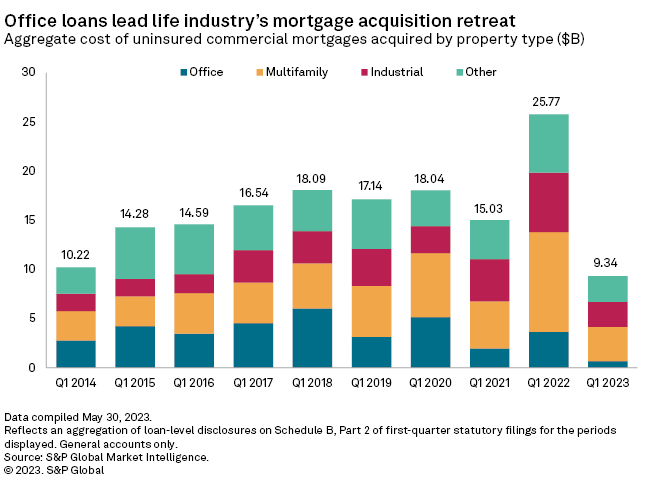

Mortgage acquisitions plunged across categories in the first quarter, but the decline was particularly steep in the embattled office property type as post-pandemic changes in working patterns have raised significant questions about cash flows, income and the potential for landlords to default.

Life insurers acquired just $693.53 million in loans on office properties during the first quarter, a decline of 81.0% from the year-earlier period, according to a loan-level S&P Global Market Intelligence analysis. Office loans accounted for only 7.4% of the mortgages acquired by life insurers, down from 14.2% in the first quarter of 2022 and a far cry from the 33.5% share they achieved in the first quarter of 2018. The low level of activity contributed to a decline of approximately 0.3 percentage points in overall industry allocation to mortgage loans to 13.2% of net admitted cash and invested assets as of March 31.

This sharp pullback did not occur in a vacuum amid rising interest rates, mounting macroeconomic uncertainty and fallout from the March banking crisis. The Mortgage Bankers Association's Commercial/Multifamily Originations Index, which incorporates trends across lender types, fell by 56% on a year-over-year basis after having moved sharply downward during the second half of 2022 as the Federal Reserve continued to raise the federal funds rate.

As was the case in each of the past three calendar years, life insurers focused their commercial mortgage acquisitions on multifamily and industrial properties, the latter of which includes distribution and logistics facilities, datacenters and manufacturing plants. But even in those property types, acquisition volume had all but collapsed relative to the first quarter of 2022 with multifamily down 65.8% and industrial off 58.0%.

Loans on multifamily properties represented the largest two mortgages acquired by individual life entities. The first was a $164.0 million loan on an Orlando, Fla., property by Equitable Holdings Inc.'s Equitable Financial Life Insurance Company; the second was the addition of a $141.4 million Brooklyn, NY, loan by Athene Holding Ltd.'s Athene Annuity and Life Co. The largest loan on an industrial property acquired during the quarter was State Farm Life Insurance Co.'s $140 million mortgage on a Solon, Ohio, distribution center. State Farm Life also had the largest acquisition of an office loan: a $52.5 million mortgage on a Vancouver, Wash., property.

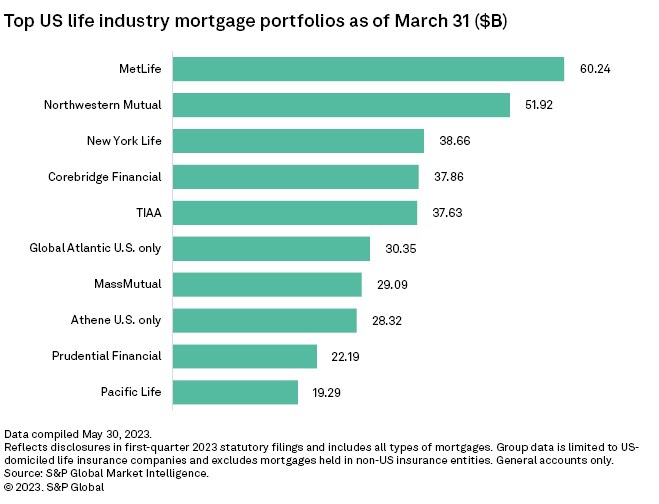

Among the life industry's largest mortgage investors at the US group level, only the group led by The Ohio National Life Insurance Co. acquired a higher dollar amount of loans in the first quarter of 2023 than in the year-earlier period. At the other end of the spectrum, acquisition volume plunged by more than 80% year over year for a number of life insurers, including the group led by New York Life Insurance Co. and the US life subsidiaries of Prudential Financial Inc.

Credit quality stays strong for now

Life insurers are traditionally viewed as conservative lenders, focusing on commercial mortgages with relatively low loan-to-value (LTV) ratios and high debt-service coverage ratios. The Northwestern Mutual Life Insurance Co. reported in a regulatory filing that the aggregate weighted-average LTV ratio for its mortgage holdings was 53% as of March 31, with 93% of that portfolio having an LTV ratio of 70% or less. Brighthouse Financial Inc. reported an overall LTV of 57% and a debt-service coverage ratio of 2.24x on its commercial mortgage portfolio as of March 31.

"The low LTVs give us significant cushion to protect against further declines in property values, even reasonably severe declines," said Brighthouse Chief Investment Officer John Rosenthal during a May 9 conference call, adding that "we feel pretty good about being able to weather any stress."

But it is difficult to paint the industry's exposure with a broad brush given the differences between carriers in terms of targeted property types, loan sizes, geographical focus, and loan terms and structures.

Massachusetts Mutual Life Insurance Co. indicated that 97% of its commercial mortgage loan portfolio at year-end 2022 consisted of bullet loans, which do not fully amortize throughout their term. While full payment is due at the end of the loans' terms, the company indicated that outcomes for its 2022 maturities included voluntary refinancing, extended maturities and prepayment in addition to payments in full. MassMutual has $2.9 billion in bullet loans scheduled to mature in 2023.

Quarterly statutory filings offer a limited view on mortgage performance. General interrogatories related to mortgage loans show that the overwhelming amount of commercial mortgages remains in good standing. The same conclusion can be gleaned from Note 5, which offers a more detailed breakout of delinquency buckets but is not consistently populated on a quarterly basis by all life insurers with mortgage holdings.

Annual disclosures of aggregate commercial mortgage risk categories, which are calculated at the loan level based on various inputs regarding underlying properties and loan structures, showed downward migration among loans considered to be in good standing. Loans in category CM3, reflective of "medium" quality, accounted for 9.2% of life insurer commercial mortgages in 2022, up from less than 6.0% at the end of 2021. Note that the current CM category disclosures date back to 2014, so it is not possible to provide data on downward migration during the financial crisis.

At the same time, Athene indicated in an April presentation that its relatively large portfolio of CM3 loans reflected "idiosyncratic features" that include more stringent LTV and debt-service coverage ratio thresholds for certain specialty real estate types. The company also noted that the risk-based capital charge assigned to CM3 loans was slightly below that associated with the highest grades of below-investment-grade fixed-income securities. While S&P Global Market Intelligence data shows that 23.8% of commercial mortgage holdings for Athene's US insurance units were categorized as CM3, the company indicated that it expected more than half of its position to migrate to higher categories in the next 12 to 24 months based on expected stabilization or the sponsor's achievement of its business plan.

Outlook

Insurers will not emerge unscathed from the current circumstances in the commercial real estate market even as their overall conservatism might provide a higher layer of protection relative to other categories of investors, but experiences will not be linear across companies.

First-quarter data shows some initial signs of stress in terms of certain changes in mortgage loan valuation. Life insurers recognized the second-highest level of other-than-temporary impairments on mortgages in any quarter since the tail end of the financial crisis era at $158.8 million. Unrealized valuation decreases of $120.2 million were the highest in absolute terms in at least 15 years. Rather than widespread weakness, however, the impact was largely isolated as Teachers Insurance & Annuity Association of America and Pacific Life Insurance Co. combined to account for a majority of the impairments, and the combination of MetLife Inc.'s primary US subsidiary and Protective Life Insurance Co. was responsible for more than three-quarters of the negative changes in unrealized valuation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.