Pressure on community banks' net interest margins will persist as institutions continue to prize deposits.

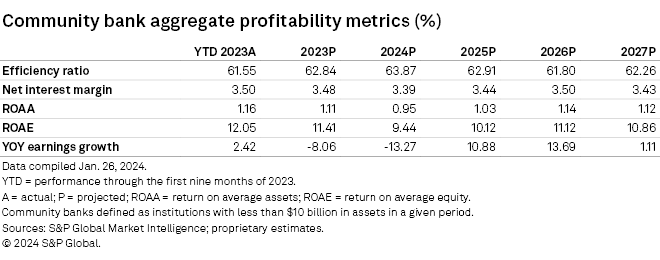

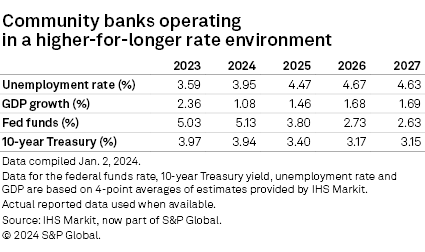

Deposits remain firmly in focus for community banks, even with interest rates expected to fall in the second half of 2024. Customers continue to shift funds into higher-cost products and demand higher rates for their funds, while regulators are encouraging banks to hold more liquidity, leading to pressure on net interest margins. That pressure will eventually subside but be replaced by higher credit costs. While many community banks will maintain attractive returns, others will seek to improve their situation through efficiency programs or by partnering with another institution.

Access data exhibits and the US Community Bank Aggregate's projections template here.

Deposit growth resumes but core funding comes with a cost

Deposit outflows slowed in the third quarter and appear to have reversed in the fourth quarter, with growth resuming in the period. Community banks have paid a price for those deposits as the cost of funds have continued to grow in the absence of rate hikes by the Federal Reserve. Intermediate and long-term rates have even declined since the end of the third quarter but banks have continued to focus on building liquidity to satisfy customer and regulatory demands.

Higher rates have woken up many customers, who became accustomed to receiving rates below 1% to 2% on their deposits in the aftermath of the global financial crisis. Younger consumers in particular had never received those rates since deposit rates remained muted between 2009 and 2022.

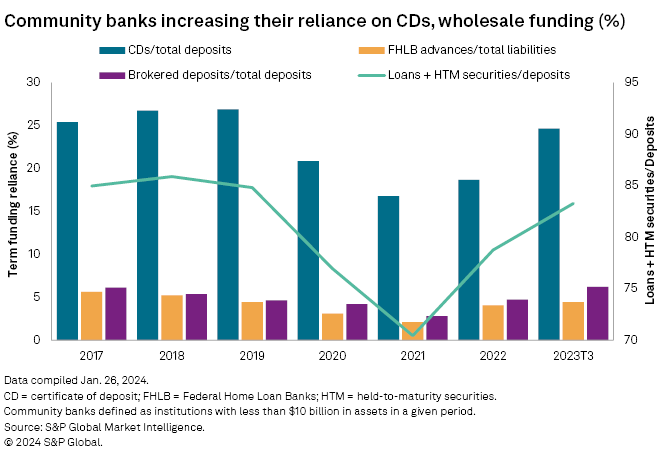

Regulators have pressured banks to bolster their liquidity in the aftermath of the large bank failures in 2023 and have encouraged institutions to hold more cash and maintain multiple levers to pull to access funding. Regulatory scrutiny has come at the same time that the Federal Home Loan Bank system's regulator, the Federal Housing Finance Agency, plans to propose rules that would curtail banks borrowings from the FHLBs to ensure they are not used as a "lender of last resort."

Regulatory pressures and the upcoming March 11 expiration of the Fed's Bank Term Funding Program could lead to even more deposit competition as banks place a higher value on deposits than other forms of funding.

As community banks' deposit costs have risen further, the gap between those products and higher-yielding alternatives in the Treasury and money markets has narrowed. While deposits have stabilized, funds continue to move out of noninterest-bearing deposits and into higher-cost products for institutions, such as brokered deposits and certificates of deposits.

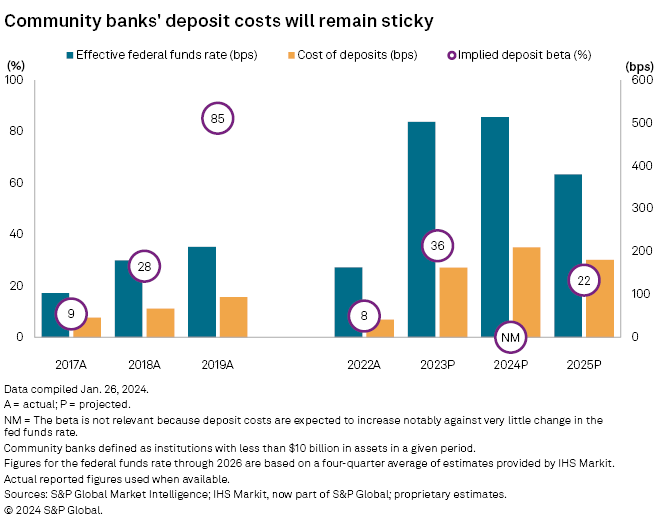

Community banks' interest-bearing deposits rose 3.2% through the first nine months of 2023, but noninterest-bearing deposits dropped 11.3% in the period. The decline pushed the industry's noninterest-bearing concentration down to 24.4% of total deposits at the end of the third quarter from 27.3% at year-end 2022 and 28% at year-end 2021. We expect noninterest-bearing deposits to decline further in 2024, dipping to 21% of deposits. The continued change in deposit mix will cause deposit costs to continue rising through the end of 2024, even as the Fed pivots to lower short-term rates in the second half of 2024.

Community banks' aggregate cost of deposits rose to 1.83% in the third quarter of 2023, up 140 basis points from a year earlier. That equates to a beta, or the percentage of change in fed funds passed on to depositors, of 45.8% in the period, compared to 30.4% in the previous quarter.

We expect the deposit costs to continue to rise as higher-cost products, such as CDs, become larger portions of banks' deposit bases. Community banks grew CDs by nearly 31% through the first nine months of 2023, climbing to 24.6% of deposits from 18.7% at year-end 2022. CD concentrations should grow further as banks market attractive rates on the products. For instance, the number of banks marketing one-year CDs with rates above 4% had risen to 767 banks as of Jan. 19, 2024, up nearly 13% since end of the September and 49% from the end of June.

Looking ahead

While banks face additional declines in margins, that pressure will eventually ease and be replaced with higher credit costs, producing a headwind to earnings.

We expect the community banks' earnings to dip just shy of 8% year over year in 2023 and then fall modestly again in 2024. The decline in earnings and returns will be far from severe but still might be enough to encourage more strategic activity from boards and management teams facing stagnant earnings over the next few years.

Several banks said on their respective, recent calls that they were in the market for acquisitions. FB Financial Corp. said that it was looking for community bank targets who face increased expenses just to operate their institutions and Community Bank System Inc. said it was hopeful that 2024 will bring more deal opportunities.

Some community banks could announce efficiency programs but others will face earnings walls, and that should eventually prompt more M&A discussions as deals offer the opportunity to cut costs.

Bank M&A activity has been anemic, with the punitive rate marks that a buyer must take on a seller's portfolios standing in the way of many transactions, as sharp increases in interest rates have left many banking assets underwater. Recent declines in intermediate and long-term rates, potential rate cuts by the Fed in the second half of 2024 and further seasoning of loan and bond portfolios could soften the blow of those required marks. Some institutions could become more motivated sellers if they run into credit issues.

While we do not expect considerable deterioration in credit quality, we do see greater delinquencies and charge-offs in the future. Banks have tried to prepare for slippage by tightening lending standards and building reserves for loan losses. We expect slower loan growth in 2024 as institutions approach new originations with greater caution. Rising funding costs could also give some banks pause to grow their balance sheets notably, but many banks are also putting less cash to work in the bond market as they seek to remain liquid. We also expect banks to continue to build reserves as they work to shore up their balance sheets to clear any potential hurdles ahead.

There are some signs of credit normalizing, with auto loan and credit card delinquencies rising off very low bases. The greatest credit concern centers on community banks' commercial real estate portfolios. CRE delinquencies have risen off historically low bases as well, and banks have increased reserves against the portfolios, particularly related to office credits, but overall loss content still remains historically low.

Loss content will be location-specific and differ across the subcategories of the asset class, but community banks will feel some pain in their commercial real estate books, particularly as borrowers digest the impact of higher interest rates, less credit availability, and lower occupancy since the pandemic.

New York Community Bancorp Inc. sparked concerns over the potential loss content in the sector when it reported an elevated provision for loan losses. The company said the reserve build stemmed from weakness in the office sector after a "deep dive" into the portfolio and risk posed by borrowers in the multifamily sector who face sharp increases in interest rates. Some investors questioned whether New York Community issues could be a canary in the coal mine, but others cautioned that they could be specific to the company.

Regulators have reiterated the importance of banks maintaining strong risk management of their CRE portfolios, particularly for institutions with elevated CRE concentrations. The FDIC has also said that it is increasing examination staff in anticipation of more "problem banks" and plans to subject institutions to tougher exams.

We expect stiffer financial conditions will cause credit quality to slip and lead to notably higher charge-offs in 2024. However, even with net charge-off losses in 2024 expected to roughly triple from 2022 levels, losses and the reserves required to fund them should prove a modest hit to earnings as opposed to the headwind that would occur during a severe downturn.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.