Introduction

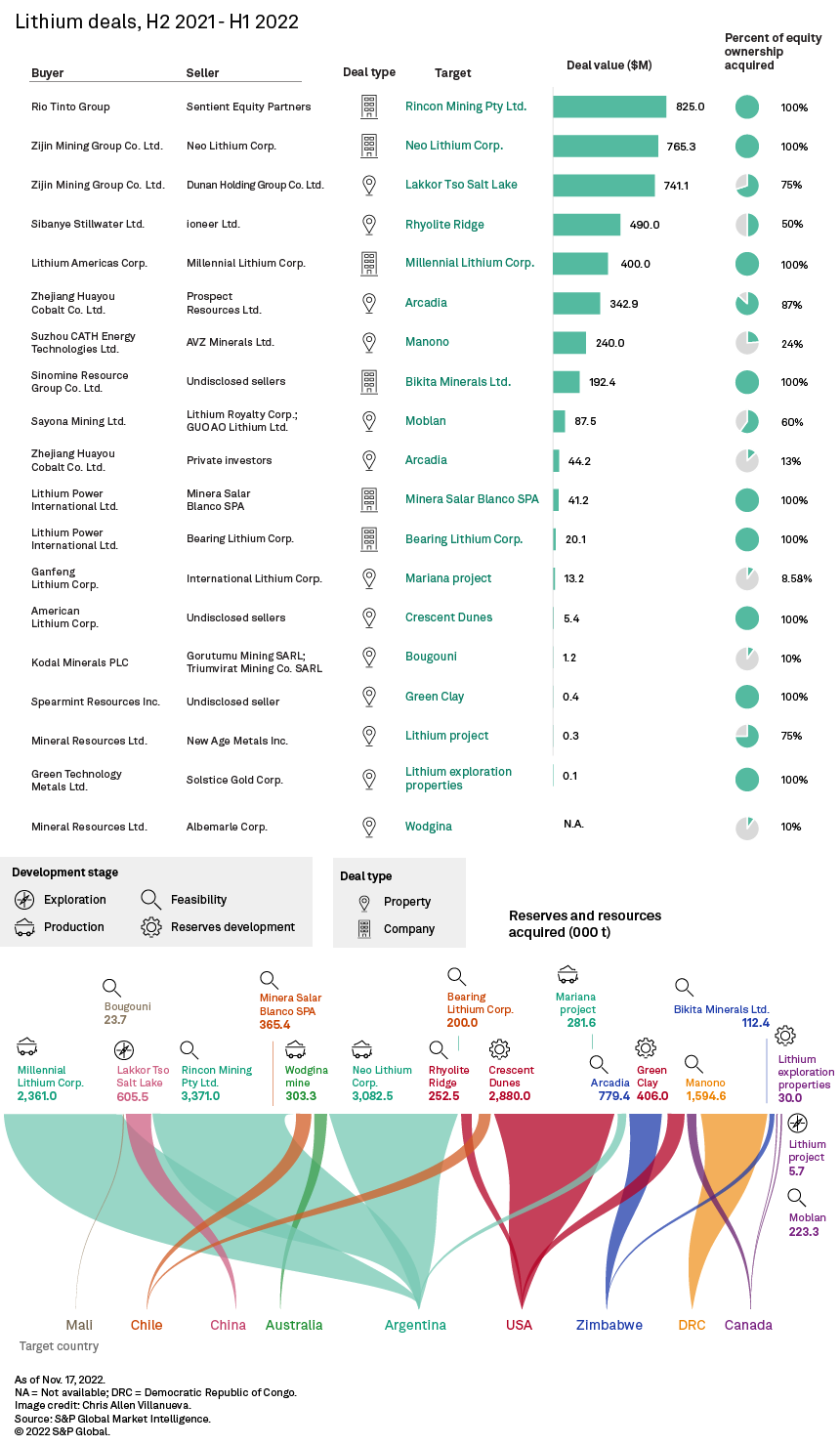

S&P Global Commodity Insights reports on project and company deals with lithium oxide, or Li2O — simply referred to as lithium in the study — in reserves and resources, exclusive of streaming or "offtake," royalty or terminated deals, announced between Jul. 1, 2021, and Jun. 30, 2022. [Note: this article was updated with additional transactions Nov. 18, 2022.]

Lithium use in batteries underpins the global energy transition. A high lithium price and a robust demand trajectory are supporting M&A activity in the sector, which has been healthy over the past year. Some companies are venturing into the lithium arena while others are expanding their footprint, acquiring mostly projects, to capitalize on the battery metal, with Argentine targets accounting for the bulk of the total deal value and the total reserves and resources acquired. Although we expect lithium to remain a target of choice the coming period, a hardening of policy lines, namely in Canada and the U.S., will likely shape the M&A landscape in new ways.

The year ended Jun. 30 has seen robust M&A activity in the lithium sphere, with increases in all key metrics — number of deals, deal value and lithium content acquired — compared with the previous period. With only four projects in production and most others in the feasibility stage, it seems companies are very much forward-looking in their investment and are taking the necessary steps to be in the lithium playing field as the green energy transition unfolds over the medium term. S&P Global Commodity Insights predicts the current lithium pipeline will be insufficient to meet demand by 2029 even if all projects enter production.

A list of deals going back to 2012 and various industry trends can be found in this databook. For analysis and commentary on those trends through the first half of 2021, please see Lithium M&A involving assets with resources, 2012-H1'21.

The higher number of deals in the period is not commensurate with the surge in deal value; although the 19 deals were nearly double the number in the previous period, the total deal value increased ninefold to $4.21 billion. Further, the 16.9 million tonnes of lithium transacted between July 2021 and June 2022 was 51% more than the 11.2 Mt that changed hands in the prior year. This resulted in the average deal value surging to $221.6 million in the more recent period, and the average metal acquired per deal being 20% lower at 888,255 tonnes. One of the reported deals, Mineral Resources Ltd.'s acquisition of an additional 10% stake in the Wodgina mine in Australia from its joint venture partner Albemarle Corp., does not include a deal value, which offsets some of the calculated numbers.

The metrics nevertheless point to a robust lithium industry, even as other commodities faltered in the first half of 2022 against a souring economic backdrop. Demand for lithium — the key component of batteries, especially for electric vehicles and energy storage — has been sustained by the global energy transition agenda, which advocates for net-zero CO2 emissions by 2050. Despite slowdowns in manufacturing activity due to the Russia-Ukraine conflict in Europe, COVID-19-related lockdowns in China and an ongoing chip shortage, EV production and sales have remained strong. Commodity Insights anticipates global passenger plug-in EV sales in 2022 to be 61.7% higher year over year, with the total number of vehicles sold to more than double between 2022 and 2026 to 22.9 million units.

Such strong demand lifted the lithium carbonate CIF Asia price 321% between July 2021 and June 2022, a trend reflected in the average deal price paid per tonne of acquired reserves and resources, which increased fourfold between the previous period covered and the recent one.

Argentina largest target in deal value, acquired reserves and resources

In the largest deal by value, Rio Tinto Group acquired Australia-based Rincon Mining Pty. Ltd. and its Argentine brine operation, Salar del Rincon, for $825.0 million. The 3.4 Mt that changed hands was the largest amount of lithium purchased in a single transaction. Within a few months of completion of the transaction, Rio announced board approval to develop a starter battery-grade lithium carbonate plant, even as the company produced its first tonne of spodumene, a precursor of lithium carbonate, in what looks to be a first step toward vertical integration.

The second- and third-largest transactions were a company and a project acquisition by Zijin Mining Group Co. Ltd. for a combined $1.51 billion, or 36% of the period's total deal value. Zijin purchased Canadian junior explorer Neo Lithium Corp. and its Tres Quebradas brine project in Argentina that is expected to start production in 2023. The property comes with 3.1 Mt of lithium in reserves and resources and is one of two transacted projects in the preproduction stage. Zijin also agreed to acquire Dunan Holdings Group Co. Ltd.'s 70% stake in the Lakkor Tso Salt Lake early-stage project in Xizang, China. With only 605,500 tonnes of lithium purchased, Zijin paid a premium of $1,224/t, compared with the approximately $250/t paid in the Neo Lithium deal.

South Africa-based gold producer Sibanye Stillwater Ltd. paid more per tonne when it agreed to acquire a 50% interest in the Rhyolite Ridge lithium-boron project in Nevada from Australia-based Ioneer Ltd., through a joint venture agreement valued at $490 million. With estimated lithium reserves and resources totaling 505,000 tonnes, the price paid per tonne was the highest of the period at $1,941. Production startup is slated for 2025, with projected production of 20,600 tonnes per year of lithium carbonate through to 2050, which would place Rhyolite Ridge among the top 10 producers based on current levels.

China-based Sinomine Resource Group Co. Ltd. acquired Bikita Minerals Pty. Ltd. and its namesake mine from undisclosed sellers for $192.4 million, or $1,772/t. Bikita is a producing lithium and tantalum mine that comes with 112,400 tonnes of lithium in reserves and resources; it is one of two acquired projects located in Zimbabwe.

At the other end of the spectrum, the 2.9 Mt of lithium — the third largest reserves and resources transacted — in the Crescent Dunes (TLC) project in Nevada changed hands for a mere $5.4 million. Canadian junior company American Lithium Corp. purchased the project from undisclosed sellers in September 2021.

New entries, consolidations, expansions — all roads lead to lithium

In a notable move, industry entrant Zhejiang Huayou Cobalt Co. Ltd. is seeking to fully acquire the Arcadia open pit project in Zimbabwe. Huayou has secured 87% of the project from Prospect Resources Ltd. and has agreed to acquire the remaining 13% stake from private investors Paul Chimbodza and Kingston Kajese for a total of $387.1 million. Similarly, Lithium Power International Ltd. is looking to purchase the remaining 48.5% equity of the Maricunga brine operation in Atacama, Chile, through two company takeovers: Bearing Lithium Corp. and Minera Salar Blanco SPA, which hold 17.2% and 31.3%, respectively, of the operation. Lithium Power bought 565,412 tonnes of lithium for $61.3 million.

While Gangfeng is consolidating its lithium footprint and Rio Tinto is venturing further into lithium in a major M&A play — both with targets in Argentina — Sibanye and American Lithium may be poised to capitalize on the U.S. government's recently announced subsidies for locally sourced battery metals and battery components, in a rapidly intensifying need for access to critical energy transition metals.

In a further example of government policy intruding into lithium dealmaking, the Canadian government, citing national security, announced Nov. 2 that it was ordering three Chinese companies — Hong Kong-based Sinomine (Hong Kong) Rare Metals Resources Co. Ltd. and Chengze Lithium International Ltd., and Chengdu, China-based Zangge Mining Investment (Chengdu) Co. Ltd. — to divest their ownerships interests in Canadian junior lithium companies Power Metals Corp., Lithium Chile Inc. and Ultra Lithium Inc., respectively.

To avoid losing critical lithium exposure and assets, some companies are setting up separate corporate entities to control their non-Canadian properties that have Chinese part-ownership. Lithium Americas Corp. announced that it intends to separate its businesses in North America and Argentina into two independent public companies, Lithium Americas and Lithium International, respectively, with the latter maintaining a 44.8% interest in the Cauchari-Olaroz lithium project in Argentina as part of a joint venture with Jiangxi, China-based Ganfeng Lithium Group Co. Ltd. Lithium Americas cemented its footprint in Argentina during the period by acquiring the producing Pastos Grandes brine operation and the Cauchari East project with the takeover of Millennial Lithium Corp. for $400.0 million.

Outlook

Lithium M&A activity is not expected to cool down in coming months, against the backdrop of an increasingly politicized global green energy transition. With lithium certain to remain in high demand and prices currently at historical highs, mining companies are increasingly turning to lithium assets to diversify or consolidate their portfolios to increase exposure to the upsides lithium offers.

New trends are emerging in risks and opportunities associated with the location of targeted assets. Companies are competing for positions in local supply chains to meet sourcing requirements and limit the risk of supply-chain disruptions such as those caused by the pandemic and geopolitical tensions. Battery-makers are also looking to secure supply by investing in mining operations to become vertically integrated — a growing trend that bears watching.

Nick Wright contributed to this article.

11/18/2022 This article has been updated with additional transactions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.