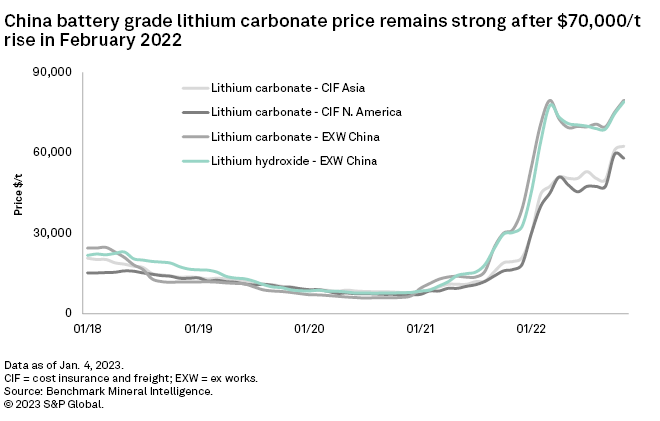

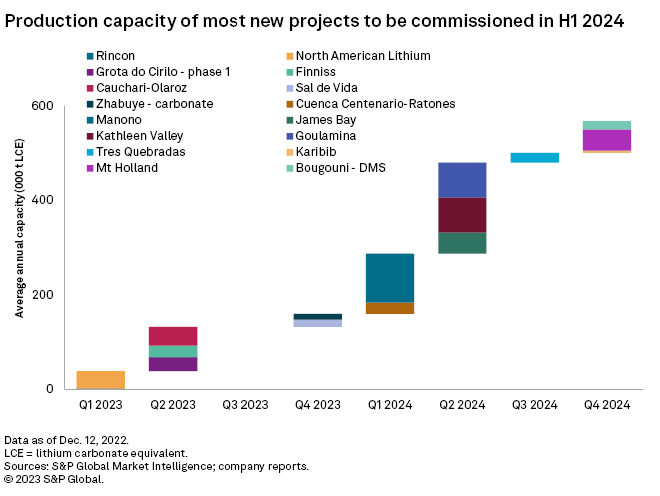

China's battery-grade lithium carbonate ex-works price remained strong in 2022 after more than quadrupling in 2021 and rising more than 1,200% from its lowest level in July 2020. Strong demand from the electric vehicle market and slower-than-expected project commissioning have pushed lithium prices to record highs. S&P Global Commodity Insights expects a 2026 lithium carbonate CIF Asia price of $42,093 per tonne, which will incentivize lithium miners to move forward with new projects to meet demand forecast to grow at a 22.4% compound annual growth rate over 2022-26. We have identified 16 projects that have set first shipment targets in 2023-24, comprising 10 hard rock and six brine, making up nine concentrate and seven chemical operations. These 16 assets will bring 567,941 tonnes of lithium carbonate equivalent, or LCE, capacity online by the end of 2024.

Market tightness is keeping lithium prices strong. The supply side is a key issue for any market deficit. We expect new projects to add 159,721 tonnes of LCE capacity in 2023 and to add a further 408,219 tonnes in 2024.

Five of the six lithium projects originally scheduled for commissioning in 2022 have been pushed back to 2023. Market deficits will continue to grow if a similar scenario repeats this year.

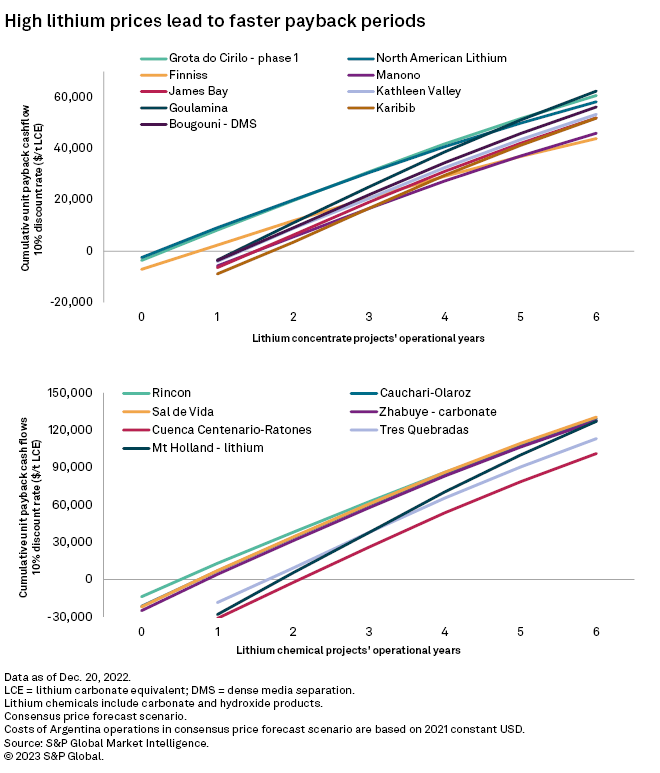

The payback period of almost all new projects is less than one year under the current high-price environment. Lithium concentrate projects will pay back faster, as they usually require lower initial capital expenditure but are at high risk of revenue reduction should the increased supply push prices down.

Existing operations and early entrants will benefit the most from protracted demand growth.

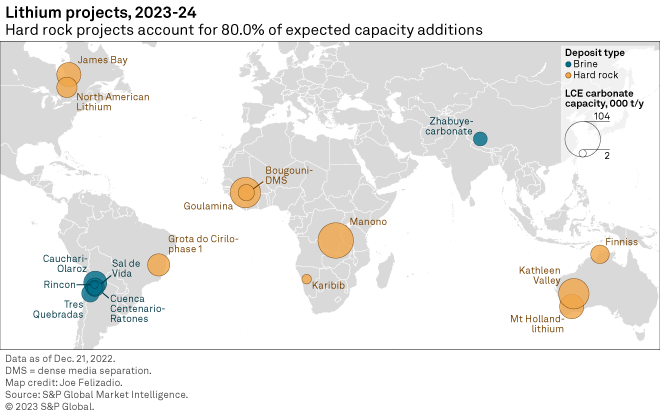

The 10 hard rock projects, including the Mt Holland - Lithium hydroxide conversion project, account for 80.0% of the expected capacity increase. The hard rock mines are scattered across the world, with four projects in Africa and three in Australia, while five of the six brine projects are in Argentina. We expect seven of the projects to add a total of 159,721 tonnes of LCE capacity in 2023, and the remaining nine projects to add 408,219 tonnes in 2024, bringing more hope for easing of market tightness.

Focusing on the seven new projects expected to commission in 2023, five had originally scheduled production starts in 2022. Brines in Argentina faced the worst delay challenges, spanning nine to 12 months. Argosy Minerals Ltd. 's Rincon project, which was unable to fulfill the original 10,000 tonnes-per-year plan, also failed to start with a 2,000 t/y alternative production plan by mid-2022. The Cauchari-Olaroz and Sal de Vida projects were expected to begin production in the second half of 2022, but have been shifted back to the second and fourth quarters of 2023, respectively, per latest company reports.

Lithium concentrate projects also experienced postponements. Phase 1 of the Grota do Cirilo project in Brazil is expected to reach first production in April 2023 — four months later than its earlier plan. These delays could see the near-term balance shift toward a larger global lithium deficit. Project delays are likely to ease over the next two years, however, with participation of major miners and expertized chemical producers to promote production progresses. For example, Contemporary Amperex Technology Co. Ltd. and Ganfeng Lithium Group Co. Ltd. bought stakes in Manono in the Democratic Republic of Congo and Goulamina in Mali; Allkem Ltd. , a company resulting from the merger of Galaxy Resources Ltd. and Orocobre Ltd. , formed to manage multiple lithium assets focusing on delivering lithium chemicals for the battery industry.

In our 2021 research , we anticipated that the availability of higher margins would push concentrate producers to move forward with developing conversion facilities to produce lithium chemicals, including carbonate and hydroxide. We repeated the analysis, applied the updated consensus forecast prices to calculate margins and payback periods of the 16 new projects, and assumed an annual discount rate of 10%. Under current high prices, the payback period of most concentrate projects is less than six months and the payback period of most chemical projects, including lithium carbonate and hydroxide products, is less than one year. The payback period of the Cuenca Centenario-Ratones project in Argentina is slightly longer than one year because of high capital expenses, led by the utilization of direct lithium extraction techniques. Although chemical projects can generate higher unit cash flow, the short-term focus of lithium miners is still to accelerate the production timeline to benefit from elevated prices. We will closely follow the concentrate projects, as they have lower capital intensity and generally shorter construction periods. Kodal Minerals PLC 's Bougouni project in Mali chose to begin with a "shorter mine life but faster setup" dense media separation plan, as it wants to take advantage of a near-term buoyant market. All developing hard rock projects have the option of selling direct-shipping ores in addition to standard concentrate products when there is slow progress in developing the processing plant. Finniss is an example: although unable to achieve the first concentrate production by 2022, this Australian project started shipping out direct-shipping ores in November of that year.

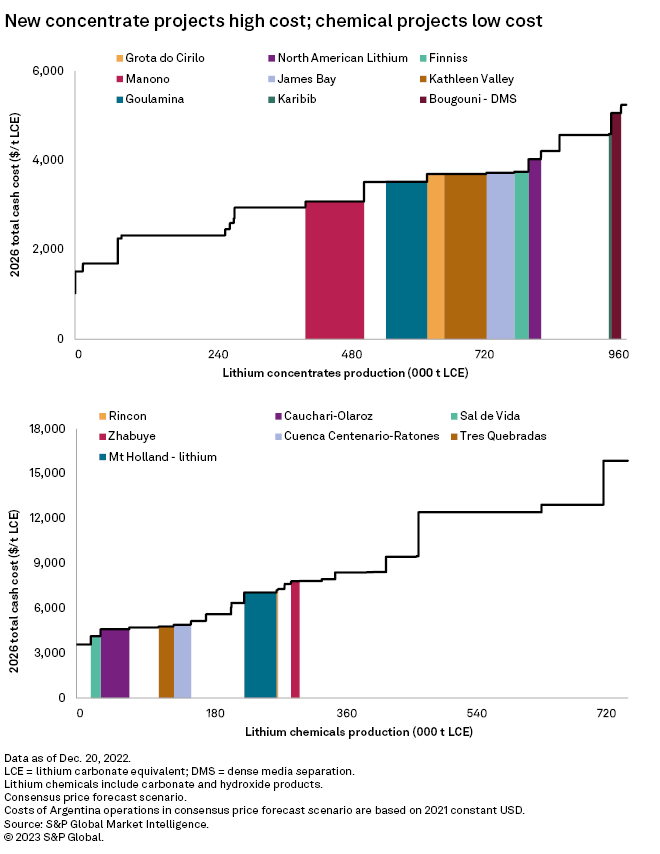

We selected the 2026 cost curve considering the time production will take in ramping up. Most of the new concentrate projects will add high-cost supply, with James Bay and North American Lithium in Canada, Finniss in Australia, Karibib in Namibia and Bougouni in Mali in the fourth quartile of the cost curve. Manono in Democratic Republic of Congo will have the lowest cost among new concentrate projects. We now assume the project will come into production in early 2024. All new chemical projects are expected to be in the lower half of the cost curve. Argentina has some of the world's most cost-competitive lithium assets; compared with assets in Chile, royalty costs of these new chemical assets will be lower .

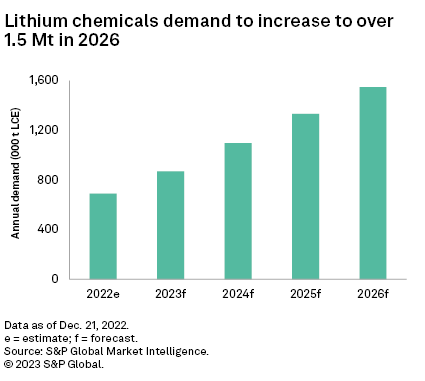

We expect lithium chemical demand to surpass 1.5 million tonnes LCE in 2026 from 690,000 tonnes in 2022. The race to develop projects continues. The 16 assets identified here will contribute to meeting much of the demand growth if they successfully ramp up to full capacity. Correspondingly, any potential failure in delivering on production as per plan will exacerbate market tightness. Existing operations will keep benefiting from unprecedented prices. We expect an improving supply environment, but it may still fall behind demand, especially in 2024.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.