Download the full report

Click hereCOVID-19 continues to disrupt global supply chains in unprecedented ways. Leveraging maritime shipping data from Panjiva, this report includes a review of trade and financial data to analyze the impact of the SARS-CoV-2 / COVID-19 coronavirus outbreak.

This report takes two approaches to analyzing the fallout from the SARS-CoV-2 / COVID-19 coronavirus outbreak on global trade and corporate supply chains. The first part of the report identifies 11 themes emerging on an event-driven basis from over 50 Panjiva Research reports. The second section considers the impact of exposures to Asia in firms’ U.S. supply chains on sector-neutral stock returns since the start of 2020.

A few of the paper’s findings:

- Second-order supply chain effects are also emerging with the apparel industry now seeing a shortage of materials globally due to earlier outages in China.

- Retailers including Costco and Target are gaining from increased sales of health- and personal care products. Yet, supply shortages are rapidly emerging in part due to medical supply export restrictions in several countries.

- Our analysis considers the share of companies' U.S. supply chains sourced from Asia and their revenue exposure to Asia compared to the sector relative stock price performance. There is a notable, but not statistically significant, relationship with firms with higher exposure to Asia having seen a weaker sector neutral stock price performance.

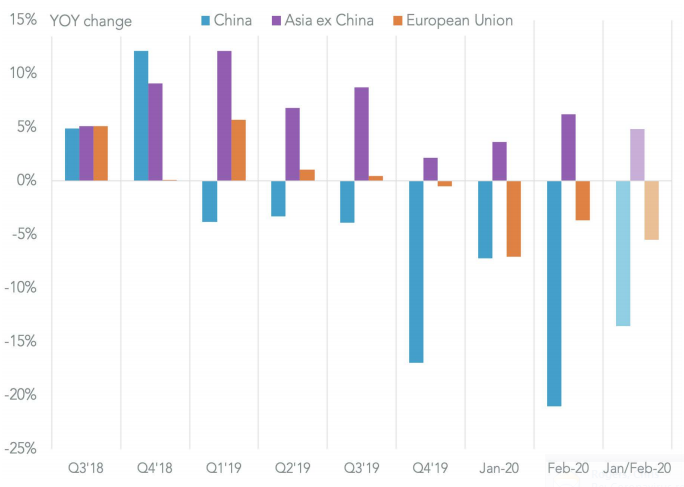

Figure 1: China-Led U.S. Import Drop in February

Chart segments change in U.S. seaborne imports by origin. Source: S&P Global Market Intelligence Quantamental Research. Data as of Feb. 29, 2020.