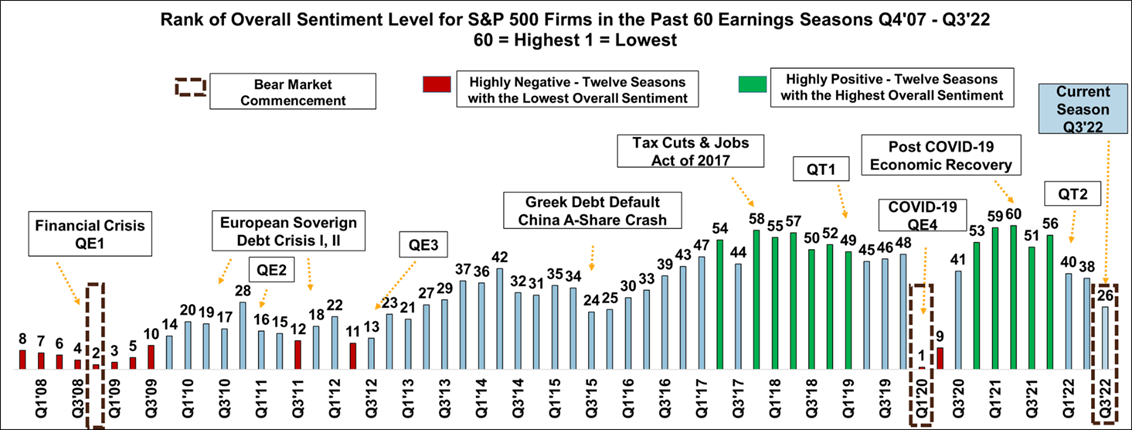

Neutral Sentiment: The overall sentiment has deteriorated from highly positive[2] to neutral in a span of three seasons, but remains well above the pessimistic depths of the two previous bear markets induced by the COVID-19 global pandemic and the ’08 housing crisis.

Unevenness to the Financials: The number of firms citing profitability[3] growth has been a bright spot as Q3’22 is ranked 12th best in the past 60 quarters in part due to cost control while the percent of firms citing bottom-line growth has been in an ‘earnings recession’ for the past three quarters in part due to rising expenses and currency headwind.

Interest Rate Top of Mind: Supply chain-, inflation- and pandemic-related worries were of waning focus on Q3’22 calls whereas ‘rising interest rate’ has taken center stage.

Guidance Not Falling Off a Cliff: The breadth of firms that are expecting growth in their financials for Q4’22 hovers at its historical average, an encouraging sign that firms are not expecting broad-based softness (yet) as actuals tend to unfold much better than guidance.

Read the full report

CLICK HERE

Source: S&P Global Market Intelligence Quantamental Research. Data as of December 2, 2022.

[1] To the best of our knowledge, this is the first series in the public domain where it reviews an entire earnings call season including examining financial actuals and guidance using texts only from call transcripts.

[2] Sentiment levels = {Highly Positive, Positive, Neutral, Negative, Highly Negative} where Highly Positive (Negative) is defined as the group of earnings seasons in the top (bottom) 20% with the highest (lowest) sentiment levels.

[3] Firms consistently discuss gross or operating margin(s) but not net margin(s). See Section 2.

Explore the data used in this research on the S&P Global Marketplace

Learn MoreMachines Signal Q4’22 Guidance Not Falling Off a Cliff - An In-Depth Textual Review of Q3’22 Earnings Call Transcripts

CLICK HERE