S&P Global Commodity Insights reports on major mining company (at least $500 million annual mining revenue) investments in the exploration sector. Investments include both earn-in for and purchase of equity in exploration-stage projects, and purchase of equity in junior exploration companies.

![]()

The number of major company investments in early-stage exploration through project earn-ins and purchases, and junior company acquisitions and financings fell to a seven-year low in 2022. The overall downward trend in the numbers of deals and financings year over year was bucked by notably higher interest in copper assets, and the lithium sector maintained a level of interest similar to the previous year. The lukewarm major-junior M&A activity nevertheless went against general M&A trends in the metals and mining industry in 2022 — perhaps suggesting majors either pacing their investment in exploration as the sector undergoes increasing government scrutiny on sourcing, or, conversely, taking the reins and shifting focus through larger-company takeovers or their own exploration efforts to metals such as copper and lithium that are key to the global green energy agenda.

![]()

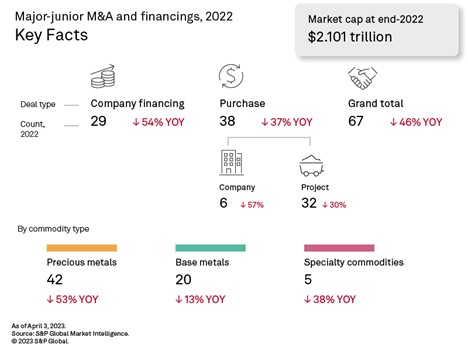

Major early-stage exploration investment in acquisitions and financings was lackluster in 2022, with the number of transactions halving year over year to just 67 — including 38 deals and 29 financings, compared with 60 and 63, respectively, in 2021. The total was a seven-year low.

The majors favored project deals over company deals; in the five transactions involving purchases of equity in companies, three targeted gold, one lithium and one silver.

Gold favored target despite lackluster investment

Despite the high market price for gold — on par with 2021 — exploration investment for gold fell considerably in 2022, following the overall trend in the majors' early-stage investment. The yellow metal nevertheless remained the favored target, accounting for more than half of the number of transactions and two-thirds of the financings.

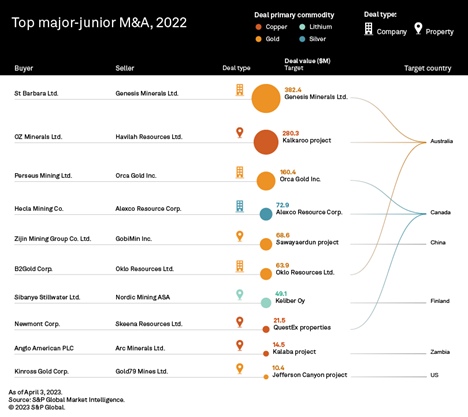

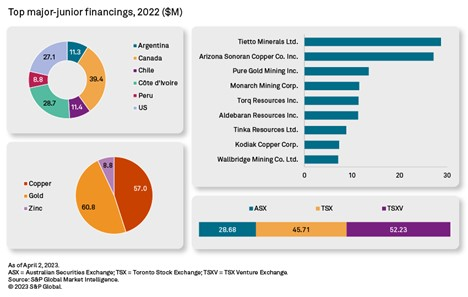

Unsurprisingly, the highest-valued financing and acquisition were both for gold. In a still-pending transaction announced in the last month of 2022, St Barbara Ltd. has agreed to acquire 100% of Genesis Minerals Ltd. and its Barimaia property in Western Australia for $382.4 million. In the second tranche of a private placement, Tietto Minerals Ltd. raised $28.7 million, with the proceeds directed to its operating Abujar gold mine in Côte d'Ivoire. Investment by Zhaojin Mining Industry Co. Ltd., one of China's largest gold miners, has allowed construction of the mine to be fully funded and on schedule. First gold was poured in January 2023.

However, this level of investment remains lackluster compared with previous years. And this is at a time when gold demand has been strong. In 2022, central banks increased their gold holdings, purchasing a record 1.1 million metric tons — a 55-year high — amounting to an 18% increase year over year in global gold demand. This trend is likely to persist, as some of the economies driving the increase, mostly emerging markets, are wary of their dependence on the US dollar and are looking to diverge from the currency. Geopolitical tensions are outweighing the impact of the high interest-rate environment and supporting gold demand and ultimately prices.

Majors are still capitalizing on this time of elevated gold demand and prices, but this has been primarily through multibillion-dollar major-major takeovers over the last few years, with the latest being Newmont Corp.'s recently approved acquisition of Newcrest Mining Ltd.

Copper transactions up on looming threat of near-term market deficit

In contrast with the trend for gold, the number of copper exploration-stage transactions involving majors increased year over year, to 17 from 13, reflecting the heightened need to find new deposits of the red metal. S&P Global predicts a global deficit of 1.6 MMt of copper by 2035 on the back of a global push to green energy generation and vehicle electrification. Copper is a key component of wind turbines and solar photovoltaics, while electric vehicles contain more than twice the amount of copper than internal combustion engine cars do. Despite the bleak macroeconomic environment in 2022, countries have furthered their commitment to renewable energy capacity additions and fleet electrification in an effort to meet decarbonization targets. The urgency to diversify from fossil fuels was increased by cuts in Russia's energy supply to Europe in retaliation for international sanctions imposed following its invasion of Ukraine.

The majors responded to these market factors in 2022, increasing greenfield copper exploration investment year over year by purchasing equity in projects; there were six earn-in transactions, three outright acquisitions and an offer for a partial stake. These 10 projects compare with four in 2021, and there were no junior company acquisitions. The number of copper financings was unchanged at seven.

The values of these copper-focused investments are increasingly on par with majors' investment in gold exploration, with copper transactions a close second in 2022. The year's second-highest value acquisition was OZ Minerals Ltd.'s $280.3 million bid to acquire Havilah Resources Ltd.'s Kalkaroo project in South Australia. Kalkaroo is one of the larger undeveloped open pit copper deposits in Australia and also contains gold and critical minerals cobalt and molybdenum. The second-highest financing was also focused on copper. Toronto Stock Exchange-listed, US-headquartered Arizona Sonoran Copper Co. Inc.'s $27.1 million private placement closed in May 2022, with Rio Tinto Group subscribing for a 7.4% stake in the company. Arizona Sonoran owns the Cactus copper-molybdenum mine in the promising Pinal County region at the intersection of Arizona's three major copper porphyry belts.

It is worth noting that the emphasis on copper went beyond this particular subsection of M&A activity in 2022. Among metals and mining industry deals with a minimum value of $10 million and 1 million ounces of gold or 100,000 metric tons of base metal in acquired reserves and resources, more money was spent on copper assets in fewer transactions than for gold. Meanwhile, exploration budgets for copper were at a nine-year high in 2022, driven by a 67% year-over-year increase by junior explorers.

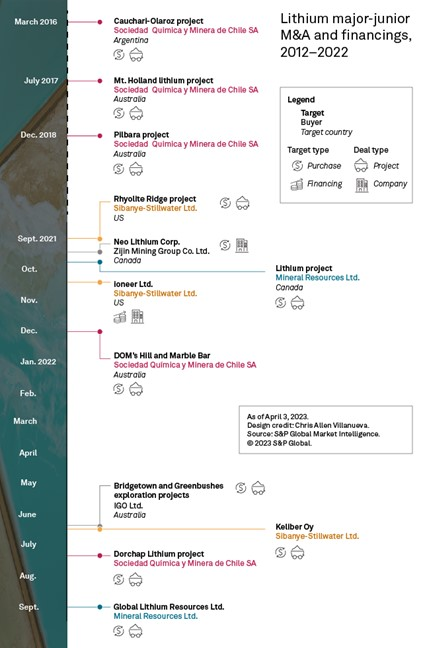

Steady interest in lithium

All four lithium-focused transactions of 2022 — just one fewer than in 2021 — were purchases: Two were earn-ins into projects, one was a 21% direct purchase of a project, and one was for an additional minority stake in a junior company. The latter was Sibanye Stillwater Ltd.'s completed $49.1 million acquisition of the Keliber project from Nordic Mining ASA, which increased Sibanye's ownership of the asset to 79%. Development of Keliber, including a lithium hydroxide refinery, will create the first integrated European operation that produces battery-grade lithium hydroxide from its own mined ore reserves, at an expected average of 15,000 metric tons per year over 16 years.

Like copper, lithium is a key commodity of the green agenda as the major component of energy storage and traction batteries. With demand from these sectors expected to increase steadily, S&P Global Commodity Insights predicts that the current lithium pipeline will be insufficient to meet demand by 2029, even if all current projects enter production.

Exploration for lithium is therefore crucial, and where future efforts will be directed will likely depend on legislated guidelines that were first laid down in 2022. For instance, the US Inflation Reduction Act, which was passed in August 2022, mandates that at least 40% of the mineral components of traction batteries must be sourced in the US, or from a free trade partner, to qualify for tax credits. Similar sourcing directives have emerged in the European Union and Australia.

North America still hosts over 50% of target assets

The geographical distribution of exploration assets acquired by majors in 2022 was fairly similar year over year. Canada-US led the regions with 55% of all targets, a slight decrease from the 59% share in 2021. With the number of investments in the US holding steady at 11 since 2019, the year-over-year decrease in the number of transactions in the region resulted in the US share jumping to 30% from 15% while Canada's share dropped to 70% from 85%.

Elsewhere, Asia-Pacific remained a distant second, followed by Latin America — a ranking the region has held for three consecutive years. Africa had a slight increase in 2022 at the expense of Europe. In addition to the previously mentioned financing of the Abujar gold mine in Côte d'Ivoire, there were three African property acquisitions, two gold and one copper, compared with two in 2021, whereas the number of investments in Europe dropped to two from seven.

Earn-ins popular avenue for supporting exploration

There was a respectable number of major-junior earn-in transactions in 2022 — 15 more than outright purchases of equity in projects. About half of the earn-ins targeted gold projects, many of which were located in the US. There were six deals for copper, three in Canada and three in Australia, and there were two lithium-focused deals.

Australian gold major Newcrest entered four earn-in transactions with US-based Headwater Gold Inc., agreeing to incur capital expenditures amounting to $145 million and to complete prefeasibility studies at four gold projects in the US Northwest. These projects are located in the general vicinity of Newmont's flagship Nevada operations.

Exploration budgets, markets, lead times

According to our Corporate Exploration Strategies 2022 study, mining industry exploration budgets were at an eight-year high for the year, with the juniors' share of the global budget rising to be almost on par with the majors' share, which was up only 5% compared with the overall 16% global budget increase. With minesite exploration still leading among the development stages, major companies favored their own backyards, spending on expansions, rather than focusing on new discoveries. A recent study by Commodity Insights revealed an average lead time of over 15 years from discovery to production for new mines, which likely underlies this trend in majors' exploration spending. Further, more environmental, social and governance issues are arising during the mine permitting process, while interventionist government sourcing and trade policies are increasingly shaping the mining development and production landscape.

A combination of the majors' caution in navigating these tricky waters and the focus on capitalizing on currently high commodities prices through ramped-up production are likely reasons behind the lackluster investment in early-stage M&A in 2022. This, coupled with a macroeconomic environment that might favor outright acquisitions — inflation pressuring small companies' balance sheets and leading them to divest more attractive assets — could continue the measured pace of investment in 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.