A number of banks have announced modest repositioning of their securities portfolios in the 2023 fourth quarter and more likely will come when announcing earnings for the period.

More than a dozen banks have sold underwater bonds at a loss in the last month and used the proceeds to either reinvest in higher-yielding securities or pay down higher-cost borrowings. In some cases, banks have sold their insurance brokerage subsidiaries to facilitate the transactions. While the loss trades have become more common, most of the sales represent incremental repositioning rather than full-scale restructuring. More banks likely will follow suit as the recent decline in interest rates has reduced the hit that institutions have to take when pruning the portfolios.

More banks pruning their bond portfolios

Sharp increases in rates since 2022 have pushed bank bond portfolios deeply underwater but more institutions have decided to sell portions of their available-for-sale (AFS) securities portfolios at a loss to improve their future earnings profile.

Some banks have taken those actions because the underwater positions serve as a drag on banks' net interest margins as many of the securities carry yields that are well below the cost of funding coming onto institutions' balance sheets. A handful of banks pruned their investment portfolios and sold securities at a loss in the 2023 second and third quarters, but the pace of transactions seems to have increased in the fourth quarter. More than a dozen publicly traded banks — Auburn National Bancorp. Inc., BOK Financial Corp., First Busey Corp., Cadence Bank, Equity Bancshares Inc., First United Corp., FVCBankcorp Inc., Horizon Bancorp Inc., Heartland Financial USA Inc., Hancock Whitney Corp., JD Bancshares Inc., Kearny Financial Corp., Pacific Premier Bancorp Inc., Synovus Financial Corp. and United Community Banks Inc. — have executed or announced plans in the 2023 fourth quarter to sell securities at a loss and reposition their investment portfolios.

In most cases, those banks either reinvested the cash at higher rates or used the proceeds to pay down higher-cost borrowings.

Many banks have been hesitant to take the hit associated with loss trades because the transactions reduce their regulatory capital. While banks must mark their AFS portfolios to market on a quarterly basis and those marks are captured in accumulated other comprehensive income (AOCI) and impact tangible common equity, they do not impact banks’ regulatory capital, save for large banks classified as US global systemically important banks (G-SIBs).

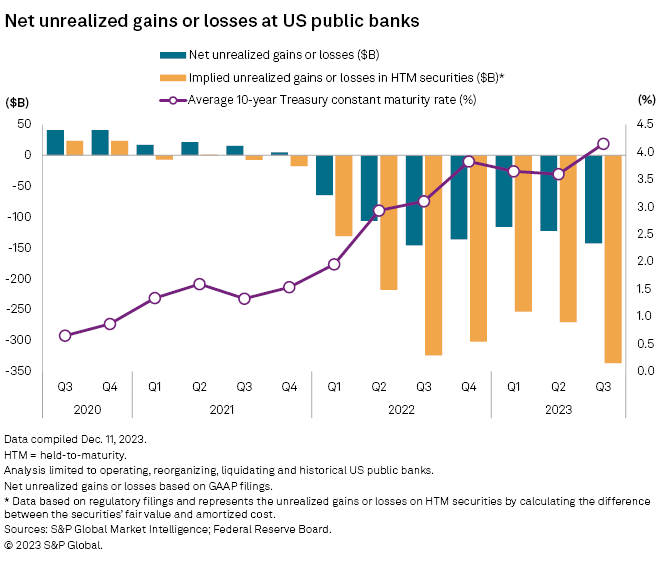

The hit to tangible book value remained quite large at the end of third quarter 2023, with institutions including US commercial banks, savings banks, and savings and loan associations that file GAAP financials reporting $142.34 billion in unrealized losses in their AFS portfolios, compared to $122.31 billion in unrealized losses in the prior quarter.

However, those losses have likely shrunk with the average yields on the 2-year, 3-year and 5-year Treasury falling 83 basis points as of Dec. 27, 2023, since Sept. 28, 2023, according to Janney Montgomery Scott analyst Chris Marinac. The analyst noted in a Dec. 28, 2023, report that the decline in yields offsets the average rate increase of 31 basis points in the third quarter and will reduce negative impact from AOCI to 8% of securities at large cap and mid-cap bank holding companies from 10% at Sept. 30, 2023. That means that the hit associated with any loss trade would now be smaller, but the prospect of additional declines in rates might also encourage institutions to simply wait and hope for further improvement in values.

Regulators remain focused on underwater bond portfolios

Bank regulators have focused on the negative impact from AOCI on bank capital, and the impact that underwater bond portfolios have on banks' access to liquidity. As banks have faced liquidity pressures amid deposit outflows, regulators have recognized that most banks' securities portfolios no longer serve as the same source of liquidity as they have historically due to high levels of unrealized losses. Regulators have said that high levels of unrealized losses have led to downgrades on liquidity ratings in some bank exams.

Contingency liquidity plans have received far greater attention from regulators as well, with examiners looking at the ratio of banks' liquid assets — cash, federal funds sold, securities purchased under agreements to resell and securities, including unrealized gains/loss on securities less pledged securities — to uninsured deposit to measure an institution's ability to meet deposit outflows. Beyond their current positioning, regulators want to see the various levers that banks can pull to access funding in times of stress and see evidence that the institutions have tested those plans.

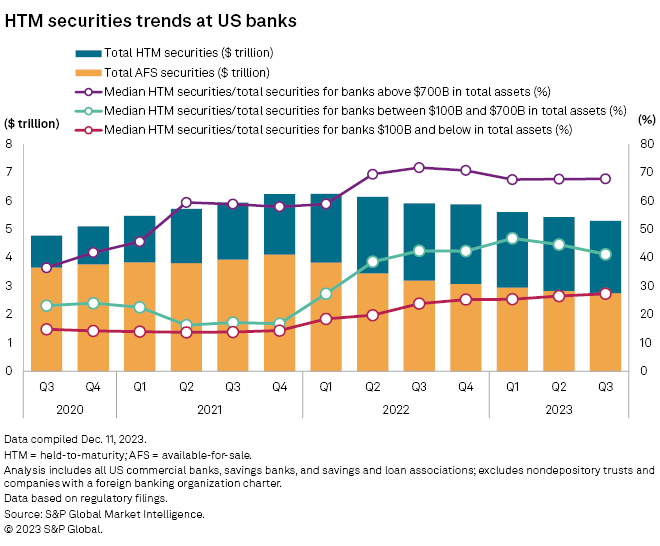

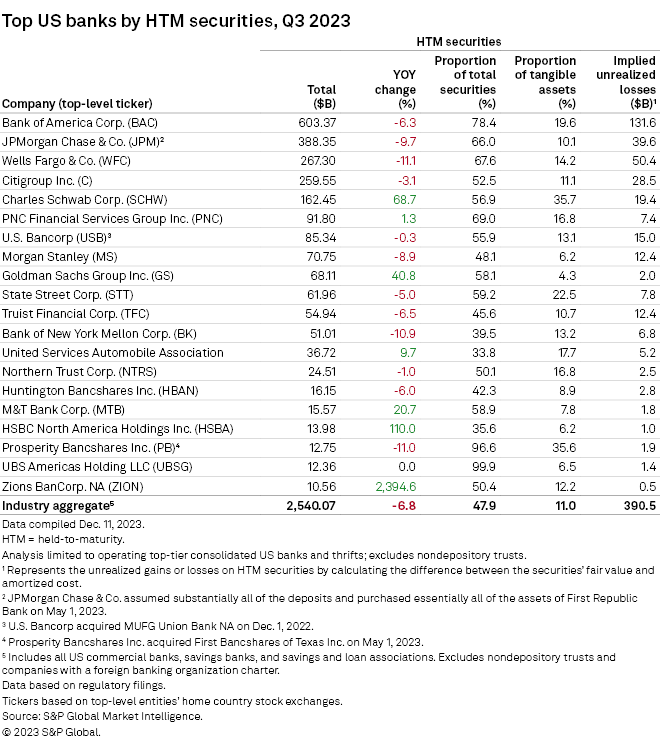

Banks took action to minimize the impact from AOCI leading up to the Fed’s tightening cycle by parking larger portions of longer-term bonds, often seen as loan surrogates, in held-to-maturity (HTM) securities portfolios. Those positions remained significantly underwater in the third quarter. Some banks, particularly the nation's largest institutions, relied heavily on the HTM designation since changes in AOCI impact tangible book value.

Unrealized losses in HTM portfolios at institutions that file GAAP financials totaled $336.57 billion in the third quarter of 2023, up slightly from $270.46 billion in the prior quarter.

For large banks classified as G-SIBs — those with more than $700 billion in assets — changes in AOCI also impact regulatory capital. Those institutions had placed nearly 68% of their bond portfolios in held-to-maturity portfolios at the end of the second quarter. Under the proposed capital rules, dubbed the Basel III endgame, changes in AOCI will also impact regulatory capital at banks with more than $100 billion in assets.

Some investors have applied the unrealized loss embedded in banks' HTM portfolios to tangible book value to reach an adjusted, burn-down value for the company. They believe that institutions still trading below historical price-to-tangible book values, on an adjusted basis, could screen relatively cheap. The investment community has also examined the ratio of loans plus HTM securities-to-deposits at a given bank to see how many deposits are tied up in less liquid assets.

Given investors’ negative focus on HTM portfolios and the drag the portfolios have created for many banks’ earnings streams, institutions likely will view HTM designations differently in the future. For many banks, they likely will place a higher importance on the liquidity generated by their investment portfolios rather than the earnings stream it provides, and that could result in less reliance on HTM designations going forward.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.