This Data Dispatch is updated monthly and was last published April 2. The analysis includes US equity real estate investment trusts that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of at least $200 million and can offer insight into how the Street is valuing different property sectors. While valuations within the portfolio of publicly traded REITs might not match all privately owned properties, the public markets can oftentimes serve as a leading indicator for potential future property pricing. That insight is particularly helpful at a time when there is little price discovery in the market due to a lack of transactions. You can download these charts in Excel format.

Share prices for US equity real estate investment trusts fell in April, further bringing down price-to-net asset value valuations for the sector.

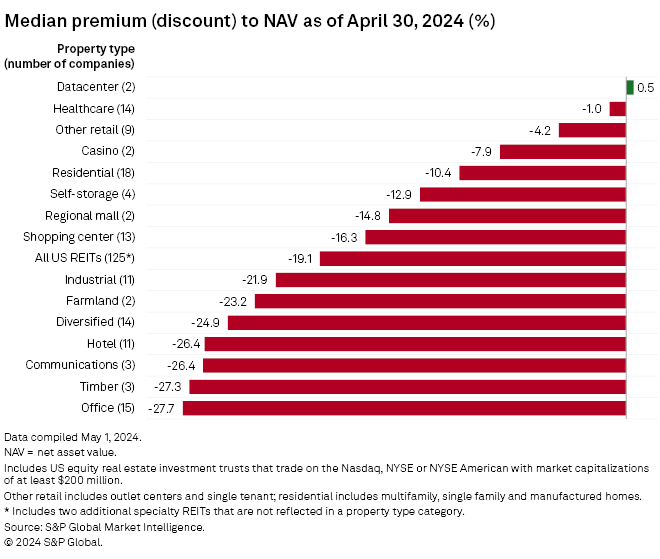

The REIT sector closed April 30 at a 19.1% median discount to their consensus net asset value (NAV) per share estimates, a 4.1 percentage point expansion from the median 15% discount as of March-end, according to S&P Global Market Intelligence data.

Largest discounts

The regional mall sector experienced the largest valuation decline in April, with the sector's median discount to NAV falling to 14.8%, from a slight 0.3% median discount the month prior.

Within the mall sector, Simon Property Group Inc. closed the month at a 2.1% discount to its consensus NAV estimate, while Macerich Co. ended the month at a 27.5% discount.

The industrial sector also saw significant share price drops during the month, with the sector closing April 30 at a median 21.9% discount to NAV estimates.

Share prices across the sector declined following Prologis Inc.'s first-quarter earnings release on April 17, in which the REIT lowered its 2024 earnings guidance, citing a slowdown in leasing activity and net absorption as tenants increased focus on controlling costs amid high interest rates and persistent inflation.

While the office sector continued to trade at the steepest discount to NAV, at a median of 27.7%, valuations slightly improved during the month compared with the median 28.2% discount in March.

The timber and communications sectors followed next, closing the month at median discounts of 27.3% and 26.4%, respectively.

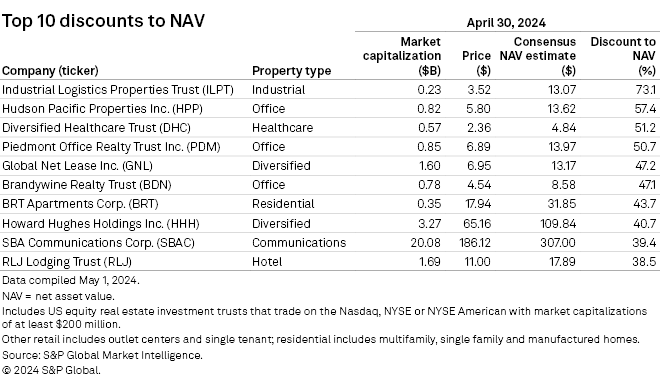

Among all US REIT stocks, Industrial Logistics Properties Trust closed the recent month at the largest discount to NAV. The industrial-focused REIT closed April 30 at $3.52 per share, 73.1% below its consensus NAV estimate of $13.07 per share.

Two office REITs — Hudson Pacific Properties Inc. and Piedmont Office Realty Trust Inc. — along with healthcare REIT Diversified Healthcare Trust closed April 30 at a more than 50% discount to their respective NAV estimates.

|

– Download an Excel template with data featured in this story. – Check out the NAV chart book to analyze how REIT valuations trended over time. – Set email alerts for future Data Dispatch articles. |

Largest premiums

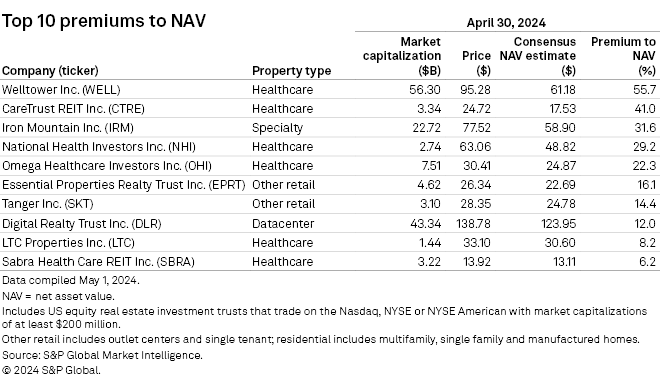

The datacenter sector remained the sole REIT property sector to close April at a median premium to NAV, although only at 0.5%, down significantly from the 10.3% median premium in March.

While the healthcare sector still traded at a slight 1% median discount to NAV estimates, the median discount shrank a bit from 2% at March-end. Additionally, more than half of the top 10 REIT stocks trading at the largest premium to their respective NAV estimates came from the healthcare sector.

Welltower Inc. closed April 30 at the highest premium of all REIT stocks, ending the month at $95.28 per share, 55.7% above its consensus NAV estimate of $61.18 per share. Another healthcare REIT, CareTrust REIT Inc., ranked second, closing the month at a premium of 41.0%.

Data storage-oriented Iron Mountain Inc. rounded out the top three, closing April 30 at 31.6% premium to its consensus NAV estimate.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.