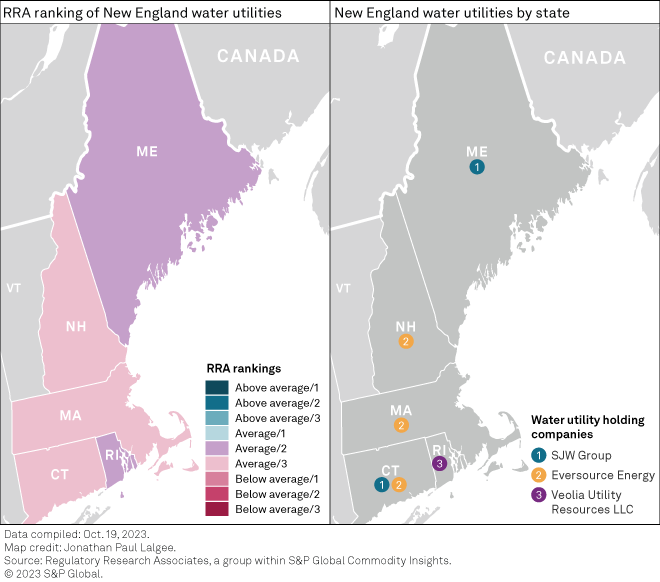

Five investor-owned water utilities operate within the New England region, with the largest two operating in Connecticut. Eversource Energy's Aquarion Water Co. Inc. operates three water utilities: Aquarion Water Co. of Connecticut Inc. (AWC-CT), Aquarion Water Co. of Massachusetts and Aquarion Water Co. of New Hampshire Inc. (AWC-NH).

SJW Group subsidiaries Connecticut Water Co. (CWC) and The Maine Water Co. and Veolia Utility Resources LLC subsidiary Veolia Water Rhode Island also have a presence in the region.

➤ The regulatory climate across New England is relatively consistent, with two of the five states in the region considered balanced and the other three considered slightly more restrictive than average, according to Regulatory Research Associates. RRA recently lowered the ranking of Connecticut regulation, which was previously considered more constructive than average, to reflect a concerning return on equity (ROE) authorization and language of the order that discourages future capital investment.

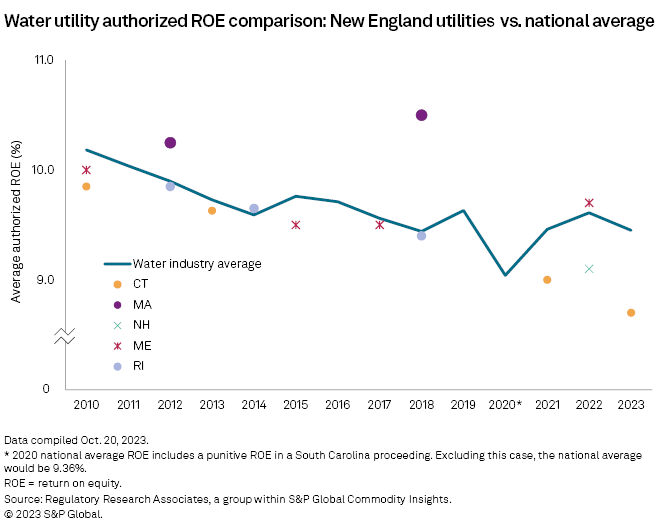

➤ With the exception of Massachusetts, authorized ROEs in the region have generally been below the prevailing nationwide average when established, and the use of historical test years in multiple states makes it challenging for the utilities in those states to earn the authorized returns. Infrastructure surcharges are used throughout the region, however, which minimizes regulatory lag.

➤ Only a handful of other constructive regulatory mechanisms have been implemented in the region for water utilities. New Hampshire allows temporary rate increases and step rate increases. Connecticut uses a revenue adjustment mechanism. In a recent decision, the Maine Public Utilities Commission approved a rate stabilization mechanism to phase in the revenue requirement related to a large water treatment plant upgrade.

➤ Implementation of innovative regulatory treatment (e.g., decoupling, future test years and multiyear rate plans) lags that for electric and gas utilities in the region and water utility regulation outside of the region. None of the New England states have passed legislation to facilitate the acquisition of municipal systems using a market-based valuation.

RRA follows water regulatory developments and rate proceedings that involve rate change requests of at least $1.0 million for the 12 largest investor-owned and privately held water utility holding companies. As part of this coverage, RRA evaluates water utility regulations in 20 states. The ranking framework includes three main buckets — Above Average, Average and Below Average, with Above Average representing the most constructive or lowest risk category from an investor viewpoint. There are three subcategories — 1, 2 and 3 — within each main bucket, with a 1 indicating the most constructive or lowest risk ranking within the larger group.

The water ranking framework aligns with the approach RRA applies to its evaluations of state regulatory climates for the energy sector. For additional detail concerning RRA's energy rankings, refer to the most recent "Quarterly State Regulatory Evaluations" report.

New England ROE authorizations largely trail national averages

As of Sept. 5, 12 water utility rate proceedings were completed across seven states nationwide, with cost-of-capital parameters provided in 10 proceedings. The authorized ROEs averaged 9.45%, compared to an average of 9.61% in 2022, when 10 water utility rate cases were completed nationwide. Authorized ROEs for water utilities continue to modestly trail the electric and gas utility averages.

While the ROEs approved in Massachusetts have been above prevailing nationwide averages when established, the authorized ROEs in the rest of the region, for the most part, have been below average, and the recent Connecticut decision is the most dramatic example.

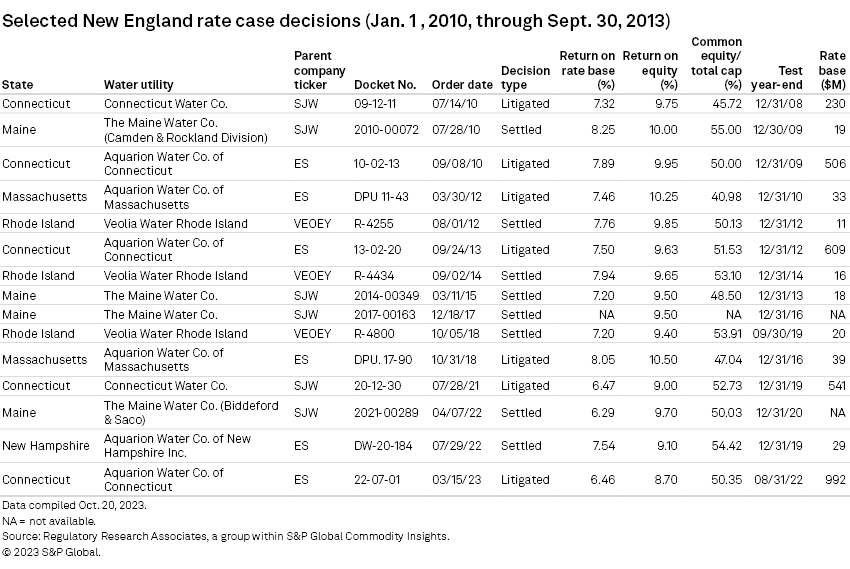

RRA takes critical view of Conn. regulatory environment

RRA lowered its ranking of the Connecticut Public Utilities Regulatory Authority (PURA) to Average/3 from Average/1 as a result of a March 15 PURA order for AWC-CT that reduced rates by $2.0 million and was based on an 8.70% ROE and recently enacted legislation that alters certain aspects of the regulatory construct for the state's utilities. The 8.70% ROE authorized for AWC-CT is the lowest nonpunitive return authorized for a water utility since 2010, as tracked by RRA. Additionally, the order admonished the company for its accelerated capital spending program. On Oct. 4, CWC filed for increased rates in a proceeding that is likely to be followed closely by both investors and other Connecticut utilities alike to gauge the changing regulatory climate within the state. Investors will likely be more cautious of a regulatory climate that discourages capital investments and offers a lower return on those investments than other jurisdictions.

Historical test years are utilized in Connecticut and water utilities have been unable to incorporate investments put into service beyond the test year, as seen in the most recent base rate case decisions for AWC-CT and CWC, making it difficult for the utilities to earn authorized returns. The use of a revenue adjustment mechanism and infrastructure surcharges has somewhat offset regulatory lag. As shown in the table below, base rate proceedings have been fully litigated rather than settled.

Water utility mergers between in-state companies have historically been permitted with minimal conditions. The PURA approved Eversource Energy's acquisition of AWC-CT in 2017 without onerous conditions, as well as multiple recent smaller transactions. The PURA, however, disallowed the recovery of transaction costs, finding that the acquisition benefited Eversource Energy shareholders rather than ratepayers, and that the companies had failed to provide evidence demonstrating savings due to the merger. By contrast, SJW Group's acquisition of Connecticut Water Service met with heightened concerns and was only approved after the companies agreed to multiple conditions. Even so, the PURA found that the company had taken a "thoughtful and thorough" approach to merger savings.

Legislation enacted in 2020 increases the statutory time frame within which the PURA must render a decision in its reviews of mergers, acquisitions or changes in control. The recently passed Senate Bill 7 is a wide-ranging piece of legislation that impacts the regulatory landscape for utilities. Changes in the regulation include precluding utilities from recovering certain costs in rates, expanding the PURA's discretion related to decoupling mechanisms, and increasing oversight of large water companies to include four-year rate reviews and mandatory audits.

AWC-CT serves approximately 210,000 customers across Connecticut and represents over 90% of Eversource's water customer base.

CWC serves more than 107,000 customers in 60 Connecticut towns and provides wastewater services to 3,000 customers in Southbury, Conn. The Connecticut subsidiary represented 33% of SJW Group's 2022 net income.

Maine regulation for water companies seen as balanced

The Maine Public Utilities Commission's ROE determinations historically have been slightly below prevailing industry averages when established. In addition, the PUC relies on an average original-cost rate base for a historical test period; however, unlike Connecticut, Maine permits adjustments for known and measurable changes. Infrastructure replacement surcharges and interim rate relief are also in place that mitigate regulatory lag to some degree, and in a June 2021 decision, the PUC approved a rate stabilization mechanism for Maine Water and allowed the company to phase in rates of a large water treatment plant upgrade.

Under the rate smoothing mechanism, the company established a regulatory liability account to hold funds until the plant was expected to enter commercial operation. Once the facility became operational and increased rates were approved, funds from the account were applied to customer bills to mitigate the impact of higher rates.

RRA accords Maine regulation an Average/2 rating for water utilities and views the climate for water utilities as relatively balanced from an investor viewpoint. For additional details on the regulatory climate of water utilities in Maine, please refer to: Maine regulation remains relatively balanced for water utilities.

Maine Water serves 34,000 water connections across 10 divisions and contributed approximately 5% of SJW Group's 2022 net income.

Water utility regulation in NH seen as slightly restrictive

New Hampshire's regulation of water utilities is slightly restrictive from an investor perspective, and RRA accords the state an Average/3 rating. The New Hampshire Public Utilities Commission has historically adopted equity returns that have been below the prevailing industry averages when established, and it typically relies on historical test years with average rate base valuations. If the commission has not issued a final decision within one year of the proposed effective date, the requested rate increase becomes permanent. Temporary rate relief and the use of an infrastructure surcharge mechanism have somewhat mitigated the adverse effects of regulatory lag on earnings. Regulatory approval of Eversource Energy's acquisition of AWC-NH was not required.

In AWC-NH's most recent rate proceeding, step rate increases were authorized and a property tax reconciliation adjustment mechanism was established. The company's proposals to utilize a decoupling mechanism were not included in the settlement the PUC approved.

AWC-NH serves a population of approximately 17,500 year-round, increasing to approximately 31,000 in the summer, in four New Hampshire towns.

Regulation seen as somewhat restrictive for Mass. water utilities

While ROE awards in recent years have been above the prevailing industry average at the time established, the Massachusetts Department of Public Utilities uses a historical test year. Towns and the attorney general often intervene in rate proceedings and exert an influence on regulatory outcomes. The department is required to render a final decision in a rate case in 10 months. The state allows an infrastructure surcharge mechanism; however, it is reconciled annually and is subject to a 3% annual revenue cap and earnings test. Innovative ratemaking, such as the decoupling mechanisms and multiyear rate plans currently utilized by the state's energy utilities, have not been implemented for water utilities.

RRA views the Massachusetts regulatory environment as somewhat restrictive for water utilities and assigns the state an Average/3 ranking.

Aquarion Water Co. of Massachusetts provides water service to less than 10,000 customers in the towns of Dover, Millbury, Oxford, Plymouth and Sheffield.

Water utility regulation seen as generally balanced in Rhode Island

Authorized ROEs for Veolia Water Rhode Island (formerly Suez Water Rhode Island Inc.) have been near the nationwide industry average for water utilities when established. The Rhode Island Public Utilities Commission relies on a forward-looking test year but utilizes an average rate base valuation in rate proceedings. An infrastructure surcharge was authorized in 2018, but innovative ratemaking, such as decoupling mechanisms, multiyear rate plans and adjustment clauses for certain operating expenses that are currently utilized by the state's energy utilities, have not been implemented for water utilities.

The regulatory environment in Rhode Island is generally balanced from an investor viewpoint. RRA accords the state an Average/2 ranking for water utilities.

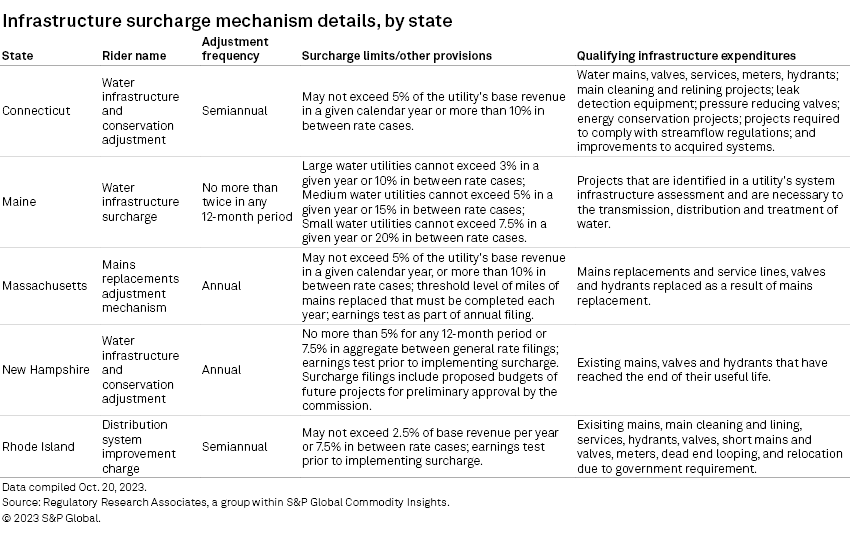

Infrastructure surcharges in place across the region

Utility regulators largely understand the high level of investment needed to replace aging infrastructure and have supported water and wastewater utility capital expenditure budgets at levels significantly above annual depreciation. Infrastructure surcharge mechanisms allow water and wastewater utilities to earn a return on incremental qualifying, non-revenue-producing infrastructure replacement in between general rate cases. They are utilized in 22 states, including across New England.

Commissions set their own mechanism parameters — defining qualifying investments, stipulating surcharge caps and frequencies, and determining program oversight. Not all infrastructure surcharge programs are created equal, and the benefits of some infrastructure surcharges have been limited by the associated rules. In Massachusetts, qualifying investments have been narrowly set to mains replacement. Massachusetts, New Hampshire and Rhode Island all include an earnings test before an infrastructure surcharge can be implemented.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Global Market Intelligence Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.