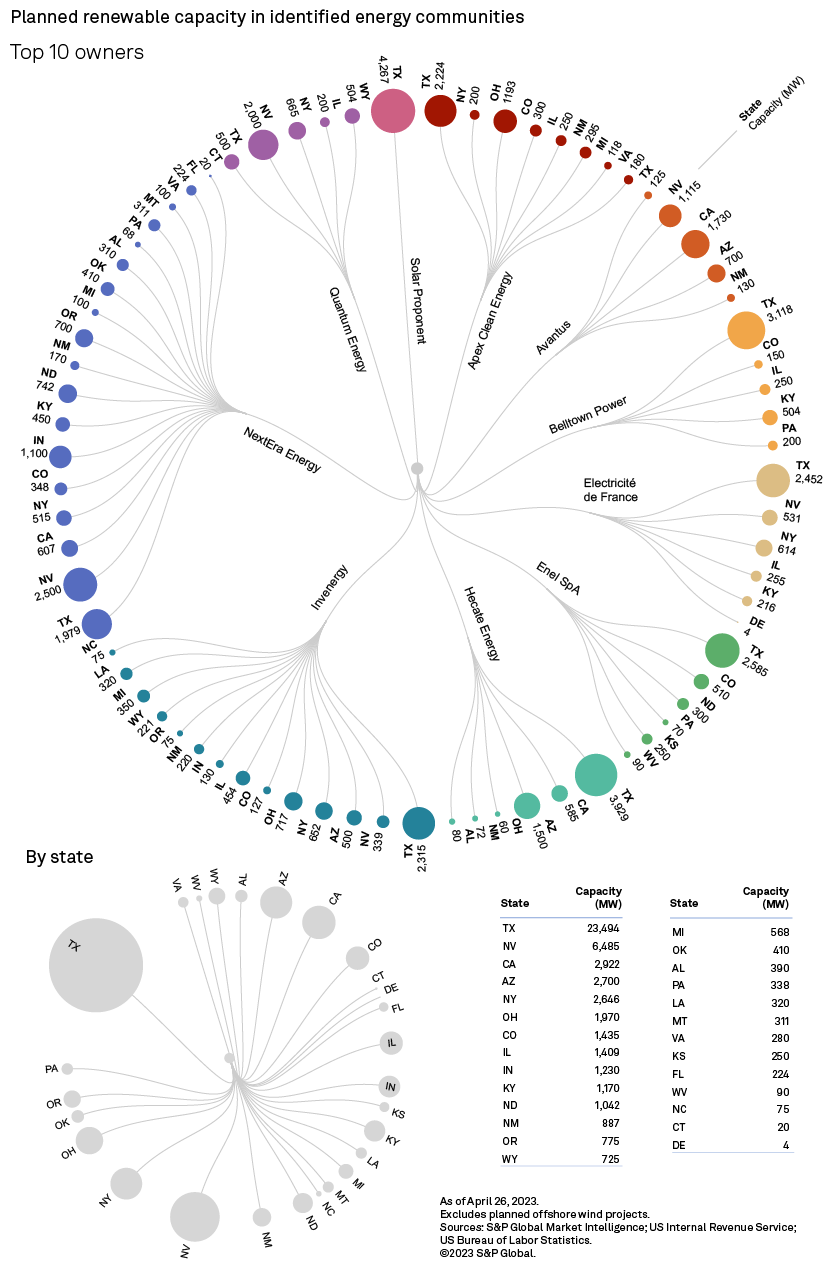

Renewable energy heavyweights dominate the top 10 leaderboard of companies planning renewable projects in geographies eligible for 10% tax credits adders under the Inflation Reduction Act of 2022's energy community special rule, with NextEra Energy Inc. at the top.

The rankings vary depending on whether one looks at the total number of planned renewable projects or their aggregate capacity (weighted to reflect ownership stakes). But our analysis reveals that NextEra is the leader either way.

Fifty-one of NextEra's 176 planned renewable projects as of writing — for an aggregate 10.7 GW of capacity — are to be situated in energy communities identified by S&P Global Commodity Insights. The bulk of NextEra's energy community-qualifying capacity is planned across the southwestern US, with close to a quarter of the total in Nevada alone.

Covering nearly the entirety of the Desert Southwest state, 17 Nevada census tracts and one nonmetropolitan statistical area made up of 13 counties likely qualify as energy communities under the act. Combined with Nevada's large swaths of open land and high insolation levels, this has the potential to turn the state into a major renewable generation hub for the Western Interconnect.

Texas is the number one state for seven of the top 10 companies by planned renewable capacity in identified energy communities, with nearly 23.5 GW, versus 6.5 GW for Nevada and under 3 GW for third-ranked California. Overall, 88 GW of currently planned renewable energy capacity is to be sited in qualifying Texas energy communities — roughly 71% of the state's onshore renewable energy pipeline.

Invenergy LLC and Hecate Energy — second and third in renewable capacity planned in identified energy communities — have sizable shares of their qualifying pipelines Texas-bound: 35.6% and 63.1%, respectively. All Solar Proponent LLC's planned 4.3-GW renewable energy capacity lies within the state.

For renewable energy developers, the benefits of targeting energy communities go beyond tax credit step-ups. Per the act, energy community qualification at the census tract level revolves around coal power plant retirements and coal mine closures, implying the presence of existing interconnection infrastructure in a nonnegligible number of identified census tracts.

According to a Climate Power report released April 25, about $243 billion in new clean energy and green manufacturing have been announced since the legislation's enactment in August last year.

Data visualization by Allen Villanueva.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.