In its monthly Nickel Commodity Briefing Service report, S&P Global Commodity Insights discusses the nickel market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

Key findings

* The London Metal Exchange, or LME, announced that it will restart its Asian nickel trading hours from March 20, a year after the exchange was forced to close the session following the historic nickel short squeeze in March 2022.

* CME Group Inc. is reportedly planning to launch a new nickel contract, underpinned by U.K.-based Global Commodities Holdings' upcoming Class 1 primary nickel spot index, to rival the LME's nickel contract.

* Commodities trading giant Trafigura alleged being the victim of a "systematic fraud" after discovering that shipments with 20,000 tonnes to 25,000 tonnes of primary nickel on board did not contain the metal.

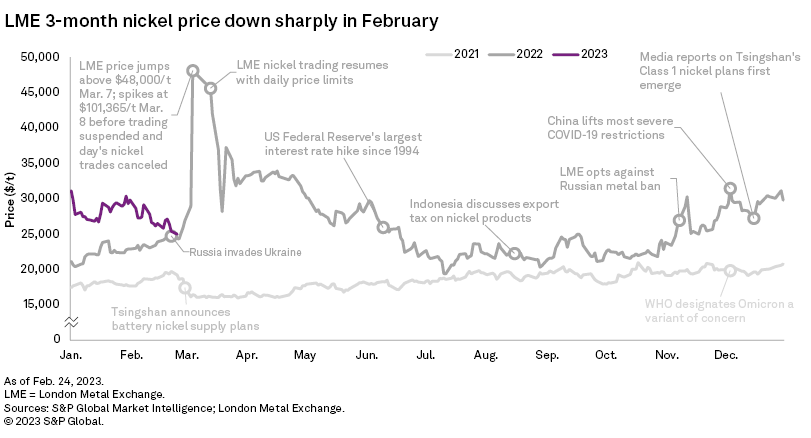

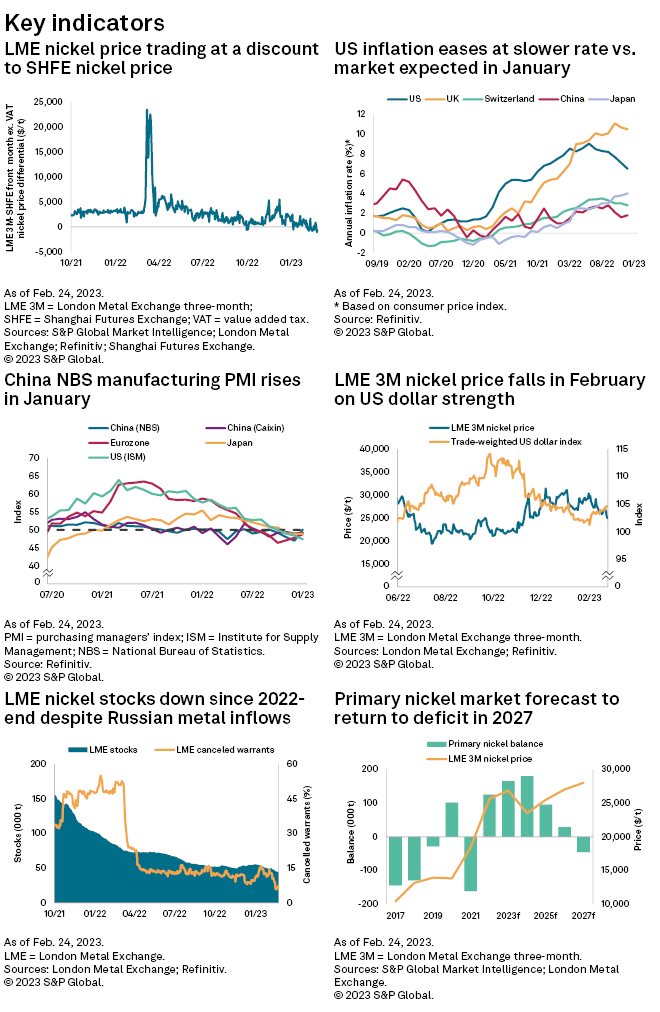

* The LME three-month, or LME 3M, nickel price dropped to a near four-month low of $24,554 per tonne on Feb. 24, the one-year anniversary of Russia's invasion of Ukraine, on U.S. dollar strength following the release of disappointing U.S. inflation data.

* New LME data shows that Russian on-warrant nickel stocks jumped during the period between October-end 2022 and January-end 2023, highlighting the consumers' continued reluctance to accept Russian material since the invasion.

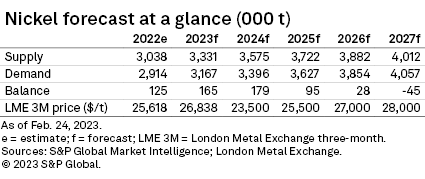

* We expect the average LME 3M nickel price to increase 4.8% year over year to $26,838/t despite a widening primary market surplus as China's economy awakens from the induced slumber resulting from its easing COVID-19 restrictions.

Access the Nickel Commodity Briefing Service February 2023 Databook.

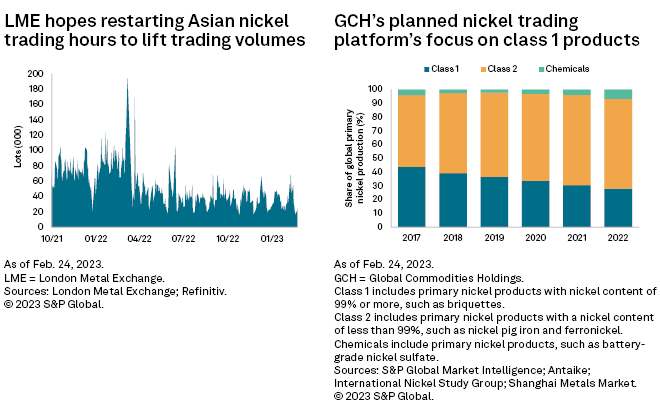

The LME hopes to revive nickel trading volumes, reduce price volatility and, most importantly, retain its status as the main price benchmark for the nickel market by restarting its Asian nickel trading hours. With trust in LME nickel prices still shaken by the infamous nickel short squeeze in March 2022, media reports suggest CME Group is collaborating with Global Commodities Holdings to enter the nickel space with its own contract. With the reopening of the LME's Asian trading session and Global Commodities Holdings' new nickel trading platform set to happen in March, that month looks set to be a key period for the global nickel market in the post-LME short-squeeze era.

Analyst comment

The LME's Asian nickel trading hours will restart from March 20, according to a statement released by the exchange Feb. 23, while CME Group looks set to enter the nickel trading exchange space.

Following the March 2022 LME nickel short squeeze, the exchange closed its Asian nickel trading hours; the LME nickel trading day currently only starts at 8 a.m. London time. LME nickel market trading will, however, return to a 1 a.m. London time, starting in March. The LME hopes that the move will help rebuild nickel trading liquidity on the exchange by allowing Asia-based traders to capitalize on arbitrage opportunities. LME nickel trading volumes have averaged 33,879 lots per day in January 2023, significantly lower than the 85,480 lots per day averaged in February 2022, the month before the squeeze. These illiquid market conditions have resulted in extreme LME nickel price volatility, evidenced by data showing that the LME 3M nickel price has closed within a $6,148/t range in the March quarter-to-date period, compared with a $5,015/t range in the whole of 2021, the last full year before the squeeze.

With price volatility underpinning the Chinese buyers' need to find alternatives to LME nickel prices during the 2023 supply negotiations and with BHP, a major mining company, recently saying that "reform of the LME's metal delivery rules is long overdue," we anticipate that Asian market participants will continue to be hesitant to resume trading on the exchange when the Asian nickel trading session returns. We therefore expect that illiquid trading conditions and volatile prices will continue to afflict LME nickel trading in the near term.

The same day the LME made its announcement, news emerged that CME Group plans to launch a nickel contract, settled with prices gathered from a physical nickel trading platform that Global Commodities Holdings will launch by the end of March. Reduced confidence in the LME nickel price as a price discovery mechanism in the aftermath of the squeeze, combined with CME's existing presence in metals markets including copper and gold, suggests it has the potential to launch a nickel contract that could be a viable alternative to the LME nickel contract. Like the LME's nickel contract, however, CME Group's contract will only be devoted to the Class 1 nickel market because it will reportedly be based on Global Commodities Holdings' upcoming Class 1 nickel spot index. As Class 1 primary nickel's share of global output fell from 43.7% in 2017 to 27.8% in 2022, according to our estimates, CME's proposed contract may struggle to attract interest from the wider nickel market.

These respective developments regarding the LME and CME Group came after the nickel market was hit by another scandal. Commodities trading giant Trafigura released a statement Feb. 9 alleging that it has been the victim of a "systematic fraud" and will take a $577 million charge in the first half of 2023, after discovering that shipments of nickel it purchased from companies owned by Dubai-based metals trader Prateek Gupta did not contain the metal. The cargoes in question reportedly represent between 20,000 tonnes and 25,000 tonnes of primary nickel, which is equivalent to between 48.4% and 60.1% of available nickel stocks on the LME as of Feb. 22. With investors concerned about such a quantity of material to be possibly missing from the global nickel supply chain, the LME 3M nickel price jumped from $27,390/t Feb. 8 to $29,142/t Feb. 9.

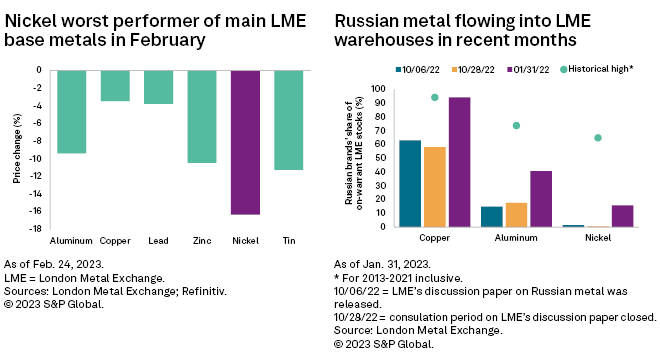

The LME 3M nickel price then dropped sharply over the next two weeks to $24,554/t Feb. 24, the lowest since November 2022, on U.S. dollar strength after disappointing U.S. inflation data raised fears that the Federal Reserve could implement more aggressive interest rate hikes to combat inflation. Given the prevailing illiquid nature of LME nickel trading, the price looks set to be the worst performer of the six main LME base metals for the second consecutive month in February.

LME nickel prices nevertheless remain at elevated levels and have found support from trends in LME Class 1 nickel stocks, which, in contrast with bearish global primary nickel market fundamentals, are down 44.3% year over year, to 44,580 tonnes Feb. 24. On Feb. 9, the LME published its first monthly report showing origin by country of its stocks. Given the focus on the metal's Russian origin since the country's invasion of Ukraine and the LME's decision to opt against banning new Russian metal deliveries into its warehouses following a three-week consultation period in October 2022, the report provided an update on the flow of Russian metal into LME sheds. The report showed that as the exchange expected, the proportions of Russian stocks have risen since the LME closed its consultation period. Indeed, Russian brand's share of on-warrant LME nickel stocks surged, from 0.5% on Oct. 28, 2022 — the day the consultation period ended — to 15.8% on Jan. 31. As these levels remain at or below their historical highs for the exchange's main contracts, it seems unlikely that the LME will impose a total ban on new Russian nickel being delivered into its warehousing network based on rising Russian metal inflows in the near-term.

Outlook

While we continue to forecast Indonesian primary nickel supply growth to cause the global primary nickel market surplus to expand from an estimated 125,000 tonnes in 2022 to 165,000 tonnes this year, we have downgraded our 2023 average LME 3M nickel price forecast from $27,518/t to $26,838/t due to the sharper-than-expected price drop in February. This is still 4.8% higher than the 2022 average price, on the expectations that a recovery in China's economy following the removal of its COVID-19 restrictions will lift industrial metals prices as the year progresses.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.