In its monthly Nickel Commodity Briefing Service, or CBS, report, S&P Global Commodity Insights discusses the nickel market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

Key findings

* The London Metal Exchange three-month, or LME 3M, nickel price dropped to $26,690 per tonne Jan. 17, the lowest since end-November 2022, on news that Tsingshan Holding Group Co. Ltd. will add Class 1 primary nickel to its diverse production mix.

* As part of this move, Tsingshan plans to convince idle copper plants in China to produce Class 1 nickel using the company's nickel matte as an input.

* Although we expect the cost of converting such copper plants to produce Class 1 nickel to be an obstacle, the process has been successfully tested at a smaller factory in central China, according to media reports.

* Management consulting firm Oliver Wyman released its highly anticipated independent review Jan. 11, into the events of the 2022 LME nickel short squeeze.

* The LME's efforts to reopen its Asian trading session for nickel are reportedly being blocked by the U.K.'s financial watchdog, the Financial Conduct Authority, or FCA, indicating that LME nickel prices are likely to remain volatile in the near term.

* U.K.-based Global Commodities Holdings said Jan. 4 that it plans to launch a physical nickel trading platform in late February to compete with the LME.

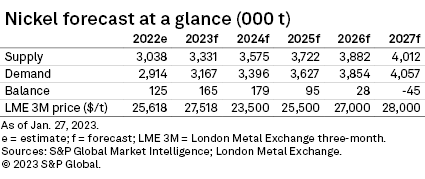

* We forecast the LME 3M nickel price to average $27,518/t in 2023, below current price levels, on expectations for a wider global primary nickel market surplus.

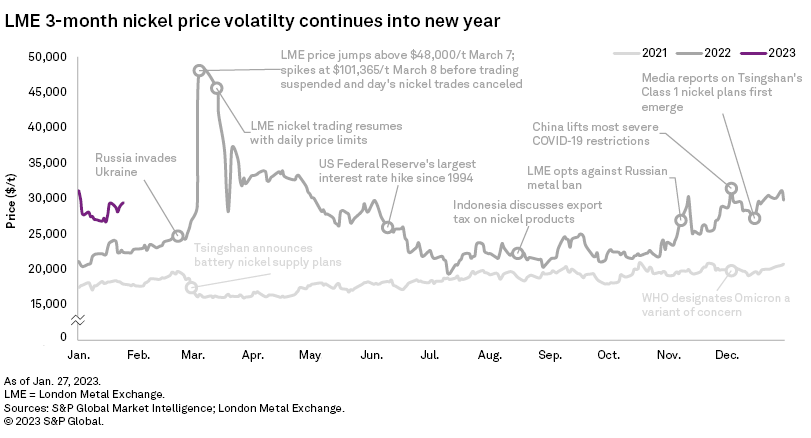

Although the aftermath of the historic LME nickel short squeeze has largely dominated market discussion since it occurred in March 2022, the latest production strategy shift by Chinese stainless steel and nickel producer Tsingshan provided the market with a stark reminder that global primary nickel fundamental developments are important to nickel price movements. News of the company's plans to persuade idled copper plants in China to produce Class 1 nickel from its nickel matte caused the LME 3M nickel price to plummet to a nearly two-month low in January. While Tsingshan's idea is bold, the company's excellent track record of advancement in the nickel market, as highlighted by the success of its recent nickel pig iron, or NPI, to nickel matte conversion strategy, provides strong evidence that Tsingshan's latest venture should be taken seriously as a downside risk to global nickel prices.

Analyst comment

News of another major shift in Tsingshan's evolving nickel production strategy put the LME 3M nickel price under downward pressure in January, as the market digested the findings of the long-awaited, LME-commissioned independent review of the unprecedented nickel short squeeze in March 2022 by consultancy Oliver Wyman.

Tsingshan — whose announcement of plans to process NPI into high-grade nickel matte that can be converted into battery-grade nickel sulfate for use in the electric vehicle battery sector rocked the global nickel market in March 2021 — is now planning to add refined nickel, also known as Class 1 primary nickel, to its production mix. Class 1 nickel is largely preferred as an input to produce battery-grade nickel sulfate, partly due to its high nickel content. News broke Jan. 9 that the company is in discussions with several Chinese copper producers, including Yanggu Xiangguang Copper Co. Ltd., about processing its nickel products into Class 1 nickel at their copper plants. This came after Dec. 19, 2022, reports that a new Tsingshan plant in Indonesia capable of producing 50,000 tonnes per year of Class 1 nickel from nickel matte will start operating in June 2023.

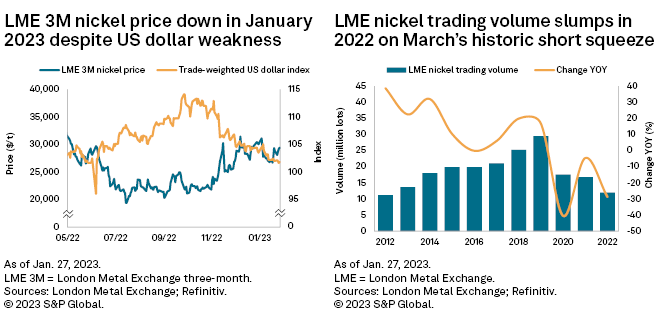

Class 1 primary nickel's share of global primary nickel output fell from 43.7% in 2017 to 27.8% in 2022, according to our estimates, constrained by a lack of significant nickel sulfide ore discoveries over the last decade and surging production of Class 2 primary nickel products, such as NPI, from Indonesia. Concerns that Tsingshan's latest plan could spark a revival in Class 1 primary nickel production in an already oversupplied global primary nickel market caused the LME 3M nickel closing price to drop from $32,169/t Jan. 3 to $26,690/t Jan. 17, the lowest since end-November 2022.

Elevated Class 1 primary nickel prices since the market short squeeze in March 2022 appear to have been a factor behind Tsingshan's latest production shift. Indeed, the LME 3M nickel price, which is underpinned by LME-deliverable Class 1 nickel products and normally trades at a discount to China's battery-grade nickel sulfate price in U.S. dollar terms, commanded a premium of $7,015/t over the price of battery-grade nickel sulfate in China Jan. 20, compared with a discount of $1,576/t Feb. 23, the day before Russia's invasion of Ukraine, an event that played a key part in triggering the squeeze.

We expect the potential cost of converting copper plants to produce Class 1 nickel to be an obstacle to Tsingshan's move. The prospect of higher average copper prices over our forecast horizon and beyond, due to the role the metal is expected to play in the wider electrification of the global economy, may also push less profitable copper producers to restart their idled smelters instead. Reports that the process has been successfully tested at a smaller factory in central China, however, suggest that it is, at least, technologically viable.

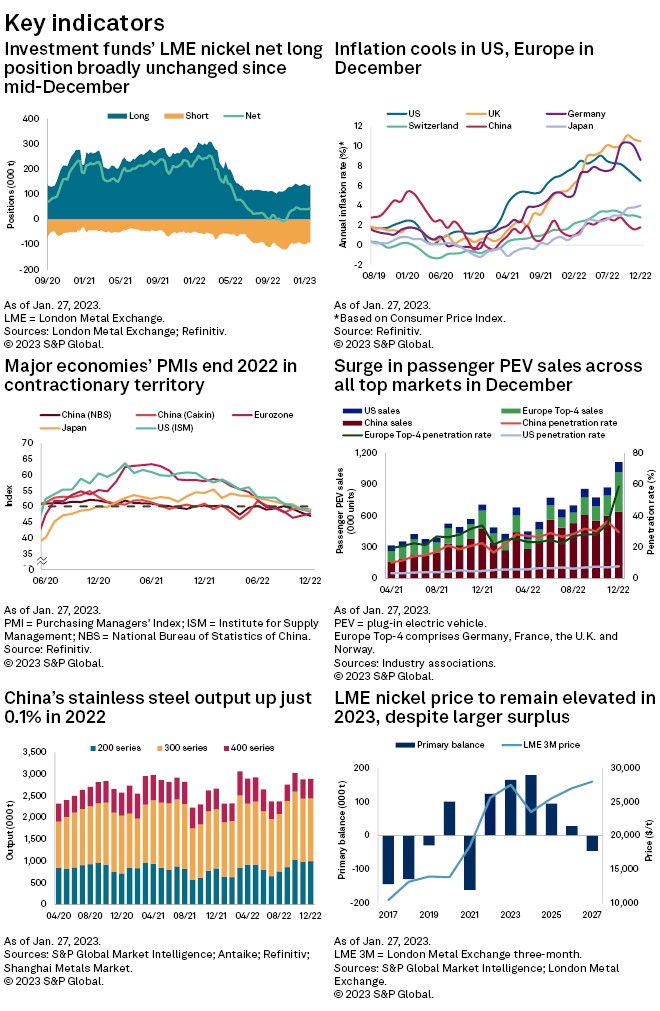

Improving global macroeconomic sentiment, driven by factors such as China's emergence from its zero-COVID restrictions and U.S. dollar weakness amid cooling inflation, helped the nickel price recover to $28,092/t Jan. 27. The price, however, looks destined to be the only one of the six main LME base metals to close January in negative territory, due to concerns around the impact of Tsingshan's planned production switch.

Oliver Wyman's long-awaited independent review of the March 2022 LME nickel short squeeze was released Jan. 11. The report gave further insights into the events that triggered the squeeze and the LME's decision to suspend trading on the exchange for six working days as a result. The paper also included recommendations to the LME intended to reduce the likelihood and impact of similar market events in the future. One of these recommendations was to "provide a clear vision for how the LME will respond to events and rebuild liquidity." Nickel trading has indeed become extremely illiquid since the event, with LME nickel trading volumes slumping 28.9% year over year to 11.9 million lots in 2022. This has resulted in heightened LME nickel price volatility and diminished confidence in the exchange's nickel price as a price discovery mechanism.

The LME has reiterated its commitment to reopening its Asian nickel trading hours to rebuild liquidity on the exchange several times since the annual LME Week gathering in London in late October 2022. It was, however, reported following the release of Oliver Wyman's report that the reopening is being blocked by the FCA, over fears that the exchange does not yet have adequate supervisory controls to restart Asian trading.

The latest developments in the LME nickel saga suggest that nickel trading on the exchange will continue to be characterized by muted trading volumes and wild price swings in the near term. With the Shanghai Futures Exchange not able to capitalize on this turmoil because the Chinese government only allows registered Chinese entities to trade on the exchange, this leaves an opportunity for new entrants in the nickel exchange space. Global Commodities Holdings, a company headed by former LME CEO Martin Abbott, said Jan. 4 that it plans to launch a physical nickel trading platform in late February. The prices on the platform will form the basis for an index that could eventually be used to create futures that could compete with the LME contract, according to the company.

Outlook

Rising Class 2 primary nickel production by Indonesia is projected to offset surging primary nickel demand from the battery sector in volume terms in 2023, according to our forecasts. We therefore expect the global primary nickel market surplus to expand from an estimated 125,000 tonnes in 2022 to 165,000 tonnes in 2023, and the LME 3M nickel price as a result to average below current levels at $27,518/t in 2023. The possibility of a resurgence in Class 1 primary nickel output, thanks to Tsingshan's latest production shift, nevertheless represents a new and significant risk for the nickel market.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.