Download The Full Report

Click hereForty-two states, representing approximately 95% of the US population, had stay-at-home orders in place as of the 7th of April 2020, as a result of the COVID-19 pandemic. In the current environment, foot traffic data provides investors and corporate managers with key insights on the level of activity at properties (vacant vs occupied) and the demographic profile (e.g. age) of visitors. Corporate managers can use this information to pinpoint properties at greater risk of tenant defaults, or benchmark their footfall activity to those of competitors. Investors can use foot traffic data to identify real estate investment trusts (REITs) managing properties where activity remains robust, as well as those that own properties that attract visitors with favorable demographic characteristics (e.g., wealthier customers).

More importantly, once the nationwide lockdown eases, foot traffic can serve as a leading indicator of a return of economic activity across industries. For example, tracking footfall at retail locations or hotels can indicate when consumers return to shopping malls and when travel rebounds.

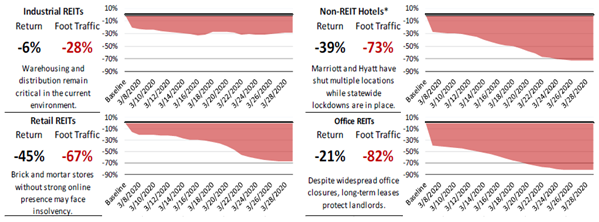

Figure 1: Russell 3000: Year-on-Year Change in Foot Traffic Versus

Return Performance (March 2020) for Select REIT Property Types

*Non-REIT Hotels are companies that manage hotel properties but have chosen not to operate as REITs.

***Return for each sub-industry is the market-cap weighted return of all stocks in that industry with foot-traffic data

Source: AirSage, S&P Global Market Intelligence Quantamental Research. Data as at 04/15/2020

Industrial REITs own warehouses that are critical for the distribution of essential items like food, which explains the lower-than-average 28% drop in footfall (Figure 1). Conversely, most offices have closed, leading to an 82% plunge in foot traffic at properties managed by office REITs. Yet, office REITS had the second-best stock performance in March 2020 with a decline of 21%. Office REITs tenants are locked into long-term leases, offering revenue protection for landlords. However, office landlords are not immune from tenants choosing to skip rent payments or tenant bankruptcies. Retail REITs will continue to face revenue challenges from higher vacancy rates as more brick and mortar retailers file for bankruptcy (vacancy rates at US malls hit their highest levels in at least two decades earlier this year).

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Explore S&P Global Marketplace

Click hereQuantamental Research Brief: No More Walks in the (Office) Park: Tying Foot Traffic Data to REITs

Click here

Quantamental Research Brief: Do Markets Yearn for the Dog Days of Summer? COVID, Climate, and Consternation

Learn more

Quantamental Research Brief: Cold Turkey – Navigating Guidance Withdrawal with Supply Chain Data

Learn more