Unique organizational structures and circumstances contributed in 2022 to the highest volume of surplus notes issuance by US property and casualty insurers since 2008, an S&P Global Market Intelligence analysis finds.

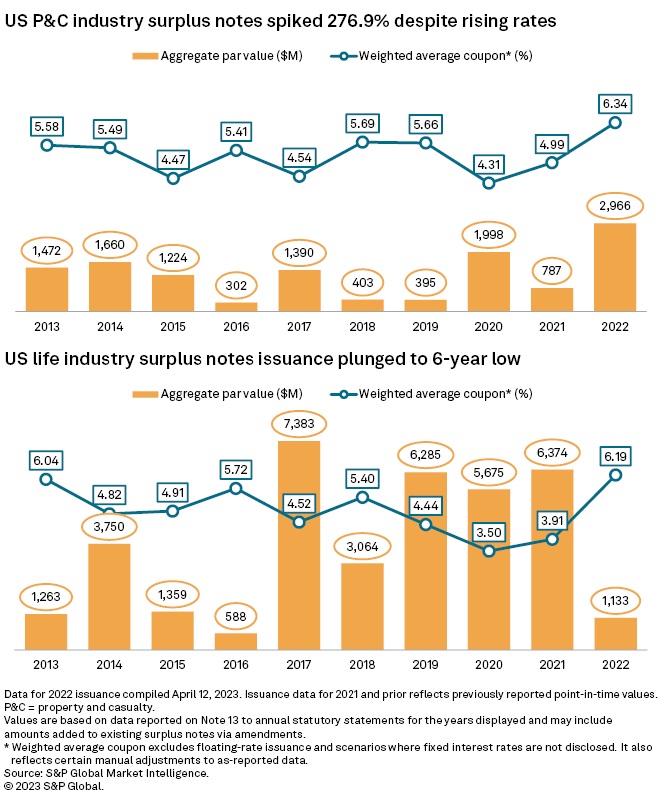

➤ Defying higher cost of funds for the deeply subordinated debt obligations, we calculate that issuance by P&C insurers increased to $2.97 billion in 2022 from $786.9 million in 2021 and average annual volume of $1.04 billion during the preceding 10-year period. Florida property insurers hit by the combination of Hurricane Ian and the state's ever-challenging operating environment, a smattering of insurtechs and fledgling reciprocal exchanges were especially active from an issuance standpoint, but it was a leading medical professionals liability insurer that generated the year's largest single transaction.

➤ Life insurers, meanwhile, engaged in little activity relative to both the P&C sector and their recent track record. The largest single deal of 2021, a $1.19 billion transaction involving what has since been renamed Empower Annuity Insurance Company of America, exceeded the entire life sector's full-year 2022 tally. Total aggregate par value of surplus notes issued by the life industry plunged to a meager $1.13 billion in 2022 from $6.37 billion in 2021 and the preceding 10-year average of $3.70 billion. Rising interest rates undoubtedly contributed to the sluggish activity as we calculated a weighted average coupon of 6.19% on the surplus notes that life insurers did issue, an increase of 228 basis points from 2021 to the highest level since 2010.

➤ With interest rates showing signs of flattening out amid fallout from the March banking crisis, it is possible that opportunistic issuance could make something of a comeback in 2023. The confluence of a heightened supply of notes issued by some of the industry's most highly rated carriers and a strong investor bid in the depths of a low-for-long rate environment is unlikely to reemerge in the near term even if one recent transaction offers a glimpse of the utility that surplus noes can provide to both sides of a trade.

P&C issuance pops

Medical professional liability insurer Doctors Co. An Interinsurance Exchange's $500 million January 2022 offering matched later transactions by Massachusetts Mutual Life Insurance Co. as the insurance industry's largest such deal for the year. Coming before the Federal Open Market Committee began raising the federal funds rate, The Doctors issued 10-year notes at a fixed rate of 4.50%. That was 200 basis points tighter than the company's penultimate issuance in 2013 and 117 basis points lower than what MassMutual achieved on its December 2022 issuance.

But rather than an opportunistic means of raising funds in times of relatively attractive interest rates, surplus notes issuances more frequently fill more fundamental roles for smaller and non-stock P&C carriers. As we observed again in 2022, this includes as a source of initial capitalization, a means of raising total adjusted capital above regulatory thresholds and, on occasion, for acquisition funding.

Two Tampa, Fla.-based homeowners insurers Slide Insurance Co. and Loggerhead Reciprocal Interinsurance Exchange, along with Charleston, W.Va.-based coal mining reclamation surety bond writer Mining Mutual Insurance Co. issued surplus notes as part of their initial capitalization and/or in connection with their launches. Kin Interinsurance Nexus Exchange issued a surplus note in combination with a sponsored conversion of what was formerly a stock insurance company known as ADM Insurance Co. to a reciprocal.

Accident Fund Insurance Co. of America, meanwhile, conducted an underwritten private placement of 10-year, 8.50% surplus notes in November 2022 in connection with its $608.9 million acquisition of AmeriTrust Group Inc.

Certain US subsidiaries of international reinsurers also emerged as surplus note issuers in the fourth quarter of 2022, with Munich Reinsurance America Inc., Endurance Assurance Corp. and Renaissance Reinsurance U.S. Inc. issuing a total of $955 million at aggregate par value. For the latter company, the $300 million 7.50% December 2022 issuance helped push its authorized control level risk-based capital ratio to 259.7%. In the absence of the surplus notes, all else being equal, RenRe U.S.'s total adjusted capital would have been less than 187.5% of its authorized control level RBC. Under the National Association of Insurance Commissioners' RBC system, an authorized control level RBC of between 150% and 200% would be at the company action level.

Following the flurry of activity in the fourth quarter of 2022, P&C insurers issued at least $52.9 million in surplus notes in the first two months of 2023. Activity included issuances totaling $17 million for Branch Insurance Exchange and $15 million each for Rockingham Insurance Co. and Slide. The latter two entities received regulatory approval to include the issuances as surplus in their 2022 financial statements under Statement of Statutory Accounting Principles No. 72.

The P&C industry total could have been even higher. S&P Global Ratings in October 2022 assigned a BBB+ rating to Farmers Insurance Exchange's proposed issuance of surplus notes due 2052, but the insurer's annual statement indicates that it last issued surplus notes in December 2017.

New life for surplus notes?

Large non-stock companies have traditionally ranked among the largest surplus notes issuers in the life sector. That trend continued in 2022 with the MassMutual transaction.

The 5.672% interest rate on the company's 30-year December 2022 issuance was the highest for an outstanding MassMutual surplus note since its June 2009 issuance of 30-year, 8.875% notes.

Other notable life sector issuances included Midland National Life Insurance Co.'s May 2022 placement of 30-year, 6.10% notes with its parent and SILAC Insurance Co.'s December 2022 issuance of a $120 million note to its parent in exchange for a then-outstanding note and cash. The latter note will bear interest at a floor rate of 325 basis points over the prime rate.

A transaction of a magnitude equivalent to the MassMutual deal has already closed in 2023. Reinsurance Group of America Inc.'s Chesterfield Reinsurance Co. issued $500 million in 7.125% surplus notes due 2043 through a subscription agreement with Apollo Global Management Inc.-affiliated insurance companies, third-party insurance managed accounts, and other institutional clients.

S&P Global Ratings, in assigning its A debt rating to the notes, reported that they are part of an embedded-value securitization where Chesterfield Re will enter a 50% quota-share retrocession agreement with RGA Reinsurance Co. An RGA filing did not provide additional information about the type of insurance liabilities involved.

RGA Re in 2022 recaptured business ceded to Chesterfield under an embedded value transaction that involved a closed block of ordinary life insurance.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.