Introduction

Tracked CO2 emissions from generation across the Western U.S. fell at a slower clip than at the national level from 2005 to 2021 but accounted for less than 15% of the U.S. total at the end of the interval — a contrast partially driven by the region's early forays in green energy. That said, a survey of local utilities shows a wide array of CO2 emission reduction commitments, aligning with the constellation of renewable portfolio standards across the region. Featuring multitudinous geographies likely qualifying for 10% tax credit adders under the Inflation Reduction Act, the recently signed law is icing on the cake for the region's renewable prospects and hence further CO2 emission erosion.

The Western U.S. achieved slower CO2 emission cuts than the broader U.S. from 2005 to 2021, but it emitted only 14.5% of the U.S. total in 2021, suggesting potential diminishing marginal declines after years at the forefront of the green energy revolution.

That said, the stars are essentially aligned to keep the geography's renewables momentum going, including abundant solar and wind resources, available land and policy supporting a move away from fossil fuels.

Finally, the region is home to dozens of geographies likely eligible for extra Inflation Reduction Act incentives to develop renewables infrastructure, according to an S&P Global Commodity Insights analysis of qualifying criteria under the recently passed law.

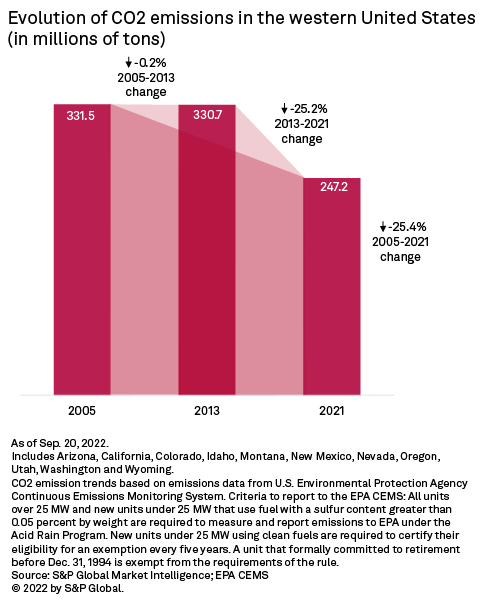

An analysis of S&P Market Intelligence data from the U.S. Environmental Protection Agency Continuous Emissions Monitoring System shows that from 2005 to 2021, tracked CO2 emissions from generation across the 11 states comprising the Western U.S. declined 25.4%, from 331.5 million tons to 247.2 million tons. However, drilling into the data reveals disparate, and perhaps counterintuitive, CO2 emission trends across the region's state lines, rising in California and Idaho while plunging nearly 50% in Nevada.

California boasts 26.4 GW of operating renewables capacity, or 42.1% of the region's renewable portfolio. In the U.S., only Texas has more operating renewable capacity. Overall, biomass, geothermal, solar and wind energy account for 31.4% of the Golden State's generation fleet. Yet tracked CO2 emissions from generation in California rose 17.3% from 2005 to 2021. That said, California, the most populous U.S. state by a relatively wide margin, emitted 37.1 million tons of CO2 from generation in 2021, or less than fellow but much smaller Western states Arizona and Wyoming. California counts roughly 13.4 million households for a population of nearly 40 million, versus 2.7 million households for a population of 7.2 million in Arizona and fewer than 237,000 households for a population of approximately 580,000 in Wyoming.

The bulk of the increase in CO2 emissions from generation in California occurred in the first half of the interval under analysis, partly reflecting the commissioning of new fossil fuel plants. For example, the 822 MW natural gas Pastoria Energy Center, interconnected to Southern California Edison Co., or SCE, came online in 2005. Per Market Intelligence's tracked CO2 emission data, the plant emitted slightly over 831,000 tons of CO2 in 2005. The figure rose to nearly 2 million tons by 2021 — more than 19% of the tracked CO2 emissions falling under the SCE umbrella in the Golden State.

SCE parent Edison International said it has aligned its climate preservation commitments with California's goals, including achieving net-zero greenhouse gas emissions by 2045. SCE is looking to deliver carbon-free energy in retail sales to its customers by 2045 within this commitment. California has some of the most ambitious renewable portfolio standards in the U.S., calling for all electricity in the state to be generated from carbon-free sources by 2045. This includes interim targets of 44% renewable energy by 2024, 52% by 2027 and 60% by 2030.

At the other end of the spectrum in Western U.S. CO2 emission trends, Nevada emitted 13.8 million tons in 2021, down 49.7% from 27.4 million tons in 2005. Two coal power plants with a combined capacity of 2.1 GW were retired in Nevada during the timeline under consideration. This includes Nevada Power Co.'s 555-MW Reid Gardner coal plant, which retired between 2014 and 2017. Per the recently signed-into-law Inflation Reduction Act, census tracts — and all adjacent ones — in which any coal power plant has been retired after Dec. 31, 2009, or in which any coal mine has closed after Dec. 31, 1999, are eligible for the 10% step-up incentive.

As of this writing, highly insolated Nevada operated 3.4 GW of utility-scale photovoltaic capacity, or 23% of the state's overall generation fleet; it had an additional 13.5 GW of solar in the pipeline. Estimates about the state's operating and planned capacity suggest Nevada could produce close to 40% of its energy from renewables by the mid-2020s. Nevada has a renewable portfolio standard requiring a determined percentage of the electricity sold in the state each year to come from renewables. Starting with a 20% target for 2020 and rising through increments every two years, it tops out at 50% in 2030. Berkshire Hathaway Energy, parent company of Nevada Power Company and Sierra Pacific Power Co., has committed to net-zero emissions by 2050.

A handful of states in the Western U.S. still display large percentages of coal in their generation portfolios. This includes Colorado, where coal accounts for 22.1% of the state's operating capacity; Montana, at 27.7%; and Utah, at 46.7%. Wyoming is at the very top, operating 6.3 GW of coal, which represents 62.5% of the state's generation fleet. In the U.S., only West Virginia has a higher share of coal in its generation mix, at 82.7%.

Wyoming has retired three coal power plants since 2010 and closed two coal mines since 2000, according to Market Intelligence data. Commodity Insights identified 27 Wyoming census tracts likely qualifying for the Inflation Reduction Act tax credit step-ups. As of this writing, an additional three Wyoming-based coal power plants had announced retirement years. Those include the 604 MW Naughton and the 755 MW Dave Johnston plants, set to retire in 2025 and 2027, respectively. Both Naughton and Dave Johnston are owned by PacifiCorp. Jim Bridger, which has a capacity of 2.1 GW, is the third Wyoming coal power plant scheduled to retire — in 2037. Jim Bridger is co-owned by PacifiCorp and Idaho Power Co.

Based on these anticipated coal power plant retirements alone, Commodity Insights identified another 20 Wyoming census tracts currently not qualifying as energy communities that may become eligible. Wyoming, which has no renewable portfolio standard, operated 3 GW of wind capacity as of this report. The state, which is endowed with abundant wind resources, has 9.8 GW of additional wind capacity in planning. A Commodity Insights analysis of 22-year U.S. 100-meter wind speeds across shows Wyoming averaging 7.2 meters per second — ranking eighth among U.S. states.

After years ahead of the energy transition curve, some states in the region, notably trend-setter California, could experience diminishing marginal declines in CO2 emissions, suggesting the region's laggards eventually will need to pick up the baton to maintain momentum. This partly hinges on local legislatures, as the Western U.S. provides a propitious environment for the development of renewables, notably some of the nation's best solar and wind resources and most plentiful open spaces.

In the region, Idaho and Wyoming do not have a renewable portfolio standard in place. Utah only has a voluntary energy goal for utilities in the state to generate 20% of adjusted electric sales from renewables by 2025, only if it is cost-effective to do so. Montana's renewable portfolio standard, meanwhile, expired in 2015. That said, the Inflation Reduction Act may help attract renewables developers to these states. Commodity Insights inventoried more than 80 census tracts likely qualifying for additional Inflation Reduction Act incentives per some of the criteria under the law.

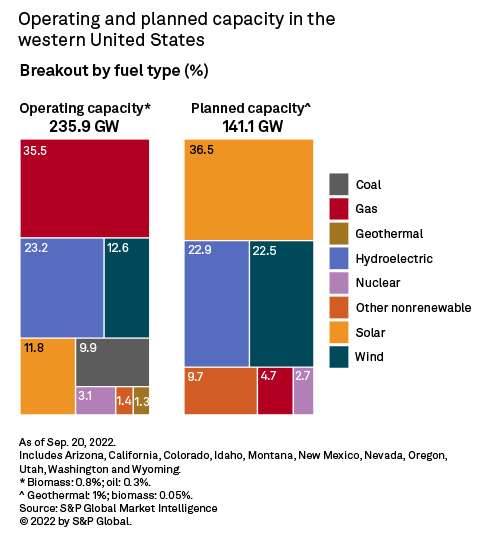

Overall, renewables — biomass, geothermal, solar and wind — accounted for 26.5% of the region's operating capacity and 60% of the additional capacity it had in the pipeline as of this analysis.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights and S&P Global Market Intelligence are owned by S&P Global Inc.

Shirley Gil contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.