Mutual insurance holding company conversions have become routine among regional property and casualty insurers, but the ownership structure rose to prominence in the mid-to-late 1990s among larger life and health insurers seeking greater access to capital, among other things.

Now, one of the life and health companies that had been caught up in that earlier wave of reorganizations has said it plans to take another look at the structure.

Mutual of Omaha Insurance Co. confirmed a disclosure in its 2023 annual statement that it is exploring the formation of a mutual insurance holding company (MIHC). The company emphasized that it has not established a timeline for the exploratory process, which it said is intended to "fully understand" the structure's requirements and the process required to create it and uncover any potential unintended consequences.

Company archives might be one place to look. Mutual of Omaha had drafted a plan in 1998 to form an MIHC and, in connection, convert to a stock company from a mutual insurer in an era when the likes of what are now known as Pacific Life Insurance Co., Principal Life Insurance Co., Minnesota Life Insurance Co. and Security Benefit Life Insurance Co. completed reorganizations of the sort.

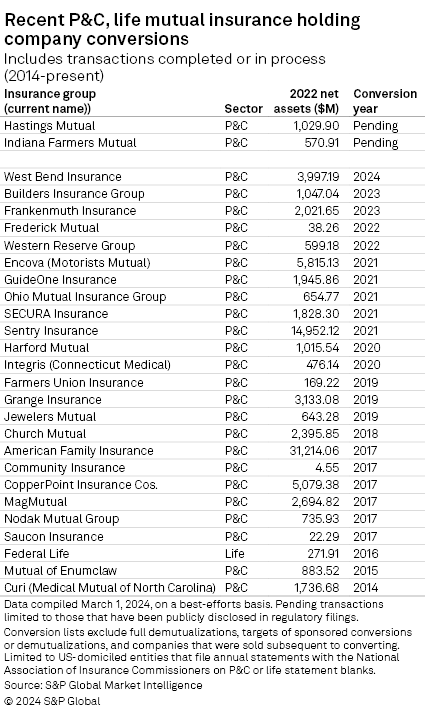

While there have been few life MIHC conversions in recent years, with the last such transaction covered by S&P Global Market Intelligence having closed in 2016, the strategy has gained favor in the property and casualty (P&C) sector; we count at least 26 completed and pending mutual-to-stock conversions in connection with formations of MIHCs since the start of 2014 (including only those entities that remain independent and were not party to sponsored conversions in conjunction with acquisitions by existing MIHCs).

P&C conversions aplenty

A desire for greater flexibility around acquisitions, market expansion and access to funding, has driven the push for MIHC conversions among life insurers in the 1990s and P&C carriers in more recent times.

The MIHC structure initially provoked criticism from some consumer groups more than two decades ago for its potential to dilute policyholders' ownership interests. But it has become especially appealing for regional P&C carriers facing operational, financial and strategic challenges that include elevated catastrophe losses in the property lines, the reemergence of various forms of loss-cost inflation, fluctuations in the availability and cost of reinsurance for certain business lines, the development of potentially transformative technology, and the difficulty of attracting and retaining talent. An MIHC strategy allows converting carriers to maintain their culture of mutuality while enhancing their ability to address those competitive and, in some cases, existential pressures.

One such transaction has closed to date in 2024 involving the conversion of the former West Bend Mutual Insurance Co. into the stock West Bend Insurance Co. The Michigan Department of Insurance and Financial Services expects to complete its final review of the pending conversion of Hastings Mutual Insurance Co. into the stock of Hastings Insurance Co. this spring. Indiana Farmers Mutual Insurance Co. has scheduled a meeting of its members for March 28 to vote on its conversion into an MIHC structure. In 2023, conversions resulting in the transition to stock insurance companies by what are now known as Builders Insurance (An Association Captive Co.) and Frankenmuth Insurance Co. took effect.

Evidence of the expanded flexibility offered by the structure emerged in late 2023 when a company that engaged in an MIHC conversion two years prior, GuideOne Insurance Co., entered a deal with the insurance investing business of Bain Capital LP that involves its receipt of a $200 million investment and its role as the inaugural company in the new Bain Capital Insurance-sponsored The Mutual Group.

According to GuideOne Insurance's annual statement, its immediate parent issued $125 mutual in 10.0% perpetual preferred stock to TMG Insurance Services LLC, of which $115 million entered the insurer's balance sheet as paid-in surplus. The remaining $75 million, which appeared on GuideOne Insurance's income statement as a miscellaneous entry, represented the consideration paid by TMG to acquire certain of the insurer's operational assets. Due in part to those additional funds, GuideOne Insurance reported an authorized control level risk-based capital ratio of 428.5% as of Dec. 31, 2023, up from 266.1% a year earlier.

The model represents something of a supercharging of the MIHC model where participating carriers can leverage TMG's operational and technological capabilities in a wide range of back-office functions that include underwriting, claims and reinsurance purchasing.

A time for transformation

Recent years have also proven transformative for the US life industry. But rather than changes in ownership structures, carriers have increasingly turned to reinsurance to materially reduce balance-sheet and income-statement volatility as well as third-party asset management to gain access to a broader range of high-quality, higher-yielding investments.

For its part, Mutual of Omaha boasts a unique business model that incorporates a mix of individual and group accident and health products, individual and group life insurance, annuities and retirement plan services. Its life and health groups combined to rank as the second-largest writer of Medicare supplement premiums in 2022 in a market where three of the top four players are publicly traded companies: UnitedHealth Group Inc., CVS Health Corp. and Elevance Health Inc. Stock subsidiary United of Omaha's 2023 product mix was highlighted by individual whole life insurance, life-contingent group annuities, disability income and group life.

Mutual of Omaha indicated in a statement that an MIHC formation would allow the company to maintain its policyholder ownership structure while expanding its access to external capital sources.

The top-tier insurer had $717.2 million in surplus notes and $399.7 million in borrowed money outstanding as of Dec. 31, 2023. The latter figure included $214.0 million in short-term Federal Home Loan Bank borrowings and $67.8 million outstanding on a senior unsecured credit agreement associated with the construction of a new home office building as of the same date. It had not drawn on a $300 million, five-year senior unsecured credit facility.

In 1998, Mutual of Omaha submitted a no-action request to the Securities and Exchange Commission in what at the time was a customary step in the conversion process to ensure the newly formed MIHC would not be subject to registration under the Securities Act of 1933, the Securities Exchange Act of 1934 and the Investment Company Act of 1940. (The SEC indicated in 2020 that it no longer would issue the requested no-action letters unless an MIHC conversion involved novel issues.)

Then-Executive Vice President and General Counsel Thomas McCusker wrote in his no-action request, which the SEC granted in November 1998, that Mutual of Omaha had proposed to form an MIHC under Nebraska's Mutual Insurance Holding Company Act.

"The reorganization will occur through a series of transactions whereby [Mutual of Omaha] will convert from a mutual insurance company to a stock insurance company owned indirectly by a newly-formed mutual insurance holding company," the letter stated. It further indicated that Mutual of Omaha anticipated the Nebraska Director of Insurance would convene a public hearing on the proposed conversion to be followed by a vote of the insurers' members. At closing, the members' interests in the predecessor company would have been extinguished and they then would have become members of the new MIHC. McCusker's letter also references proposed articles of incorporation of the new MIHC in connection with the issuance of membership interests to new and existing customers.

While the public record does not offer additional detail about why the conversion did not proceed, Mutual of Omaha was not alone among its mutual peers in contemplating the new structure in the mid- to late-1990s. Massachusetts Mutual Life Insurance Co. also reportedly did so in 1998, for example. Others such as the companies now known as The Prudential Insurance Company of America, Metropolitan Life Insurance Company and John Hancock Life Insurance Co. (USA) pursued full demutualizations and subsequent initial public offerings for Prudential Financial Inc., MetLife Inc. and John Hancock Financial Services Inc. Principal, too, ultimately engaged in a demutualization from its short-lived MIHC structure, resulting in the IPO of Principal Financial Group Inc.

Of the top 20 US life groups by 2022 statutory net assets, 14 are owned by US or international publicly traded companies; three, including MassMutual, are mutuals; one (Nationwide Life Insurance Co.) is a stock subsidiary of a P&C mutual, and one (Teachers Insurance & Annuity Association of America) is owned by a not-for-profit entity. Pacific Life is the lone top 20 life group that is part of an MIHC structure.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.