Q3'23: North American Solar Radiation

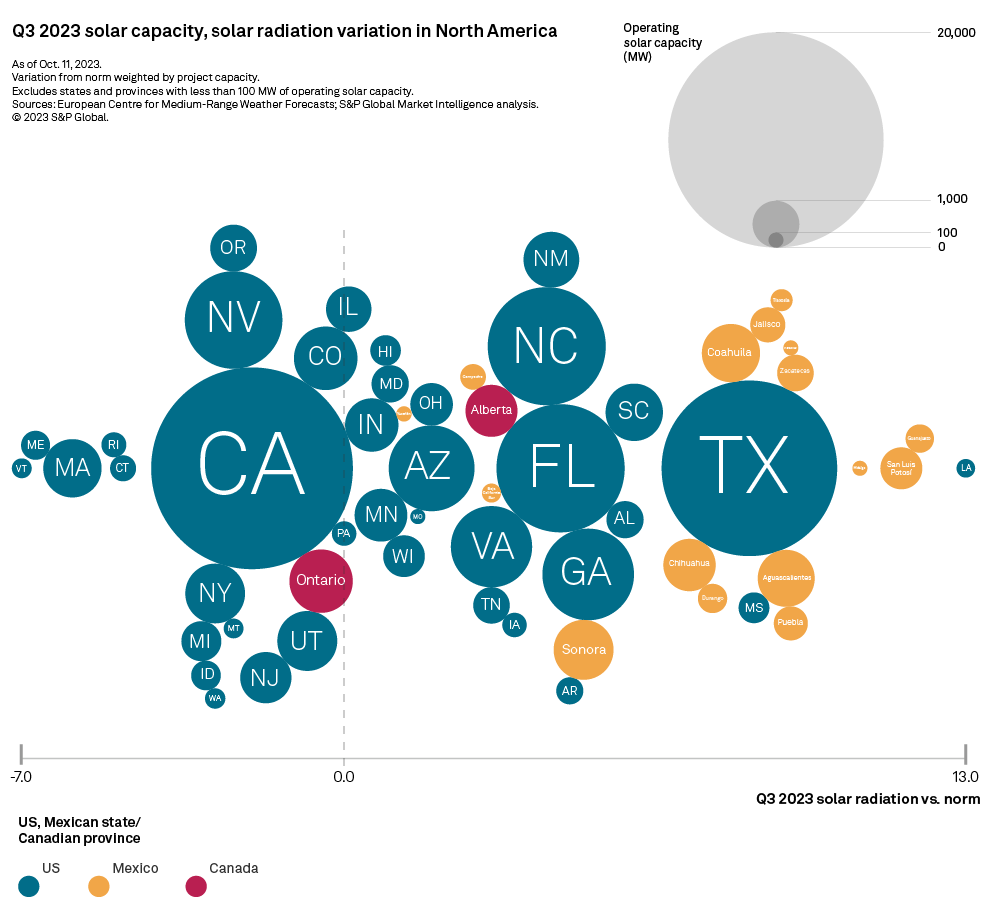

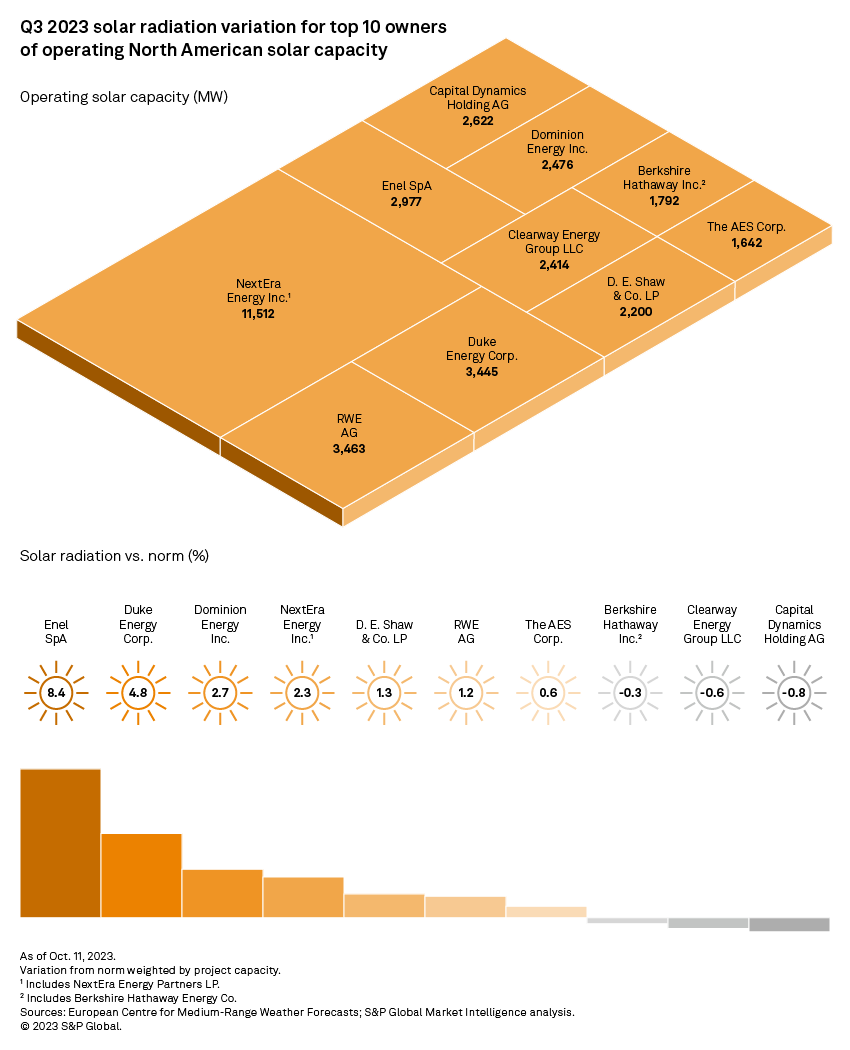

Sixteen of the top 20 holders of North American solar capacity experienced above-average radiation levels in the third quarter, likely resulting in a boost to solar earnings on higher photovoltaic generation output. With particularly dramatic departures from the norm in the southern half of the US and in Mexico, including high single- to low double-digit jumps in more than a dozen states, companies with portfolios heavily concentrated in the region stand out. This includes Enel SpA, Energia Aljaval and Engie SA, with deviations ranging from 6.3% to 9.8%. Breaking out the geography along national borders shows Mexico leading the pack, with the 10.4-GW Latin American market experiencing an 8.2% insolation surge. The US, up 1.9%, and Canada, up 1.1%, though both in positive territory, are far behind. Overall, more than 62 GW of utility-scale solar across two-thirds of the states and provinces making up the North American territory soaked up above-average sunshine.

Double-digit deviations were recorded in Louisiana and in half a dozen Mexican states. Most of the southern half of the US, where the top US solar portfolios are heavily concentrated, logged sizable jumps. Texas, home of the second-largest US solar generation park, saw radiation soar nearly 9% above the norm. The US northeast faced much cloudier skies. New England notably reeled from mid- to high single-digit retreats from the norm. That said, the region hosts only 2.7 GW of large-scale solar capacity — 3.2% of the US total. Among the top 10 owners of North American utility-scale solar, seven profited from excess sun. Enel SpA tops the leaderboard with an 8.4% departure from the norm. Nearly 94% of the North American solar portfolio of the Rome-headquartered multinational is based in Texas and in the Mexican states of Coahuila, Guanajuato and Tlaxcala. The 500- MW Roseland Solar Project in Texas experienced the largest deviation across Enel's solar assets, with third-quarter radiation 9.7% higher than normal. US grid-scale solar capacity leader NextEra Energy Inc. registered a 2.3% average radiation uptick, with the company's 25% portfolio exposure to California and Nevada, both in the red this quarter, offsetting a 4.7% deviation from the norm in Florida, where 43% of NextEra's pool of photovoltaic generators are situated. NextEra projects in the US Northeast did not help. For example, the 77 MW Farmington Solar Project in Maine — NextEra's largest in the region — saw radiation plunge 7.1% below normal.

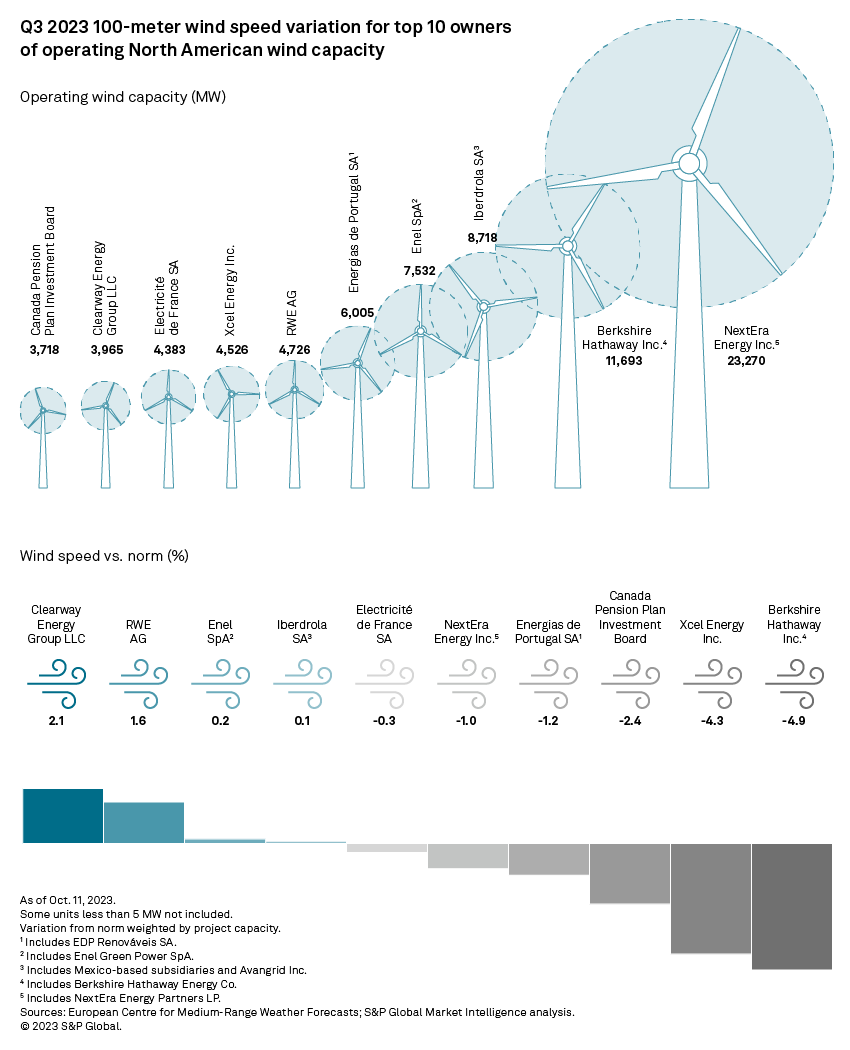

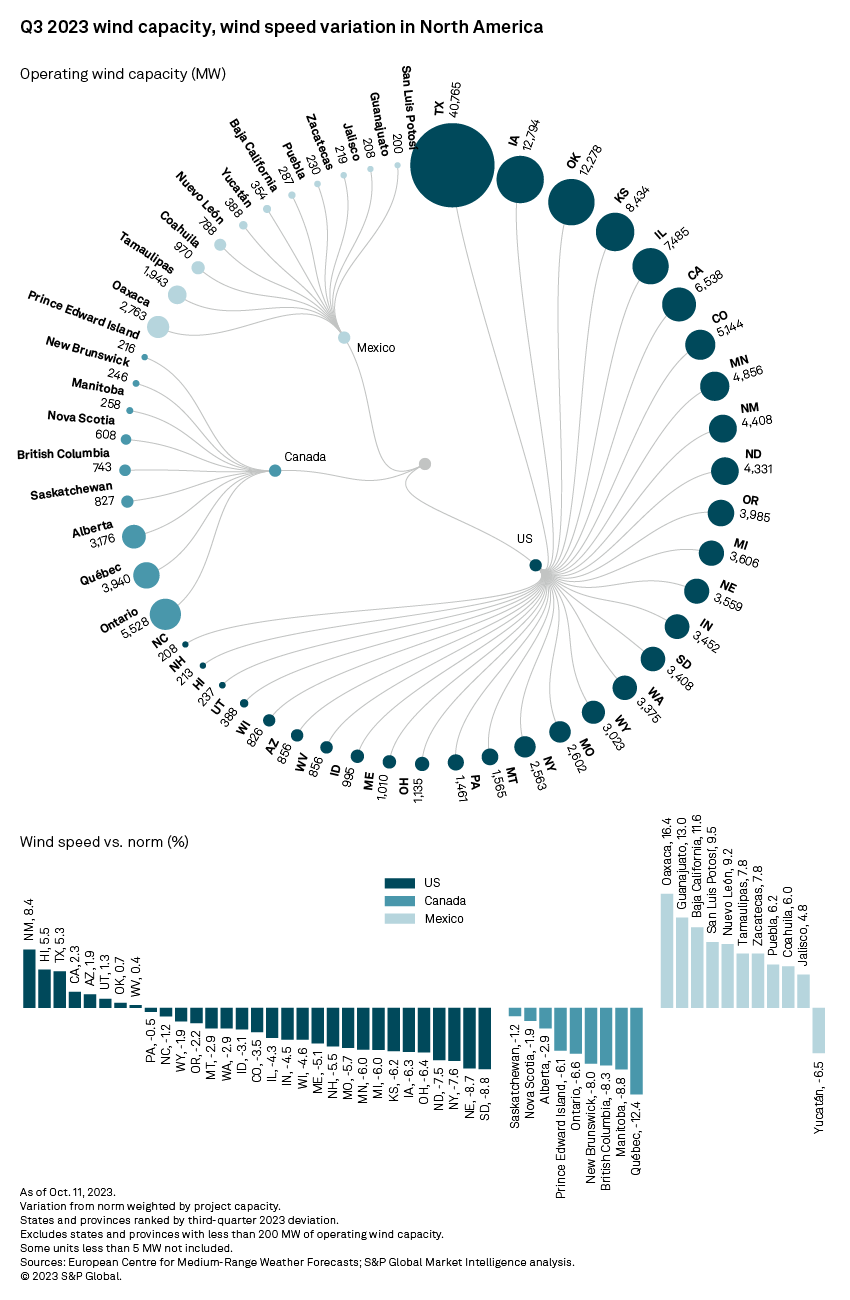

Q3'23: North American Wind Speed Radiation

Below-average wind speeds continued throughout most of the North American continent in the third quarter of 2023. While quarterly negative deviations from the norm were not as dramatic as the second quarter, the majority of US and Canadian territories remained stuck with below-normal winds. That said, Texas, California, New Mexico and Oklahoma — all with robust operating wind fleets — rebounded between July and September, with breezes higher than the 20-year average. Mexico also experienced mostly stronger winds in the third quarter, highlighting the general trend of southern territories having aboveaverage winds, while the northern half of the continent had below-average breezes. New Mexico led all US states in the third quarter with wind speeds 8.4% higher than the 20-year average, undoubtedly boosting the generation of its 4.4-GW wind fleet, after the second quarter's deviations were 5.7% below normal. Similarly, Texas — the North American leader for wind power — experienced windier-than-usual conditions, with 5.3% above-average breezes in the third quarter of 2023.

Portfolios of top wind owners generally experienced below-average wind speeds in the third quarter, with average wind speed deviations 1.0% below normal quarter over quarter. This is still a vast improvement from the second quarter, where average wind speed deviations were 7.1% below normal. Wind energy leader NextEra Energy Inc. experienced wind speeds across its portfolio of 1.0% below the 20-year average. Calmer third-quarter winds at the company's projects in the Midwestern US and Canada were only partially countered by their large fleet of wind generation in Texas and New Mexico with higherthan-normal winds. Berkshire Hathaway Inc. 's wind portfolio had the largest negative deviation from the norm at 4.9%. The company's large presence in the underperforming states of Iowa, Nebraska and Kansas brought down the quarterly average wind speeds across its wind fleet. The 400-MW Grande Prairie Wind project in Nebraska experienced the slowest winds compared to normal, at 10.8% lower than the 20-year average. In general, the geographically diverse wind portfolios of the top 10 wind owners resulted in close-to-normal quarterly average wind speeds, as slower winds in the northern half of the US and Canada were partially offset by stronger winds in Texas, New Mexico and California. Eight of the top 10 wind owners saw portfolio-wide deviations within plus or minus 2.5% of the 20-year average.