For the first time, natural language processing algorithms get to tell the earnings call story. This recurring series reviews an earnings season exclusively using texts from call transcripts.

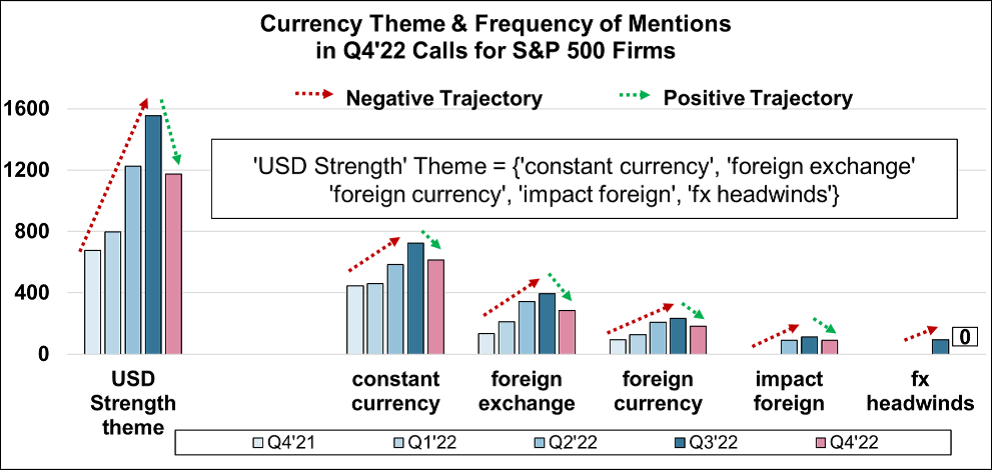

The sentiment from S&P 500 firms’ latest earnings calls rebounded for the first time in 2022. Earnings continued its recovery after hitting a trough two quarters ago. The headwind surrounding the strong dollar started to recede. Defensive sectors led the way while the cyclicals continued their struggle. The recent implosions of SVB Financial Group and Signature Bank have intensified this divergence. Other regional banks appear susceptible as the sentiment from their latest calls has turned negative, a rare historical occurrence that preceded the demise of the two, now FDIC seized, banks.

Source: S&P Global Market Intelligence Quantamental Research. Data as of February 24, 2023.

Sentiment Rebounded as Earnings Continued to Recover: The overall sentiment rebounded as the breadth of S&P 500 firms citing earnings growth continued its recovery to recapture its 15-year historical average (Exhibit A.1).

Consumer Staples & Financials Are ‘A Tale of Two Sectors’: Consumer Staples had the largest year-over-year sentiment improvement as executives see margin recovery and strong demand for 2023 and beyond. Financials had the largest sentiment deterioration from a year ago as loan originations dried up and the cost of their deposit base exploded (Exhibit 2).

Rare Negative Call Sentiment Before the Bank Implosions: Executives’ sentiment on recent earnings calls for SVB Financial Group and Signature Bank were negative prior to their implosion. Other regional banks appear susceptible, as the sentiment of their latest calls has turned negative, a rare event that has only occurred in 6% of the calls since Q4’07.

Explore the datasets used to conduct this research

Textual Data Analytics (TDA)

TDA is an off-the-shelf NLP solution that tailors to our Machine Readable Transcripts and outputs 800+ predictive and descriptive analytics for equity investing and various data science workflows.

Machine Readable Transcripts

NLP-friendly data from earnings calls, with metadata tagging and investor relations details. Keep track of company events and analyze data from earnings, M&A, guidance, and more. Benefit from intraday updates and 11,600+ covered entities with history dating back to 2004.

Machines Signal Q4'22 Guidance Not Falling Off a Cliff - An In-Depth Textual Review of Q3-22 Earning Call Transcript

CLICK HERE