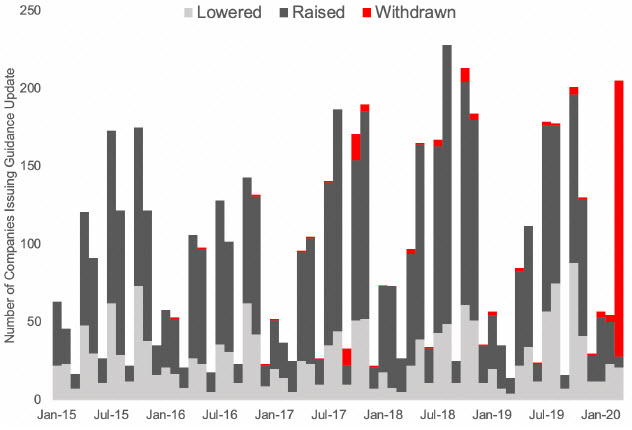

A recent surge in corporate earnings guidance withdrawals has left decision-makers missing a wrench in their toolbox. Corporate guidance was already declining, in 2018, when the number of companies in the Russell 3000 providing guidance peaked at 1,721, dropping 6.9% year over year in 2019 to 1,632 companies. Guidance has been further impacted by the Coronavirus pandemic – 173 companies withdrew their previous guidance in the first quarter (Figure 1). This leaves decision-makers looking for alternative forward-looking information on a company’s prospects.

Figure 1: Corporate Earnings Guidance Changes; Russell 3000

1/1/2015 – 3/31/2020

Source: S&P Global Market Intelligence Quantamental Research. Data as of 4/8/2020

Shipping data can provide a near real-time view into a firm’s activities. Declines in shipping activity could indicate the rate at which a company’s underlying business is slowing. Alternatively, if shipments remain largely unchanged, a company’s underlying health may also be unchanged. Increased international trade activity could indicate an increase in corporate inventories and associated activity. A buildup in inventories often occurs as firms hope to turn imports into sales, or plan for an anticipated supply disruption. Firms and industries that show a decrease in international trade may suggest 1) inventory levels are over-stocked 2) demand forecasts are unfavorable, or 3) significant supply chain shifts are underway. Finally, it is important to contextualize shipment and supply chain data within the business functions that generate it. A generalized firm places orders based on management’s balancing of sales forecasts and lead times. Shipment data allows an investor to see a snapshot of that equation (Appendix 2 in the full paper) before results are announced.

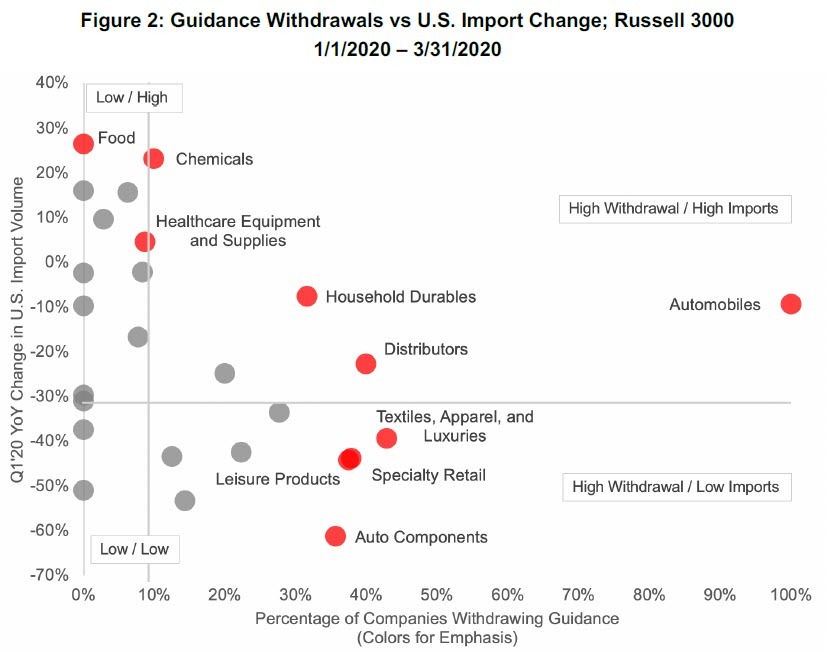

U.S. import activity associated with companies in the Russell 3000 indicates that industries with the greatest guidance withdrawals also tended to see a decrease in year-over-year shipment volume in the first quarter (Figure 2). Until corporate guidance for those firms resume, shipment data provides an indication of industry activity and corporate outlook.

Source: S&P Global Market Intelligence Quantamental Research. Data as of 4/8/2020

The Textiles, Apparel, and Luxury Goods industry saw a 39.3% year-over-year decline in U.S. imports by volume in the first quarter – this industry has been affected by stay-at-home orders issued across several states. Specialty Retail and Leisure Products are also impacted by stay-at-home orders, seeing year-over-year decreases in U.S. seaborne imports of 43.9% and 44.1%, respectively. Guidance withdrawal rates of 37.8% and 37.5% in those industries show severe disruption in industries that managed to escape the brunt of the U.S.-China trade war.

Automotive and Auto Components have been hit as well; in the Automotive industry both Ford and GM withdrew, while components had 35.7% of firms withdraw. Quantamental Research went deeper into the automotive industry with February 11th’s Ship to Shore Mapping the Global Supply Chain with Panjiva Shipping Data in Xpressfeed™.

Panjiva shipping data also shows industries that have been booming during the crisis. The Airfreight and Logistics industry (not pictured in Figure 2) have seen a shipping volume increase of 131.8% year over year in the first quarter, and none of the six firms in the industry have withdrawn their guidance. Logistics firms have become critical partners for states and organizations that need to source personal protective equipment. For a broader overview of Coronavirus impacts in trade, both up and down, see March 25th’s Long Road to Recovery: Coronavirus Lessons from Supply Chain and Financial Data.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Learn More About Panjiva

Request DemoQuantamental Research Brief: Cold Turkey – Navigating Guidance Withdrawal with Supply Chain Data

Click here