Investors looking for ideas amid the recent market downturn may profit from an understanding of beneficial ownership filings: SEC schedules 13D and 13G. Large shareholders must file a 13D or 13G when they acquire 5% or more of a voting class of a corporation’s shares. These purchases, therefore, often represent high conviction buys by activists, industry insiders, hedge funds, etc. Our previous investor activism research shows that investors can benefit by following activists’ lead: a portfolio of stocks that activists had targeted outperformed the market by over 8% annually and target shareholders saw rising dividend payments and share buybacks post-activism.

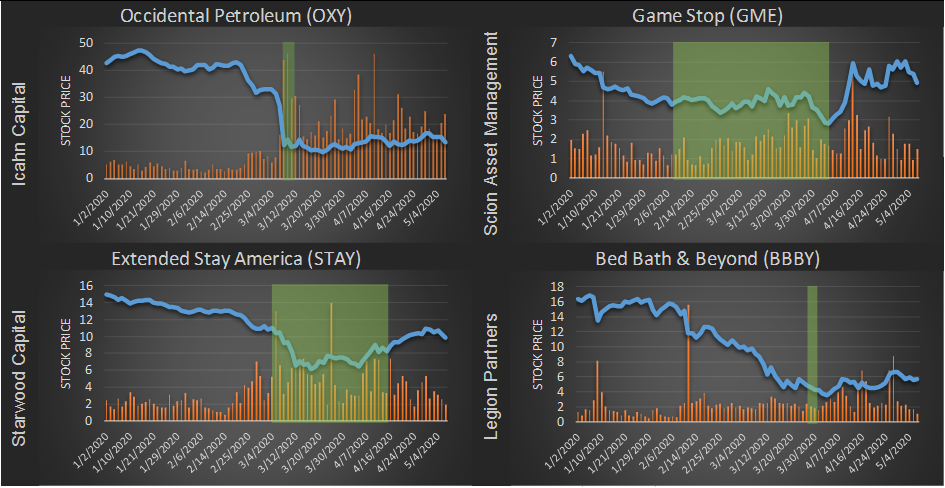

This report examines recent 13D and 13G filings, and spotlights four purchases of target companies with high historical operating cash flows and below average dividend payments, characteristics of companies typically targeted by activists. High cash flow generation can be used to fund both corporate growth and shareholder payouts. Figure 1 shows buy zones (in green) for four select 13D filings.

Figure 1. Four Recent 13D Filings, with Purchasing Firm (on Vertical Axis) and Buy Zone (Green Highlight)

Source: S&P Global Market Intelligence Quantamental Research. Past performance is not a guarantee of future results. Data as of May 6, 2020.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Learn about XpressfeedTM

Click hereQuantamental Research Brief: Never Waste a Crisis - Following the Smart Money through Beneficial Ownership Filings

Click here

Quantamental Research Brief: No More Walks in the (Office) Park: Tying Foot Traffic Data to REITs

Learn more

Quantamental Research Brief: Do Markets Yearn for the Dog Days of Summer? COVID, Climate, and Consternation

Learn more