Foot traffic can be used by both lenders and investors as a proxy for business health - an increase in footfall may indicate business expansion, while a decline may suggest business contraction. Lenders can use this information combined with other factors to identify customers that require additional credit facilities to support growth, or companies where existing credit lines need to be reassessed given bleak prospects. For equity investors, foot traffic can help identify companies where revenues may be accelerating or firms that may have difficulty meeting financial obligations. An extended deterioration in footfall activity implies fewer customer visits, lower sales and reduced cash flows.

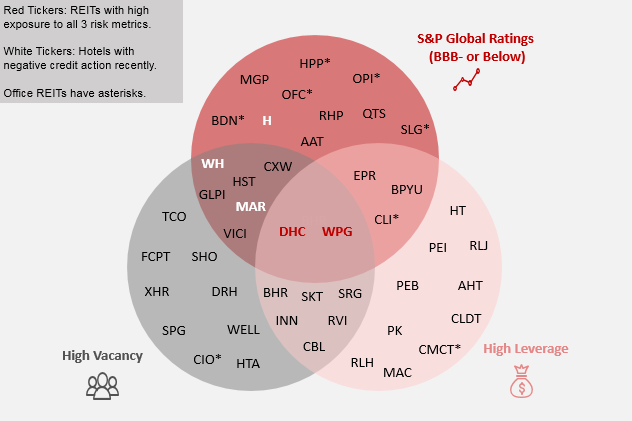

Figure 1 shows real estate investment trusts (REITs) that saw large declines in foot traffic at their properties and also had unfavorable exposures to the following measures of business risk:

- 1. Vacancy Rates: REITs managing properties in geographic locations with high vacancy rates will likely find it difficult leasing properties should retail tenants close locations or office tenants downsize.

- 2. Leverage: Raising additional debt to plug a shortfall in cash flow may not be an option for highly leveraged REITs, especially if they face strict debt covenant ratios.

- 3. S&P Global Ratings: REITs with stretched balance sheets may incur higher borrowing costs, given the weak macro-economic environment backdrop.

Figure 1: REITs with the Largest Decline in Foot Traffic, Highest Credit Risk and

Unfavorable Vacancy Demographics - Russell 3000 (March 2020)

Source: AirSage, S&P Global Market Intelligence Quantamental Research. Data as at 04/15/2020.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Explore S&P Global Marketplace

Learn moreQuantamental Research Brief: Risky Business - Foot Traffic, Vacancy Rates, and Credit Risks

Click here

Quantamental Research Brief: No More Walks in the (Office) Park: Tying Foot Traffic Data to REITs

Learn more