| US Federal Reserve Chair Jerome Powell has delayed expected interest rate cuts this year as inflation has remained above the Fed's 2% goal. Source: Kevin Dietsch/Getty Images News via Getty Images. |

Interest rate reductions that have yet to materialize and prolonged artificial intelligence enthusiasm have made this year one of mixed signals so far, but 2025 stands to bring more certainty for tech investors.

Heading into this year, investors expected the US Federal Reserve to cut the federal funds rate multiple times. Persistent inflation, however, has kept those plans on the backburner and elevated rates are keeping many equity investors and would-be M&A buyers cautious. At the same time, the rapid development of AI is boosting Big Tech earnings and generating interest in startups. The enthusiasm around AI has fueled enterprise IT spending and stock price gains.

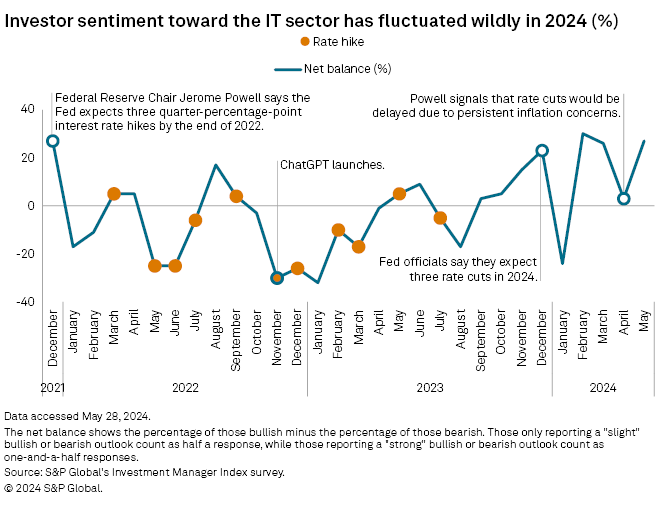

The combined impact of these trends has led to wild swings in US equity investor sentiment this year. The IT sector saw a massive month-over-month drop in investor sentiment in January, with the sector falling deep into negative territory, according to S&P Global Market Intelligence's Investment Manager Index. A month later, sentiment on IT was back in positive territory at the highest level seen since November 2021.

Looking further out, however, industry observers see reasons to believe that 2025 will bring more stability.

"When you start to get into calendar 2025 and beyond and when you think about the tech sector, a lot of folks, myself included, are bullish," said Greg Sward, US strategy lead for KPMG's TMT Deal Advisory & Strategy practice. "But we are going through a very unusual set of events right now that we just have to work our way through."

Interest rates redux

The Fed hiked interest rates 11 times between March 2022 and July 2023 as part of an effort to combat a historic surge in inflation. Since then, the federal funds rate, or the interest rate range at which banks lend to one another, has remained steady at 5.25% to 5.50% for almost a year.

Higher interest rates impact the tech sector in a number of ways. In the period where rates hovered near zero, investors could focus more on growth potential over profitability.

"Tech stocks thrive in a low-interest-rate environment," said S&P Global Market Intelligence 451 Research analyst Scott Denne, who specializes in tech M&A.

For every 100-basis-point increase in the fed funds rate, research and development spending at public companies has historically fallen by between 1% and 3%, according to Chicago Booth Associate Professor of Finance Yueran Ma and Frankfurt School of Finance and Management Assistant Professor of Finance Kaspar Zimmermann.

"By decreasing demand, monetary policy tightening can reduce the profitability of developing new products and the incentives to innovate," Ma and Zimmermann wrote.

Beyond R&D budgets, investment by venture capital firms fell by about 25% one to three years after the hike, Ma and Zimmermann found.

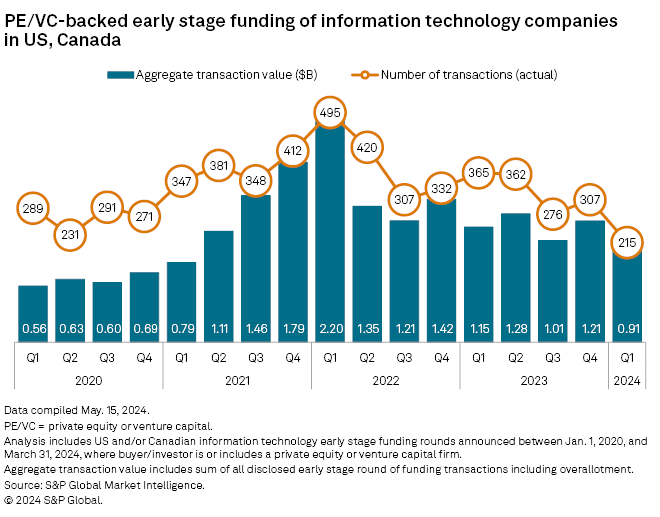

Early-stage funding for IT startups in the US and Canada saw a 21% year-over-year drop in the first quarter, according to data from S&P Global Market Intelligence. Startups in the sector raised $910.0 million, representing the lowest quarterly total in three years.

Dearth of deals

Higher interest rates, combined with increased regulatory scrutiny, also led to a significant drop in tech dealmaking starting in the second half of 2022. In part, this is because higher rates raised the bar on the returns needed to justify an investment.

"If your interest rate is effectively zero versus something 3 or 4 points higher ... that means the value that you have to create has to exceed that," Sward said.

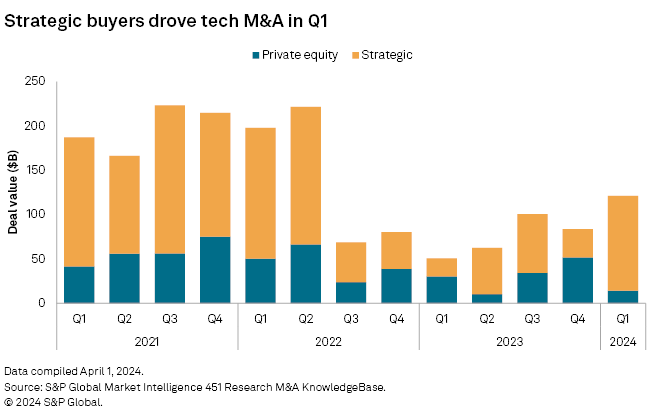

While strategic buyers returned to the deal table during the first quarter of 2024, financing deals with equity or cash on hand, private equity buyers like Thoma Bravo LP and Vista Equity Partners Management LLC remained largely on the sidelines. According to 451 Research, there were 25% fewer tech transactions with a financial buyer in the first quarter of this year as compared to a typical quarter before the Fed started hiking interest rates.

"Nobody is waiting more impatiently on a Fed pivot than private equity," wrote 451 Research analyst Brenon Daly. "The US central bank's expected cuts of the historically high interest rates can't come soon enough for these credit-hungry dealmakers. Until then, there isn't much for them to do."

The Fed at this point is expected to make one, possibly two, rate cuts by the end of the year, with some economists eyeing September for the first cut.

With buyout shops still sitting on high amounts of dry powder, Sward said there is only so much longer that private equity firms can hold off on dealmaking.

"Private equity firms have to get money from their partners ... but then they have to put it to work and earn a return," Sward said. "That's private equity 101."

Impact of AI

While interest rates have impacted overall tech M&A and fundraising, there is one pocket of the market that has seen significant growth this year: AI.

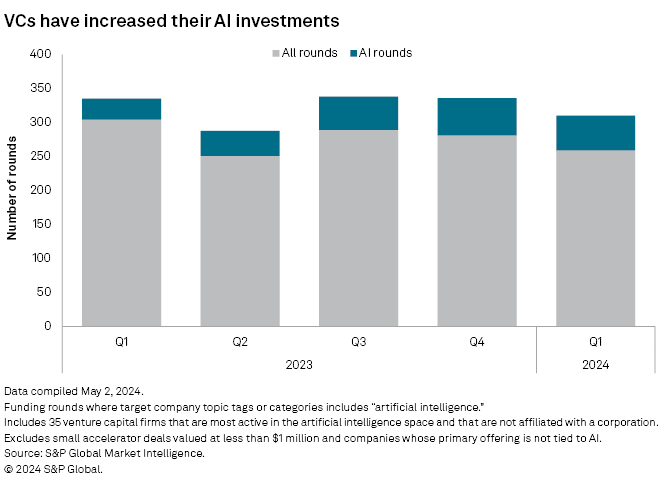

For instance, in the first quarter, the top 35 venture capital firms announced 51 AI funding rounds, up from 31 a year earlier, according to Market Intelligence data.

A first-quarter Market Intelligence analysis of IT companies with a market capitalization of $5 billion or above found that more than half of the top 50 performers in terms of share price movement had a connection to AI. While the list included some obvious names such as NVIDIA Corp. — whose graphics processing units are a critical source of the computing power needed for AI — other beneficiaries of the rising AI tide included chipmakers such as Broadcom Inc., Advanced Micro Devices Inc. and Micron Technology Inc., as well as providers of AI-optimized servers such as Super Micro Computer Inc. and Dell Technologies Inc.

The equity gains are following strong earnings growth. NVIDIA's first-quarter revenue more than tripled year over year to $26.0 billion on the strength of its datacenter revenue. The chip designer's net income expanded even more, growing to $14.88 billion from $2.04 billion a year earlier.

"The next industrial revolution has begun," NVIDIA CEO Jensen Huang said during the company's May 22 earnings call. "Companies and countries are partnering with NVIDIA to shift the trillion-dollar installed base of traditional datacenters to accelerated computing and build a new type of datacenter, AI factories, to produce a new commodity, artificial intelligence."

|

S&P Global is hosting upcoming webinars on the impacts of higher-for-longer interest rates: - June 12 - Navigating financial uncertainty with data-driven insights and actionable intelligence - June 26 - M&A in Focus: Value Creation in a Higher-for-Longer World Email globalevents@spglobal.com to register or for more information. |

While NVIDIA's datacenter revenue growth has become a proxy for the strength of the AI revolution, the impact is far from limited to one chip designer. Looking at companies in the S&P 500 Information Technology index, consensus estimates for 2025 revenue have risen almost 3% since January, 451's Denne noted.

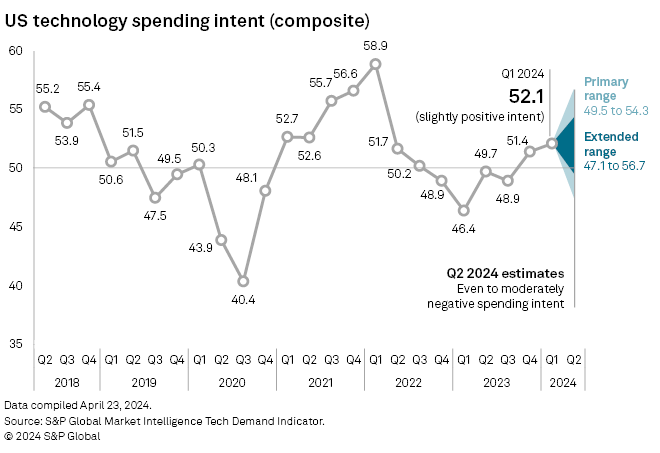

The higher revenue forecast is supported by first-quarter survey data showing that tech spending intent by corporations and consumers hit a two-year high. 451 Research's US Technology Demand Indicator rose to 52.11, 12% higher than the comparable period last year. A value above 50 indicates expansion. The TDI is a survey-backed composite of US intent to spend on technology and typically predicts revenue performance for tech vendors by up to a few months. The primary driver of the increase, according to the survey, was enterprise spending on AI and related technologies like cloud infrastructure and information security.

While 2023 was about understanding what generative AI is, 2024 is about figuring out how use it to solve specific business problems, Sward said. That evolution is part of what makes him optimistic about 2025.

"As the technology evolves ... people get more knowledgeable and more concrete about how they can use it," he said.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.