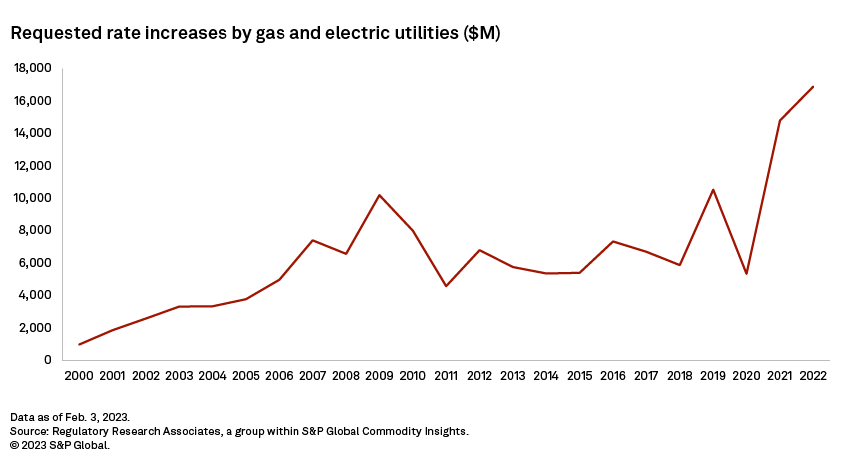

U.S. investor-owned utilities requested rate increases totaling a combined $16.89 billion in 2022, up about 14% from a record-setting 2021, as tracked by Regulatory Research Associates.

* After filing a record-setting amount of rate requests in 2021, utilities doubled down in 2022 with an even more ambitious rate request agenda, seeking the highest combined increase in electric and gas rates since RRA began tracking cases.

* Rate requests in 2022 were dominated by electric utilities, which requested $12.48 billion in rate increases, and gas utilities, which requested $4.41 billion. The electric rate filings reflect the utilities' significant capital expenditure plans for upgrading transmission and distribution systems and installing new renewable generation and new technologies to accommodate the clean energy transition. The gas filings continue to reflect investment to replace aging infrastructure. Inflation has also been raised as a factor in recent rate case filings.

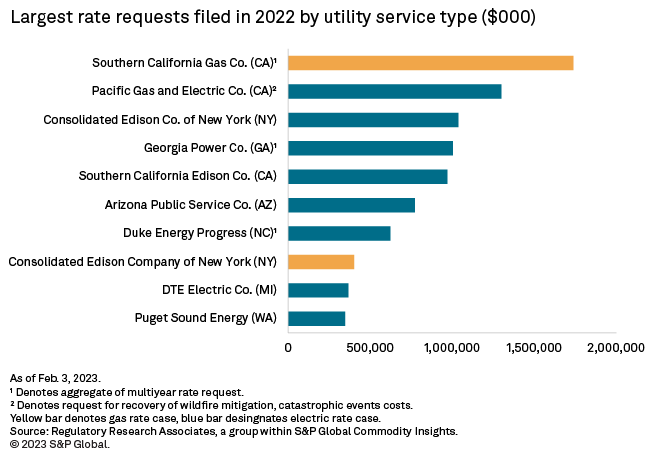

* Some of the largest rate requests came from California utilities Southern California Gas Co. and Pacific Gas and Electric Co., which are seeking to make investments in sustainability, safety and reliability or are embarking on ambitious wildfire risk mitigation efforts involving burying or reconstructing thousands of miles of power lines, respectively.

* With more than $3 billion in rate increase requests filed through early February, 2023 is likely to be another banner year for rate case activity. Historically, rate case filings have been more numerous in the late spring and early summer months, so activity can be expected to accelerate as the year progresses.

These general rate cases and limited-issue rider proceedings have been driven by the need to invest in infrastructure to upgrade aging transmission and distribution systems; build new natural gas, solar and wind generation; and implement new technologies, including smart meter deployment, smart grid systems, cybersecurity measures, electric vehicles and battery storage. The rate requests also included revenues needed to shutter aging fossil fuel plants amid a nationwide push toward clean energy, protect customers against growing climate-related risks such as wildfires, and recover costs incurred during the COVID-19 pandemic.

Refer to the linked data tables for annual rate requests by utility service type and rate case count since 2000 and more detailed data on rate case requests by individual utilities through 2022.

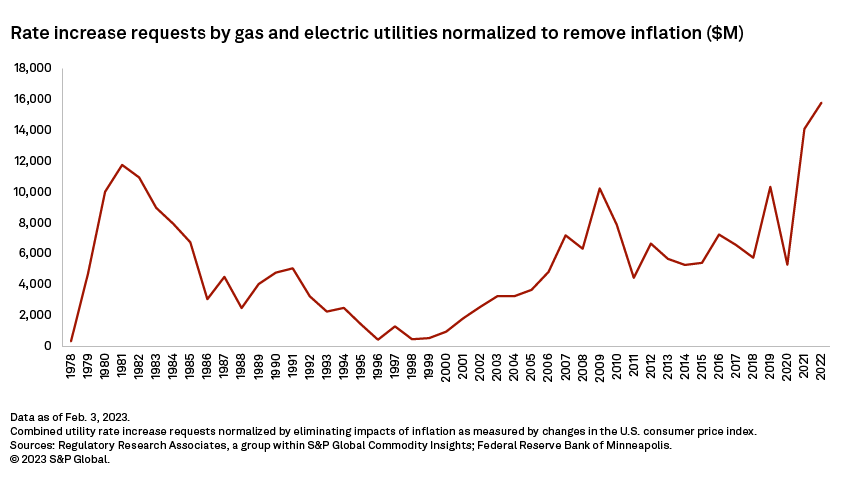

Even after stripping out the impacts of inflation, which was rampant throughout the late 1970s and early 1980s, more was requested in rate increases by energy utilities in 2022. Inflation remained relatively stable over much of the past decade but did tick higher in 2021 and more so into 2022, based on estimated changes in the U.S. Consumer Price Index.

Rising inflation has become a growing topic of interest in ongoing rate cases. For example, in a gas rate case filed in May 2022, Docket 20220067-GU, filing Florida Public Utilities Co. noted "historically high inflation in areas such as increased insurance premiums, cost of materials and labor" as key drivers in the proceeding.

In its electric rate case filed in September 2022 in South Carolina, a cost-of-capital witness for Duke Energy Progress LLC testified that a "perfect storm" was "impacting investor risk perception of electric utilities — declining sales per customer and rising costs, all at a time when large capital investment is needed to address aging infrastructure and other issues."

In some cases, utilities have requested specific mechanisms to alleviate inflationary impacts. For example, as part of its rate case filing in May 2022, Delmarva Power & Light Co. requested that the Maryland Public Service Commission approve inflation-related ratemaking adjustments to account for the "current high inflation environment." The PSC has approved such mechanisms in a number of previous cases. "Not addressing the higher-than-normal inflation in this direct filing merely kicks the issue down the road," the company said in testimony.

For more about how inflation plays out in rate cases, refer to "Inflation rearing its head in electric, gas general rate cases nationwide."

Even so, there are regulatory constructs in certain states that may protect investor-owned utilities from rising costs. For more, refer to "State regulatory constructs offer insight on inflation threat to utility income."

The rate increases requested by utilities in 2022 were more than three times higher than rates requested in 2020 during the beginning of the COVID-19 pandemic when many utilities withdrew or postponed rate cases to reduce the economic impact on struggling businesses and residents. As utility disconnection moratoriums have mostly long since expired, utilities have begun to seek recovery of bad-debt expenses and other costs incurred during the pandemic in rate cases.

More than $3 billion in rate increase requests have already been filed by investor-owned utilities through early February. The busiest time for rate case filings tends to be late spring or early summer, with the least activity seen in the fall; by contrast, the fourth quarter is generally the busiest time of the year for rate case decisions, particularly in December.

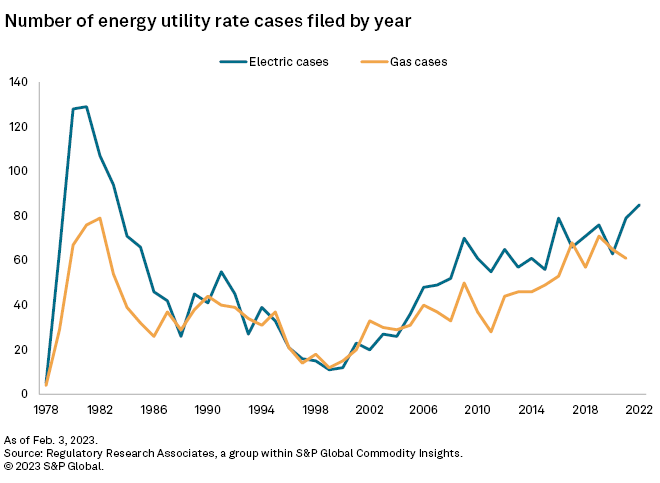

The sheer number of cases

With respect to new electric and gas rate cases that were filed in 2022, some of which also were decided in that year, there were 142, up from 140 filed in 2021. In 2019, 147 new rate cases were filed, the most since 1983.

Rate case activity in 2022 remained elevated, with about 136 decisions issued by state public utility commissions during the year. However, this level of activity is down from 2021, a record year with 151 decisions rendered in electric and gas rate cases across the U.S. The average authorized return on equity for electric utilities approved in cases decided during 2022 rebounded from 2021, which was the lowest annual average in RRA's rate case database comprising all major rate cases decided since 1980. For gas utilities, the average authorized ROE in 2022 fell to the second-lowest annual average on record. For more, refer to RRA's "Major Rate Case Decisions – Quarterly Update."

The surge in requested rate increases by utilities came amid a backdrop of rising capital expenditures by the energy utility sector. Projected 2022 capital expenditures for the 47 energy utilities included in the most recent RRA's sample of the publicly traded U.S.-based utility universe was almost $159 billion, well above 2021's expected $132 billion investment level and 2020's $130 billion actual level. 2023 is on track to be another record year for energy infrastructure investments, with spending driven by pent-up demand to replace and modernize aging infrastructure, renewable portfolio standards of multiple states — that include large expansions in low-carbon energy generation capacity — continuing to ramp up, and federal infrastructure investment plans that are intended to steer conversion of the nation's power generation network to zero-carbon sources by 2035 coming to fruition. For the most recent Financial Focus report on capital expenditures refer to "2023 energy, water utility capex plans on track to break prior spending records."

Since the Inflation Reduction Act was signed into law in August 2022, utilities have been drastically ramping up capital spending plans. The legislation features $370 billion in spending and tax incentives intended to spur clean energy investments. An update to our Financial Focus capital expenditure forecast report is expected to be published following the end of the fourth-quarter 2022 earnings season.

Individual proceedings among largest

Some of the largest rate cases filed in 2022 were multiyear requests. Taken in aggregate, the largest rate case (Docket A-22-33-016) was by Southern California Gas, which requested that the California Public Utilities Commission authorize it to increase gas base rates by almost $1.74 billion over four years. Southern California Gas is seeking an increase of $767 million in the 2024 test year, followed by incremental increases of $292 million in 2025, $267 million in 2026 and $413 million in 2027.

Southern California Gas indicated the rate request is its first to include sustainability, alongside safety and reliability, as one of the driving forces to support investments. The rate request includes investments in key areas: maintaining and enhancing reliability and safety, supporting sustainability, and promoting innovation and technology to meet operational and customer needs and workforce development.

The case is expected to conclude in late 2023.

Other multiyear rate cases that were among the largest filed in 2022 included an alternate rate plan (Docket No. 44280) by Georgia Power Co. seeking a cumulative $1.004 billion increase in electric base rates consisting of an $852 million increase in 2023, an incremental $107 million increase in 2024 and $45 million in 2025. The Southern Co. subsidiary indicated the rate increases were necessary to strengthen the electric grid; to invest in the continued transition of Georgia Power's power generation to cleaner and more economical resources, including renewables such as solar; and to enhance operations and improve the customer experience through investments in technology.

On Dec. 20, 2022, the Georgia Public Service Commission voted 4-1 to approve a settlement authorizing Georgia Power a multiyear electric rate increase of nearly $1 billion; almost all of that was sought by the company. For an in-depth review of the commission's decision in that case, refer to RRA's rate case report.

The second-largest rate request made in 2022 and tracked by RRA was by California's Pacific Gas and Electric, or PG&E, which filed (Docket A-22-12-009) on Dec. 15, 2022, an application for recovery of recorded expenditures related to wildfire mitigation, certain catastrophic events, and several other activities. Specifically, the request, separate from an ongoing general rate case, sought recovery of several wildfire-related safety enhancements and investments, including enhanced and routine vegetation management, costs incurred responding to wildfire and weather-related events, and incremental costs to protect the health and safety of PG&E employees and customers during the COVID-19 pandemic. These activities included supporting employees in a remote work environment, modifying facilities to comply with state and county health orders, sequestering critical employees to maintain utility operations, and purchasing cleaning supplies and other equipment like masks and shields to protect employees from virus exposure.

The California PUC recently acted on the application, adopting a settlement Feb. 2 and authorizing PG&E an increase in electric rates of $1.038 billion.

Long-term perspective

From a historical perspective, the $16.89 billion requested by utilities in 2022 was even higher than rate requests in the early 1980s when the nation was undergoing a major boom in baseload fossil fuel plant construction. After 2021, the next-highest requested rate increase occurred in 1981, when utilities put forth petitions for about $13.1 billion in rate increases.

Rate requests fell steeply throughout the later 1980s as regulators adopted an integrated resource planning process to better control power plant construction and keep retail electric rates in check. Rate requests continued to fall until the financial recession of the early 2000s before accelerating and peaking during the Great Recession from 2007 to 2009 after the turmoil associated with the U.S. housing bubble and the global financial crisis.

Since then, a strong push for new renewable energy investment and to upgrade aging infrastructure has led to a steady increase in rate increase requests.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.