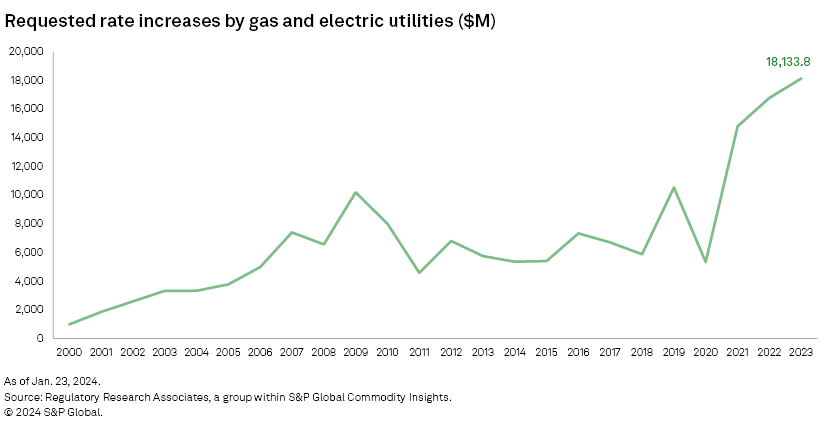

US investor-owned utilities requested rate increases totaling $18.13 billion in 2023, compared to $16.78 billion in the full year 2022, as tracked by Regulatory Research Associates. It was the third year of rising utility rate requests after records were hit in 2021 and 2022.

➤ After filing record-setting rate requests in 2021 and 2022, utilities brought an even more ambitious rate case agenda in 2023, with requests totaling more than $18.13 billion. It is the highest annual total of electric and gas rate increase requests since Regulatory Research Associates began tracking rate cases.

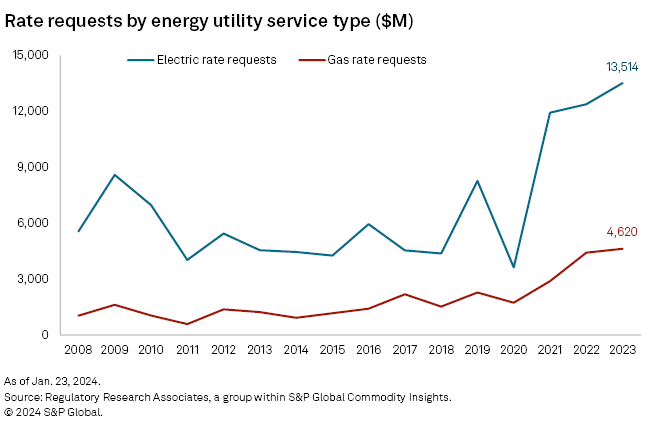

➤ Rate requests in 2023 were dominated by electric utilities, which requested $13.51 billion in rate increases, while gas utilities requested $4.62 billion. The electric rate filings reflect the utilities' significant capital expenditure plans for upgrading transmission and distribution (T&D) systems and installing new renewable generation and technologies to accommodate the clean energy transition. The gas filings continue to reflect investment to replace aging infrastructure. Inflation and rising debt costs have also been highlighted as factors in recent case filings.

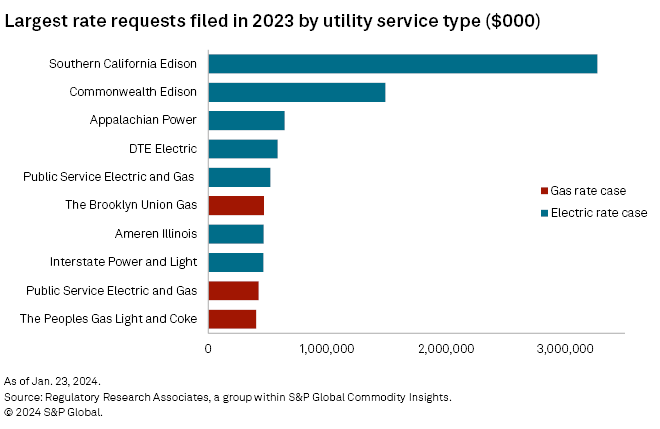

➤ The growing prevalence of multiyear rate plans is a large driver of the aggregate increase. Some of the largest rate requests in the period were attributable to multiyear plans from Southern California Edison Co. and Commonwealth Edison Co., which seek to invest in sustainability, safety and reliability or embark on ambitious wildfire risk mitigation efforts.

➤ Historically, rate case filings have been more numerous in the late spring and early summer months, while more rate case decisions are usually rendered later in the year.

These general rate cases and limited-issue rider proceedings have been driven by the need to invest in infrastructure to upgrade aging T&D systems; build new gas, solar and wind generation; and implement new technologies, including smart meters, smart grid systems, cybersecurity measures, infrastructure to support electric vehicles and battery storage. The rate requests reflect the need to shutter aging fossil fuel plants amid a nationwide push toward clean energy, protect customers against growing climate-related risks such as wildfires and recover costs incurred during the COVID-19 pandemic.

Rate requests in 2023 amounted to the highest annual total ever tracked by RRA. The busiest time for new rate case filings tends to be late spring or early summer, with the least activity seen in the fall; by contrast, the fourth quarter is generally the busiest time of the year for rate case decisions, particularly in December.

The 2023 total of $18.13 billion exceeded 2022's record-setting $16.78 billion by 8%. The rate increases requested by utilities in 2022 were more than three times higher than the amount sought in 2020 at the beginning of the pandemic, when many utilities withdrew or postponed rate cases to reduce the economic impact on struggling businesses and residents.

Refer to the linked data tables for detailed data on rate case requests by individual utilities through 2023, as well as a breakdown of rate requests by utility service type.

Rising inflation, particularly labor and supply-chain-related costs, has been a constant topic of discussion in ongoing rate cases. For example, on June 15, 2023, NorthWestern Corp. filed its first electric rate case in South Dakota in nearly a decade. The utility said it is essential to consider certain factors, such as "[T]he combination of persistently high inflation, the [US] Federal Reserve's changes in monetary policy and the dramatic shifts in market conditions" when determining increased market risk and "an appropriate forward-looking [return on equity] ROE."

In its first gas rate case in Iowa in more than 20 years, MidAmerican Energy Co. indicated it has accounted for several headwinds it expects will impact the financial environment in the near term and, as a result, guide the determination of an appropriate ROE and capital structure. MidAmerican said it is concerned that increased capital costs are tangible and flow from the Fed's changes in monetary policy to address inflation. Rising interest rates, increased market risk and resulting higher returns required by investors are expected to increase the company's capital costs.

In some cases, utilities have noted the need to refinance maturing long-term debt and to reinforce their financial standing in an environment of rising interest rates as among the factors necessitating a rate case filing.

In Florida, Peoples Gas System noted that the Fed moved quickly and aggressively to reduce interest rates in response to economic distress caused by the pandemic but was raising interest rates to combat inflation. "These changes have impacted capital markets, long- and short-term borrowing costs and the cost of common equity," the company said. Increases to Peoples Gas System's cost of capital were estimated to account for about $35 million of the company's projected $139.3 million 2024 test year revenue requirement increase request.

Inflation and rising T&D reliability and resiliency investment costs drove Portland General Electric Co. to request a $337.8 million increase in electric rates in Oregon. The rate request is the largest by the utility, as tracked by RRA in cases dating back 40 years. The company said in testimony that "exceptionally high inflation levels" continue to impact the company due to the pandemic, specifically with regard to energy market prices, insurance, interest rates, labor, materials and technology-associated costs.

Inflationary pressures were being cited by utilities in cases throughout the year and even as 2023 drew to a close. In a Dec. 29, 2023, filing, OGE Energy Corp. subsidiary Oklahoma Gas and Electric Co. filed a rate case seeking a $332.5 million base rate increase and also a vegetation cost tracking mechanism that would allow the company to record a regulatory asset or liability for these costs if they vary from a base level. "Vegetation management costs are highly variable. ... [N]ot only have the costs for vegetation management been changing fast due to inflationary pressures and higher demand for these services, but there is a lot of variability given the size of the company's service area and the unpredictable nature of weather-related events," the company testified.

In its first rate case in more than five years, also filed Dec. 29, 2023, Public Service Electric and Gas Co. (PSE&G) indicated its capital investment far exceeds the amount it is recovering for depreciation expense in current rates and increases the company's rate base and the depreciation expense needed to recover this investment. PSE&G has also seen increased materials and supplies needs because of preparation for planned increases for system maintenance and capital work and in response to supply chain constraints that have forced it to diversify suppliers and revamp material forecasting models. The proposed total net rate increase is $461.9 million, equating to a total average overall bill increase of 7.70%.

PSE&G testified that the capital requirements needed to support the clean energy transition in New Jersey, along with uncertainties impacting its businesses, "particularly in the current inflationary and higher interest rate environment, strongly suggest that the electric and gas businesses are subject to meaningfully higher risk during the on-going energy transition than they were when PSE&G's cost of equity was established in 2018."

In its first rate case in North Dakota in more than five years, Otter Tail Corp.'s Otter Tail Power Co. (OTP) noted that there had been significant market changes in labor, material and equipment costs since its last rate case. According to OTP, the pandemic created a "challenging landscape for utilities" as shortages arose in labor and materials, as well as equipment and manufacturing backlogs. Additionally, OTP contends that high inflation is causing increased costs and risks for the utility. Specifically, it has experienced increased operating expenses and costs driven by the effect of those market forces on the costs of the utility's investments in generation and T&D infrastructure. The company is requesting a $40.6 million rate increase. However, customers would see a net rate increase of $17.4 million, or 8.43%, after the transfer of revenue from several riders into base rates.

For more information about how inflation plays out in rate cases, refer to Inflation rearing its head in electric, gas general rate cases nationwide.

There are regulatory constructs in certain states that may protect investor-owned utilities from rising costs. For more information, refer to State regulatory constructs offer insight on inflation threat to utility income.

Number of cases

There were 156 new electric and gas rate cases, including limited issue rider proceedings, filed in 2023, compared to 140 that were initiated in 2022. In 2019, 147 new rate cases were filed, the most since 1983.

Rate case determinations in 2023 were brisk, with 63 electric ROE authorizations by state utility regulators and 43 gas cases decided that included an ROE determination. The average ROE authorized electric utilities was 9.60% in rate cases decided in 2023, modestly above the 9.54% average for 2022. The average ROE authorized gas utilities was 9.64% in cases decided in 2023 versus 9.53% in 2022.

The surge in requested rate increases comes amid a backdrop of rising capital expenditures by the energy utility sector. 2023 is anticipated to be a record year for utility capital investments, with the aggregate forecast capex for the 46 tracked energy utilities of nearly $172 billion when results are tallied, according to an RRA analysis. This figure is expected to be very significant, with the anticipated capex total rising more than 19% compared with the 2022 realized spending of $144 billion by these tracked utilities.

Spending is driven by pent-up demand to replace and modernize aging infrastructure, renewable portfolio standards of multiple states — which include large expansions in low-carbon energy generation capacity — continuing to ramp up, and federal infrastructure investment plans that are intended to steer conversion of the nation's power generation network to zero-carbon sources by 2035. For the most recent report on capex, refer to Utility capex poised for new heights in 2024, 2025.

Utilities have been drastically ramping up capital spending plans since President Biden signed the Inflation Reduction Act into law in August 2022. The law features $370 billion in spending and tax incentives intended to spur clean energy investments.

Multiyear rate change proposals

Legislation passed at the state level over the past few years has driven an increase in multiyear rate change requests, whereby utilities can request incremental rate increases over several years. RRA considers the provision of such plans to be a constructive ratemaking element. In 2023, 21 rate cases that were filed requested multiyear rate changes. That was down slightly from 25 multiyear rate case filings in both 2021 and 2022 but up from the 14 multiyear rate plans filed in 2020.

In 2021, RRA raised its ranking of North Carolina regulation to Above Average/3 from Average/1, following the enactment of comprehensive energy legislation that provides utilities the ability to file multiyear rate plans with the commission and develop performance-based incentives, with the ability to pursue regulatory approval for increases of up to 4% over three years, rather than initiating a new rate case each year.

Other jurisdictions, including Washington, Maryland and Washington, DC, have seen an increase in multiyear rate plan filings in recent years. In California, utility regulators in 2020 extended the three-year rate case cycle for energy utilities to a four-year cycle to allow utilities more time to implement risk-mitigation and accountability structures and less time to litigate issues with stakeholders in hopes of making rate cases more efficient and predictable.

Just as in 2022, some of the largest rate cases filed in 2023 were multiyear requests. In aggregate, in the largest rate case, Docket A-23-05-010, filed May 12, 2023, by Southern California Edison, the company requested the California Public Utilities Commission authorize an increase in California-jurisdictional electric rates of $3.27 billion over the four years 2025–28. The company indicated the request is driven by investments in safety, reliability and intentions to meet California's clean energy transition policy goals. Southern California Edison plans to improve the grid's resiliency against wildfires, other extreme climate events, and physical and cybersecurity threats, and to make the grid ready to support distributed energy resources, EVs and load growth to foster widespread electrification and decarbonization in concert with California's climate change goals. A commission decision is expected in November.

Other multiyear rate proposals that were among the largest filed in 2023 included one in Illinois by Commonwealth Edison, Docket 23-0055, in which the utility was seeking a rate increase of $1.50 billion in several steps between 2024 and 2027. The rate plan filing, in conjunction with a comprehensive grid plan proposal, was submitted in accordance with legislation enacted in Illinois in 2021 that alters aspects of the state's electric utility ratemaking framework and leverages opportunities presented by two prominent federal laws signed over the past two years.

Long-term perspective

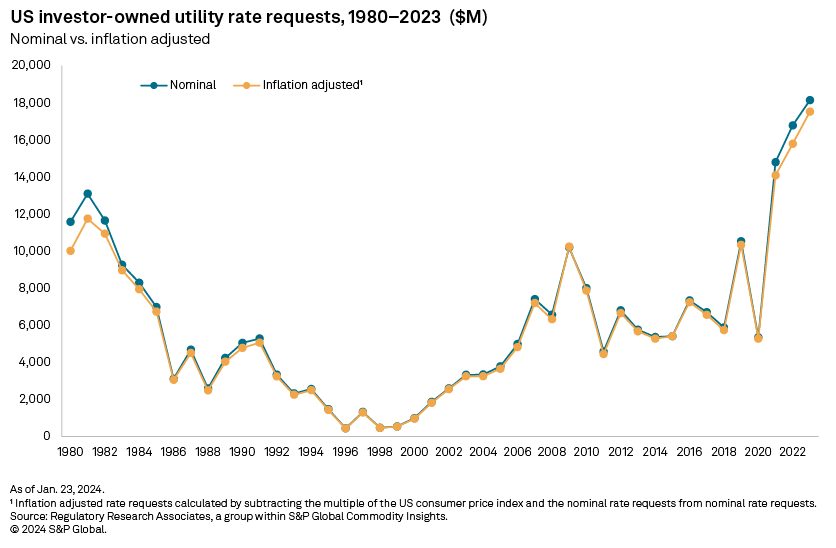

From a historical perspective, the $18.13 billion requested by utilities in 2023 significantly exceeded rate requests in the early 1980s, when the nation was undergoing a major boom in baseload plant construction. After 2022 and 2021, the next-highest requested rate increase total occurred in 1981, when utilities put forth petitions for about $13.1 billion in rate increases.

Comments on RRA's methodology

RRA endeavors to follow all "major" rate cases for investor-owned utilities nationwide, with major defined as a case in which the utility's request would result in a rate change of at least $5 million or in which the commission approves a rate change of at least $3 million. In addition to base rate cases, the rate case history database includes details regarding certain limited-issue rider proceedings, primarily those that involve significant rate base additions that are recognized outside of a general rate case. In some of these cases, the rate change coverage criteria may not apply.

Moreover, some US utilities operate under formula-based rate plans where rates are adjusted annually (or on some other periodic basis) without a full rate case filing and generally without revisiting the authorized return. These proceedings are generally not included in the database and, therefore, would not be included in the tally of cases or the aggregate rate change stats. Details are discussed in the footnotes to the case in which the formula rate plan was established.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.