Mortgage loans held by US life insurers rose to new heights in 2023 based on aggregate dollar value and as a percentage of invested assets even as their exposure to commercial real estate showed some incremental signs of weakening asset quality.

➤ Long known for their presence in commercial real estate, US life insurers have refined their focus in that area while diversifying into residential whole loans. As a result, according to an S&P Global Market Intelligence analysis of disclosures in annual statutory filings, while their overall holdings of loans backed by the embattled office property type declined 6.4%, for example, the aggregate statement value of mortgage investments rose 5.5% to $732.49 billion.

➤ Residential mortgages accounted for 11.2% of the mortgages held by life insurers at year-end 2023, an increase of 2.7 percentage points from 2022 and an increase of more than 2x their relative position as recently as the end of 2020. Insurers have invested in residential whole loans on an individual basis and, in select cases, through acquisitions of whole loan pools. The smaller size and greater quantities of individual residential loans led to a decline of 49.3% in the average size of mortgage loans acquired in 2023 relative to 2022, and the decline is even larger for years before that.

➤ Rotation into residential loans and strongly performing commercial real estate property types such as industrial has helped mitigate the effects of deterioration in fundamentals in the office and retail sectors, but life insurers have not been immune to it. Data for 2023 showed various evidence of deterioration, including some downward migration in commercial mortgage risk categories, higher loan-loss provisioning and a spike in other-than-temporary impairments to the highest levels on record on a current-dollar basis. Nevertheless, approximately 99.4% of the aggregate dollar value of uninsured commercial mortgages held by life insurers remained classified as being in good standing.

|

– View the latest version of the Commercial Real Estate Chart Book. – Access key data exhibits. |

Acquisitions slow

Even as overall portfolios continued to grow, the pace by which the industry's mortgage holdings expanded slowed significantly in 2023. The 5.5% growth rate ranked the second slowest in a decade, ahead of only 2020 when origination volumes cratered amid COVID-19 lockdowns.

A dramatic slowdown in the acquisition of uninsured commercial mortgages created a significant headwind for overall mortgage holdings. Acquisitions of loans in that category plunged 40.0%, offset partly by a 20.7% increase in acquisitions of uninsured residential mortgages. All told, acquisitions across categories fell 28.0% in the largest such annual retreat since the global financial crisis.

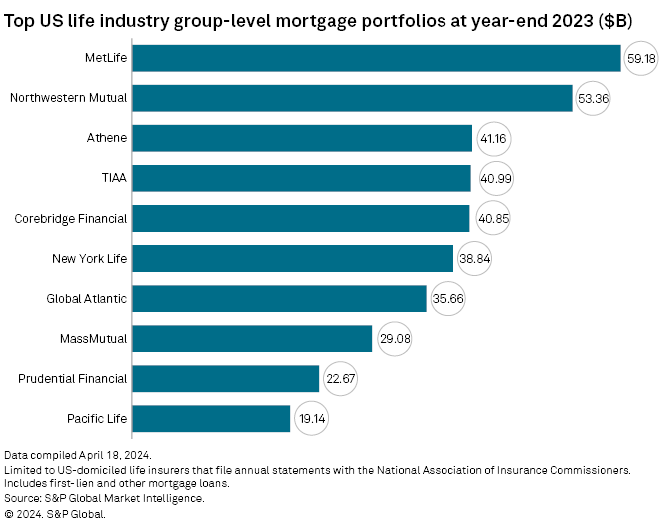

Of the top 50 US life industry mortgage investors at the group level, 38 showed declines in mortgage acquisitions in excess of 20% on a year-over-year basis. That included a drop of 64.4% at the No. 1 mortgage holder in the sector, the US life subsidiaries of MetLife Inc.

Industry acquisitions of loans backed by office properties plunged 54.0% to $6.49 billion in 2023. Purchases in the industrial and multifamily sectors, two property types that had produced historically high levels of US life insurer acquisition volume in 2022, also fell sharply in 2023, by more than 30% apiece.

If we compare 2023's activity with 2019's, before the abject COVID-19-era weakness in the office sector, overall acquisition volume was down 8.9% with growth of 4.8% in industrial property loan purchases partially offsetting a 68.4% retreat in the office category.

Signs of modest deterioration in credit-related statistics

Although data in 2023 annual statements showed evidence of some fraying around the edges in US life insurers' mortgage investments during a time of mounting weakness for select property types, the vast majority of their positions continued to perform. And even in those instances where the deterioration appeared to be of greater historical significance from an absolute dollar value standpoint, it appeared much more modest on a relative basis, taking into account the industry's materially larger mortgage portfolios today relative to previous times of stress.

The overwhelming majority of the dollar amount of uninsured commercial mortgages remain in good standing, but that phrase casts a wide net that incorporates essentially all loans that are either current or delinquent by less than three months, not restructured and not in the process of foreclosure.

A review of Asset Valuation Reserve data, which includes the allocation of uninsured commercial mortgages to seven distinct classifications of risk based on a wide range of public and nonpublic inputs related to individual loans and underlying properties, paints a somewhat different picture. There, the share of loans designated as CM1, which represents the highest quality and is associated with the lowest risk-based capital charge, fell to less than 46.5% in 2023 from 47.1% in 2022 and a high of 62.3% in 2014. The method of assigning and disclosing the risk categories differed prior to 2014, and it should be noted that regulators set a particularly high bar to loans backed by commercial properties other than office, retail, industrial or multifamily to attain the highest scores.

The downward migration led the share of loans in categories CM2 through CM7 to rise to their highest levels during the stretch from 2014 through 2023, with the largest increases as measured by basis points in CM2 (high-quality loans) and CM6 (loans 90-plus days past due). Loans that were severely delinquent or in the process of foreclosure accounted for only 0.38% of uninsured commercial mortgages, but that share was more than 3x the 2022 result.

Loan-to-value statistics, which life insurers disclosed on supplemental investment risk sections of their annual statements, also show some evidence of deterioration in commercial mortgages. In the lowest-risk band in this disclosure, loan-to-value ratios of 70% or less relative to the underlying properties' most recent appraisals, the share of commercial mortgages dropped to less than 85.2% in 2023 from 90.6% a year earlier. In the highest-risk band, loan-to-value ratios of more than 95%, the share spiked to 2.2% from 0.7%.

Reflecting the increase in risks associated with certain loans and certain property types, life insurers experienced significant increases in both impairments and valuation allowances. Impairments of $1.09 billion in 2023 exceeded those recorded in the previous seven years combined. Of the $739.2 million in impairments on loans held by insurers at year-end 2023, 63.9% were associated with office loans and 87.2% were associated with the combination of office and retail loans. The largest single impairment was $136.6 million by Pacific Life Insurance Co. on a May 2014 loan backed by a Washington, DC, office property it classified as being in the process of foreclosure.

S&P Global Market Intelligence's Commercial Properties prospecting tool shows that Pacific Life originated a mortgage on a mixed-use property at 616 H Street NW, which is adjacent to Capital One Arena, on the same date. Published reports indicate that the property was subject to a receiver's sale in March.

Total impairments amounted to less than 0.2% of the industry's year-end 2022 mortgage holdings. Similarly, while the valuation allowance on mortgages more than doubled in 2023 to $1.42 billion, that represented less than 0.2% of the industry's gross mortgage holdings.

Home loan push accelerates

Greater emphasis on residential mortgages has implications for insurers' risk profile and their asset-liability matching strategies.

Residential mortgages are individually more susceptible to nonperformance relative to the kinds of commercial mortgages most life insurers tend to acquire, though the effects of a default are minimized by the markedly smaller size of the typical loan. Of the industry's year-end 2023 uninsured residential mortgage holdings, 2.4% were in the process of foreclosure, restructured or 90-plus days past due as compared with 0.6% of uninsured commercial loans.

From a duration standpoint, more than 70% of the aggregate dollar value of the uninsured residential mortgages held by US life insurers have maturity dates subsequent to 2050. That compares to uninsured commercial mortgages where 63.7% of the loans outstanding at year-end 2023 are scheduled to mature between 2024 and 2030.

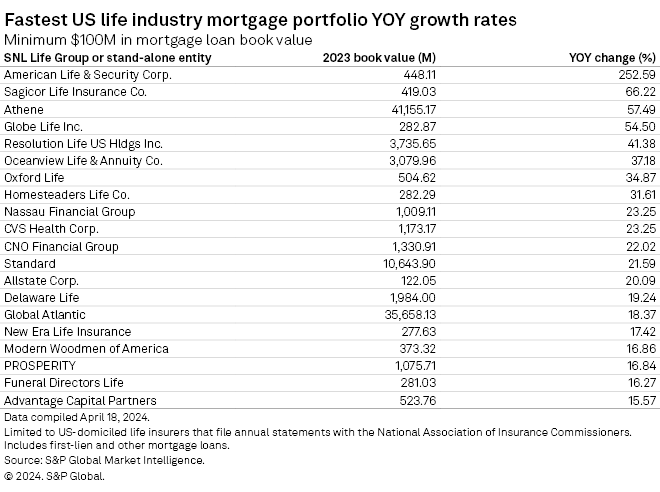

Four of the six US life insurance groups and stand-alone US life insurers that grew their mortgage holdings at the fastest rates in 2023, limited to entities with total mortgage holdings of at least $100 million, experienced dramatic expansions in residential loans.

Residential mortgage positions more than doubled at Sagicor Life Insurance Co. in 2023, accounting for most of the company's 66.2% year-over-year growth in mortgages across property types. The company boosted its exposure to the asset class as part of an effort to boost returns on capital- and risk-adjusted bases, and it noted that it mostly sources loans through participations in colending agreements to limit its risk.

The US life subsidiaries of Athene Holding Ltd., which have long maintained holdings of residential whole loans, more than doubled their holdings in the property type in 2023. Athene Annuity and Life Co. said its growth in mortgages, overall, reflected the investment of proceeds from retail annuity sales and funding agreement issuances.

Resolution Life LP's Security Life of Denver Insurance Co. acquired nearly $1.05 billion in uninsured residential mortgages in 2023 after previously having no such exposure, driving the Resolution Life companies' 41.4% growth in mortgage holdings. Growth of 37.2% in Oceanview Life & Annuity Co.'s mortgage investments was fueled by a $706 million rise in uninsured residential mortgages.

Athene and Resolution Life were among six US life groups that showed growth in residential mortgage investments in excess of $1 billion during 2023. The TIAA group, led by Teachers Insurance & Annuity Association of America, increased its residential mortgage positions by $3.57 billion largely owing to purchases made as a condition of the 2023 sale of its former banking business. The US life subsidiaries of Corebridge Financial Inc. and Global Atlantic Financial Group Ltd. along with the group led by Massachusetts Mutual Life Insurance Co. grew residential mortgage holdings by more than $1 billion apiece. Corebridge listed residential mortgages among the various asset classes that it expects a Blackstone Inc. affiliate to invest in as part of a long-term asset management relationship.

American Life & Security Corp. posted the most rapid growth in overall mortgage holdings among entities with at least $100 million in exposure to the asset class, but residential mortgages played only a small part in its 252.6% expansion.

Methodology

This report relies on the combination of consolidated disclosures on the balance sheets and Schedule B - Verification pages of US life insurers' annual statements as filed with the National Association of Insurance Commissioners as well as loan-level disclosures on Schedule B. Industry-level results are subject to change as additional information is received.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.