Though U.S. retail stock trading has declined since the first quarter of 2021, the public remains more active in the market than they were prior to the pandemic. We expect this overall heightened level of retail engagement to persist, though sudden rallies in single stock names now seem less likely, as discussed in our recently published U.S. Digital Investing Market Report.

Retail trading activity in the U.S. has declined since the first two months of 2021 but remains above pre-pandemic levels. We expect 2022 to largely resemble the latter half of 2021. Meme stocks are still popular, particularly with younger traders, but rallies like the one in late January 2021 now seem less likely to occur.

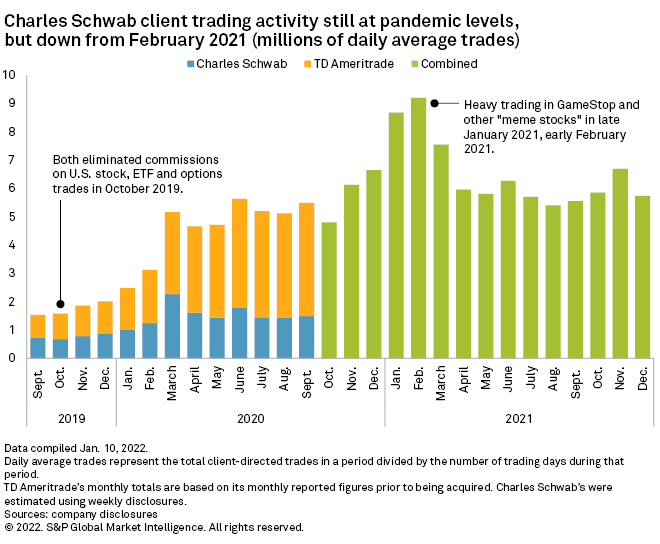

Figures from The Charles Schwab Corp. illustrate recent trends in U.S. retail trading, with daily average trades spiking in March 2020 and again in January 2021 and February 2021. Activity cooled a bit in the last three quarters of 2021, but December 2021's daily average trades were still 84% higher than February 2020 — prior to the full impact of the pandemic in the U.S.

We consider Charles Schwab a useful gauge of U.S. retail trading activity overall. The company has long been one of the leading retail trading platforms in the U.S. and grew even larger when it acquired TD Ameritrade Holding Corp., another top platform, in October 2020.

Fellow retail trading platform E*TRADE Financial LLC no longer releases monthly daily average trade totals after being acquired by Morgan Stanley in October 2020, but its quarterly figures echoed Charles Schwab's. Daily average trades spiked 32% in the first quarter of 2021, then declined 55% and 9% in the two subsequent quarters. But activity in the third quarter of 2021 remained 47% higher than the pre-pandemic first-quarter 2020 level.

Retail volume is particularly important for Robinhood Markets Inc., a trading app provider that has taken the market by storm since its founding in 2013. The majority of its revenue comes from market makers who pay Robinhood to route trades to them prior to sending the trades to the exchanges. In addition to payments for equities and options trades, Robinhood has similar agreements for crypto trades known as "transaction rebates."

What memes may come

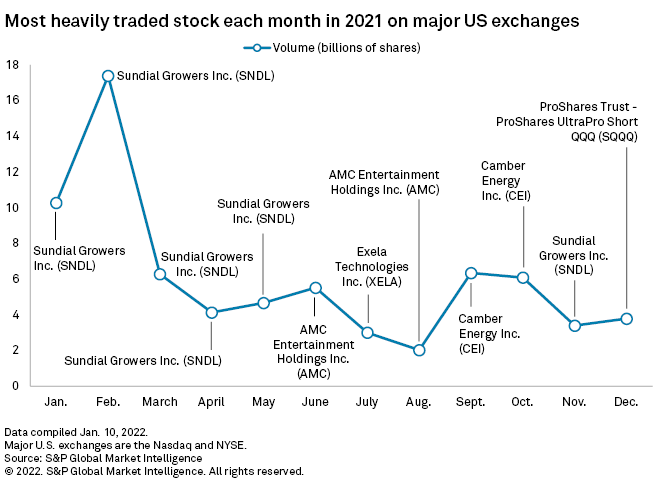

Trading in so-called meme stocks remains high, but the potential for a seismic market event like the one in late January 2021 — when Reddit posts triggered a flood of buying in video game retailer GameStop Corp. and other stocks — seems less likely. Subsequent rallies have been more muted. For instance, a burst in trading of movie theater operator AMC Entertainment Holdings Inc. in June 2021 did not have the same impact.

One might expect GameStop to have been the most heavily traded stock in January 2021 and February 2021. But based on volume alone, it was Sundial Growers Inc., a cannabis company. Business process automation company Exela Technologies Inc. and oil and gas company Camber Energy Inc. were other popular stocks later in the year.

The businesses of Sundial Growers, Exela Technologies and Camber Energy might be very different, but the companies have one thing in common: They were all "penny stocks" at one point, trading below $1 per share. Gen Z traders have a particular penchant for penny stocks, according to Apex Clearing Corp., a company that provides backend services for several retail trading apps.

To be fair, Gen Z traders like many large-cap stocks too, including Tesla Inc., Apple Inc., Amazon.com Inc., Microsoft Corp. and NVIDIA Corp. Those five stocks were found in the top 10 lists across all the age groups Apex surveyed in the third quarter of 2021. But that age demographic seems unique in its embrace of penny stocks.

It is also useful to look at the total dollar amount traded in major U.S. exchange stocks, as a different picture emerges. The aforementioned Big Tech companies, like Apple and Amazon, were top names by that metric in 2021, and Tesla dominated nearly every month. Retail traders have tended to be bullish on other electric vehicle plays as well, including Rivian Automotive Inc., Lucid Group Inc. and NIO Inc., according to TD Ameritrade's Investor Movement Index, which tracks the sentiment of the company's clients.

Conclusion

The December 2021 volume data took an interesting turn, with some traders starting to show a bearish side. The most popular stock that month was an exchange-traded fund, ProShares Trust - ProShares UltraPro Short QQQ, that not only shorts the Nasdaq 100 index, but is triple leveraged against it. Additionally, TD Ameritrade's Investor Movement Index found that retail investors were net sellers of equities in December 2021. On the other hand, the Invesco QQQ Trust Series 1 ETF, which positively tracks the Nasdaq, was one of the most heavily traded stocks by dollar amount throughout 2021, including December.

Regardless of whether this signals the start of a U.S. equity market correction, we think it supports our main points that retail traders are still an active and potent force in the market and that, in the aggregate, they seem less likely to ride the bandwagon on specific stocks and instead trade on broader themes.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global