The decision by SECURA Insurance Mutual Holding Co. to exit its personal lines business, according to an Oct. 20 announcement, underscores the significance of the challenges that small- and midsized property and casualty insurers are facing in an environment shaped by the combined effects of economic inflation and severe convective storms.

➤Superregional property and casualty (P&C) insurer SECURA did not appear on the surface to be a prime candidate to pull out of personal lines altogether. Unlike Kemper Corp., which announced plans earlier in 2023 to exit its preferred auto and home business, SECURA is not a publicly traded group and can focus on long-term results without confronting the shorter-term pressures of maximizing shareholder returns. SECURA President and CEO Garth Wicinsky also seemed to have deemphasized the impact of the group's storm-inflated 2022 underwriting loss in SECURA's most recent annual report, writing that "we are well equipped to endure a challenging year like 2022." Further, the group has long-standing customer relationships as an entity that traces its roots back to 1900 and boasted a unique packaged home and auto product called MILE-STONE that helped it to stand out in an increasingly commoditized marketplace.

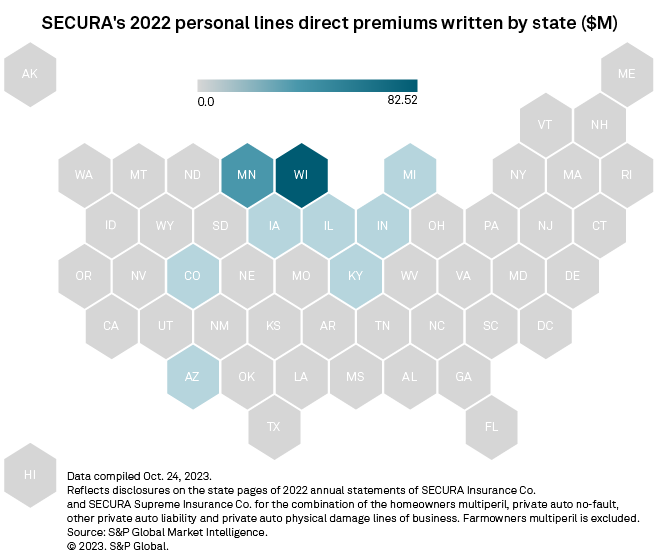

➤But other factors undoubtedly tipped the scales in favor of more dramatic action. Upper Midwest-concentrated property insurers faced rapidly rising reinsurance costs after a series of destructive 2022 storms that pushed the homeowners direct incurred loss ratios to their highest levels in more than two decades in Wisconsin and Minnesota, which together accounted for 68.3% of SECURA's personal auto and homeowners writings that year. Plus, exiting the personal lines will permit SECURA to focus on its other businesses, which have expanded more rapidly and have been more consistently profitable.

➤We expect that the steady stream of headlines about personal lines writers tightening their underwriting standards, significantly raising rates, curtailing or suspending new business writings in select areas, and exiting states will continue to flow. Who will take their place remains an open question, particularly as the growth appetite of market incumbents and other logical capacity providers remains constrained or focused elsewhere.

The personal lines financial woes were not unique to the Neenah, Wis.-based SECURA Insurance Co. and SECURA Supreme Insurance Co., but that does not make them any less significant. The companies recorded what Wicinsky described in the 2022 annual report as "a record-high number of claims," leading to a worst-in-at-least-25-years combined ratio across all business lines of 111.6%. That marked an increase of 14.9 percentage points from 2021's result, and it broke a decadelong streak of underwriting profitability. The combined ratios spiked to 121.5% in SECURA's private auto business and 186.1% in its homeowners business, each of which was well above industrywide results of 112.2% and 104.4%, respectively.

In the personal lines, we calculate that SECURA's 2022 combined ratio hit 148.2%. S&P Global Market Intelligence's personal lines roll-up includes the private auto, homeowners and farmowners businesses, but SECURA plans to continue to offer farm and agribusiness products alongside commercial and specialty lines. Additionally, our calculation excludes any personal property coverage attributable to SECURA's independent dwelling fire program.

We constructed a logic SECURA peer group of 19 P&C groups and stand-alone entities that produced more than $10 million in homeowners direct premiums written in 2022 and generated more than three-quarters of their homeowners business from the east and west North Central US census divisions, which contain the states that would generally be considered to constitute the upper Midwest. The results showed unprofitable underwriting results across the board with the magnitude of the losses dependent upon specific geographic concentrations in the states hardest hit by convective storms. Their 2022 home and auto combined ratios ranged from a low of 105.4% at the Ohio Valley-focused group led by Celina Mutual Insurance Co. to SECURA's high of 148.2%. Ten of the 20 entities produced sub-100% combined ratios excluding policyholder dividends in 2021.

|

– Access data exhibits containing projections at the line of business level – Access the 2023 US Auto Insurance Market Report. – Keep track of product withdrawals using US Product Filings data keyword searches. |

SECURA had generated seven straight years of home and auto underwriting profits as measured by sub-100% combined ratios through 2018. Since then, however, its home and auto combined ratio exceeded 100%, excluding the impact of policyholder dividends, in three of the last four years, including the outsized 2022 result. Given the combination of those catastrophe losses, rate hardening and a supply/demand imbalance in the marketplace, SECURA said in its 2022 annual statement that it was bracing for higher reinsurance costs in 2023. Developments in the reinsurance market have triggered chaos among Wisconsin's town mutuals, the business model originally adopted by SECURA's predecessor at the time of its founding 123 years ago.

A uniquely diversified franchise effectively facilitates SECURA's pivot away from personal lines. Of the aforementioned 19-member peer group, only Encova Mutual Insurance Group, Western National Insurance Group, West Bend Mutual Insurance Co., Frankenmuth Mutual Holding Co., Farmers Automobile Insurance Association (the group leader of companies that do business as Pekin Insurance), and Hastings Mutual Insurance Co. join SECURA in having obtained a majority of their 2022 direct premiums written from what we deem to be the commercial lines.

SECURA's non-home-and-auto business has been more profitable and has also been growing more rapidly. We calculate that its non-home-and-auto combined ratio was below 95% in eight of the previous 10 years through 2022. Its five-year compound annual growth rate in direct premiums written of 11.3% is well over 2x the 4.4% expansion in the home and auto business. Geographic expansion has focused on the commercial lines and agribusiness lines, with SECURA entering Pennsylvania with those products in 2022.

But having other geographies or business lines to reallocate resources is not necessarily a predictor of future market retreats in today's challenging environment. California Casualty Indemnity Exchange, a personal lines-focused carrier, is in the process of pulling out of 36 of the 43 markets in which it operates. FBAlliance Insurance Co. and FBAlliance Insurance Inc., personal lines insurers formed by 11 separate Farm Bureau companies, have submitted filings to regulators in three of their five active states, South Carolina, Wyoming and Virginia, reporting that their board made "a business decision to exit all lines of business" in those markets.

To fill the void left by the carriers that are pulling back from the residential property business, we have seen a variety of niche entities such as reciprocal exchanges emerge to selectively write coverage in catastrophe-exposed regions. Meanwhile, many established carriers continue to approach new business growth in the private auto market with caution. And at least one conceivable prospective home and auto capacity provider, Chubb Ltd., dismissed the notion that it might consider stepping in to broaden its footprint beyond the high net worth segment of the US personal lines market.

Chubb Chairman and CEO Evan Greenberg said during an Oct. 25 conference call, "We don't bring anything to that party."

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.