Download the full report

Click HereWorld merchandise trade accounted for an estimated $19.7 trillion in 2018, about 90% of which is by sea. While financial data tells us “how a company has done in the past,” shipping data provides a closer-to-real time indicator of “what a company is doing now.” Panjiva’s shipping data allows investors to track trends, identify anomalies, and assess risks for companies engaged in international trade. This paper illustrates how to find investment insights in Panjiva’s US seaborne and Mexican datasets using the US auto parts industry as a case study.

Findings include:

- Shipment trends often lead fundamentals: Rising shipments amid flat or declining fundamentals may signal future financial trend reversal

- Growth in the number of a company's suppliers and in the types of products it imports may signal strengthening demand and/or product line diversification.

- Tracking industry-level product-line trends can help identify companies with significant exposure to rising or declining product lines.

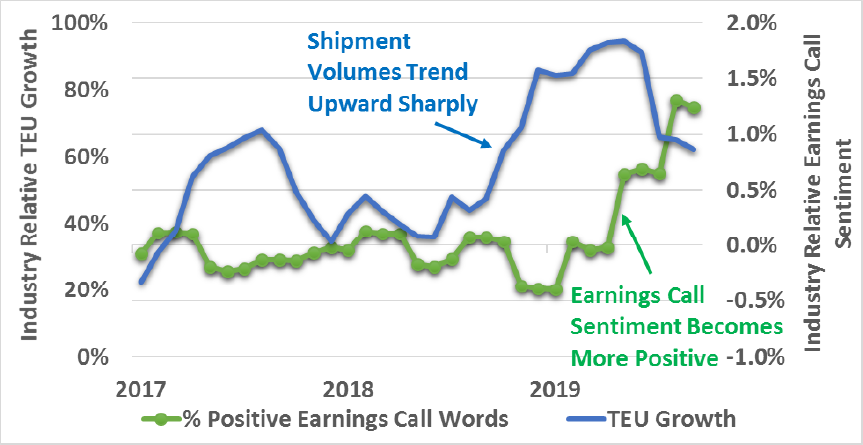

LCI Industries: Industry-Relative Import Growth vs. Earnings Call Sentiment, 2017-2019

To access the complete findings, as well as the SQL queries needed to recreate the paper’s use cases, click here.