US utilities are focused on strengthening their balance sheets as they navigate economic uncertainty. Since late 2022, multiple utilities have initiated internal strategic reviews and begun the process of divesting assets or selling minority interests in projects to raise cash and to facilitate capital reallocation.

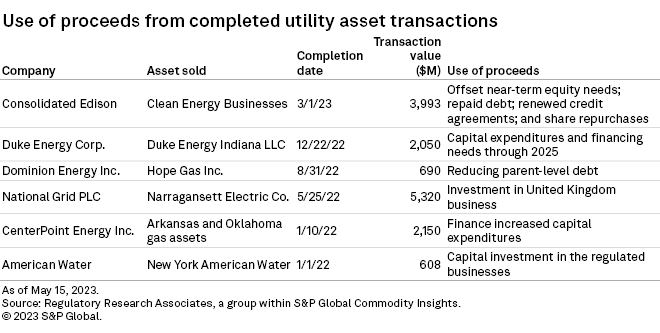

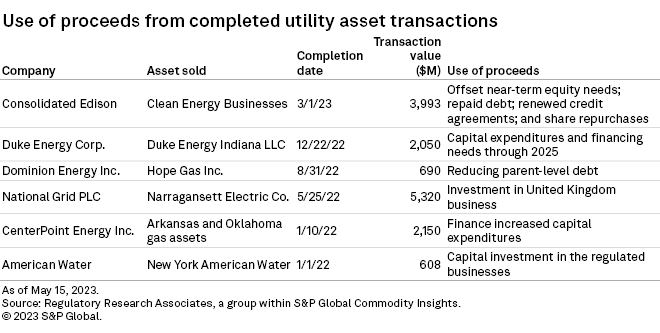

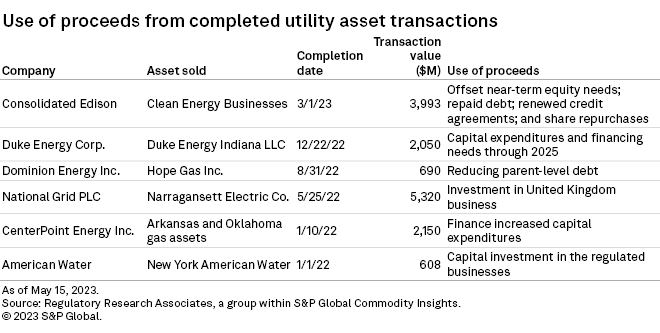

➤ US utilities have reverted to small strategic transactions, in contrast to the utility "megadeals" of decades past. These utility holding companies aim to simplify their business profile, strengthen their balance sheets and reduce strategy risk through a greater focus on regulated pursuits. Proceeds of sales are intended to finance capital expenditure programs, reduce and refinance debt obligations, and mitigate equity financing needs.

➤ While investors seem to prefer full asset sales, Duke Energy Corp. and NiSource Inc. have opted for minority interest sales in Indiana to shore up their balance sheets and fund the state's clean energy transition.

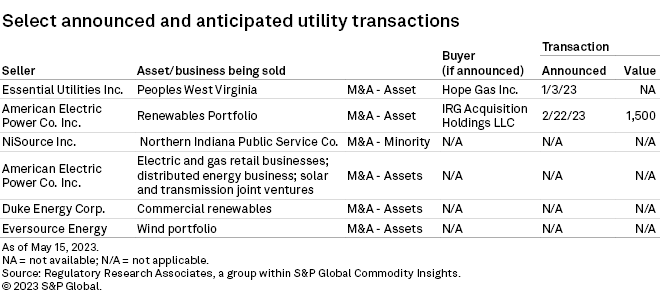

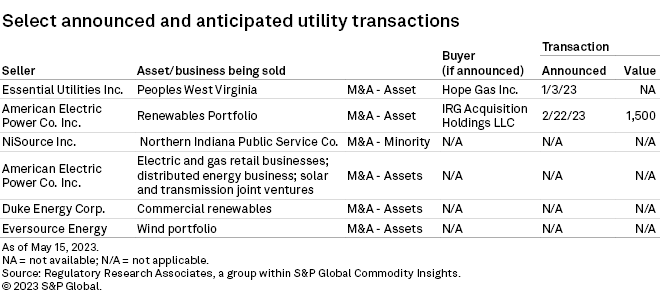

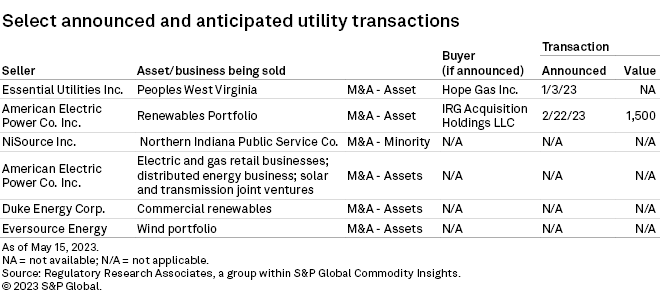

➤ In addition to Consolidated Edison Inc., which has already completed a divestiture of its clean energy assets, Duke Energy and Eversource Energy have also targeted renewable energy assets to spin off.

➤ In the case of Dominion Energy Inc. and Algonquin Power & Utilities Corp., strategic reviews are primarily being undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions.

Consolidated Edison's divesture already complete

Proceeds from Consolidated Edison's (Con Edison's) divestiture of its unregulated business are already being utilized to strengthen the balance sheet. Following a strategic review, Con Edison announced a $6.8 billion divestiture of Con Edison Clean Energy Businesses Inc. in October 2022. On March 1, 2023, Con Edison completed the sale of most of this business to RWE Renewables Americas LLC, a subsidiary of RWE AG, for $3.993 billion. The purchase price was adjusted downward by the value allocated to a project that was not able to be conveyed to RWE upon closing. Con Edison continues to value the transaction at $6.8 billion; however, it may take until Feb. 28, 2025, for the transfer of the deferred project, Broken Bow II, a 75-MW nameplate capacity wind power project in Nebraska, which is dependent on one outstanding counterparty consent.

About a week after the sale was completed, the company announced a $1 billion accelerated share repurchase program. Also in March, the company replaced a $2.5 billion credit agreement and repaid $600 million borrowed under a 364-day senior unsecured term loan credit agreement.

Additional renewables businesses up for sale

Eversource Energy is conducting a strategic review of its offshore wind portfolio and is seeking buyers for its 50% stakes in three US East Coast offshore wind projects developed in conjunction with Danish renewables developer Ørsted A/S. Buyers could be announced as soon as the second quarter. Eversource's decision to launch a strategic review in early 2022 to seek buyers for the assets emerged as a result of a February 2022 federal offshore wind auction for areas off the New York and New Jersey coast that attracted strong interest from numerous companies.

Management said proceeds from the sales could result in "greater levels of regulated investment, less financing needs, or a combination of the two."

Duke Energy characterized the sale of its commercial renewables business as in "the late stages" and aims to complete the transaction in the second half of 2023. The prospective sale includes the utility-scale renewables and distributed generation pieces of the business unit.

Minority interest sales in Indiana

Duke Energy sold a minority interest in Duke Energy Indiana to an affiliate of GIC Pte. Ltd., Singapore's sovereign wealth fund, in a two-phase sale transaction. Completed in December 2022, Duke received cash proceeds of $2.05 billion for a 19.9% indirect minority interest. On a recent call with investors, management highlighted the April action by Moody's to reaffirm Duke's credit ratings and stable outlook at the holding company, saying it was evidence that the company is taking the appropriate steps to maintain the balance sheet.

In November 2022, NiSource announced plans to sell a 19.9% stake in its Indiana multi-utility, expected to be completed in 2023. The decision to make a minority sale stemmed from a desire to reduce capital market risk. NiSource anticipates the transaction will minimize the need for an equity issuance, and proceeds will go toward redeeming $900 million of preferred equity. When pressed why the company decided on a minority sale instead of an outright asset sale of one or more of its five pure-play gas utilities, President and CEO Lloyd Yates said the transaction "on a risk adjusted basis maximizes the value creation that we can provide to all of our stakeholders."

National Grid (US) Holdings Ltd., which distributes gas in Massachusetts and New York, is considering selling a part of the Northeast gas utility business, sources told The Wall Street Journal. The talks include selling a minority interest in the business, the WSJ reported.

Larger strategic evaluations

In some instances, strategic reviews are being primarily undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions. When Dominion Energy initiated a "top-to-bottom" review in November 2022, Dominion President, CEO & Chairman Robert Blue said, "The market is telling us that we're not performing the way investors expect." Though the company would not comment on a recent WSJ article that Dominion is considering selling its gas utilities in North Carolina, Ohio and western US states, the company did include a reference in its Form 10Q filing to a willingness to divest "all or a portion of certain operations." The combined value of the assets identified by the WSJ is estimated to be $13 billion, but they are not expected to be sold in a single transaction. Details on the company's strategy are anticipated in the third quarter.

Dominion sold its West Virginia natural gas utility, Hope Gas Inc., to Ullico Inc.'s infrastructure fund for $690 million in August 2022 with proceedings going toward reducing parent-level debt. In 2021, Dominion sold its remaining 67% controlling interest in certain nonregulated solar projects to Terra Nova Renewable Partners and its remaining 50% controlling interest in Four Brothers and Three Cedars to Clearway Energy Inc.

Most recently, Algonquin Power & Utilities announced a strategic review May 11 with the intention of raising $1 billion in asset sales. The company had already lowered its dividend and scaled back its capital expenditure program in January. The company is pursuing strategic alternatives for its nonregulated operating and development of power generation assets. "Both our renewable energy group and our regulated services group have grown into strong businesses, with scale and high-quality assets, and are positioned to benefit from the energy transition," Algonquin President and CEO Arun Banskota said. "However, we believe the market does not fully appreciate the value of our assets."

With the aim of refocusing its investments toward its core electric utility, regulated renewables and transmission businesses, American Electric Power Co. Inc. (AEP) has launched a sale process for its retail energy and distributed resource segment and its stake in a solar joint venture with PNM Resources Inc. AEP is also reviewing its ownership stakes in various transmission joint ventures with Duke Energy and Evergy Inc. and is in the process of exiting its unregulated renewables business.

AEP's latest efforts to reshape its business toward one focused primarily on regulated electric transmission and distribution and renewables extend back several years when management announced a strategic review and potential sale of its Kentucky generation, transmission and distribution assets with the aim to offset financing needs for planned renewable energy additions at its other utility units. AEP and sale partner Algonquin eventually terminated a $2.85 billion deal for the Kentucky assets, including debt, with AEP now considering its strategy in the state ahead of a potential electric base rate case filing.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

US utilities are focused on strengthening their balance sheets as they navigate economic uncertainty. Since late 2022, multiple utilities have initiated internal strategic reviews and begun the process of divesting assets or selling minority interests in projects to raise cash and to facilitate capital reallocation.

➤ US utilities have reverted to small strategic transactions, in contrast to the utility "megadeals" of decades past. These utility holding companies aim to simplify their business profile, strengthen their balance sheets and reduce strategy risk through a greater focus on regulated pursuits. Proceeds of sales are intended to finance capital expenditure programs, reduce and refinance debt obligations, and mitigate equity financing needs.

➤ While investors seem to prefer full asset sales, Duke Energy Corp. and NiSource Inc. have opted for minority interest sales in Indiana to shore up their balance sheets and fund the state's clean energy transition.

➤ In addition to Consolidated Edison Inc., which has already completed a divestiture of its clean energy assets, Duke Energy and Eversource Energy have also targeted renewable energy assets to spin off.

➤ In the case of Dominion Energy Inc. and Algonquin Power & Utilities Corp., strategic reviews are primarily being undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions.

Consolidated Edison's divesture already complete

Proceeds from Consolidated Edison's (Con Edison's) divestiture of its unregulated business are already being utilized to strengthen the balance sheet. Following a strategic review, Con Edison announced a $6.8 billion divestiture of Con Edison Clean Energy Businesses Inc. in October 2022. On March 1, 2023, Con Edison completed the sale of most of this business to RWE Renewables Americas LLC, a subsidiary of RWE AG, for $3.993 billion. The purchase price was adjusted downward by the value allocated to a project that was not able to be conveyed to RWE upon closing. Con Edison continues to value the transaction at $6.8 billion; however, it may take until Feb. 28, 2025, for the transfer of the deferred project, Broken Bow II, a 75-MW nameplate capacity wind power project in Nebraska, which is dependent on one outstanding counterparty consent.

About a week after the sale was completed, the company announced a $1 billion accelerated share repurchase program. Also in March, the company replaced a $2.5 billion credit agreement and repaid $600 million borrowed under a 364-day senior unsecured term loan credit agreement.

Additional renewables businesses up for sale

Eversource Energy is conducting a strategic review of its offshore wind portfolio and is seeking buyers for its 50% stakes in three US East Coast offshore wind projects developed in conjunction with Danish renewables developer Ørsted A/S. Buyers could be announced as soon as the second quarter. Eversource's decision to launch a strategic review in early 2022 to seek buyers for the assets emerged as a result of a February 2022 federal offshore wind auction for areas off the New York and New Jersey coast that attracted strong interest from numerous companies.

Management said proceeds from the sales could result in "greater levels of regulated investment, less financing needs, or a combination of the two."

Duke Energy characterized the sale of its commercial renewables business as in "the late stages" and aims to complete the transaction in the second half of 2023. The prospective sale includes the utility-scale renewables and distributed generation pieces of the business unit.

Minority interest sales in Indiana

Duke Energy sold a minority interest in Duke Energy Indiana to an affiliate of GIC Pte. Ltd., Singapore's sovereign wealth fund, in a two-phase sale transaction. Completed in December 2022, Duke received cash proceeds of $2.05 billion for a 19.9% indirect minority interest. On a recent call with investors, management highlighted the April action by Moody's to reaffirm Duke's credit ratings and stable outlook at the holding company, saying it was evidence that the company is taking the appropriate steps to maintain the balance sheet.

In November 2022, NiSource announced plans to sell a 19.9% stake in its Indiana multi-utility, expected to be completed in 2023. The decision to make a minority sale stemmed from a desire to reduce capital market risk. NiSource anticipates the transaction will minimize the need for an equity issuance, and proceeds will go toward redeeming $900 million of preferred equity. When pressed why the company decided on a minority sale instead of an outright asset sale of one or more of its five pure-play gas utilities, President and CEO Lloyd Yates said the transaction "on a risk adjusted basis maximizes the value creation that we can provide to all of our stakeholders."

National Grid (US) Holdings Ltd., which distributes gas in Massachusetts and New York, is considering selling a part of the Northeast gas utility business, sources told The Wall Street Journal. The talks include selling a minority interest in the business, the WSJ reported.

Larger strategic evaluations

In some instances, strategic reviews are being primarily undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions. When Dominion Energy initiated a "top-to-bottom" review in November 2022, Dominion President, CEO & Chairman Robert Blue said, "The market is telling us that we're not performing the way investors expect." Though the company would not comment on a recent WSJ article that Dominion is considering selling its gas utilities in North Carolina, Ohio and western US states, the company did include a reference in its Form 10Q filing to a willingness to divest "all or a portion of certain operations." The combined value of the assets identified by the WSJ is estimated to be $13 billion, but they are not expected to be sold in a single transaction. Details on the company's strategy are anticipated in the third quarter.

Dominion sold its West Virginia natural gas utility, Hope Gas Inc., to Ullico Inc.'s infrastructure fund for $690 million in August 2022 with proceedings going toward reducing parent-level debt. In 2021, Dominion sold its remaining 67% controlling interest in certain nonregulated solar projects to Terra Nova Renewable Partners and its remaining 50% controlling interest in Four Brothers and Three Cedars to Clearway Energy Inc.

Most recently, Algonquin Power & Utilities announced a strategic review May 11 with the intention of raising $1 billion in asset sales. The company had already lowered its dividend and scaled back its capital expenditure program in January. The company is pursuing strategic alternatives for its nonregulated operating and development of power generation assets. "Both our renewable energy group and our regulated services group have grown into strong businesses, with scale and high-quality assets, and are positioned to benefit from the energy transition," Algonquin President and CEO Arun Banskota said. "However, we believe the market does not fully appreciate the value of our assets."

With the aim of refocusing its investments toward its core electric utility, regulated renewables and transmission businesses, American Electric Power Co. Inc. (AEP) has launched a sale process for its retail energy and distributed resource segment and its stake in a solar joint venture with PNM Resources Inc. AEP is also reviewing its ownership stakes in various transmission joint ventures with Duke Energy and Evergy Inc. and is in the process of exiting its unregulated renewables business.

AEP's latest efforts to reshape its business toward one focused primarily on regulated electric transmission and distribution and renewables extend back several years when management announced a strategic review and potential sale of its Kentucky generation, transmission and distribution assets with the aim to offset financing needs for planned renewable energy additions at its other utility units. AEP and sale partner Algonquin eventually terminated a $2.85 billion deal for the Kentucky assets, including debt, with AEP now considering its strategy in the state ahead of a potential electric base rate case filing.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.