Consumers across Latin America were greeted with higher streaming bills during the first half of the year as most global over-the-top providers rolled out price increases to help squeeze more value from their offerings. Rising inflation and content investments have also triggered higher subscription streaming fees in major markets around the region.

![]()

➤ Streaming price hikes have become a regular occurrence across Latin America in 2023, especially as global subscription video-on-demand services place more emphasis on boosting profits over subscription growth.

➤ Some of the services kept pricing steady for annual subscription plans, which carry discounts that could attract long-term users and help minimize churn in key markets.

➤ As streaming competition intensifies in Latin America, most SVOD services are experimenting with hybrid business models to unlock new revenue streams.

![]()

Kagan has updated our OTT Services & Devices database with recent price hikes carried out by global streaming operators such as Amazon.com Inc., Walt Disney Co., Warner Bros. Discovery Inc., Netflix Inc. and Paramount Global in select major Latin America markets such as Argentina, Brazil, Chile, Colombia, Mexico and Peru. Our proprietary database tracks data on nearly 2,000 OTT services worldwide across a variety of operating models and regions.

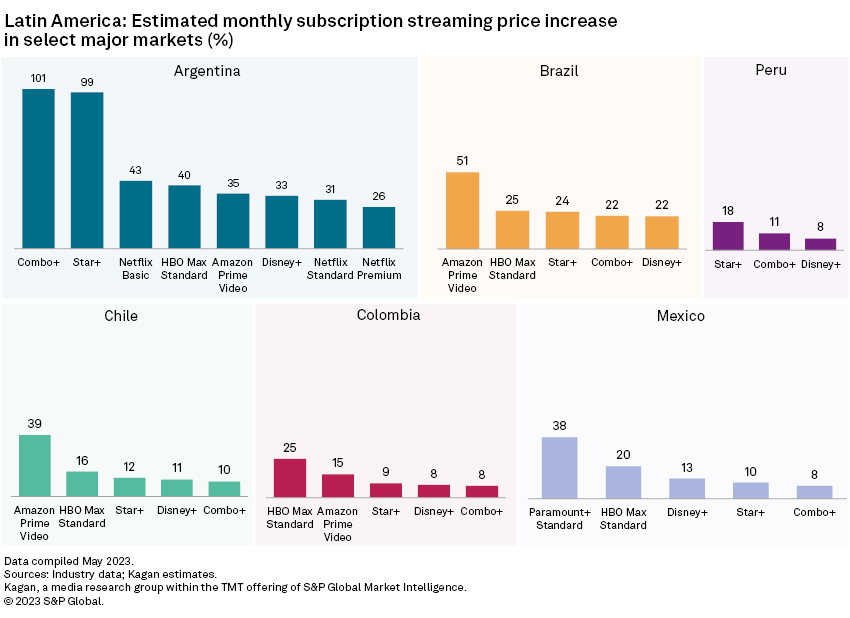

Among the major markets that we tracked in Latin America, Argentina experienced the biggest subscription streaming price increases, in large part driven by a surging inflation rate that soared to over 100% at the start of the year. Consumers in the country are also likely to pay more because of various taxes, including a value-added tax of approximately 21% and a country tax of about 8%, which are tacked on to subscription fees charged by most international streaming platforms.

Disney's Combo+ package, which bundles access to the Disney+ and Star+ service, more than doubled its monthly fee in Argentina while the stand-alone Star+ service that serves live sports content increased its price by an estimated 99%. In the other markets, Disney implemented subscription price hikes that ranged from 8% to 24%. It was the only global OTT operator to hike fees in Peru so far this year.

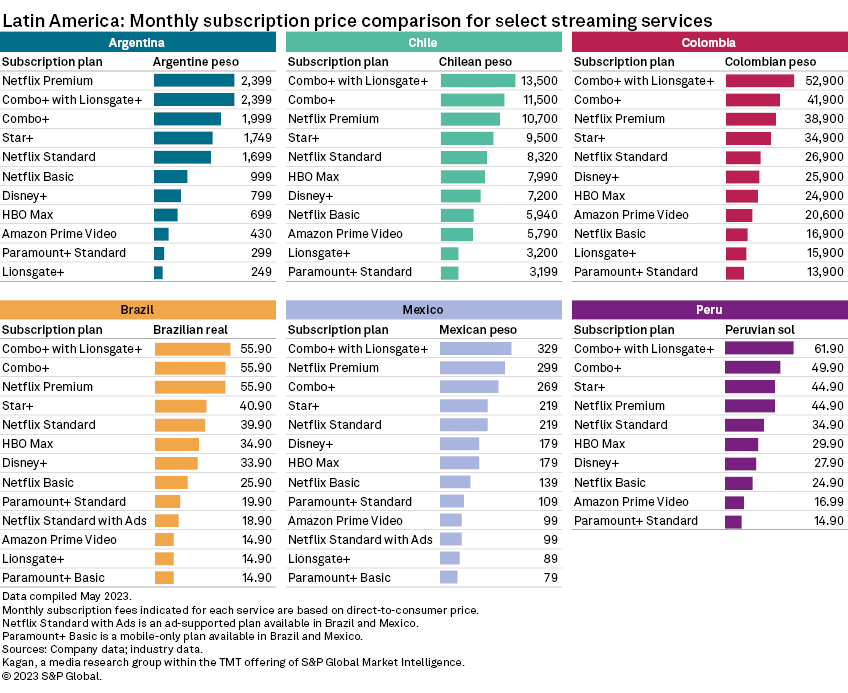

Along with Netflix's Premium plan, Disney's Combo+ and Star+ are among the most expensive offerings in the region. The company also joined forces with Lions Gate Entertainment Corp. to form the Combo+ with Lionsgate+ subscription bundle. Disney has acquired a sizeable streaming subscriber base in Latin America since launching Disney+ in November 2020 followed by Star+ in August 2021.

Access our Disney+ global subscriber estimates for year-end 2022.

Amazon's Prime Video service also raised its monthly charge in Argentina, Brazil, Chile and Colombia by as much as 51%. Subscription cost for HBO Max's Standard plan, meanwhile, rose between 16% and 40%. Warner Bros. Discovery is expected to rebrand the service in Latin America to Max later in the year.

When HBO Max launched in the region in June 2021, it offered a 50% lifetime discount on monthly plans to subscribers that signed up directly via its website during its first month. The discount remains applicable so long as the customer continues the subscription without interruption; however, it will now be applied to the current price following the increase. Aside from the price hike, the service discontinued its mobile-only plan, which was approximately 30% cheaper than the Standard plan in most of Latin America, making the entry-level package for HBO Max even more expensive for new subscribers.

In contrast, Paramount+ recently introduced a more affordable mobile-only plan called Paramount+ Basic in Brazil and Mexico, in line with company data showing that more than 50% of subscribers watch on the platform through mobile devices like smartphones and tablets. Following the lead of most of the other global streamers in the region, Paramount+ rolled out an annual option that offers discounts of up to 25% versus monthly plans to help with subscription churn. Disney and Warner Bros. Discovery have been offering annual subscription plans for their respective streaming services since launching in the region. Both companies have for the most part maintained the price points of their annual plans.

Netflix, which does not offer an annual plan, has already hiked monthly fees several times since debuting in major markets like Brazil and Mexico. Its latest price increase in Latin America happened in Argentina, where it raised rates for all its subscription plans by an average of over 30%. That said, the service did trend in the opposite direction at the start of the year when it rolled out price cuts in some of the smaller markets in the region like Bolivia, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua and Venezuela, among others.

Access our analysis of Netflix's global pricing strategy.

Although its customer base in Latin America slightly contracted at the end of the first quarter, Netflix remains the biggest streamer in the region with over 41.2 million subscribers. Total revenues grew 5% on a sequential basis to over $1.07 billion during the period. Latin America markets like Chile, Costa Rica and Peru were among the first markets where Netflix tested a password-sharing fee in 2022.

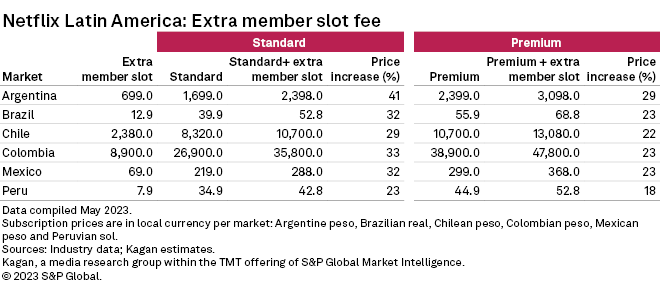

As it looks to improve monetization to boost revenue growth and profit, Netflix has taken a more proactive role to address account sharers in different households globally. The service recently implemented a broader rollout of its paid sharing fee, allowing Standard and Premium plan subscribers to add up to two subaccounts for an extra charge. Adding a subaccount in Latin America could bump up the monthly cost for Standard or Premium subscribers by up to 40% depending on the market. However, putting a minimal difference between the extra member charge and its entry-level subscription packages could encourage account borrowers to eventually sign up for their own accounts, supporting Netflix's long-term goal of revenue optimization.

Netflix launched an ad-supported subscription plan priced 28% cheaper than the Basic plan for more cost-conscious consumers in markets like Brazil and Mexico. Disney also announced in 2022 plans to launch a paid, ad-supported tier in international markets starting this year. With subscriber gains tapering off in many markets, advertising has become an area of focus for many global SVOD players that aim to generate better operating margins.

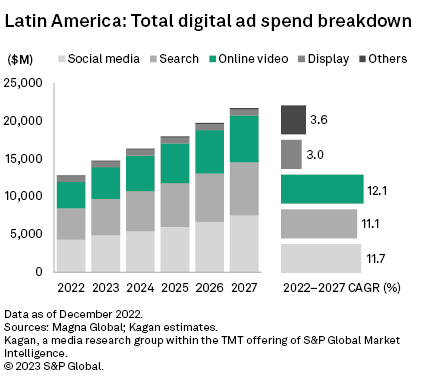

Latin America is showing great potential for advertising growth on streaming platforms. Projections data from Magna Global points to a 20% annual increase in ad spend on online video platforms in the region to nearly $4.20 billion at the end of the year. Moreover, growth for online video is expected to outpace that of other digital advertising platforms with a five-year CAGR of 12.1%, possibly leading to total ad spend of almost $6.21 billion by 2027.

Free, ad-supported streaming TV (FAST) services continue to gain popularity in Latin America, especially as average households in most parts of the region grapple with inflation and economic uncertainty. Fox Corp. expanded the reach of Tubi when it launched in Costa Rica, Ecuador, El Salvador, Guatemala and Panama in 2022. The service has been accessible in Mexico since 2021 but is still not as widely available in the region compared to other FAST platforms like Paramount's Pluto TV and TelevisaUnivision Inc.'s Vix.

Economics of Internet is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.