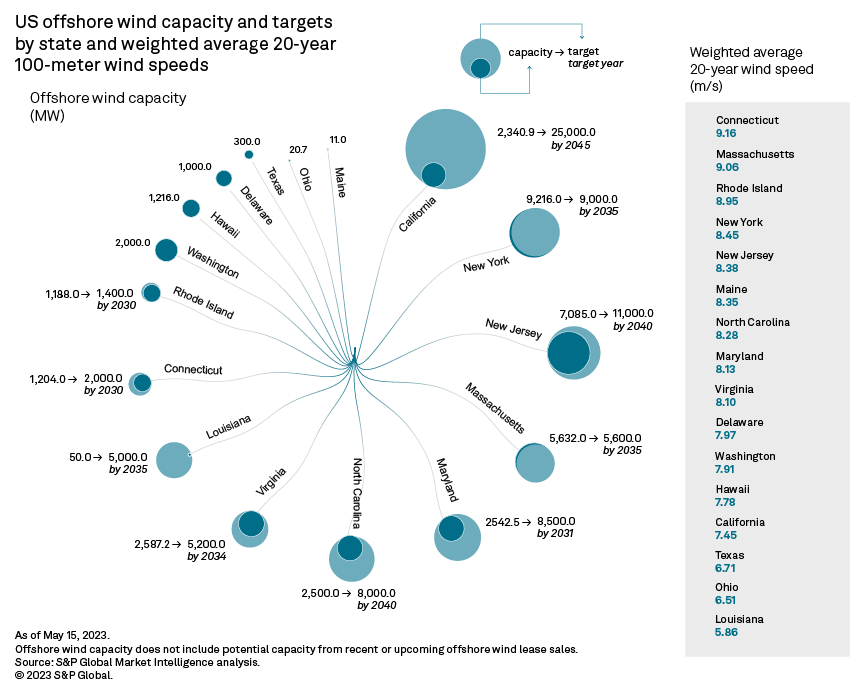

In the US, state-level offshore wind procurement targets currently total 80.7 GW, and the Biden administration implemented a countrywide goal of 30 GW by 2030. Additionally, coastal states — particularly along the mid- and northern Atlantic Ocean — boast strong offshore wind resources, with nine states averaging 100-meter wind speeds above 8 meters per second. Despite these formidable legislative and geographic drivers, the US offshore wind industry continues to move at a snail's pace, with only 42 MW in operation and just 3% of the 39 GW of capacity in the pipeline having begun construction.

The US continues to fall behind Europe in installed offshore wind capacity despite nearly two decades of effort and capital being poured into the industry. Developers have remained persistent, knowing the potential for offshore wind, particularly in the mid- and northern Atlantic, owing to increasing clean energy commitments and favorable geographic drivers in the form of strong winds and shallow water depths. Now with the first utility-scale projects under construction, this persistence appears to be finally paying off.

New England and New York are expected to pace the offshore wind market in the US for the foreseeable future, as projects off these states' coasts should see average 100-meter wind speeds in excess of 9 meters per second. This is supported by legislative drivers, including state-level clean energy requirements and offshore wind procurement targets.

Unlike many European countries , offshore wind has not yet gained a foothold in the US, although that may finally be changing. There are 40 projects in various stages of development along US coastlines, with the majority located in the mid- and northern Atlantic's shallow waters, where fixed-bottom foundations are feasible. There are also proposed projects in the Pacific Ocean, Gulf of Mexico and even Lake Erie, though these projects remain in very nascent development stages.

Two projects are in operation — the 29.3-MW Block Island Offshore Wind project in Rhode Island, owned by offshore veteran Ørsted A/S , and the 12-MW Coastal Virginia Offshore Wind (Virginia Offshore Wind Technology Advancement Project) demonstration project, owned by Dominion Energy Inc. Both boast annual capacity factors in the mid-to-high 40s, with monthly capacity factors occasionally surpassing 60%, fueled by 100-meter average wind speeds of 8.9 m/s for Block Island and 8.2 m/s for Coastal Virginia. Based on the performance of these two projects, the current pipeline of wind projects in the US would produce more power annually than that consumed by the entire state of Ohio in 2021.

This estimate may even be conservative if one looks at the wind speeds of projects in planning. Currently, 7.2 GW of planned capacity is in locations with average wind speeds above 9 m/s. Topping the list is the 1,600-MW SouthCoast Wind Energy Project (Mayflower Offshore) , which should expect winds of 9.2 m/s on average, with speeds in the breezier winter months easily surpassing 10 m/s. The Vineyard Offshore Wind Project , under construction off the coast of Massachusetts, is also expected to tap high winds averaging just shy of 9.2 m/s. Other projects with average wind speeds above 9 m/s include Commonwealth Offshore Wind Project , New England Wind (Park City Wind Offshore) project, Beacon Offshore Wind Project and NY4 Excelsior Offshore Wind Park project — all in the North Atlantic.

Based on currently known proposed offshore project locations, the Atlantic seaboard has the highest average wind speeds among all US offshore regions, with every project but two — the 1,000-MW Garden State Offshore Wind Farm project and the 2,076-MW Boardwalk Offshore Wind (Empire Wind) (Rockaway Peninsula) project — having average wind speeds above 8 m/s. The 150-MW Redwood Coast Offshore Wind Project in California is the only proposed offshore wind farm not in the Atlantic that has average wind speeds above 8 m/s.

The Redwood project is located near the Humboldt Wind Energy Area (WEA), which was auctioned off in December 2022, with the two lease areas going to RWE AG subsidiary RWE Offshore Wind Holdings LLC and Copenhagen Infrastructure Partners Holding P/S subsidiary California North Floating LLC. The wind speeds of this area and the Morro Bay lease areas average between 8.0 m/s and 9.5 m/s. They steadily rise farther from the coast, although projects in the Pacific must contend with deeper ocean depths, which consequently require floating foundations .

Two more offshore wind area auctions are planned for the Gulf of Mexico and Gulf of Maine. The Bureau of Ocean Energy Management (BOEM) completed the environmental assessment for the three proposed Gulf of Mexico WEAs. An auction date has not been set yet, but it is expected to be before year-end. Twenty-year average wind speeds in the Gulf vary less than those in the Pacific and hover around the 7 m/s mark.

The next BOEM offshore wind auction after the Gulf of Mexico sale is for the Gulf of Maine. The Bureau has not yet designated the official WEAs, and the planning area is quite large, with areas on the zone's eastern edge being over 100 miles from the nearest onshore interconnection point. Average wind speeds vary depending on proximity to land in the Gulf of Maine planning area, but locations farther offshore consistently experience winds in excess of 9.5 m/s.

Legislative drivers remain crucial

To help expedite offshore wind development in the US, several state legislatures implemented mandated offshore wind capacity targets. These targets are met by offshore wind solicitations, where developers submit proposals for offshore wind projects within designated areas, with the winning bidders being guaranteed a power purchase agreement to help facilitate project financing. Such mandates initially manifested in East Coast states, such as Massachusetts and New Jersey, which have aggressive clean energy requirements and relatively limited onshore resources for large-scale wind and solar development.

State-level offshore wind targets are expanding, with 10 states now having offshore wind mandates or goals in place, led by California's recently implemented goal of 25 GW by 2045 to help the state's load-serving entities reach their 100% carbon-free generation requirement by the same deadline. The offshore industry in California is still in its infancy, with four projects in development but in very early planning stages. But development activity should ramp up on the heels of the December 2022 BOEM auction. Wind speeds vary along the state's 800+ miles of coastline, with an overall average of 7.45 m/s, but developers willing to drift farther from shore will be rewarded with winds above 9 m/s.

Maryland upped its offshore wind target in April to 8,500 MW by 2031. At present, the state has four projects in planning totaling 2,542 MW, led by the combined 966-MW Skipjack Offshore Wind Project and Skipjack 2 Offshore Wind Project being developed by Ørsted. Toto Holding subsidiary US Wind is developing the Momentum Offshore Wind Project — in the advanced development stage — and the Ocean City Offshore Wind Project (Marwin) . Wind speeds off Maryland's coast average 8.1 m/s.

New York has a 9,000-MW offshore wind target by 2035, implemented as part of the Climate Leadership and Community Protection Act enacted in 2019. Over 4,100 MW of contracted offshore wind capacity is in development in the state, having been awarded as part of solicitations in 2018 and 2020. A third solicitation was announced in 2022, with winners set to be announced in the summer of 2023. Some of the proposals have come from companies that won at the record-setting New York Bight Auction in February 2022. There is 9,200 MW of offshore wind capacity in development, according to S&P Global Market Intelligence data — enough to meet the state's procurement target, with more likely on the way once winning bids for the 2022 solicitation are formally announced.

Connecticut and Massachusetts have the highest average coastal wind speeds at 9.2 m/s and 9.1 m/s, respectively. Rhode Island is third at just under 9 m/s. There are seven projects in development across these three New England states, totaling over 8 GW.

Top owners

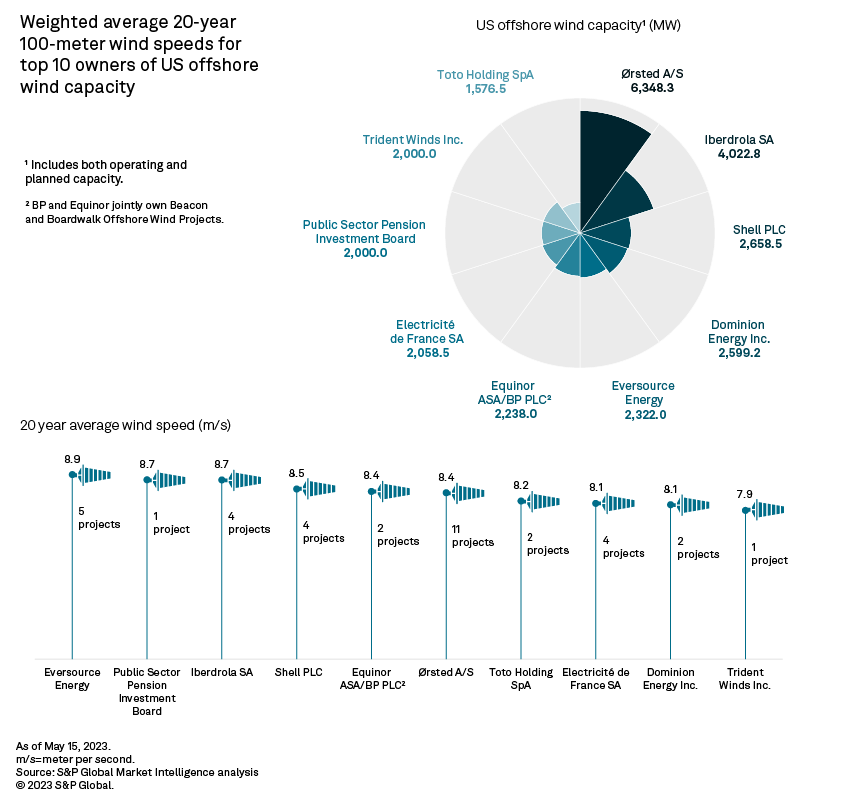

Danish clean energy developer Ørsted leads all companies in US offshore wind capacity in development, with 6.3 GW across 10 projects plus the operating Block Island wind farm. Currently, all Ørsted-developed projects are in the Atlantic, from Massachusetts down to Maryland. Its portfolio averages 8.4 m/s, led by its Sunrise Wind Offshore Farm , with average wind speeds of nearly 9.0 m/s.

Eversource Energy ranks second on the number of projects with five in development, although the company is in the process of offloading its stakes in several US wind farms. It co-owns four projects with Ørsted, including Sunrise Wind Offshore Farm, and its portfolio average wind speed of 8.9 m/s is the highest of any ultimate parent company.

Iberdrola SA , through its subsidiary Avangrid Renewables LLC , has 4 GW of offshore wind in development, led by the company's 80% stake in the 2,500-MW Kitty Hawk Offshore Wind Farm . Its four projects have a weighted average wind speed of 8.7 m/s.

Avangrid's Commonwealth Offshore Wind Project in Massachusetts made headlines over the past year when the company requested permission to renegotiate the project's power purchase agreements with Eversource Energy subsidiary NSTAR Electric Co. , Unitil Corp. subsidiary Fitchburg Gas and Electric Light Co. Inc. and National Grid PLC utilities Nantucket Electric Co. and Massachusetts Electric Co. The Massachusetts Department of Public Utilities denied the request, resulting in Avangrid moving to terminate the agreement and reenter the project in a competitive solicitation under revised project costs. The company cited inflationary pressure and rising interest rates as reasons for the project's lack of financial viability under the original contract.

Both Shell PLC and EDP - Energias de Portugal SA subsidiary EDPR Offshore North America LLC requested renegotiated contract rates for their 1,600-MW SouthCoast Wind Energy Project due to similar financial stresses. The companies say they remain committed to the project.

Headwinds remain for offshore development in the US, from inflation to supply chain constraints and ongoing resistance from competing maritime industries and local residents. Federal support has been given a boost on account of increased tax incentives from the Inflation Reduction Act of 2022, and state legislations on all coasts are increasingly dedicated to getting offshore wind up and running. These factors, combined with favorable geographic forces in the form of strong winds, might finally be turning the corner, with two major offshore projects under construction.

It has taken nearly two decades for offshore wind to make a breakthrough in the US, but the industry finally appears to have momentum on its side.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast .

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Kristin Larson, Joe Felizadio, Jonathan Paul Lalgee and Chris Allen Villanueva contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.