Over 19 GW of tracked renewable capacity was signed in more than 200 deals to corporate buyers in the 12 months since the February 2023 update. The tech industry once again dominated clean energy deals struck over the past 12 months, accounting for over two-thirds of these newly identified corporate renewable deals. Solar's rapidly expanding global footprint extends to the corporate procurement sector as well, with photovoltaic capacity making up 70% of reported capacity signed to non-utility off-takers over the past 12 months.

The 2024 corporate renewables update indicates a slight pullback from 2023 levels, but there is little evidence this is the beginning of a long-term downward trend. With clean energy procurement expanding globally and self-imposed carbon reduction efforts by corporations maintaining strong momentum, annual corporate renewable purchases are expected to remain aggressive for the foreseeable future.

The rise of artificial intelligence is leading to a wave of datacenter development plans, resulting in significant energy demand increases across several concentrated markets. This trend is placing hyperscalers at the center stage of the energy industry. Not only are tech companies contending with stiff pushback from local grid operators worrying about long-term reliability, they are also facing increasing difficulties in meeting their own CO2-mitigation goals in the face of this rapidly rising demand for electricity.

Solar development plans have massively increased in the US and abroad, with corporate buyers taking advantage of financially attractive long-term power purchase agreements. But the combination of solar's intermittency and clean energy targets' increasing stringency — such as around-the-clock carbon-free generation goals — is driving more corporate buyers to explore more consistent forms of generation, such as nuclear, geothermal and hydroelectric power.

Key findings

− Singling out US-based companies specifically, S&P Global Commodity Insights tracked nearly 190 new deals signed in the past 12 months to procure a combined 17 GW of renewable energy capacity.

− Fifty-four percent, or 9.1 GW, of this newly tracked capacity is based in the US, including 3.9 GW in Texas alone.

− Throwing major non-US corporations into the mix brings overall US-based renewable energy capacity contracted during the same period to 11.3 GW.

− An aggregate 2.8 GW of battery energy storage is tied to the US-based renewable energy capacity contracted between February 2023 and February 2024.

− Overall tracked renewable energy capacity contracted by US corporate off-takers to-date stands at 93.5 GW, while overall US-based renewable energy capacity contracted either by US corporations or major non-US corporations comes in at 74.6 GW.

− Outside of North America, the bulk of the renewable energy capacity contracted by US corporate off-takers is based in Europe, including an identified 7.8 GW in northern Europe, 5.1 GW in southern Europe and 2.8 GW in western Europe.

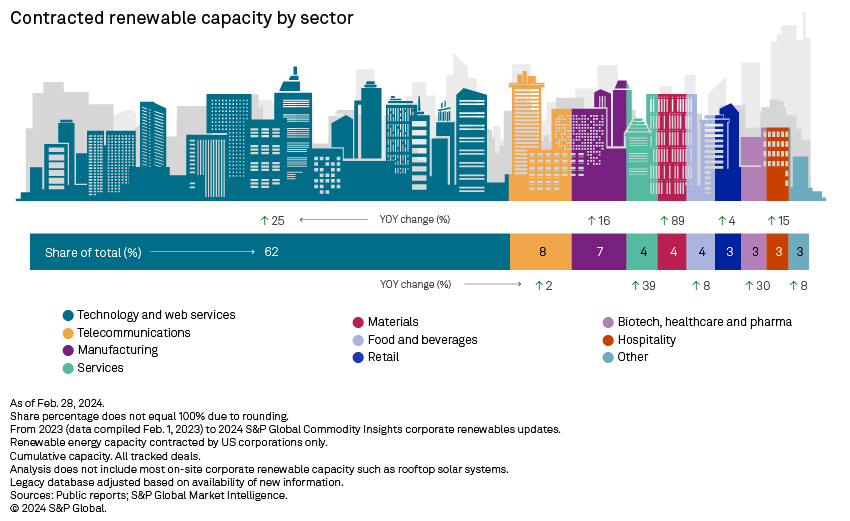

Sector dynamics

The technology sector again set the pace for corporate renewable energy deal activity in the 12 months to Feb. 28, 2024, accounting for more than 68% of both tracked deals and associated contracted capacity. To date, S&P Global Commodity Insights has tracked 57.7 GW of renewable energy capacity contracted by US tech corporations. Amazon.com Inc. alone has amassed about 28 GW of renewable energy generation capacity, of which more than 63% is based in the US. Facebook, Instagram and WhatsApp parent company Meta Platforms Inc. is a distant second, with a tracked 10.5 GW. Google parent Alphabet Inc. is not too far behind Meta, with an identified 9.5 GW.

With artificial intelligence on the rise, the technology and web services universe is expected to remain a major driver for contracted corporate renewable energy capacity. Energy-hungry datacenters — the backbone of AI — are contributing to a quickly steepening power demand curve, suggesting the tech sector could weigh on decarbonization efforts if carbon-free energy procurement does not keep up. With this in mind, tech giants such as Microsoft Corp. and Amazon are looking at nuclear energy options to supplement renewable power generation across their operations.

That said, in the past 12 months, the materials sector logged the largest year-over-year percentage increase in contracted renewable capacity, up 88.7%. With an activity primarily revolving around the processing and transformation of raw materials, the space is also quite power-intensive. Since the 19th-century industrial revolution, the sector has relied heavily on fossil fuel-powered plants, making it popularly associated with environmental damage. In the past 12 months, LyondellBasell Industries NV accounted for 81% of the tracked corporate renewable energy capacity contracted by US corporate off-takers across the materials industry.

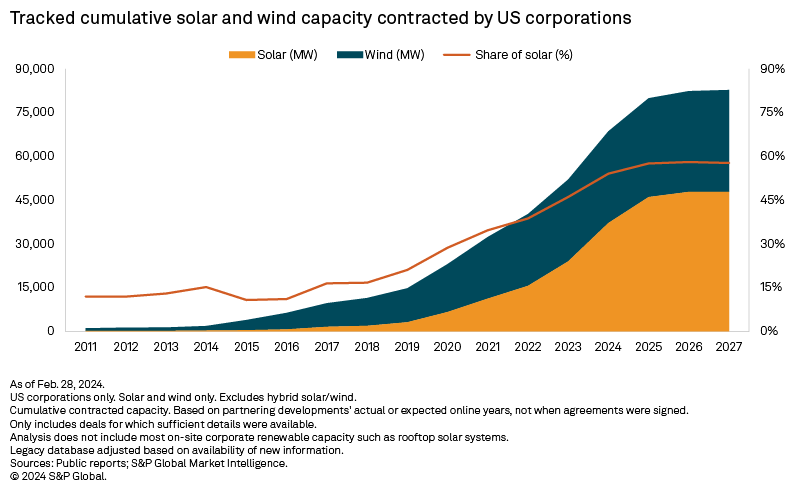

Solar deals continue to outpace wind

Global development of solar continues to grow rapidly, and corporate procurement is definitively following that trend. Solar accounted for 70% of the total corporate renewable capacity tracked since the 2023 update, with 12.4 GW signed by US-based corporations around the globe. While the gap between solar and wind development is widening, wind maintains a foothold in corporate procurement, with 5.2 GW signed over the past year. Based on tracked online years, solar is anticipated to surpass wind in corporate capacity contracted by US corporations by the end of 2024.

Australia-based mining conglomerate Rio Tinto Group signed the largest solar deal in the 2024 update, procuring 1.1 GW from the Upper Calliope Solar Farm project in Queensland, Australia. In the US, Amazon signed 1 GW worth of deals with the Bellefield Solar Project and Bellefield 2 Solar Farm being developed in California by AES Corp. Both projects are expected to have a nameplate capacity of 500 MW individually and to come online by 2026. Meta signed a 525-MW agreement with Berkshire Hathaway Inc. subsidiary PacifiCorp procuring supply from the Faraday solar project in Utah.

Amazon also signed the largest wind power purchase agreement (PPA) among US corporate buyers, taking 415 MW from the 990-MW Buffalo Plains Wind Farm in Canada. Google's long-term agreement with Offshore Windproject Hollandse Kust Noord in the Netherlands for 379 MW was the largest offshore wind deal signed within the past 12 months. There was an uptick in European offshore wind PPAs in general, with at least nine different companies signing deals totaling more than 1 GW of offshore wind capacity across projects in Germany and the Netherlands.

Data visualization by Chris Allen Villanueva.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.