Grupo Televisa SAB's recently announced decision to merge its content unit with Univision will create a Spanish-language content giant and leave a very different company bearing the Televisa name in Mexico: a heavily focused broadband and pay TV operation looking to expand its domestic market share.

The announced $4.8 billion transaction with Univision is expected to create the world's largest Spanish-language media content producer, with operations in the U.S. — the largest Spanish-language market by value — and in Mexico — the most populous Spanish-speaking country in the world.

Already a client? Click here to read about recent M&A activity in the Latin American telecommunications market.

The deal will also make Televisa into a much more streamlined pay TV and broadband company that will be positioned to widen its reach in its home market of Mexico, where it is already one of the main players.

Televisa is the leading provider in Mexico's pay TV market, serving 64.5% of the market as of the third quarter of 2020, according to Mexico's telecommunications regulator, IFT. It is also the country's second-largest fixed internet provider, with 25% of the market, behind América Móvil's local unit Telmex.

During the call to discuss the merger with Univision, Televisa's co-CEO Alfonso de Angoitia said, "We see a huge opportunity in terms of growing in the broadband market in Mexico. The opportunity is still there. There continues to be low penetration of broadband."

A growing share of the revenue

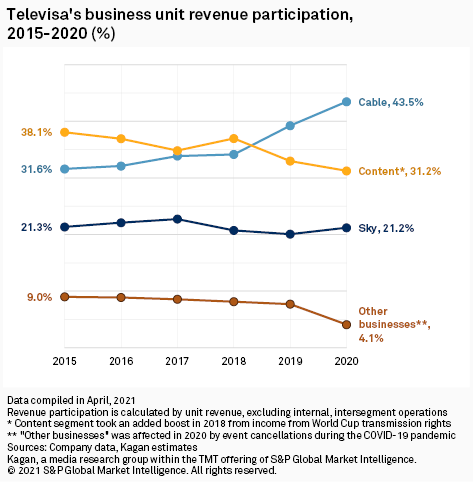

Televisa is best known for its TV channels and Spanish-language programming, with licensing rights deals across dozens of countries for its popular soap operas and shows. However, for several years, its content division has been losing its predominant place in the company's revenue share to its mostly Mexico-bound pay TV and broadband operation.

Televisa's content division went from being the largest revenue-producing unit of the company in 2015, with 38.1% of the pie, to the second-largest, with revenue participation of 31.2% as of the end of 2020. During the same period, the cable division, which includes Televisa's izzi-branded hybrid fiber-coaxial, or HFC, as well as fiber-optic pay TV and broadband operations, grew from 31.6% to 43.5% of revenue, highlighting the company's increasing focus on that sector.

The separate Sky division, which includes the company's premium direct-to-home service in Mexico and Central America and which started providing fixed wireless broadband connectivity in 2018, has consistently stayed above 20% revenue share and closed 2020 with 21.2% participation. Accounting for both the cable and Sky divisions, Televisa's broadband and multichannel operations represent 64.7% of its total revenue.

The "other businesses" unit, which includes live sporting events, casinos and other operations, makes up another 4.1% of the company's revenue and will also remain under Televisa's umbrella after the content merger with Univision.

With a five-year CAGR of 3.4% from 2015 to 2020, cable is the only one of Televisa's divisions to see an increase in revenue in U.S. dollar terms since 2015. Sky had a 3.1% decrease, mostly on the back of DTH's loss of momentum in the Latin American region as well as currency depreciation. Content had a negative 6.8% CAGR during the same five-year period. The smaller other businesses unit had a more significant 17.2% contraction over the period, mostly affected by the suspension of live events, public venues and sport tournaments during the pandemic.

All included, Televisa's remaining units following the Univision deal produced 68.8% of the company's revenue during 2020, excluding internal, inter-business unit operations.

Fixed broadband on the lead

Televisa's decision to focus on the broadband side of the business fits a trend identified by Kagan across the region where broadband subscriptions take the lead in terms of growth, and pay TV takes a backseat in the purchasing decisions of most customers. The Latin America and Caribbean broadband market is expected to grow by 5.6% in 2021, much faster than the 0.3% expected for the multichannel segment during the year. For Mexico, Kagan estimates that the residential multichannel market could expand by 1.8% by the end of 2021, while the broadband market is expected to grow by 6.8%.

Already a client? Click here to read our Latin America outlook for broadband and multichannel.

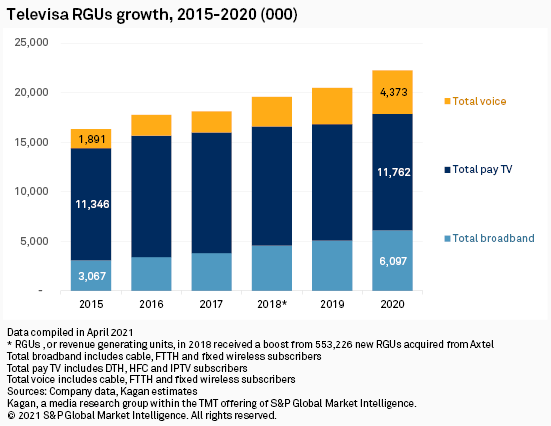

In the case of Televisa, the company ended 2020 with 6.1 million broadband customers when including all technological platforms it offers — HFC, fiber to the home and fixed wireless broadband. Broadband customers increased 98.8% since 2015, which translates into a CAGR of 14.7%.

By contrast, the company's multichannel business, offered via DTH, HFC and IPTV, grew 3.7% during those same five years at a 0.7% CAGR.

"Following a transition period … we will focus primarily on our Mexican connectivity and content distribution businesses," de Angoitia added in the call. "Post-transaction, we will keep developing and expanding our industry-leading telecom business in Mexico offering best-in-class high-speed Internet access and providing high-quality programming as a content aggregator."

A better financial profile

Televisa's de Angoitia said the proceeds of the content unit's transaction would be used primarily to reduce the company's debt but did not disclose how much of the $3.0 billion in cash it is expected to receive would be allocated to that end. He did mention, however, that he expects the company's net leverage ratio, or net debt to EBITDA, to fall below 2x its 2020 EBITDA of $1.77 billion. As of the end of 2020, that ratio stood at 2.65x, according to S&P Global Market Intelligence financial data for Televisa.

De Angoitia also said that "our best-in-class high-speed Internet network and content distribution platforms will have revenue and EBITDA of over $3.5 billion and $1.3 billion, respectively. So we see a huge opportunity in terms of growing in the broadband market in Mexico." The company's cable, Sky and other business units generated a combined $3.36 billion in revenues in 2020.

Regarding capital expenditures, the company focused most of its resources into its cable and broadband businesses in the last few years. In 2019, 68.1% of the company's $992.2 million in capex was applied to its cable division, while another 21.1% went to its Sky division. In 2020, the company invested $939.4 million, of which 70.5% went to cable and 26.6% went to Sky.