Download the full report

Click HereCorporate boards are responsible for shaping and overseeing environmental, social and governance (ESG) policies for their organizations. This report examines the relationship between companies connected through shared board members and ESG performance. It finds that companies with strong board networks (companies with directors who serve on more than one corporate board or are well-connected) have better certain ESG outcomes than firms with weak board networks.[1] Well-connected directors can utilize their network for information on emerging ESG trends/best practices and share this knowledge with their companies. Given their roles on multiple boards, well-connected directors are also better informed about the needs of different stakeholders (governments, communities, ESG activists) than directors with little or no network. This awareness of stakeholder management translates to better ESG performance for companies with well-connected directors.

- Companies with strong(weak) board networks are more (less) proactive about addressing gender diversity issues at both the C-Suite and board level. Firms with strong board networks are twice as likely to have female CEOs compared to firms with weak board networks. Also, 16% of directors on companies with strong board networks are women, compared to 12% for firms with weak board networks, Table 1.

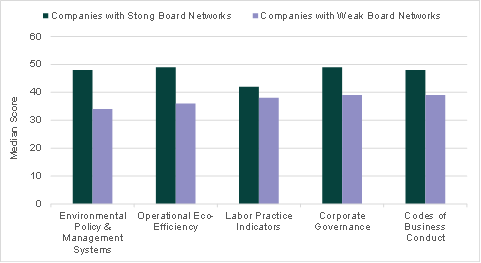

- Companies with strong board networks score better than companies with weak board networks on ESG issues such as codes of business conduct, operational eco-efficiency (environmental waste) and labor practices, Figure 1. Companies with well-connected directors have fewer incidents of bribery/corruption cases, generate less environmental waste, and have greater gender diversity in senior management than companies with less connected directors.

Figure 1: Median Scores for Companies with Strong and Weak Board Networks

Firms are Ranked on a Scale of 0 – 100: Russell 3000: Sept 2013 – Dec 2019

[1] The number of boards that all directors serve on is aggregated to compute a company’s connected score, see methodology.