About 17% of US broadband subscribers use fiber optic connections, a modest adoption rate compared to many European and Latin American markets like France (67%) and Brazil (75%).

But US telco fiber subscribers grew double digits in 2023 and made up about 63% of the entire telco subscriber base, with the balance on legacy copper DSL. But fiber is not exclusive to telcos (defined as traditional landline phone operators). Cable operators and wireless internet service providers (fixed wireless) are also increasingly running fiber lines directly to the home and to the node.

And earlier this year, Mobile Network Operator T-Mobile US Inc. entered the space via its $950 million joint venture acquisition of Lumos which could lead to competitive shakeups in the latter's markets if T-Mobile takes its "Uncarrier" approach to fiber broadband.

If we were to make a 30-year forecast, we might assume most US broadband households would be using fiber. This is not only because the technology is superior for broadband, but also due to non-legacy telco operators increasingly adopting the technology.

Subscribers

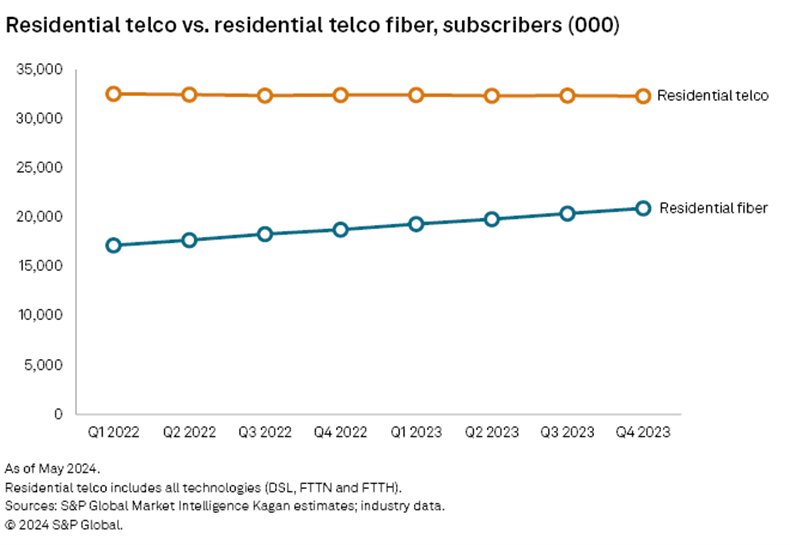

According to S&P Global Market Intelligence Kagan estimates, the telco industry had 22.1 million residential and commercial fiber broadband customers as of Dec. 31, 2023. In terms of residences, 20.9 million of the 119.7 million broadband homes use telco fiber.

Residential fiber subscribers for the entire industry saw copious net gains with around 2.2 million additions in 2023. However, industry residential fiber additions have not been enough to offset copper DSL losses. Regardless of technology, residential customers served by any telco have been at a standstill, occasionally seeing seasonal growth only to be bogged down eventually by legacy losses and churn.

Passings

Combined, a core group of telcos grew their passings, including overbuilds, by 10.9% year over year. AT&T dominated the race with a share of 39% of locations passed. Second-ranked Verizon had the lowest year-over-year growth rate with its Fios passings, although its mature fiber footprint made it one of the highest penetrated fiber providers in the industry.

Revenue

Fiber revenue from a core group of telcos, including commercial and residential, climbed 16.7% in 2023, outpacing subscriber growth.

For context, the entire residential telco segment (encompassing all technologies) earned about $22.7 billion, representing a 4.2% year-over-year increase, which is more modest than the 16.7% growth of fiber revenues from our select list of telcos.

Cost per location

Without the Broadband Equity, Access and Deployment Program, four major telcos averaged $1,195 to pass a location with fiber in 2023. Of the list, Lumen reported the highest possible cost to deploy fiber at $1,500 per location.

However, when BEAD funding is finally doled out to the operator-level, it is possible that costs may surge. The limited labor pool may be one of the critical factors that could cause the spike as BEAD is distributed.

Consolidated Communications Inc. disclosed the lowest cost among its peers at only $780 per passing in 2023. Its life-to-date cost was lower at $660 per passing.

One critical factor influencing the cost per passing was topography. Lumen Technologies Inc. CFO Chris Stansbury cited an example during a September 2023 conference, saying: "The bigger issue is, if we're in Florida, we're building in sand. If we're in Seattle, we're building in rock. And so depending on where we're building that year, where we're getting permits sooner than other places, it will fluctuate around." Urban markets also tend to merit a lower cost per passing considering the density of those markets versus rural ones.

Multichannel Trends is a regular feature from S&P Global Market Intelligence Kagan.

This is an abridged copy. The article's full version with its accompanying datasets is available on the S&P Capital IQ Pro platform.