Investments in residential mortgage loans among US life insurers accelerated to a new high on a relative basis in the second quarter as an extraordinary event accounted for a sizable portion of the boost.

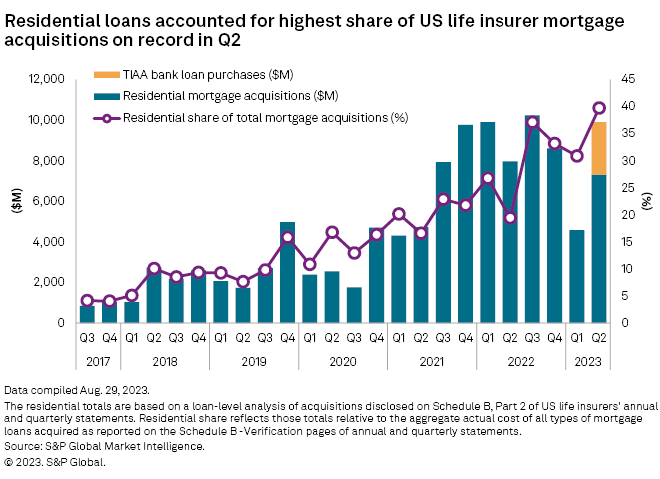

Loans on residential properties accounted for 36.8% of the $39.39 billion aggregate cost of mortgage loans acquired by US life insurers in the first half of 2023, according to a loan-level analysis of disclosures in quarterly statutory filings, up from 23.4% in the year-earlier period and 25.8% for full year 2022. Residential loans accounted for less than 10% of the aggregate dollar amount of mortgages acquired by the industry annually as recently as 2018, but changes in market conditions, investor appetites and life insurer capabilities in that realm have since triggered steady increases. Transactions connected to Teachers Insurance & Annuity Association of America's sale of a majority stake in its former banking business are providing an extra jolt in 2023.

The absolute amount of residential mortgages acquired in the first half of the year fell by 22.7% during a period in which acquisitions of other types of mortgages plunged by 59.5%. TIAA's addition of $2.59 billion of residential mortgages from its former bank on April 10 accounted for a meaningful chunk of that divergence as residential mortgages would have fallen by 36.5% in the absence of that activity. The latter figure would have been much more in line with the 37.2% decline in the dollar amount of one- to four-family mortgage originations observed by the Mortgage Bankers Association.

With TIAA having acquired another $2.3 billion in residential mortgages from the bank on July 14, which was rebranded as EverBank NA upon the Aug. 1 completion of its sale, we would expect residential mortgages to continue to account for an unusually high share of total US life insurer mortgage acquisitions in the third quarter. We will also expect a considerably smaller year-over-year decline in acquisitions of other types of loans given that comparisons will become far less daunting than they have been in recent periods.

Fueled by their additions on residential mortgages, the US life insurance subsidiaries of Athene Holding Ltd. and TIAA led the industry in the total dollar amount of mortgage loans acquired in the second quarter at $3.92 billion and $3.17 billion, respectively. Residential mortgages accounted for 74.3% and 81.7% of those amounts.

Athene viewed its mortgage investments during the quarter as opportunistic in nature, as Chairman, CEO and Chief Investment Officer James Belardi said during an Aug. 16 conference call that he sees "very strong relative value and absolute yield" in the asset class. Mortgages accounted for nearly 40% of Athene's overall investment purchases during the quarter on a consolidated basis across geographies. Commercial and residential mortgages accounted for 11.7% and 7.1% of Athene's $213.67 billion in net invested assets as of June 30 with both categories having long served as areas of focus for the group.

At TIAA, mortgages accounted for 12.8% of the company's total invested assets as of year-end 2022, but residential mortgages represented less than 0.2% of total invested assets and just 1.2% of total mortgage loans. If everything else were to remain static, the addition of the residential mortgages from what is now EverBank would boost those percentages on pro forma bases to 1.8% and 12.6%, respectively. TIAA said the residential mortgage acquisitions did not impact its surplus or net income.

Several other US life groups allocated majorities of their second-quarter mortgage loan acquisitions to residential mortgages, including the US life subsidiaries of Corebridge Financial Inc., Tokio Marine Holdings Inc., Resolution Life U.S. Holdings Inc. and First Trinity Financial Corp. as well as the group led by Massachusetts Mutual Life Insurance Co.

Corebridge identified residential mortgages as one of the asset classes in which affiliates of Blackstone Inc. had been investing on its behalf under the parties' strategic asset management relationship. The holding company reported that its direct residential mortgage loan exposure increased to $7.46 billion on a consolidated basis as of June 30 from $5.86 billion at the end of 2022.

MassMutual has generally focused on homogenous pools of residential whole loans as opposed to individual loans. As such, it engaged in 48 acquisitions of residential mortgages across individual group members valued at an average cost of $12.3 million as compared with the thousands of residential mortgages put on the books of Athene, TIAA and Corebridge with average sizes in the hundreds of thousands of dollars during the second quarter.

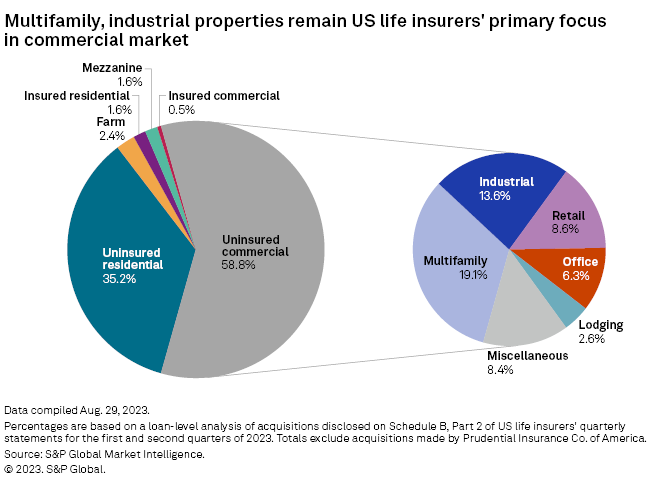

Commercial acquisitions skew residential

Multifamily properties continued to serve as the primary area of focus for US life insurer investments in commercial mortgage loans amid economic uncertainty and broad-based concern about the future for office properties. Of the $23.14 billion in uninsured commercial mortgages acquired during the first half of 2023, 32.6% were backed by multifamily properties while 10.8% pertained to offices. The latter property type, which has become embattled given slumping demand from employers, represented the primary focus for the industry in the early- to mid-2010s.

That is not to say that life insurers completely steered clear of the asset class during the second quarter with at least some of the activity representing refinancings.

While the largest two mortgage acquisitions by individual life entities were in the multifamily and residential realms by subsidiaries of Corebridge and Athene, respectively, three of the top seven additions by actual cost were backed by office properties. New York Life Insurance & Annuity Corp. and The Northwestern Mutual Life Insurance Co. each reported adding $149.4 million worth of loans on property at Seattle's Union Square, according to documents on file with the King County, Wash., recorder's office. The effective interest rate on the loans was 7.67%. Northwestern Mutual reported that a $250 million mortgage on a Seattle office property with an effective interest rate of 3.79% had been repaid on the same day the new loan was acquired.

In Watertown, Mass., Northwestern Mutual acquired a $150 million mortgage on an office property that reportedly refinanced a $100 million Bank OZK construction loan. The new 165,000-square-foot building is occupied by life sciences companies.

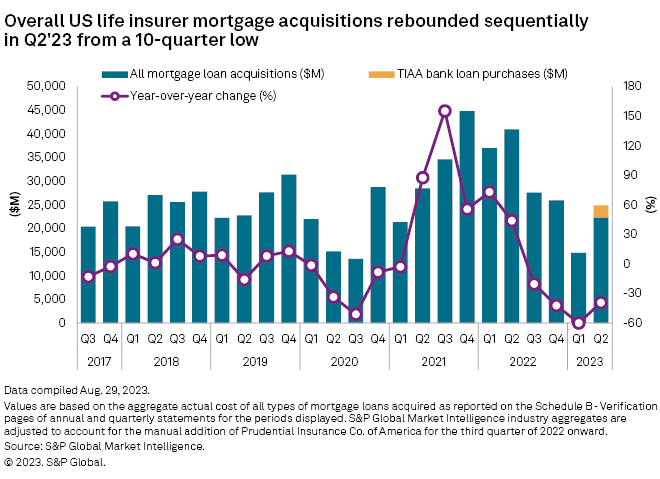

The Mortgage Bankers Association's Quarterly Commercial/Multifamily Mortgage Bankers Originations Index shows that originations across property types in the second quarter remained far below their late-2021 peaks amid sharply higher interest rates, but they increased in many cases from the lows of the first quarter. The index notably showed a sequential increase in life insurer originations of 95% as compared with a decline of 4% across depositories, suggesting that the industry may be helping to pick up some of the slack left in the wake of the March banking crisis.

Markedly higher interest rates for newly acquired loans could also serve as a source of encouragement. The weighted average effective interest rate increased to nearly 6.8% for mortgages acquired by US life insurers during the first half of 2023 when excluding the TIAA bank purchases from a rate of just 3.6% in the year-earlier period.

Relative value is likely to continue to drive a certain amount of investment in mortgages, but we expect markedly lower rates of decline in loan acquisitions in the coming quarters than the second quarter's 39.2% retreat owing to easier comparisons. Second-quarter acquisition volumes were only 9.6% lower than those in the third quarter of 2022, for example.

Methodology

Data in this article unless otherwise noted reflects disclosures on Schedule B of quarterly statements filed by US life insurers. Aggregates reflect data obtained through Aug. 29, including the manual addition of data for Prudential Financial Inc.'s The Prudential Insurance Company of America.

Loan acquisitions reflect disclosures by individual life entities and reflect legal ownership of the underlying assets, gross of the impact of any applicable modified coinsurance relationships. In some cases, participation in the acquired loans may be spread among group members. Acquisitions include but are not limited to newly originated loans.

Aggregates and percentages will change as additional information is received, though we do not anticipate they will deviate materially from the values contained in this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.