The White House has announced a plan to apply tariffs on all imports from Mexico of 5% from June 10, citing the need for Mexico to help address increasing northbound migration. If no action is forthcoming the tariffs will be increased to 10% on Jul. 1 and by a further 5% points each month thereafter.

As flagged in Panjiva's research of May 20 this comes just as resolution on passing the U.S.-Mexico-Canada Agreement had been reached. It does mark a change in rhetoric from President Trump who had previously only threatened to close the border.

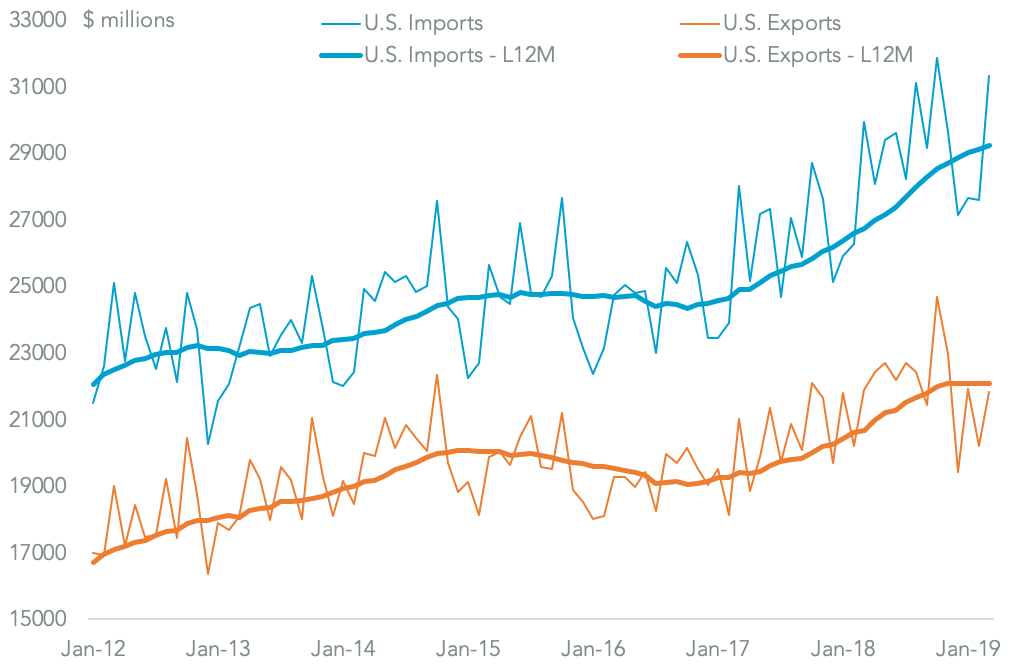

Panjiva analysis shows that U.S. imports from Mexico in 2018 were worth $346.2B, implying each 5% of tariffs will cost U.S. importers - who pay tariffs in the first instance rather than Mexican exporters - $17.3B.

TARIFFS MAY CAP RECORD U.S. IMPORTS FROM MEXICO

Chart segments U.S. trade with Mexico by direction on a monthly and 12-month average basis. Source: Panjiva

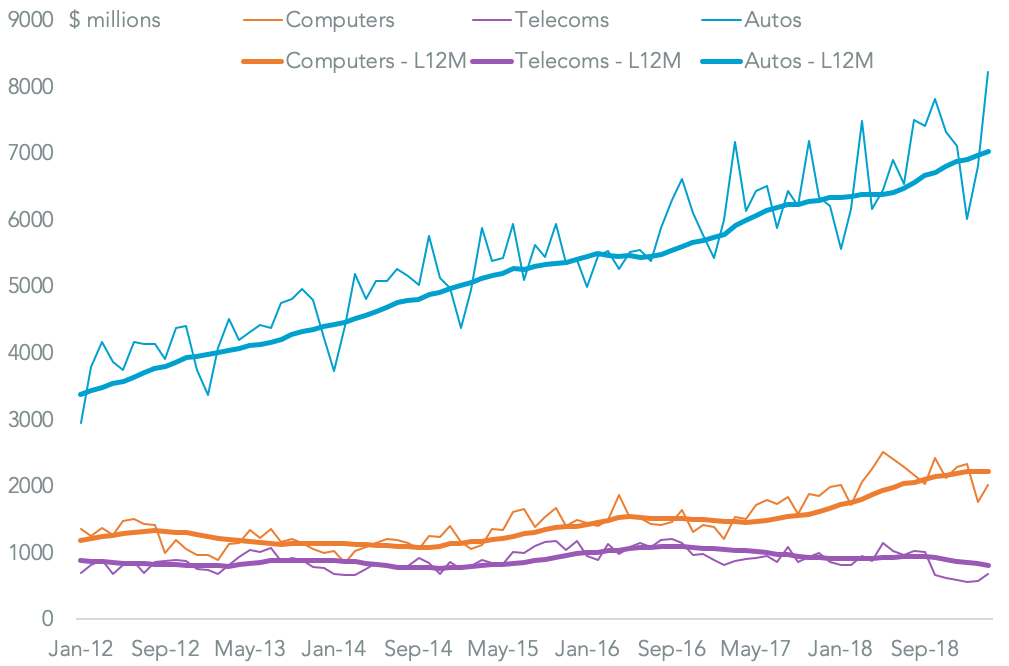

The leading products that will face duties include: motor cars, commercial vehicles and parts worth $35.0B, $22.8B and $24.7B respectively; computer and telecoms equipment worth $26.4B and $10.B; and crude oil worth $14.5B.

AUTOS ACCELERATING, COMPUTERS POWERING DOWN

Chart segments U.S. imports from Mexico by product (HS-4) on a monthly and 12-month average basis. Source: Panjiva

The situation for corporations is more complex given many operate cross-border supply chains where finished goods can be re-exported several times. Those transitions can generate exemptions from duties for products that are re-exported.

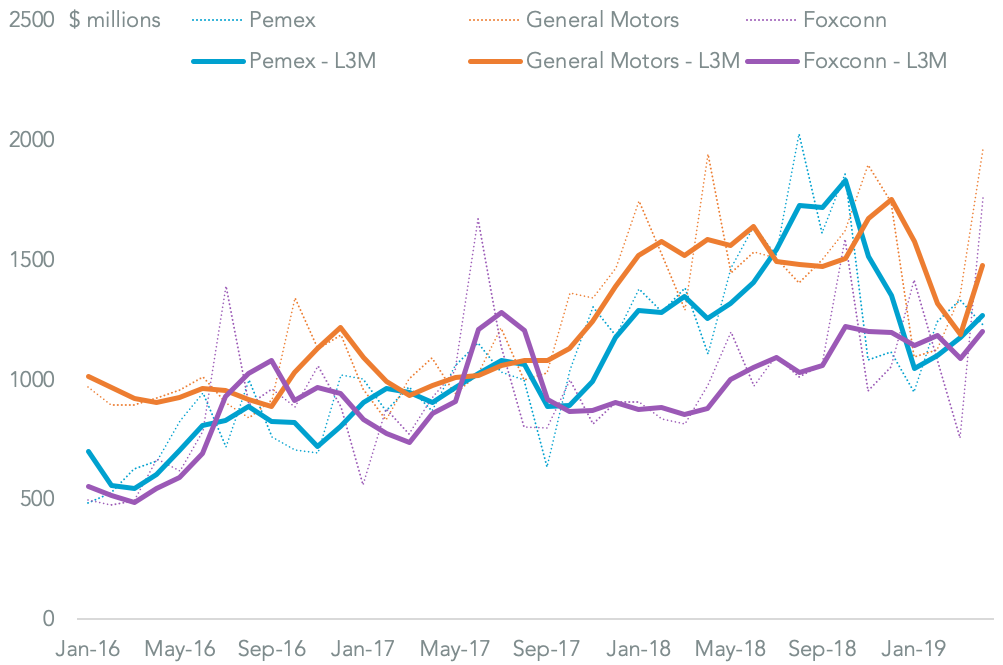

Nonetheless, the three largest companies per sector - measured by their import entities - among the largest 50 firms involved in imports from Mexico include:

Energy: Pemex ($18.6B)

Autos: General Motors ($17.3B); Fiat-Chrysler ($14.7B); Volkswagen ($8.5B)

Auto-parts: Delphi ($3.1B); Panasonic Auto Systems ($1.4B); Yazaki ($1.3B)

Trucks: Daimler ($7.7B); Izuzu ($3.3B)

Tech. Hardware: Foxconn ($14.3B); Wistron ($4.3B); Jabil Circuit ($3.2B)

Beverages / Food: Constellation ($2.9B); Driscoll ($1.4B)

Capital Goods: Johnson Controls ($1.6B); Cummins ($1.1B); Black & Decker ($825M)

Healthcare: Invacare ($5.5B)

Metals: Industrias Peñoles ($1.4B); ArcelorMittal ($703M); Tenaris ($696M)

FOXCONN AND GM'S EXPORTS TO THE U.S. HAD BEEN GROWING, PEMEX SLOWING

Chart segments Mexican exports to the U.S. by shipper or consignee for Pemex, General Motors and Foxconn on a monthly and three-month average basis. Source: Panjiva