The average annual earned return on equity for the Financial Focus energy coverage universe of utility operating companies took a dip for the second consecutive year in 2023, as utilities put forth an increasingly ambitious rate case agenda to boost returns.

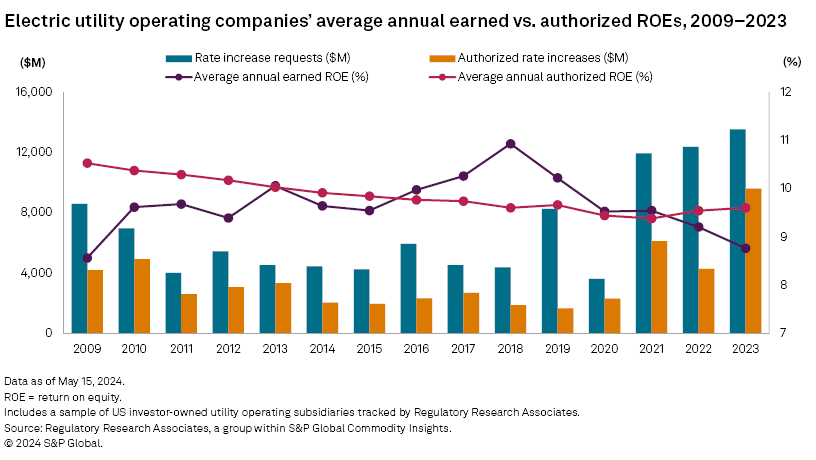

Electric utilities' average annual earned return on equity (ROE) climbed steadily from 2015 to 2018 and exceeded the average authorized ROE from 2016 to 2021. The average earned ROE, however, declined in 2022 and even further in 2023, falling further from the average authorized ROE as utilities have blamed persistent inflation and high interest rates with stifling returns. Authorized ROEs are established in state utility regulatory commission proceedings.

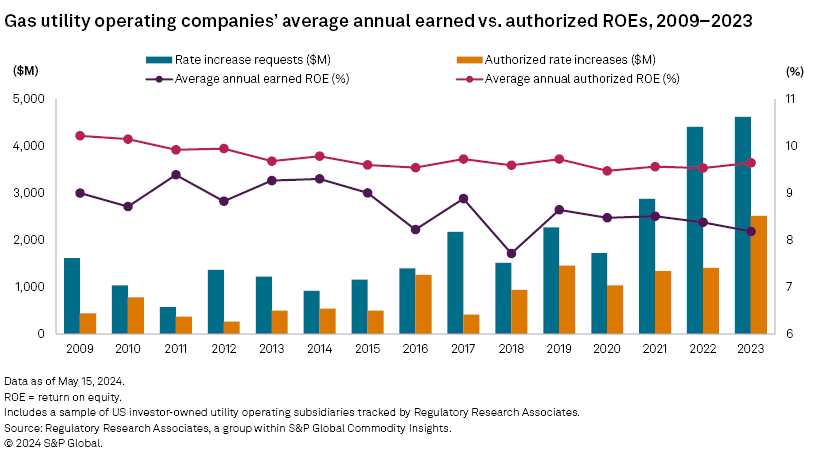

The average annual earned ROE from a sample of US investor-owned gas utility operating companies also fell further in 2023, as the spread from authorized ROE grew. Over the 15-year time frame, the average annual earned ROE by gas utilities has never eclipsed its authorized ROE. The closest the group came to meeting its average authorized ROE was in 2013–14 when the average earned ROE fell short by 54 and 58 basis points, respectively.

➤ Energy utility-earned ROEs, on average, have been pressured over the past several years, reflecting the difficult operating environment for utilities during a period of tremendous volatility brought about by the COVID-19 pandemic, persistent inflation and high interest rates that utilities say have increased borrowing costs and cost of equity. But when the data is broken down by service type, electric utilities have fared far better.

➤ After six years of overearning authorized ROEs, electric utilities on average slipped below that threshold in 2022 and further in 2023. Underearning has been cited in testimony as a common factor in the uptick in rate case filings over the past couple years.

➤ Gas utilities underearned authorized ROEs on average for the entire 2009–23 time frame, though some in our sample of gas utilities showed consistent overperformance.

➤ While there is new evidence of rising authorized ROEs in data collected by Regulatory Research Associates, history cautions about the stickiness of authorized returns. Commissions may be less inclined to boost approved returns in an environment of high inflation and interest rates.

Following the outbreak of the COVID-19 pandemic in 2019, states began to institute service disconnection moratoriums for customers unable to pay their utility bills, as businesses shuttered or curtailed operations in 2020. In turn, earned ROEs for US investor-owned electric and gas utility operating subsidiaries fell. The decline since 2019 has been much more pronounced among electric utilities. The decline in earned returns for electric utilities predated the arrival of COVID-19 and has continued to the present, whereas earned returns on the gas side have been more moderated.

While disconnection moratoriums have largely expired and states of emergency have been lifted, inflation has not subsided and interest rates remain elevated. In the past several years, utilities have filed some of the largest rate cases ever witnessed by RRA, and underearning has been frequently cited as a factor by utilities in testimony.

Rate requests by utilities totaled a combined $18.13 billion in 2023, up about 8% from a record-setting 2022, as tracked by RRA. Coinciding with record-breaking capital investment plans by utilities, this should bode well for utilities and could point toward a rebound in earned ROEs.

Utilities have noted several capital market factors that could increase their cost of equity, including changes in monetary policy, exceptionally high inflation, increasing interest rates and volatile market conditions. Inflation and rising interest rates, in particular, pose challenges to the recovery of capital investment and authorized ROEs.

Examining the period from 2009 to 2023, the variability in average earned ROE has only been slightly higher for electric utilities compared to gas utilities. The largest variance between average earned ROE and average authorized ROE occurred in 2009, which was the height of the global financial crisis. The average electric earned ROE fell short of the average authorized ROE by 195 basis points. At that time, the economy was in the depths of a sharp recession, and the US GDP declined 2.5%.

By comparison, the biggest variance for gas utilities occurred in 2018 when the average earned ROE was 178 basis points below the average authorized ROE.

Earned ROEs peaked for electric utilities in 2018 at 105 basis points above authorized ROEs on average, but dropped in 2023 to 84 basis points below authorized ROEs.

Utilities did not get a break from weather in 2023, as the US experienced a lower-than-average number of cooling degree days during summer and a lower-than-average number of heating degree days during the waning months of the year.

Regulator-approved authorized ROEs have drifted steadily lower through much of the review period for both gas and electric utilities. Most recently, however, RRA has seen an increase in authorized ROEs. The average ROE authorized for electric utilities was 9.60% for rate cases decided in 2023, up from the 9.54% average observed in full year 2022. The average ROE authorized for gas utilities was 9.64% for cases decided in 2023, up from the 9.53% average observed in full year 2022.

For a chronological listing of the major energy rate case decisions issued during 2023, as well as historical summary data going back to 1990, see Regulatory Research Associates' latest "Rate Case Decisions Quarterly Update."

In RRA's view, macroeconomic factors could reduce customer and regulatory tolerance for rate increases, which could maintain downward pressure on authorized ROEs. If history is any guide, the contraction in spreads between US Treasury Bills and average authorized returns may continue, causing authorized ROEs to remain relatively flat, or perhaps even fall in some instances, if interest rates continue to rise. For more information, refer to "Recent developments signal shifts in energy regulatory climate in 2 states."

An important issue to note is whether the authorized equity return accurately represents the utility's cost of equity capital. Unlike the cost of debt, which can be observed, the cost of equity cannot be directly observed/measured, as it is an investor expectation, which does not always lend itself well to measurement. Regulators utilize various models to estimate the required ROE. Because it is not directly observable, the required ROE cannot be conclusively demonstrated that the authorized ROE, as estimated by regulators, is the company's actual cost of equity capital, which may be higher or lower.

Comments on methodology

The earned ROE data used in this analysis was primarily taken from the latest pull of data reflected in Financial Focus Utility Subsidiary Quality Measures Databooks, while the authorized ROE data is derived from RRA's "Major Rate Case Decisions" reports. Both are, or will be, available in the Research Library.

The earned ROE data represents the simple average of the returns for the electric and gas utility operating companies in the Financial Focus coverage universe, and the authorized ROE is the simple average of the equity returns adopted by regulators in the specified 12-month period. As noted, RRA uses the average annual authorized ROE as a proxy for the average required equity return in each annual period.

RRA emphasizes that this analysis is an overall industry study and not one of individual companies. For some companies, determining the authorized ROE is difficult, if not impossible, since rate cases can be resolved through black box settlements that do not specify an authorized ROE. In addition, some utilities operate in multiple regulatory jurisdictions, and the authorized ROE can differ across these regions. Companies may also operate both electric and gas utility divisions and it is at RRA's discretion which service type to evaluate them under. Also, for multijurisdictional companies, ROE determinations in various jurisdictions may have occurred in different years.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Brian Collins contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.