451 Research is a technology research group within S&P Global Market Intelligence. For more about 451 Research, please contact us.

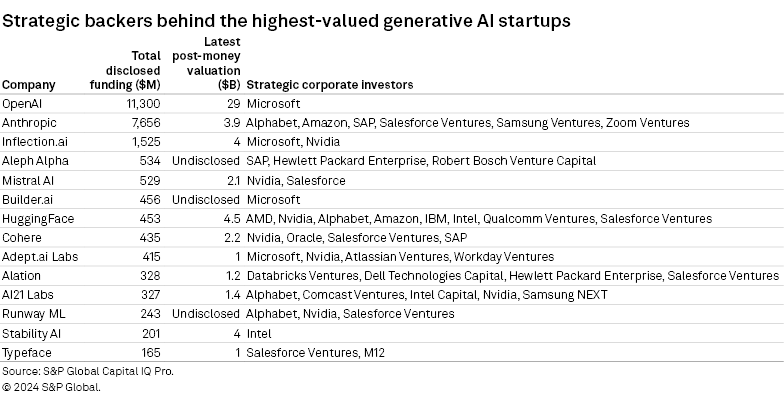

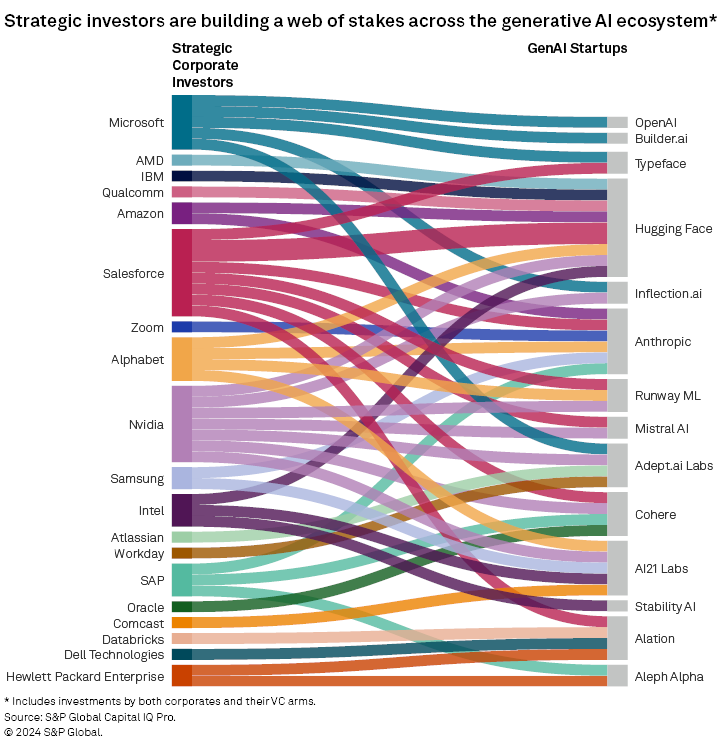

Strategic investors across the board — hyperscalers; infrastructure, software and media providers; and even generative AI players themselves — are all racing to claim a piece of the hot GenAI pie. However, a limited number of investment opportunities has not only propelled valuations to astounding highs, but also created a tangled web of interests, influences and unorthodox investment structures that are only becoming more complicated as these companies scale.

It is likely to be another big year for generative AI funding, with rumored rounds to come for both foundation model specialists Cohere (looking to raise another $500 million to $1 billion) and Anthropic (seeking $750 million at a valuation of $18 billion). However, cracks are already appearing in some places due to the astronomical cash needs of these startups and the degree of influence to which these strategic investors aspire. Microsoft Corp.'s $10 billion investment in OpenAI LLC is now facing a regulatory probe in both the UK and EU as regulators question the minority shareholder's degree of influence and whether it should be subject to merger rules. Anthropic, meanwhile, has reaped the financial benefits of investors trying to keep pace with one another (e.g., Google and Amazon.com Inc.) or grab larger stakes before future rounds (Menlo Ventures). In a market where the winners have yet to be defined, simultaneously diversifying and maintaining a meaningful amount of influence is a tricky dance — and one that few can afford.

Market context

In a subpar year for venture funding, AI's star shone bright in 2023. Tech investors shelled out 27% fewer dollars than the average over the previous five years, according to data from S&P Capital IQ Pro. AI vendors, meanwhile, claimed almost $2 of every $10 (17%), with generative AI accounting for most of the year's largest rounds. Taking the lead on many of them were tech giants, some of which made more investments last year than ever in their history as they shifted out of acquisition mode (a big bet on a single entity) to focus instead on building a web of stakes in the emerging market.

Microsoft, for example, printed its fewest purchases in the history of 451 Research's M&A KnowledgeBase (only one with the pickup of datacenter management provider Fungible), but notched its second-highest count of corporate investments. One was its astounding $10 billion commitment to OpenAI in January.

So essential has it become to curry influence that even generative AI startups themselves have delved into the fray. OpenAI itself made eight investments last year in AI startups via its OpenAI startup fund, an unorthodox undertaking for an early-stage, venture-backed startup.

As a result, many of these startups have far more stakeholders behind them than is typical, even for later-stage companies. Tech giants account for virtually half of the number of investors in open-source model specialist Hugging Face, for instance. By comparison, late-stage player Databricks — which raised its series I in December 2023 — counts only five corporate venture stakeholders out of a total 60 backers.

In most cases, investors coexist nicely — Alphabet Inc. and Comcast Corp. have different designs for AI21 Labs, for example. In others, vying interests have been a boon for these startups as their backers pony up to keep pace with one another.

Hyperscalers

The big three — Microsoft, Amazon and Google — have been dominant investors in the space given that they offer the cash and compute force to be both competitive and attractive partners. As all three aspire to contend across the three layers of the generative AI stack (infrastructure, model and application), they are sowing seeds throughout the landscape. However, something of a proxy war has emerged over the two biggest foundation model specialists: OpenAI and Anthropic. All backers are investing as corporate entities and via their investment arms, but we will focus here on the former.

Microsoft's big bet is OpenAI, which stands out as one of the few vendors on this list with a sole strategic investor. The startup's backer has paid handsomely for exclusivity — with Microsoft's $10 billion investment propelling OpenAI to the most valuable generative AI provider in the world. It remains to be seen how subsequent rounds (rumored to be coming soon) will affect this, or the aforementioned investigations in the UK and EU. The company also made an investment in Databricks' series I round late in 2023, and led personal AI startup Inflection.ai's $1.3 billion venture round alongside NVIDIA Corp. Microsoft's other portfolio companies include Engineer.ai (doing business as Builder.ai), in which it is also an exclusive strategic investor and whose developer assistant, Natasha, is slated to be integrated with Teams.

Amazon and Alphabet (Google), meanwhile, have both chosen Anthropic as their leading horse in the generative AI race, creating a complicated investment triangle. Google first invested in Anthropic in late 2022 (reportedly $500 million for a 10% equity stake), becoming a key cloud supplier, but reportedly has struggled with cloud service delivery. This move was overshadowed by Amazon's $4 billion commitment this past September that, in theory, made AWS Anthropic's primary — although not exclusive — cloud service and chip supplier. Google then committed another $2 billion a month later, reclaiming some clout. The startup has independently inked large cloud service deals with both cloud providers.

In other places, co-investment has been more cordial. Amazon and Google are both backers of open-source model directory specialist Hugging Face, alongside many other strategic investors (although the AWS partnership appears more robust). Google has also invested in several other unicorns: AI21 Labs (series C) and Runway AI (series C). Additionally, both vendors are funding AI accelerators for early-stage startups.

Semiconductors and infrastructure providers

NVIDIA made 2023 a huge investment year, becoming the most prolific tech backer of generative AI unicorns. The company participated in 22 financing events last year, compared with a previous record of eight in 2022, according to S&P Capital IQ Pro. The chipmaker, which saw its revenue and stock price soar in 2023, is leveraging that wealth and sky-high demand for its processors to embed itself in the new wave of vendors. It is a coveted partner as all of its investees currently utilize its products (either chips or software).

Although it has avoided OpenAI and Anthropic thus far, NVIDIA has participated in half of the rounds listed above, including OpenAI rivals Cohere and Inflection.ai, AI21 Labs, RunwayML and PerplexityAI. Additionally, Databricks and CoreWeave are other significant data management and cloud infrastructure players addressing heightened demand for AI workloads.

Intel has been active here as well as it seeks to make up for struggling performance in other parts of its business. The semiconductor manufacturer has helped fund several of the highest-valued startups (Hugging Face and AI21 Labs, alongside NVIDIA and Stability AI), but its most interesting move has been the recent spinoff of generative AI platform purveyor Articul8.ai, which it is supporting alongside lead investor Digital Bridge as the only strategic backer. Many of Articul8.ai's employees were pulled directly from Intel Corp.'s database team, while the technology was built in-house and architected on the investor's hardware.

Other notable investors include QUALCOMM Inc., Dell Technologies Inc., Advanced Micro Devices Inc., Hewlett Packard Enterprise Co., Databricks and Oracle Corp., all of which have been more selective in their commitments. They have thrown their weight behind one or two unicorns, with the size of many of these transactions in line with what their backers have shelled out for large acquisitions — for example, Aleph Alpha's recent $500 million round led by HPE and SAP SE or Oracle's close relationship with Cohere, which will likely see the vendor doubling down on Cohere's rumored-to-be-pending round. Many are also investing heavily via their venture arms.

Application software providers

Although at more of an arm's length, application software providers have also been splashing the cash in the generative AI startup sphere. Salesforce Inc. is one of the few ASPs that has made a corporate investment in a unicorn GenAI startup, with its December 2023 commitment to Mistral AI's series A sparking rumors about the company's intent to acquire the open-source large language model (LLM) specialist.

All of its other investments have happened via Salesforce Ventures, which recently led Hugging Face's series D round, showcasing the firepower that corporate venture capital groups have been granted in this race. Last August, Salesforce Ventures announced that it was doubling its generative AI fund to $500 million.

Other players like SAP, Workday Inc., Atlassian Corp. and Zoom Video Communications Inc. have also built stakes in various LLM and generative AI specialists through their venture arms. However, we expect them to become more involved in the evolving application layer, just as we have seen with AI broadly.

Conclusion

Not all are choosing the same investment path, despite the headlines and hype. Meta Platforms Inc., for instance, has been surprisingly quiet on the VC front, having made no corporate investments since late 2022. Databricks and Adobe Inc., meanwhile, stand apart as having made outright purchases — the latter bought video generation vendor Rephrase.ai a few months ago for an undisclosed amount, while Databricks shelled out $1.3 billion for LLM training specialist MosaicML in June 2023.

For most, the field remains too early-stage and expensive to take a meaningful plunge at a corporate level. With many of these startups rising from relative obscurity to unicorn status in a matter of months, there are likely plenty of opportunities to come for those waiting in the wings.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.