Bank bond portfolios remained deeply underwater in the fourth quarter of 2022, reducing banks' access to liquidity in the first quarter when deposits became far more precious.

Having deeply underwater bond portfolios proved unfavorable for at least SVB Financial Group, which purged its available-for-sale securities portfolio for liquidity and ultimately saw a run on its bank. The bank run and others that followed sparked investors' concerns over the stability of the industry's funding. The events also prompted some members of the investment community to write down the values of bonds in their held-to-maturity portfolios, which are not marked to market, when evaluating companies in case more banks need to harvest securities for liquidity needs. While that approach could continue to weigh on bank stocks, most banks likely will not have to go down that road and will continue to utilize alternative sources of funding like wholesale funding, CDs or the Federal Reserve's new term funding program.

Unrealized losses gain even more attention amid deposit outflows

Deposits declined across the banking industry in 2022, prompting investors and even regulators to fear that some banks might need to sell bonds for liquidity needs. Those fears were realized when SVB announced that it sold its available-for-sale portfolio at an after-tax loss of $1.8 billion. The company hoped that the move and related plans to raise capital would stem investor concerns, but ultimately the opposite occurred as depositors flocked from the bank, pulling $42 billion in deposits the following day.

The modern-day bank run ultimately resulted in the failure of Silicon Valley Bank on March 10. As fears spread across the marketplace, Signature Bank experienced a bank run as well, reportedly losing 20% of its deposits in a single day. The New York Department of Financial Services took possession of New York-based Signature Bank on March 12.

A few other institutions like First Republic Bank have reported notable outflows as well, but many banks say that their deposit balances have held fairly steady even in the face of liquidity fears that have erupted in the market. A number of regional banks have reported that depositors remain confident in their institutions, and community banks say they have not only avoided significant outflows but have reported deposit inflows into their institutions. That is good news for the industry, which would also incur some pain if it needed to sell underwater bonds for liquidity needs.

The Federal Reserve's H.8 data, which tracks commercial bank balances on a weekly basis, shows that deposits continued to decline in the first quarter, falling 1.7% through the week ended March 15. In the week after SVB experienced a bank run, deposits at domestically chartered US commercial banks fell by $53.25 billion. Meanwhile, the Fed data shows considerable growth in time deposits across the industry. Higher-cost funds like CDs and borrowings likely will become even larger portions of banks' deposit base, while non-interest-bearing deposits decline.

The Fed has separately reported that borrowing through its newly created Bank Term Funding Program jumped to $53.67 billion, up from $11.94 billion the week prior. Meanwhile, discount window borrowing declined to $110.25 billion from a record high of $152.85 billion the week ended March 15.

Banks portfolios underwater but most institutions won't need them for liquidity

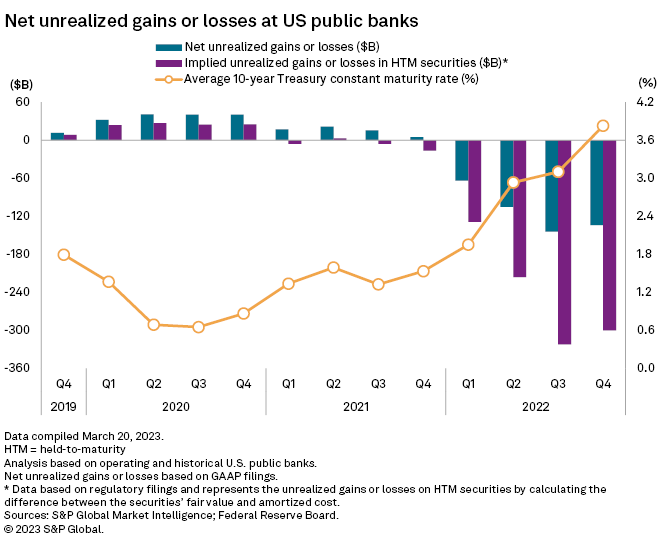

Bank bond portfolios remained well underwater through year-end 2022. Unrealized losses in banks' available-for-sale (AFS) securities portfolios, which continue to hold the majority of bonds that most banks own and must be marked to market on a quarterly basis, remained quite large at the end of the fourth quarter. In the fourth quarter, institutions including US commercial banks, savings banks, and savings and loan associations that file GAAP financials reported $134.10 billion in unrealized losses in their AFS portfolios, compared to $144.53 billion in unrealized losses in the prior quarter.

Unrealized losses in AFS portfolios are captured in accumulated other comprehensive income (AOCI). While AOCI does not impact bank earnings, it does impact tangible common equity and has depressed the capital metric considerably.

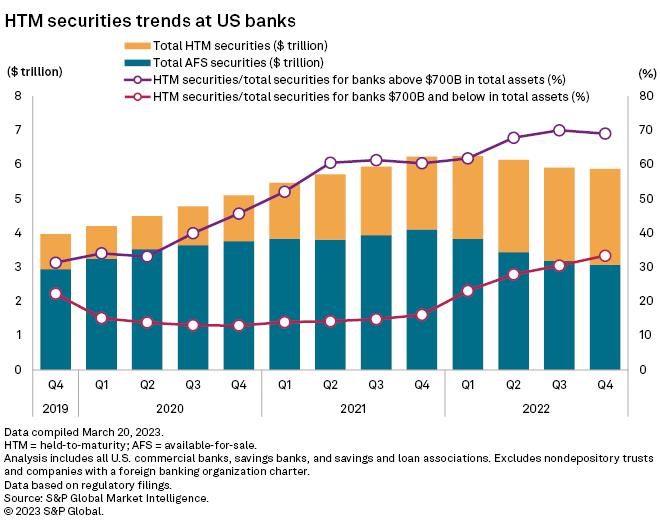

Banks' held-to-maturity (HTM) portfolios, which are not marked to market on a quarterly basis, had even larger unrealized losses at year-end 2022. Some banks, particularly the nation's largest institutions, have sought to protect large portions of their securities portfolios from swings in the market by placing bonds in HTM portfolios. For banks with over $700 billion in assets, changes in AOCI would impact regulatory capital in addition to tangible book value.

Large banks classified as US global systemically important banks (G-SIBs) — those with more than $700 billion in assets — have placed 69% of their bond portfolios in held-to-maturity portfolios. That is down slightly from 70% in the third quarter and up from about 31% three years ago.

Unrealized losses in HTM portfolios totaled $300.15 billion in the fourth quarter of 2022, down slightly from $322.20 billion in the prior quarter. Some investors have begun applying the unrealized loss embedded in banks' HTM portfolios to tangible book value to reach an adjusted, burn-down value for the company. They believe that institutions still trading below historical price-to-tangible book values, on an adjusted basis, could screen relatively cheap and offer some protection against the turmoil in the market, which has wreaked havoc on many bank stocks. The investment community has also examined the ratio of loans plus HTM securities-to-deposits at a given bank to see how many deposits are tied up in less liquid assets.

Somewhat ironically, the intense focus on bank liquidity might offer a lift to values of bank bond portfolios in the first quarter. The liquidity crunch in the banking sector has led to a flight to quality in the bond market. Accordingly, the pressure on bank bond portfolios likely will ease in the first quarter, with intermediate and long-term rates falling notably since the end of the fourth quarter.

Janney Montgomery Scott analyst Christopher Marinac estimated in a recent report that the decline in rates could result in a 2.1%, mark-to-market benefit to bank investment portfolios. Some observers like Todd Baker, a senior fellow at the Richman Center for Business, Law and Public Policy at Columbia Business School and Columbia Law School, have even suggested that banks could take advantage of the recent swings in the market to reposition their investment portfolios.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.